Employment Tax Rates Oklahoma

Tax rate of 1 on taxable income between 1001 and 2500. The new employer tax rate will remain steady at 150 for 2021.

The Cost Of Tax Cuts In Oklahoma Oklahoma Policy Institute

The Cost Of Tax Cuts In Oklahoma Oklahoma Policy Institute

Similar to the federal government Oklahoma has an income tax that applies higher rates to higher income levels.

Employment tax rates oklahoma. There are no local income taxes in Oklahoma. Notably Oklahoma has the highest maximum marginal tax bracket in the United States. Established employers are subject to a lower or higher rate than new employers depending on an experience rating.

After registration with the Oklahoma Tax Commission employers will be assigned an account number for each registered account. The good news is that only the state charges income tax so theres no need to worry about local taxes. For single taxpayers living and working in the state of Oklahoma.

Business Business Licensing and Operating Requirements Secretary of State - Business Services Department of Commerce. Doing Business in the State. This is an increase form 2020 where rates ranged from 010 to 550.

Oklahoma has six marginal tax brackets ranging from 05 the lowest Oklahoma tax bracket to 5 the highest Oklahoma tax bracket. 2020 rates included for use while preparing your income tax deduction. Tax rate of 05 on the first 1000 of taxable income.

Add additional amount or percentage elected by the employee to the pay period tax calculated in the above step and ROUND TO THE NEAREST DOLLAR to determine the amount of tax to be withheld for this payroll period. The wage base for SUI is 24000. Rates include state county and city taxes.

Each marginal rate only applies to earnings within the applicable marginal tax bracket. Oklahomas unemployment-taxable wage base and unemployment tax rates are to increase for 2021 a spokeswoman for the state Employment Security Commission said Sept. Over the last decade it generally has been somewhere between 1 and 24.

The rate is calculated using the information from the table in the Oklahoma Employment Security Act for a contribution rate of 28. As a for-profit business operating in Oklahoma you are required to pay Unemployment Insurance UI tax. Oklahoma State Unemployment Insurance SUI Oklahoma has a State Unemployment Insurance SUI which ranges from 03 to 75.

Divide the annual Oklahoma tax withholding by 26 and round to the nearest dollar to obtain the biweekly Oklahoma tax withholding. Oklahoma State Website. Tax rate of 2 on taxable income between 2501 and 3750.

Learn more about the upcoming changes to 2021 rates how they are calculated and how to protest rates. Small Business Events in Your Area. Like the Federal Income Tax Oklahomas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

In Oklahoma different tax brackets are applicable to different filing types. See this example. The rates range from 05 to a top rate of 5 based on the income brackets shown below.

Divide the annual Oklahoma tax withholding by 26 and round to the nearest dollar to obtain the biweekly Oklahoma tax withholding. The state UI tax rate for new employers known as the standard beginning tax rate also changes from one year to the next. Single filers will pay the top rate after earning 7200 in taxable income per year.

It has six tax brackets with rates ranging from 050 up to 500. The latest sales tax rates for cities in Oklahoma OK state. Employment Security Commission Unemployment Insurance New Hire Registry.

Tax rates range from 05 to 50. 1 2021 the wage base is to be 24000 for 2021 up from 18700 in 2020 the spokeswoman told Bloomberg Tax in an email. All companies remitting an average of 5000 or more per month in taxes in the previous fiscal year shall file returns online through Oklahoma Taxpayer Access Point OkTAP.

Like the majority of the nation Oklahoma has a progressive state income tax system. Oklahoma employers withholding tax accounts can be established online at wwwtaxokgov. Add additional amount or percentage elected by the employee to the pay period tax calculated in the above step and ROUND TO THE NEAREST DOLLAR to determine the amount of tax to be withheld for this payroll period.

All companies remitting withholding tax of 10000 or more per month are required to file and remit according to the Federal semi-weekly schedule. PO Box 52003 Oklahoma City OK 73152-2003. Oklahoma Employment Security Commission.

Account numbers must be used by the employer for all returns and correspondence with the Oklahoma Tax Commission. Benefit wage charge amount of 10000 divided into an amount of timely taxable wages of 300000 ends up with a benefit wage charge ratio of 33. The bracket you fall into will depend on your income level and filing status.

The 10000 is 33 of the 300000. Oklahoma collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Effective January 1 2021 Oklahomas experienced-employer unemployment tax rates are to be determined with Conditional Factor D causing rates to range from 030 to 750.

Oklahoma Income Tax Calculator Smartasset

Oklahoma Income Tax Calculator Smartasset

Https Www Ok Gov Tax Documents Deweysclass2020 Pdf

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Https Www Ok Gov Tax Documents 514pkt 18 Pdf

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Reality Check Restoring Oklahoma S Gross Production Tax Won T Hurt The Economy Oklahoma Policy Institute

Reality Check Restoring Oklahoma S Gross Production Tax Won T Hurt The Economy Oklahoma Policy Institute

Https Www Ok Gov Tax Documents 08whpkt Pdf

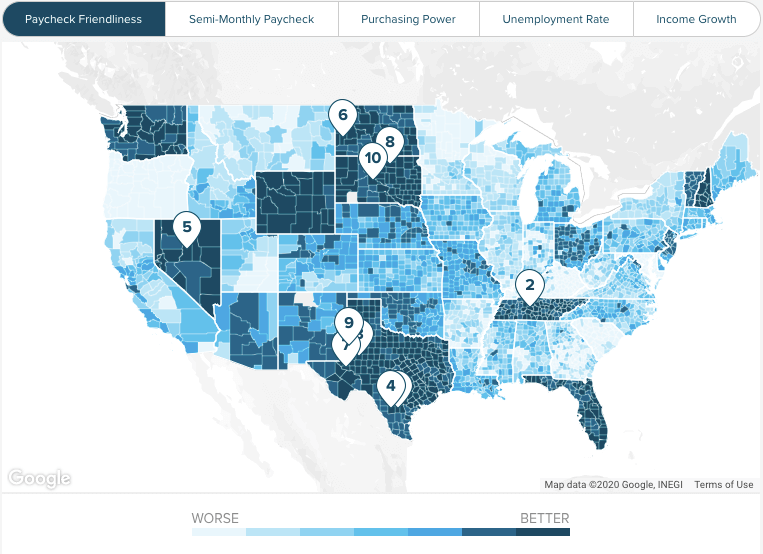

Oklahoma Paycheck Calculator Smartasset

Oklahoma Paycheck Calculator Smartasset

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Http Www Ok Gov Tax Documents 2021whtables Pdf

The Cost Of Tax Cuts In Oklahoma Oklahoma Policy Institute

The Cost Of Tax Cuts In Oklahoma Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Reality Check Restoring Oklahoma S Gross Production Tax Won T Hurt The Economy Oklahoma Policy Institute

Reality Check Restoring Oklahoma S Gross Production Tax Won T Hurt The Economy Oklahoma Policy Institute

Oklahoma Tax Commission General Information

Oklahoma Tax Commission General Information

Https Www Ok Gov Tax Documents 511nrpkt 19 Pdf

The Cost Of Tax Cuts In Oklahoma Oklahoma Policy Institute

The Cost Of Tax Cuts In Oklahoma Oklahoma Policy Institute

Oklahoma Income Tax Calculator Smartasset

Oklahoma Income Tax Calculator Smartasset

Post a Comment for "Employment Tax Rates Oklahoma"