Washington Employment Tax Rates

Washington State Unemployment Insurance varies each year. Self-employed individuals have to pay the full 29 in Medicare taxes and 124 in Social Security taxes themselves as there is no separate employer to contribute the other half.

This Explains Sales Taxes And How They Work Sales Tax Tax Local Sales

This Explains Sales Taxes And How They Work Sales Tax Tax Local Sales

If you have employees working in Washington you likely must pay unemployment taxes on their wages in this state.

Washington employment tax rates. See the IRS Employers Tax Guide for more information. The Departments unemployment tax rates for 2021 are expected to be finalized in December. You are responsible for ensuring Square Payroll has the correct tax ID numbers and tax rates.

21 percent of Washington employers will have a lower tax rate in 2020 60 percent will remain the same and 19 percent will move to a higher rate class. About 47percent of all taxable employers are in rate. The businesss gross receipts determine the amount of tax they are required to pay.

The average tax rate will decrease from an estimated 103 percent in 2019 to an estimated 099 percent in 2020. Under the bill the average 2021 unemployment tax rate is projected to be 117 a 43 tax cut. The 2020 average unemployment tax rate is 103 of taxable wages a tax rate that is projected to increase to 188 in 2021.

Liable employers must submit a tax report every quarter even if there are no paid employees that quarter andor taxes are unable to be paid. What are the highest lowest and average tax rates in Washington. The change to the taxable wage base takes effect Jan.

The tax rate for most employers is 06 of the first 7000 each worker earns up to a maximum of 42 per employee. State law instructs ESD to adjust the flat social tax rate based on the employers rate class. You can locate your UI Tax Rate and EAF Rate on the Tax Rate Notice sent by the Washington State Employment Security Department.

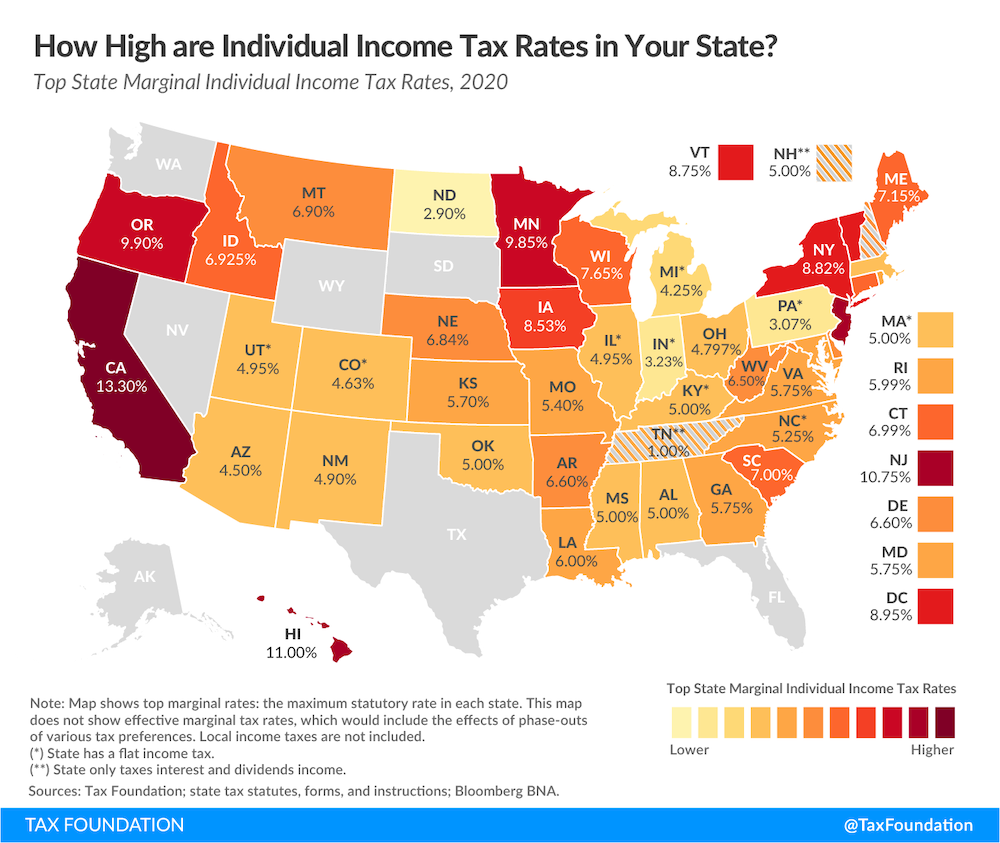

Hawaii for example has a top tax rate of 11New York and Minnesota have top rates of 882 and 985 respectivelyHowever a lower marginal tax rate. Washingtons unemployment-insurance program is an experience-based system. The Washington Department of Employment Security announced today that the unemployment taxable wage base is set to rise to 56500 in 2021 up from 52700 in 2020.

For 2021 the wage base is 56500. Search by address zip plus four or use the map to find the rate for a specific location. The bill provides over 12 billion in relief of benefit charges for all employers for benefits paid to employees from March 22 through May 30 2020 during the Stay Home Stay.

The average total tax paid per covered em-ployee will decline by 2 to 200. The wage base is 56500. No income tax in Washington state Washington state does not have a personal or corporate income tax.

However there is a deduction available during tax season to help recoup some of that high self-employment tax. Unemployment tax rates are going up at a time when few can afford it after hearing from the Washington Employment Security Department last. The experience year WA uses to calculate tax rates is July 1 - June 30.

Register with the Washington Department of Employment Security. Some states have higher rates though. Taxable employers in the highest rate class pay 57 percent not counting delinquency or Employment Administration Fund taxes.

In general your tax rate depends on how much your former workers collect in unemployment benefits and the size of your payroll. Taxable employers in the highest rate class pay 54 percent not including delinquency or Employment Administration Fund taxes. However people or businesses that engage in business in Washington are subject to business and occupation BO andor public utility tax.

Determining your tax rates. The flat social tax is capped at 050 for 2021 075 for 2022 080 for 2023 085 for 2024 and 090 for 2025. New employers use the average experience tax rate of 097.

These changing rates do not include the social cost tax of 122. You must have a registered business in order to hire employees. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington.

If you know you will be hiring employees at the time of application including minors and workers in the home select the Hire Employees or Hire Employees under 18 for the purpose of the application. Tax reports or tax and wage reports are due quarterly. Washington SUI Rates range from.

If you cant find it please contact the agency at 360 902-9670. For very small employers these payments may be made at the time of annual filing but larger employers are required to make payments quarterly. Look up a tax rate on the go.

Look up a tax rate. Employers who are delinquent in paying their taxes may have. Rates also change on a yearly basis ranging from 011 to 540.

013 to 572 for 2020 which do not include the Employment Administration Fund assessment of 03 Washington new employer rate. Youll find rates for sales and use tax motor vehicle taxes and lodging tax. There are two major components of state unemployment taxes an experience-rating tax based on an average of the.

In all other years the flat social tax is capped at 122.

Ir 2018 251 Internal Revenue Service Cpa Moving Expenses

Ir 2018 251 Internal Revenue Service Cpa Moving Expenses

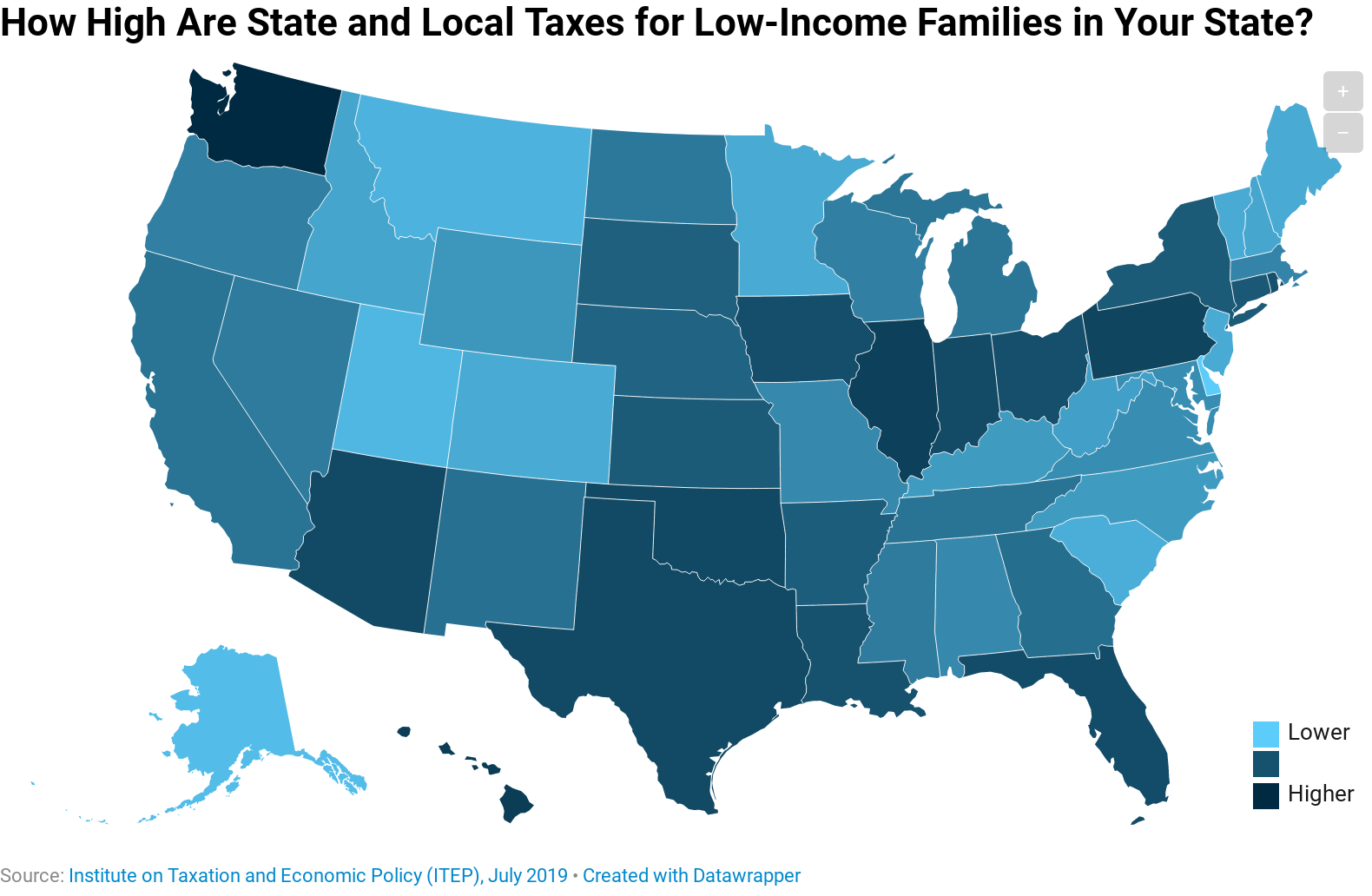

Which States Have The Highest Tax Rates For Low Income People Itep

Which States Have The Highest Tax Rates For Low Income People Itep

Income Taxes What You Need To Know The New York Times

Income Taxes What You Need To Know The New York Times

Washington Paycheck Calculator Smartasset

Washington Paycheck Calculator Smartasset

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Tax Rates Congressional Budget Office

Tax Rates Congressional Budget Office

State Income Tax Vs Federal Income Tax What S The Difference Federal Income Tax Income Tax Tax Rules

State Income Tax Vs Federal Income Tax What S The Difference Federal Income Tax Income Tax Tax Rules

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Why Is Overtime Taxed At A Higher Rate How Are The Rates Determined Quora

Payroll Taxes 2021 Filing Deadlines Rates And Employer Responsibilities

Payroll Taxes 2021 Filing Deadlines Rates And Employer Responsibilities

Indiana Income Tax Rate And Brackets 2019

Indiana Income Tax Rate And Brackets 2019

Effective Marginal Tax Rates For Low And Moderate Income Workers In 2016 Congressional Budget Office

Effective Marginal Tax Rates For Low And Moderate Income Workers In 2016 Congressional Budget Office

Progressiveness Of Taxes Informative Facts Tax

Progressiveness Of Taxes Informative Facts Tax

Ifta Tax Filing Filing Taxes Tax Tax Rate

Ifta Tax Filing Filing Taxes Tax Tax Rate

Federal Revenue From Capital Gains Taxes Fell Sharply During The Recession Down 100 Billion From 2007 To 2009 Rates Are Capital Gain Capital Gains Tax Gain

Federal Revenue From Capital Gains Taxes Fell Sharply During The Recession Down 100 Billion From 2007 To 2009 Rates Are Capital Gain Capital Gains Tax Gain

Free Tax Preparation And Filing Centers Around The Country 75 Free Centers In Western Washington Tax Preparation Tax Free Income Tax Preparation

Free Tax Preparation And Filing Centers Around The Country 75 Free Centers In Western Washington Tax Preparation Tax Free Income Tax Preparation

Post a Comment for "Washington Employment Tax Rates"