Fnma Guidelines Verification Of Employment

Employment Documentation Provided by a Third-Party Employment Verification Vendor. Signed federal income tax returns may also be required to verify unemployment income related to seasonal employment A verbal VOE is also required from each employer.

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

A completed Request for Verification of Employment Form 1005 or the borrowers recent paystub and IRS W-2 forms covering the most recent one-year period.

Fnma guidelines verification of employment. 3 rows Fannie Maes underwriting guidelines emphasize the continuity of a borrowers stable income. These verifications are acceptable as long as. DU Validation Service Reference Guide requires DU DO or Fannie Mae Connect credentialsprovides the details of the logic used by DU to validate income employment and assets.

Fannie Maes requirements for documentation to be requested from the IRS align with the income documentation required at origination. The employment offer or contract must. A completed Request for Verification of Employment Form 1005 or Form 1005 S.

There are no changes to the age of documentation requirements for military income documented using a Leave and. If a recent paystub or bank statement is obtained in lieu of the verbal verification of employment VOE an d the documentation evidences reduced hours andor pay due to the pandemic what are the next step s. The borrower provided proper authorization for the lender to use this verification method.

Use of Employment Verification Services Lenders may use any employment verification service that provides the same. AIG will follow Fannie Mae LL- 2020-03 guidance issued on 3312020 and updated on 792020 related to employment verification requirements. For reduced hours or pay continue to follow the requirements and guidance in the Selling Guide.

A completed Request for Verification of Employment Form 1005 or Form 1005 S. Lenders must perform a verbal verification of employment in accordance with B3-31-07 Verbal Verification of Employment or follow the temporary policies outlined below. Only when the borrowers federal income tax returns are required in the underwriting process per the Selling Guide does Fannie Mae require the lender to request federal income tax return transcripts.

When the lender receives employment and income verification directly from a third-party employment verification vendor we are now requiring that the information in the vendors database be no more than 60days old as of the note date. Such as Verification of Employment VOE paystubs W2s and tax returns for consistency and clarify any substantial differences in the data that would have a bearing on the qualification of the borrowers. Clearly identify the employer and the borrower be signed by the employer and be accepted and signed by the borrower.

Or the borrowers recent paystub and IRS W-2 forms covering the most recent two-year period. Printing Instructions This form must be printed on letter size paper using portrait format. The lender may receive employment and income verification directly from a third-party employment verification vendor.

Clearly identify the terms of employment including position type and rate of pay and start date. Verification of self-employment. Signed federal income tax returns may also be required to verify unemployment income related to seasonal employment A verbal VOE is also required from each employer.

Fannie Mae Freddie Mac relax appraisal employment verification standards in wake of coronavirus Will allow drive-by and desktop appraisals in certain circumstances March 23. 9 with new effective date UPDATED Jul. The verbal VOE must be obtained within 10 business days prior to the note date for employment income and within 120 calendar days prior to the note date for self-employment income.

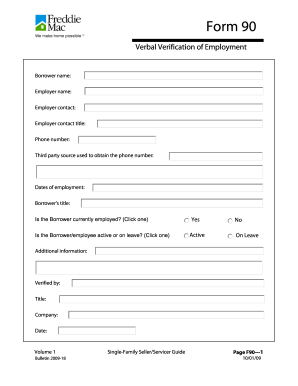

Requiring lenders to confirm the borrowers business is open and operating within 10 business days of the note date UPDATED May 5 Jun. This information is to be used by the agency collecting it or its assignees in determining whether you qualify as a prospective mortgagor under its program. Lenders must obtain a verbal verification of employment verbal VOE for each borrower using employment or self-employment income to qualify.

You can access this guide on our website using your Fannie Mae login credentials for DU Desktop Originator DO or Fannie Mae Connect. While representation and warranty relief for employment validation is temporarily suspended lenders will still be able to take advantage of the income and asset validation services with representation and warranty relief. Or the borrowers recent paystub and IRS W-2 forms covering the most recent two-year period.

Verification of Employment The lender uses this form for applications for conventional first or second mortgages to verify the applicants past and present employment status. The Seller must ensure that the borrower is currently employed at the time of the loan closing and all income sources must be reviewed carefully to ensure that the income will continue at the same or. Bonus and Overtime Income DU will require the following.

Request for Verification of Employment Privacy Act Notice. It will not be disclosed outside the agency except as required and permitted by law.

Kentucky Fha Mortgage Work History And Income Requirements Fha Loans Fha Fha Mortgage

Kentucky Fha Mortgage Work History And Income Requirements Fha Loans Fha Fha Mortgage

Https Singlefamily Fanniemae Com Media 23906 Display

Verification Of Employment Form 1005 Pdf Fannie Mae Verification Of Employment Form 1005 Pdf Fannie Mae Pdf Pdf4pro

Verification Of Employment Form 1005 Pdf Fannie Mae Verification Of Employment Form 1005 Pdf Fannie Mae Pdf Pdf4pro

Https Singlefamily Fanniemae Com Media 22801 Display

Verification Of Employment Form Fill Out And Sign Printable Pdf Template Signnow

Verification Of Employment Form Fill Out And Sign Printable Pdf Template Signnow

Fha Streamline Refinance Fha Streamline Refinance Fha Mortgage Fha Streamline

Fha Streamline Refinance Fha Streamline Refinance Fha Mortgage Fha Streamline

Verification Of Employment Form 1005 Pdf Fannie Mae Verification Of Employment Form 1005 Pdf Fannie Mae Pdf Pdf4pro

Verification Of Employment Form 1005 Pdf Fannie Mae Verification Of Employment Form 1005 Pdf Fannie Mae Pdf Pdf4pro

Kentucky Mortgage Rates Today Mortgage Loans Preapproved Mortgage Mortgage

Kentucky Mortgage Rates Today Mortgage Loans Preapproved Mortgage Mortgage

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Previous Employment Verification Form Beautiful Form 1005 Fannie Mae Request For Verific Party Invitations Diy Birthday Party Invitations Diy Business Template

Previous Employment Verification Form Beautiful Form 1005 Fannie Mae Request For Verific Party Invitations Diy Birthday Party Invitations Diy Business Template

Mortgage Loan Processor Resume Templates Resume Downloads Cover Letter For Resume Resume Templates Resume

Mortgage Loan Processor Resume Templates Resume Downloads Cover Letter For Resume Resume Templates Resume

Fannie Mae Voe Sample Page 1 Line 17qq Com

Fannie Mae Voe Sample Page 1 Line 17qq Com

Pin On Kentucky Fha Va Usda Khc Jumbo And Fannie Mae Mortgage Loans In Ky

Pin On Kentucky Fha Va Usda Khc Jumbo And Fannie Mae Mortgage Loans In Ky

Http Hfhmn Org Wp Content Uploads 2018 09 Verification Of Employment Pdf

Verification Of Employment Form 1005 Pdf Fannie Mae Verification Of Employment Form 1005 Pdf Fannie Mae Pdf Pdf4pro

Verification Of Employment Form 1005 Pdf Fannie Mae Verification Of Employment Form 1005 Pdf Fannie Mae Pdf Pdf4pro

Kentucky Va Mortgage Qualifying Guidelines Va Mortgages Va Mortgage Loans Kentucky

Kentucky Va Mortgage Qualifying Guidelines Va Mortgages Va Mortgage Loans Kentucky

Https New Content Mortgageinsurance Genworth Com Documents Training Course Income 20series 20part 201 20calculating 20 20documenting 20base 20income 20nov 202016 Pdf

Https New Content Mortgageinsurance Genworth Com Documents Training Course Reviewcalculatebaseincome Presentation 0119 Pdf

Post a Comment for "Fnma Guidelines Verification Of Employment"