Which Countries Have Withholding Tax

The circumstances in which such a liability arises are discussed below. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or.

Panama Tax Treaties Tax Panama

Panama Tax Treaties Tax Panama

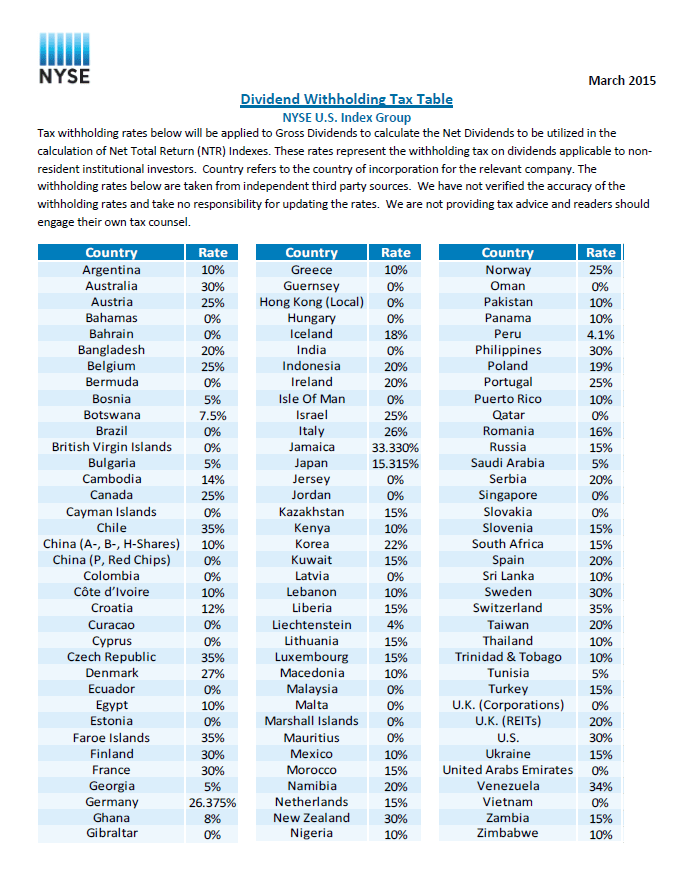

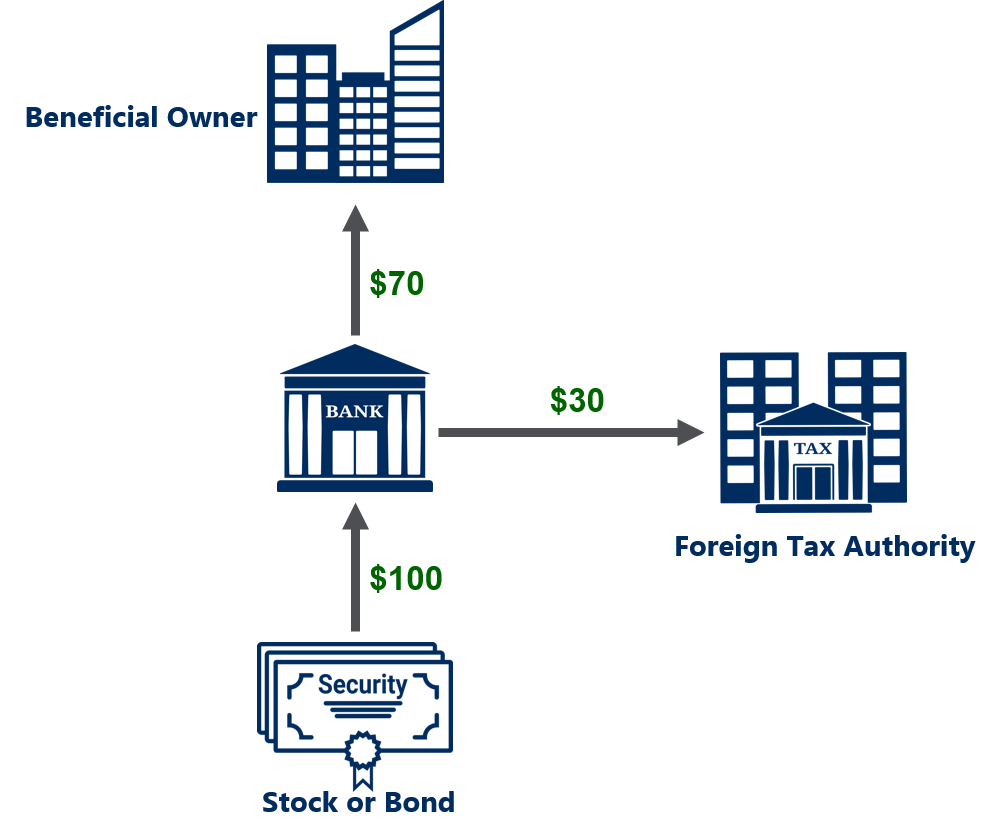

Typical dividend withholding tax for United States domiciled companies is 30 so why is the withholding tax only 15.

Which countries have withholding tax. However Taiwan has entered into tax treaties with 33. If you are a resident of one these treaty countries you only need to present a form to the casino that will prevent any withholding tax from being applied. There are select countries which have a tax treaty with the United States US that will reduce the 30 withholding tax on gambling proceeds.

226 rows A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in. Withholding tax on dividends in China is 10 and withholding tax on dividends in Germany is 25. Corporate - Withholding taxes Under UK domestic law a company may have a duty to withhold tax in relation to the payment of either interest or royalties or other sums paid for the use of a patent.

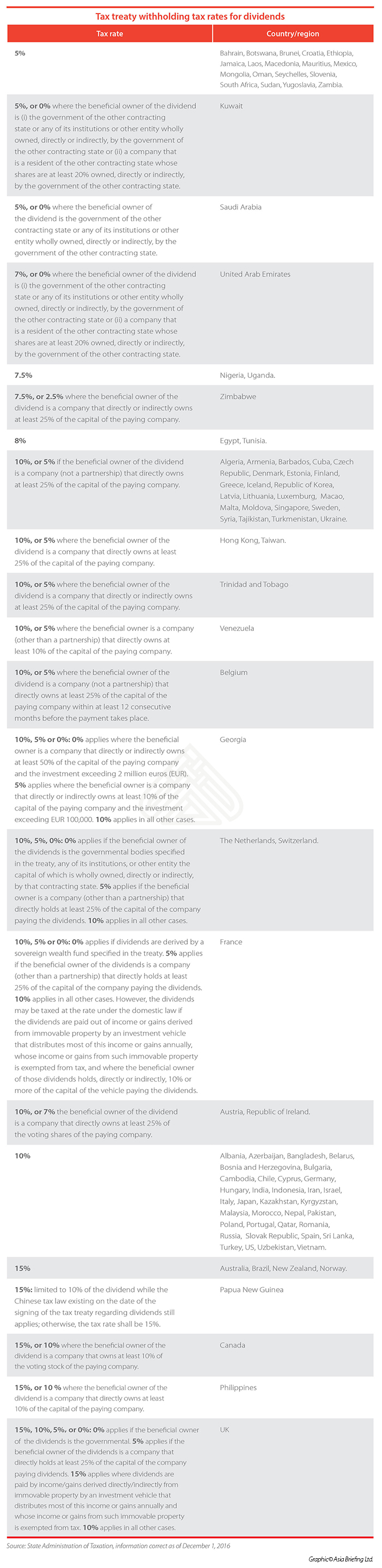

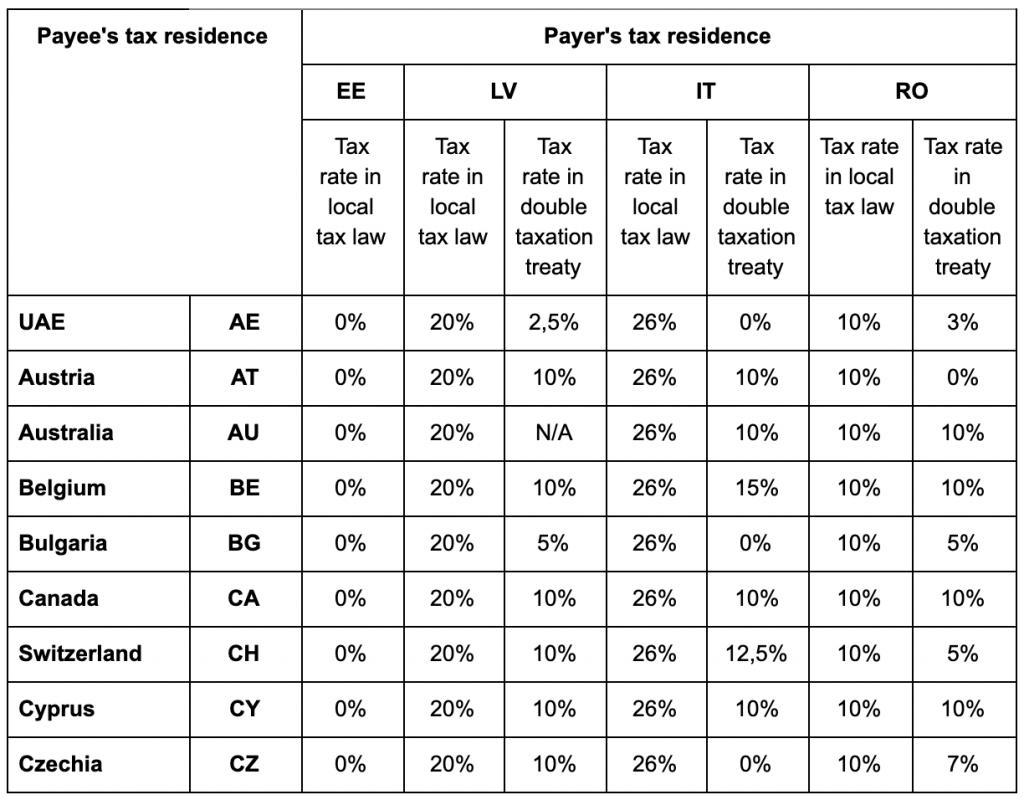

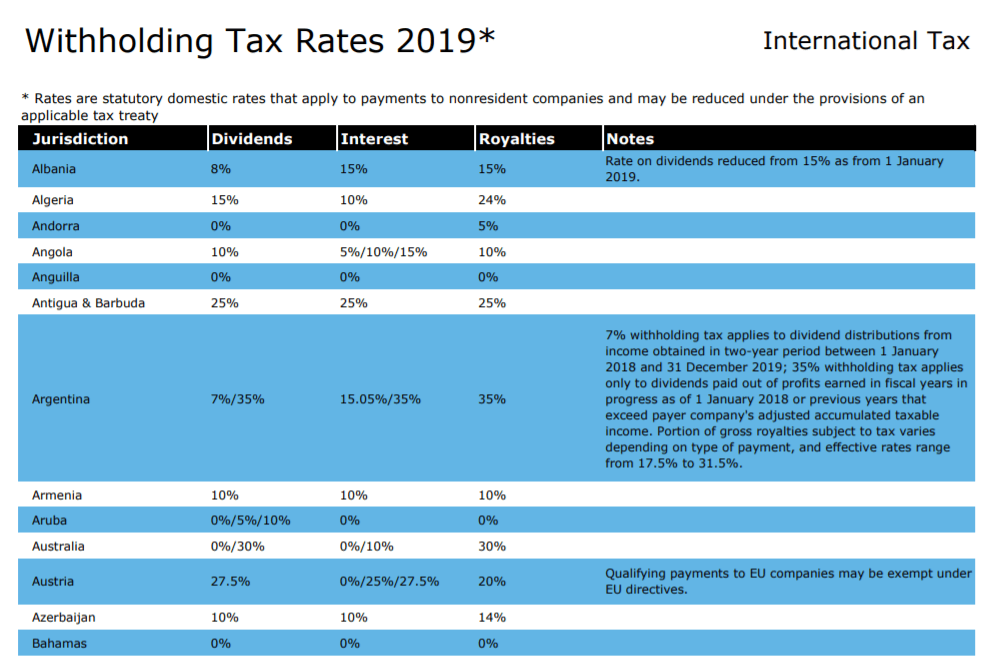

153 rows Angola Last reviewed 05 January 2021 Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in Angola. Under these treaties residents not necessarily citizens of foreign countries are taxed at a reduced rate or are exempt from US. Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 150 countries worldwide.

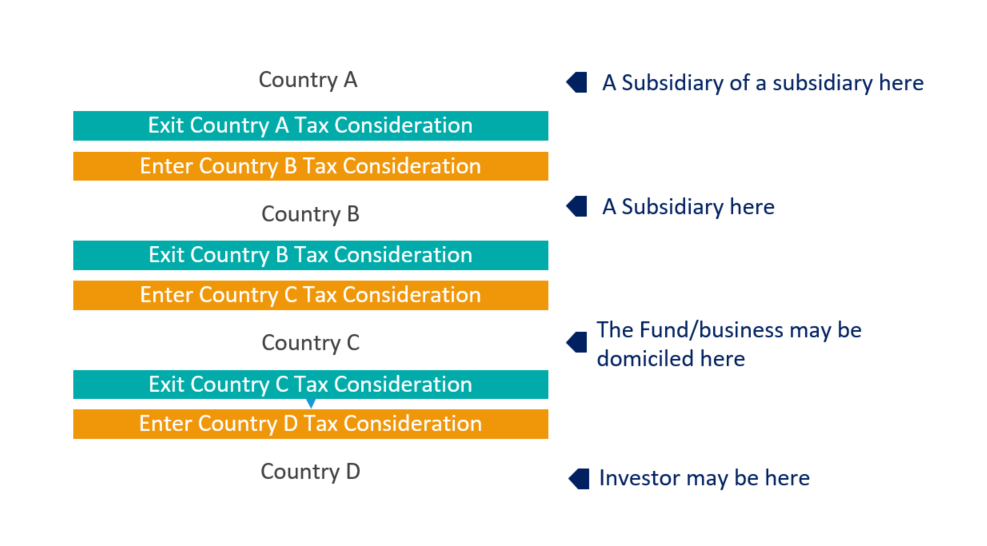

We compare the withholding rates negotiated in these treaties with the Netherlands to those negotiated between the same six countries and other OECD countries of which there are a substantial number. In general Taiwan-source dividends are subject to withholding tax at 21 while other profit distributions interest income rental income and royalties earned by foreign companies are subject to withholding tax at 20. Low-tax countries on the other hand use territorial systems that only tax.

There is wide variation in the effective marginal tax rates. Taxes on certain items of income they receive from sources within the United States. Countries with no taxes have a straightforward system where you dont pay any income tax whatsoever.

The average of all countries is 56 percent. Low-tax and no-tax countries are functionally similar but they use separate types of tax systems. Address withholding tax requirements in Argentina Brazil and Mexico.

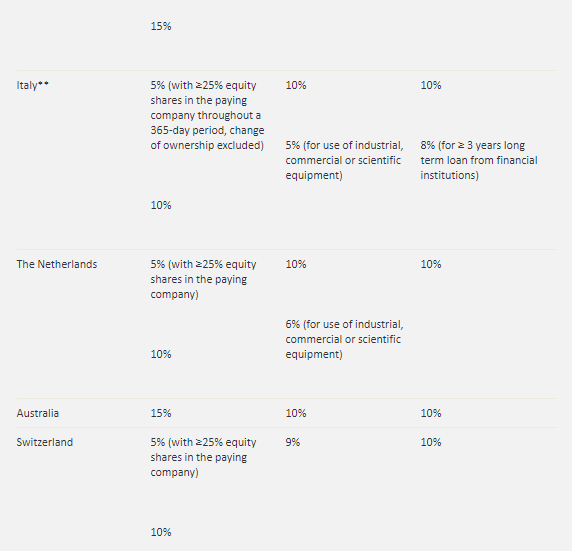

The nationals of the following countries are exempt from US income tax on gambling winnings. Meanwhile some of the most popular foreign dividend companies including those in Australia Canada and Europe can have very high withholding rates between 25 and 35. Interest on loans granted by third parties or shareholders is liable to investment income tax at 15 and 10 respectively.

Twenty-eight countries have effective marginal tax rates higher than 50 percent. The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US. The penalties that each country imposes on companies that run afoul of these rules can be sizeable as well.

IWDA is domiciled in Ireland when the dividends from the US stock is paid to the fund there is 15 withholding tax. As is the case with all forms of transactional. The United States has tax treaties with a number of foreign countries.

Income taxes on certain income profit or gain from sources within the United States. 3 Non-Resident Withholding Tax Rates for Treaty Countries 134 Non-Resident Withholding Tax Rates for Treaty Countries1Continued Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Lithuania7 10 515 10 101525 Luxembourg 10 515 010 25 Malaysia 15 15 15 1525 Malta 15 15 010 1525 Mexico 10 515 010 1525 Moldova 10 515 10 1525. As you can see some nations are far friendlier to foreign dividend investors than others.

Each country has multiple forms of withholding taxes rates and procedures. These reduced rates and exemptions vary among countries and specific items of income. From Bulgaria at 29 percent to Sweden at 76 percent.

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

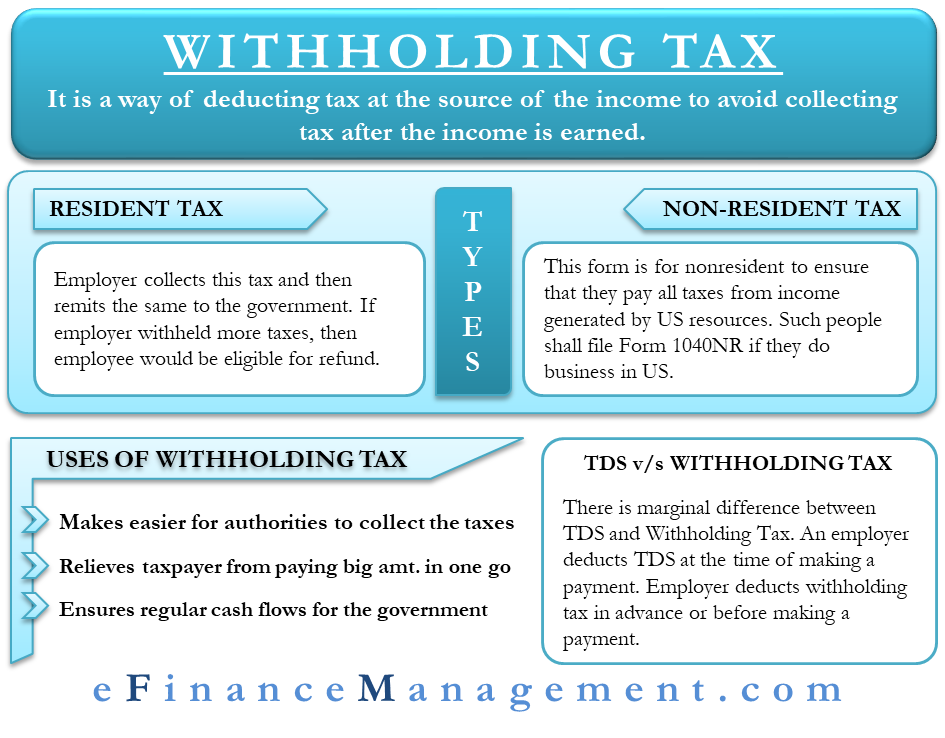

Withholding Tax All You Need To Know

Withholding Tax All You Need To Know

Dividend Withholding Tax Rates By Country 2015 Topforeignstocks Com

Dividend Withholding Tax Rates By Country 2015 Topforeignstocks Com

Withholding Tax In China China Briefing News

Withholding Tax In China China Briefing News

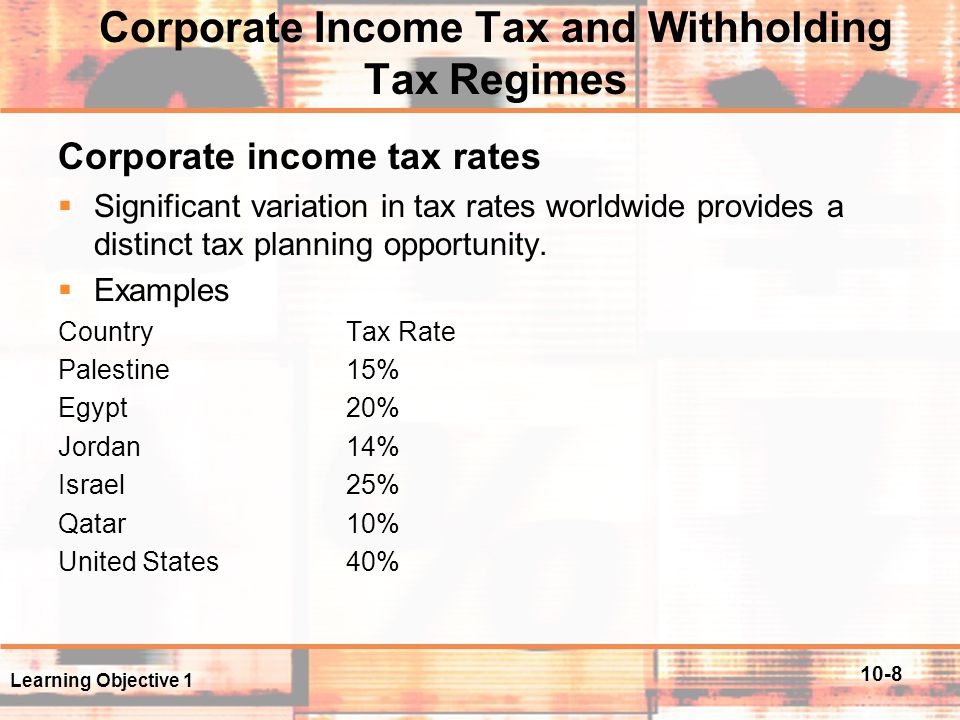

International Taxation Ppt Download

International Taxation Ppt Download

International Withholding Tax Recovery Envisage Gmbh

International Withholding Tax Recovery Envisage Gmbh

Extended Withholding Tax Sap Simple Docs

Extended Withholding Tax Sap Simple Docs

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Is Dividend Withholding Tax Important In Investing Investment Moats

Is Dividend Withholding Tax Important In Investing Investment Moats

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

Withholding Tax And Interest Rates P2p News

Withholding Tax And Interest Rates P2p News

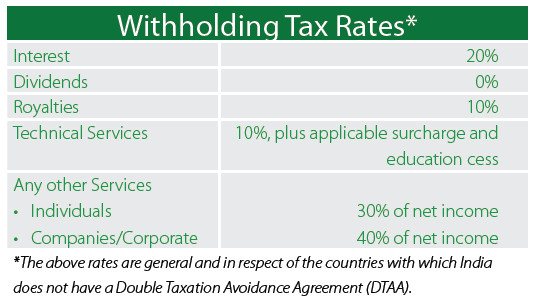

Withholding Tax Rates In India Dezan Shira Associates

Withholding Tax Rates In India Dezan Shira Associates

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Is Dividend Withholding Tax Important In Investing Investment Moats

Is Dividend Withholding Tax Important In Investing Investment Moats

Extended Withholding Tax Sap Simple Docs

Extended Withholding Tax Sap Simple Docs

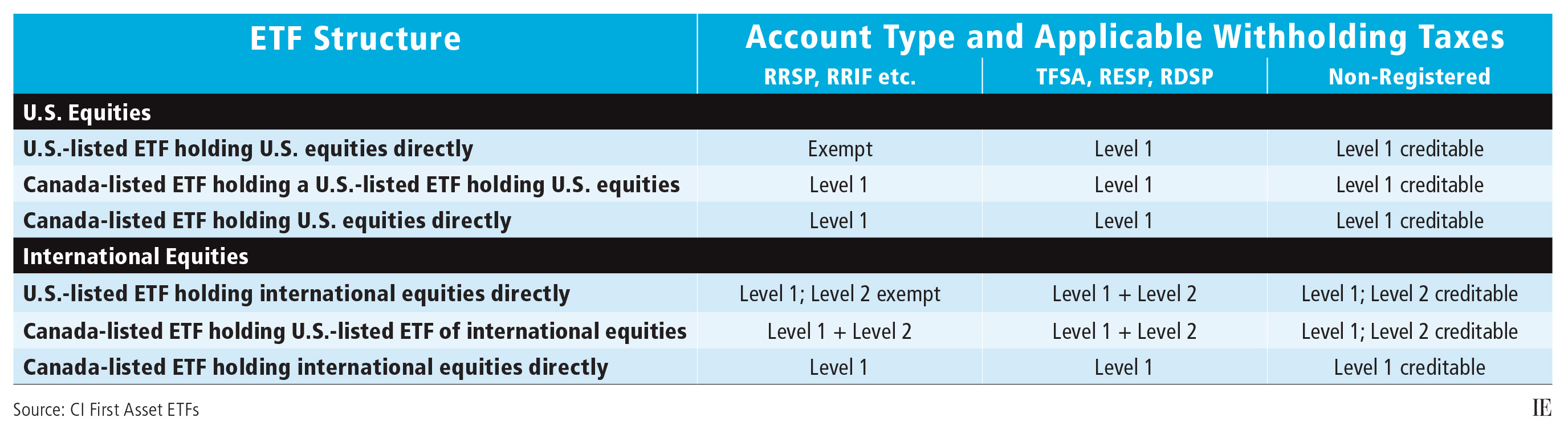

Etfs And Foreign Withholding Taxes Investment Executive

Etfs And Foreign Withholding Taxes Investment Executive

Post a Comment for "Which Countries Have Withholding Tax"