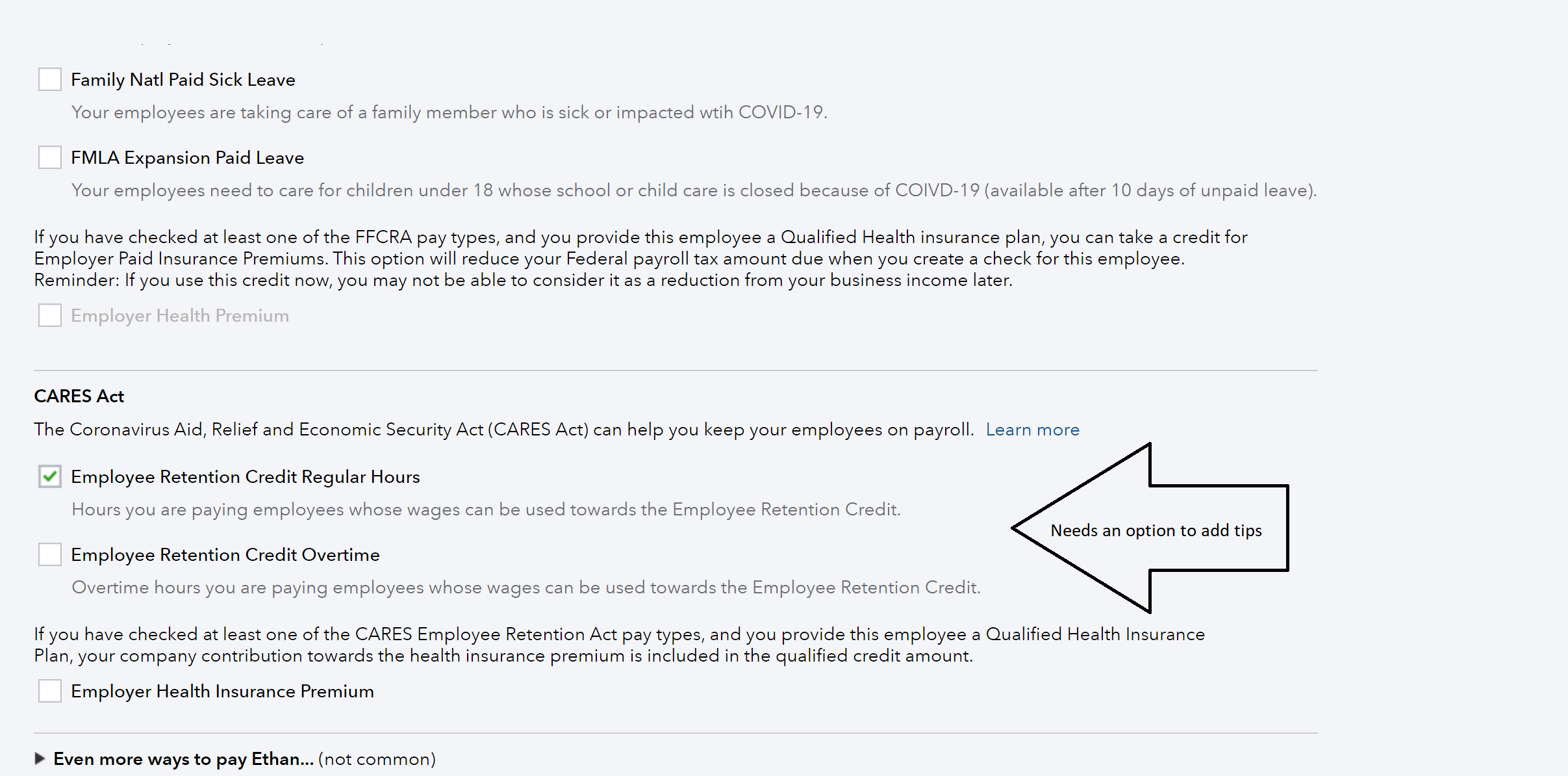

Employee Retention Credit And Tipped Employees

Qualified wages are limited to 10000 per employee per calendar quarter in 2021. The small business Employee Retention Credit lets employers take a 70 credit up to 10000 of an employees qualifying wages per quarter.

Employee Retention Credit The Dancing Accountant

Employee Retention Credit The Dancing Accountant

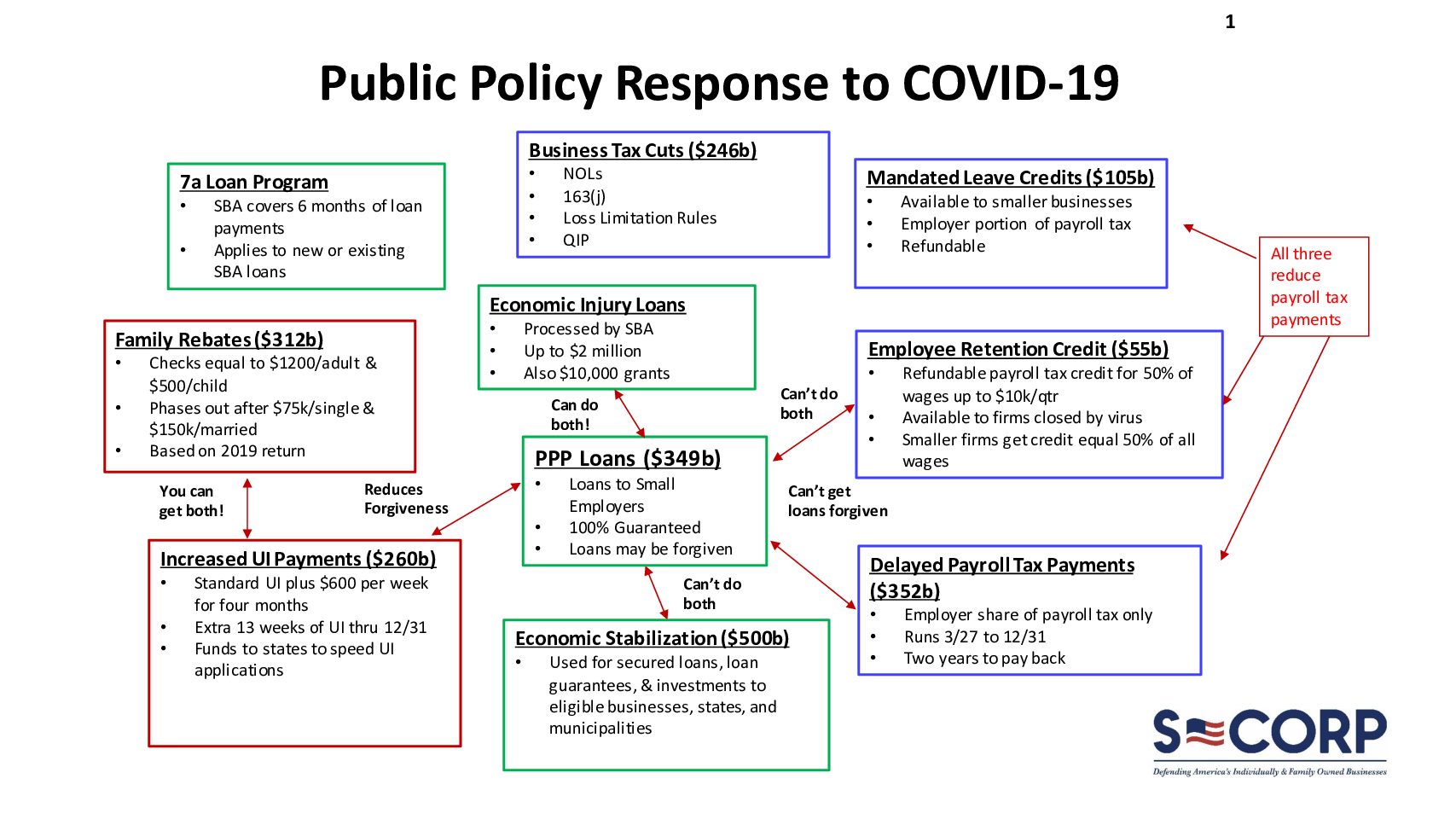

The IRS has issued guidance for employers claiming the Employee Retention Credit under the Coronavirus Aid Relief and Economic Security Act CARES Act modified by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 Relief Act.

Employee retention credit and tipped employees. Specifically the Employee Retention Credit is designed to aid and encourage employers into keeping employees on their companys payroll and mitigating the financial loss and burden imposed on employers from the effects of COVID-19. Maximum Credit Amount. Key Takeaways The updated Employee Retention Credit ERC provides a refundable credit of up to 5000 for each full-time equivalent employee you retained between March 13 and Dec.

The total credit is capped at 5000 per employee and applies against employment taxes on wages paid to all employees. The credit was created by the Coronavirus Aid Relief and Economic Security CARES Act PL 116-136 and amended by the Consolidated Appropriations Act 2021 PL 116-260. Which employers are eligible for the employee retention credit.

Again the maximum credit amount per employee for 2021 is 14000 7000 per quarter. In general eligible employers can claim a refundable employee retention credit against the employer share of Social Security tax equal to 70 percent of the qualified wages they pay to employees after December 31 2020 through June 30 2021. April 6 2021 The IRS published Notice 2021-23 on April 2 with new guidance regarding changes made to the Employee Retention Credit for 2021.

1 As with Notice 2021. The employee retention credit can now be claimed through Dec. If youre a small restaurant or business with 500 or fewer employees and youve had more than a 20 decline of gross receipts in a quarter compared to 2019 you may be interested in hearing about this latest news regarding the Employee Retention Tax Credit ERTC.

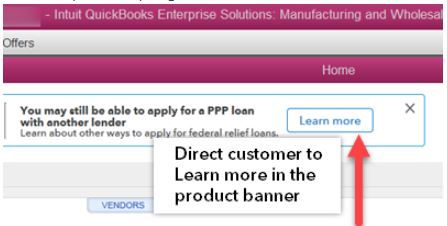

Notice 2021-23 explains the changes to the Employee Retention Credit for the first two calendar quarters of 2021 including the following. April 9 2021 652 AM If youre a business owner getting ready to file your quarterly employment tax return you may have a lot of questions especially when it comes to the Employee Retention Credit. And thanks to the new provision in the law yes this applies even if youve already applied for the first or second draw PPP.

The IRS explained the changes to the employee retention credit ERC for the first two calendar quarters of 2021 in Notice 2021-23 which amplifies Notice 2021-20The credit was created by the Coronavirus Aid Relief and Economic Security CARES Act PL 116-136 and amended by the Consolidated Appropriations Act 2021 PL 116-260. A tip is the sole property of the tipped employee regardless of whether the employer takes a tip credit. 31 2021 to eligible employers who retained employees during the COVID-19 pandemic.

31 2020 and up. The Employee Retention Credit is a beneficial provision of the CARES Act nestled within the COVID-19 stimulus bill. Eligible employers may claim a refundable tax credit against their share of Social Security tax equal to 70 of qualified wages paid to employees after December 31 2020 and through June 30 2021.

The IRS released guidance on the version of the Employee Retention Credit ERC contained in the Taxpayer Certainty and Disaster Relief Act TCDRA of 2020 that is in effect for the first two quarters of 2021 in Notice 2021-23. The tax credit is equal to 50 of up to 10000 in qualified wages paid between March 12December 31 2020. Under the recently enacted American Rescue Plan Act and previously under the Consolidated Appropriations Act 2021 the employee retention credit a provision of the CARES Act is extended and expanded.

1 T The FLSA prohibits any arrangement between the employer and the tipped employee whereby any part of the tip received becomes the property of the employer. The new Notice only deals with the new rules for the first two calendar quarters of 2021 that were passed by Congress last December. There is a 100-employee limitation.

This Notice follows the extensive Notice 2021-20 which covers details of the ERC related to 2020. The Notice 2021-23 expands on the IRSs guidance issued on the Employee Retention Credit ERC in Notice 2021-20 on March 1st. The IRS explained the changes to the employee retention credit ERC for the first two calendar quarters of 2021 in Notice 2021-23 which amplifies Notice 2021-20.

4 hours agoThe credit shes talking about is the Employee Retention Credit a fully refundable tax credit for employers who continued to pay employees even after the pandemic disrupted many of their.

Employee Retention Tax Credit Erc For Covid 19 By Deducting The Right Way Deductright Medium

Employee Retention Tax Credit Erc For Covid 19 By Deducting The Right Way Deductright Medium

Blog Employee Retention Credit Could Help Your Business Montgomery Community Media

Blog Employee Retention Credit Could Help Your Business Montgomery Community Media

Norman Grill The Employee Retention Credit Could Help Your Business

Norman Grill The Employee Retention Credit Could Help Your Business

Don T Leave Money On The Table Employee Retention Credit Modified And Extended Cpa Practice Advisor

Don T Leave Money On The Table Employee Retention Credit Modified And Extended Cpa Practice Advisor

17 Employee Benefits Are Something That We As People All Fight For In The Workplace And To Make Sure That Th Employee Benefit Job Benefits Personal Insurance

17 Employee Benefits Are Something That We As People All Fight For In The Workplace And To Make Sure That Th Employee Benefit Job Benefits Personal Insurance

The Employee Retention Credit And How It Can Help Your Business Narfa

The Employee Retention Credit And How It Can Help Your Business Narfa

Payroll Tax Deferral Retention Credit S Corps Molen Associates

Payroll Tax Deferral Retention Credit S Corps Molen Associates

Employee Retention Credit The Dancing Accountant

Employee Retention Credit The Dancing Accountant

Tips To Maximize 2020 Employee Retention Credit Erc Ppp Interaction The Dancing Accountant

Tips To Maximize 2020 Employee Retention Credit Erc Ppp Interaction The Dancing Accountant

Employee Retention Tax Credit Ertc Is It For Me Ketel Thorstenson Llp

Employee Retention Tax Credit Ertc Is It For Me Ketel Thorstenson Llp

Innovative Techniques And Strategies For Employee Retention Hr Retention Em Employee Retention Employee Engagement Infographic Employee Retention Strategies

Innovative Techniques And Strategies For Employee Retention Hr Retention Em Employee Retention Employee Engagement Infographic Employee Retention Strategies

How To Look Up The Employee Retention Tax Credit Erc In Gusto Payroll The Dancing Accountant

How To Look Up The Employee Retention Tax Credit Erc In Gusto Payroll The Dancing Accountant

Employee Retention Tax Credit Significantly Modified And Expanded For Businesses Shindelrock

Post a Comment for "Employee Retention Credit And Tipped Employees"