Employment Tax Incentive Extension

American Rescue Plan Act of 2021 Were reviewing the tax provisions of the American Rescue Plan Act of 2021 signed into law on March 11 2021. Welcome to the 2020 Oklahoma Business Incentives and Tax Information Guide.

Business Tax Renewal Instructions Los Angeles Office Of Finance

Business Tax Renewal Instructions Los Angeles Office Of Finance

The rules legislation and appropriations related to taxes and incentives are very dynamic and as changes occur this Tax Guide will be updated.

Employment tax incentive extension. Get details in this announcement. Employers were eligible to defer an unlimited amount of employer Social Security taxes on wages paid between March 12 2020 and December 31 2020. Update to Form 8844 Rev.

As part of the COVID-19 tax relief measures provided by the Minister of Finance the Employment Tax Incentive ETI for qualifying employees were increased from R 1 000 to R 1 500 for the first 12 qualifying months and from R 500 to R 1 000 to the second 12 qualifying months. This information is designed to assist business people and people thinking about operating a business in Oklahoma. The way the term Indian reservations was used in the bill caused confusion as to Congressional intent.

Oklahoma Business Incentives and Tax Guide 1. To resolve this issue Congress further defined reservations and portions of Oklahoma that qualify as reservations in the Taxpayer Relief Act of 1997. OTC County Apportionment for Distribution of Tax Revenues Top 100 Delinquencies Tax Professionals Tax Preparers Software Developers Bonus Depreciation Information Individual E-Filing Guidelines Corporate E-Filing Guidelines Tax Preparers.

What follows is meant to be basic introductory information and should not be considered the final word in business taxes in Oklahoma. This is now part of our very sparse tax breaks offered by Government for the long haul and which is an easy and totally. The Taxation Laws Amendment Act No.

The credit ranges between 125 and 25 of the amount paid towards a paid leave. 23 of 2018 promulgated on 17 January 2019 extended the Employee Tax Incentive scheme ETI scheme which would have lapsed on 28 February 2019 for a further 10 years. March 2020 for Revenue Procedure 2020-16 --19-JUN-2020.

Empowerment Zone tax benefits which expired in 2017 have been retroactively renewed for 2018 2019 and 2020. Extension of tax incentive for Returning Expert Programme REP The application period for the REP incentive to be extended for another three years and revised as follows. Employer payroll tax deferrals.

Louis van Manen Director. The deadlines for individuals to file and pay most federal income taxes are extended to May 17 2021. Continue to monitor this webpage for updates on guidance once it becomes available.

OKLAHOMA BUSINESS INCENTIVES AND TAX GUIDE FOR FISCAL YEAR 2020. The tax incentive for businesses locating on former Indian lands expired as of December 31 2013 awaiting extension by Congress. Latest Updates on Coronavirus Tax Relief Tax Deadlines Changed.

TCDTRA section 113 extends the Work Opportunity Tax Credit WOTC from December 31 2020 through December 31 2025 2 The WOTC is a federal income tax credit ranging from 2400 to 9600 for each qualified newly. More than two-thirds of the lands in Oklahoma meet the Internal Revenue Service-qualifying definition of former Indian lands and qualify for accelerated depreciation. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the empowerment zone designation to December 31 2025.

Incentive Current Proposed For employers hiring employees earning RM1500 and above per month RM800 per month. December 18 2019 Tax Extenders Passed By House Extends WOTC Through 2020 The Taxpayer Certainty and Disaster Tax Relief Act of 2019 extends the Work Opportunity Tax Credit WOTC another year through December 31 2020. Government formally introduced the Employment Tax Incentive ETI into law on 1 January 2014 through the promulgation of the Employment Tax Incentive Act No 26 of 2013.

Business Tax Types. The IRS is working to provide guidance implementing this extension. The purpose of the ETI was to reduce the cost to employers of hiring young and inexperienced youth.

40 of monthly income for a period of 6 months subject to a maximum of RM4000 per month. Employee tax incentive extension opportunities and concerns. The high levels of unemployment in South Africa in particular unemployment in the youth led to the introduction of the employment tax incentive ETI scheme created under the Employment Tax Incentive Act No 26 of 2013 ETI ActThe purpose of the ETI is to encourage employers to employ young job seekers.

For employers hiring disabled long-term unemployed and retrenched workers Disabled workers - RM1000 per month. 17 April 2020. In the Budget Reconciliation Act of 1993 Congress provided income tax incentives to businesses located on Indian reservations.

Flat rate of 15 on employment income for a period of five consecutive YAs. This is a tax credit added by the Tax Cuts and Jobs Act TCJA and it. In other words the ETI is essentially a cost-sharing mechanism.

The deferred taxes will be paid in two equal installments at the end of 2021 and 2022.

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Taxes 2021 Everything New Including Deadline Stimulus Payments And Unemployment Cnet

Calculating Your Solar Tax Credit 2021 Rec Solar

Calculating Your Solar Tax Credit 2021 Rec Solar

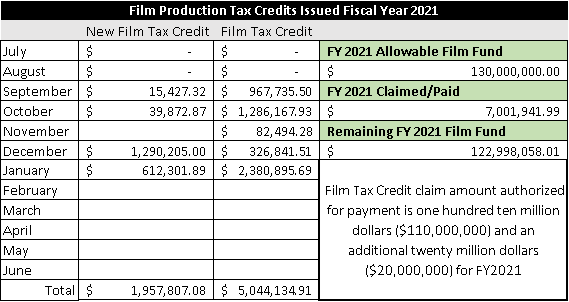

Film Production Tax Credit Tax Professionals

Film Production Tax Credit Tax Professionals

Good News The Federal Income Tax Deadline Is Extended By A Month Bring Me The News

Good News The Federal Income Tax Deadline Is Extended By A Month Bring Me The News

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Year End Appropriations Act Includes Income And Employment Tax Provisions Stoel Rives Llp Jdsupra

Year End Appropriations Act Includes Income And Employment Tax Provisions Stoel Rives Llp Jdsupra

Us Congress Passes Stimulus Package Kpmg Global

Us Congress Passes Stimulus Package Kpmg Global

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

The Coronavirus Relief Bill Every Benefit For Small Businesses Bench Accounting

The Coronavirus Relief Bill Every Benefit For Small Businesses Bench Accounting

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Help For Self Employed Coronavirus Relief For Self Employed Individuals

Q A Can I File A Second Irs Tax Deadline Extension For My Corporate Business Taxes Business Tax Tax Deadline Irs Taxes

Q A Can I File A Second Irs Tax Deadline Extension For My Corporate Business Taxes Business Tax Tax Deadline Irs Taxes

Doing Business In The United States Federal Tax Issues Pwc

Doing Business In The United States Federal Tax Issues Pwc

Https Www Irs Gov Pub Irs News Fs 09 11 Pdf

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Cares Act Provisions For Financial Advisors And Their Clients

Cares Act Provisions For Financial Advisors And Their Clients

Trump Extends Some Coronavirus Relief And Defers Payroll Tax Courthouse News Service

Trump Extends Some Coronavirus Relief And Defers Payroll Tax Courthouse News Service

Post a Comment for "Employment Tax Incentive Extension"