Sc Employment Tax Forms

Withholding Tax is taken out of taxpayer wages to go towards the taxpayers total yearly income tax liability. March 31 2023 Work Opportunity Tax Credit 1.

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

Department of Employment and Workforce is here to help you with your business needs.

Sc employment tax forms. The most common use of the 1099-G is to report unemployment compensation as well as any state or local income tax refunds you received that year. Download South Carolina Form SC1040ES from the list of forms in the table below on this page. Form NumberSC W-4 South Carolina Employees Withholding Allowance Certificate - 2021 SC W-4.

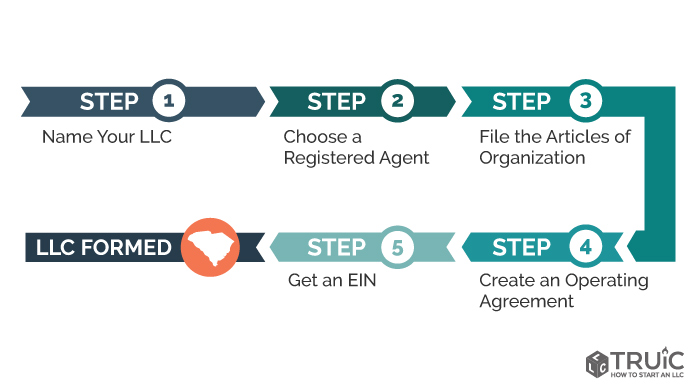

Form NameSC Withholding Tax Information Guide. Corporations must be represented by an attorney licensed in the state of South Carolina. Small Business Events in Your Area.

Business Licenses Permits Registration South Carolina Secretary of State Department of Commerce. South Carolina State Website. Department of Employment and Workforce Appeal Tribunal PO.

South Carolina Form SC1040ES is used to pay estimated taxes. Department of Employment and Workforce 1550 Gadsden Street. Department of Labor Licensing and Regulation Department of Employment and Workforce.

Department of Employment and Workforce is excited to welcome you to the refreshed dewscgov website. Employer Address and Telephone 5. Name of person with self-employment income as shown on Form 1040 1040-SR or 1040-NR Social security number of person with.

After the registration is complete you will receive an Employer Account Number EAN and can begin to file wage reports and maintain your account via the online system. We offer services including assistance finding qualified workers instructions on how to pay your unemployment tax information about qualifying for a tax credit and more. APPLICANT INFORMATION See instructions on reverse 2Date Received For Agency Use only EMPLOYER INFORMATION 3.

Notary Public Application PDF Motor Vehicle Forms. If you have too little tax withheld you will owe tax when you file your tax return and you might owe a penalty. State income tax return Unemployment compensation is taxable to South Carolina if it is paid by the state or received by a state resident the state Department of.

1205-0371 Individual Characteristics Form ICF Expiration Date. Box 995 Columbia SC 29202 During the hearing an administrative hearing officer acts as the impartial judge of all facts presented and a field deputy speaks on behalf of the agency. Local Government Reports Accommodations Tax Allocations by County Assessed Property by County Homestead Exemption Reimbursements FIND A FORM Page Image.

Please use the form listed under the current tax year if it is not listed under the year you are searching for. A 1099-G is a tax form from the IRS showing the amount of refund credit or interest issued to you in the calendar year filing from your individual income tax. Drivers License Renewal PDF Disabled Placards and Tags.

Welcome To South Carolina State Unemployment Insurance Tax System Employers who have paid wages in covered employment must register for an employer account. All of the information that you have come to rely on from our agency is in this fresh clean efficient format which is also now fully compatible in mobile view. If you have taxable income from self-employment interest dividends unemployment compensation and pensions you may have to pay estimated tax to the state of South Carolina.

Many of these tasks can now be done online through the UI tax portal SUITSSome forms can be submitted electronically by going to State Information Data Exchange System SIDES E-Response or the Bridge to Benefits Employers Self-Service Portal. Attach to Form 1040 1040-SR or 1040-NR. If you have too much tax withheld you will receive a refund when you file your tax return.

Below are the Unemployment Insurance UI tax forms you may need when reporting to DEW. Tax and Legal Forms. Doing Business in the State.

South Carolina Department of Revenue. Every employerwithholding agent that has an employee earning wages in South Carolina and who is required to file a return or deposit with the IRS must make a return or deposit to the SCDOR for any taxes that have been withheld for state purposes. Form NameSouth Carolina Employees Withholding Allowance Certificate - 2020.

Self-Employment Tax Go to wwwirsgovScheduleSE for instructions and the latest information. Uninsured Motorist Registration PDF Motor Vehicle Dealership License PDF Senior Citizens Discount DOC Change of Residency Affidavit PDF Non-Profit Organizational. Employment and Training Administration Control No.

Form NameNonresident Beneficiary - Affidavit and Agreement Income Tax Withholding. Auxiliary aids and services available upon request to individuals with disabilities at ADAdewscgov. Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay.

![]() Ui Tax Forms Sc Department Of Employment And Workforce

Ui Tax Forms Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

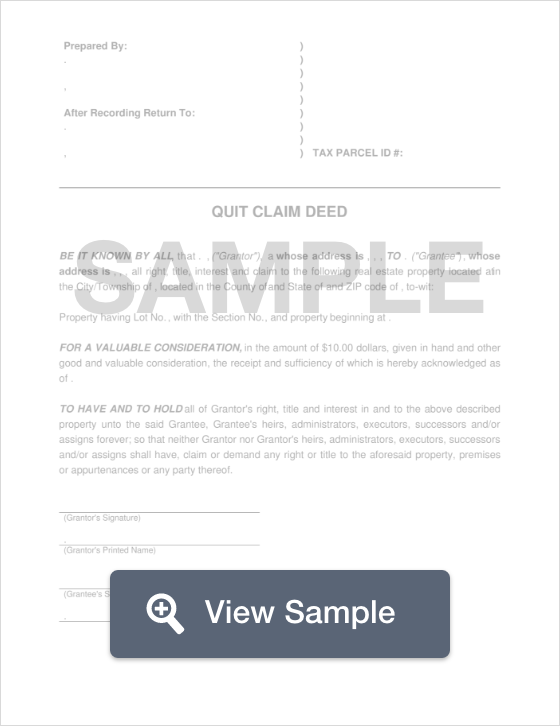

Free South Carolina Quit Claim Deed Templates Pdf Docx Formswift

Free South Carolina Quit Claim Deed Templates Pdf Docx Formswift

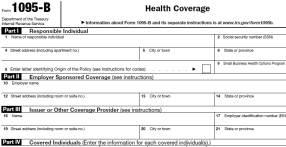

Irs Form 1095 B Frequently Asked Questions Sc Dhhs

Irs Form 1095 B Frequently Asked Questions Sc Dhhs

![]() Forms Sc Department Of Employment And Workforce

Forms Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

W 4 Employee S Withholding Certificate And Federal Income Tax Withholding For 2020 Sap Blogs

How To Change Your South Carolina Registered Agent For Free

States Solidify Plans For New W 4s Paycheckcity

States Solidify Plans For New W 4s Paycheckcity

Accessing Your 1099 G Sc Department Of Employment And Workforce

Accessing Your 1099 G Sc Department Of Employment And Workforce

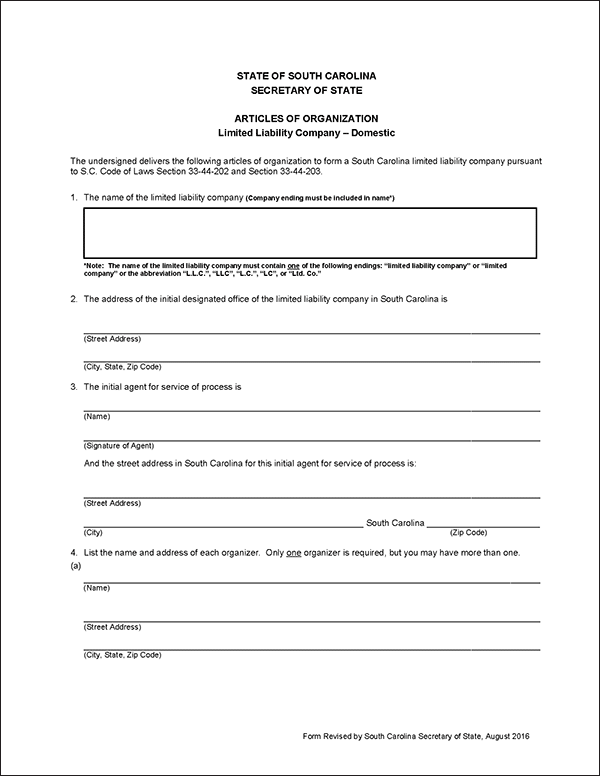

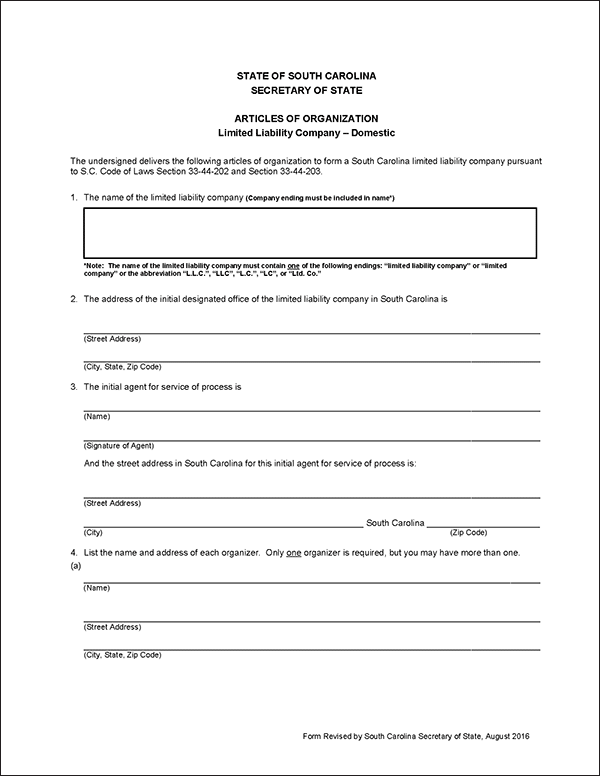

Llc In Sc How To Form An Llc In South Carolina Truic Guides

Llc In Sc How To Form An Llc In South Carolina Truic Guides

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

![]() Unemployment Tax Information Sc Department Of Employment And Workforce

Unemployment Tax Information Sc Department Of Employment And Workforce

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Llc In Sc How To Form An Llc In South Carolina Truic Guides

Llc In Sc How To Form An Llc In South Carolina Truic Guides

What Your Clients Need To Know About Form 1095 C Accountingweb

What Your Clients Need To Know About Form 1095 C Accountingweb

Post a Comment for "Sc Employment Tax Forms"