Self Employment And Ui

Benefits available for self-employed workers Unemployment benefits are available for Washingtonians who have lost work because of the COVID-19 crisisincluding freelancers independent contractors and other self-employed workers. 1040-ES Estimated Tax for Individuals.

Self Employment Ledger Template Newest Blank General Journal Form Of 25 Graceful Self Employm Self Employment Statement Template Bookkeeping Templates

Self Employment Ledger Template Newest Blank General Journal Form Of 25 Graceful Self Employm Self Employment Statement Template Bookkeeping Templates

Coronavirus and Unemployment Insurance.

Self employment and ui. If you are not traditionally eligible for UC you may be eligible to receive PUA. - Regardless I was required to apply for regular UI first before having the option to apply for PUA which would supposedly appears as a link in my connect portal. Pandemic Unemployment Assistance PUA is part of the federal assistance that helps unemployed Californians who are not usually eligible for regular Unemployment Insurance UI benefits.

- I applied for Regular UI on October 2020 through this website. Social security and Medicare taxes and income tax withholding. The Virginia Employment Commission said it has an application available for self-employed workers to receive unemployment benefits during the COVID-19 outbreak.

You have reached Indianas one stop shop for Unemployment Insurance needs - for Individuals who are Unemployed and for Employers. Get Started Now PUA Application Step-by-Step Guide View FAQs. 944 Employers Annual Federal Tax.

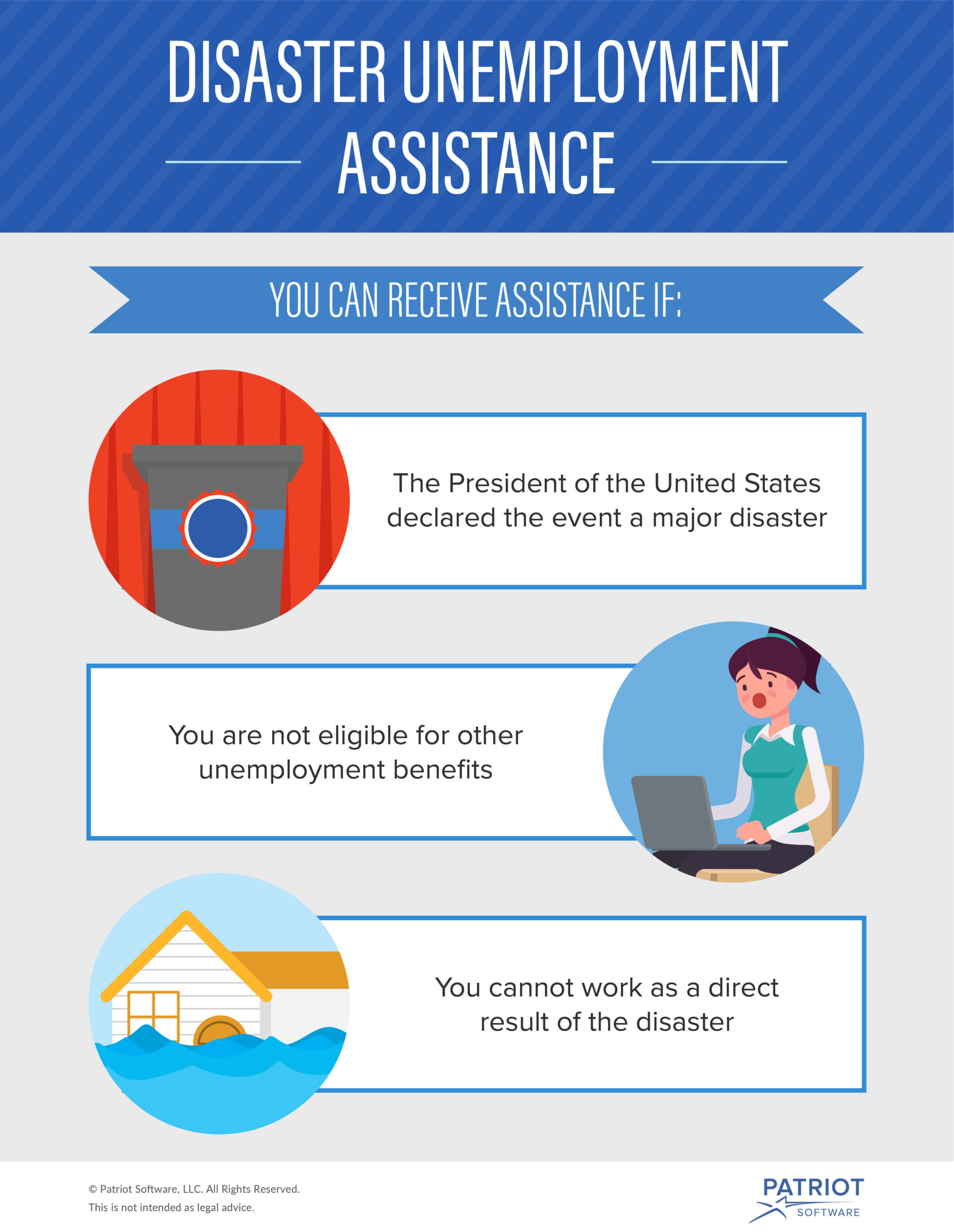

PUA Overview PUA is a temporary federal program that provides up to 79 weeks of unemployment benefits to individuals who are not eligible for regular Unemployment Insurance UI such as. What you need Pandemic Unemployment Assistance PUA provides payment to workers not traditionally eligible for unemployment benefits self-employed independent contractors workers with limited work history and others who are unable to work as a direct result of the coronavirus public health emergency. Please note that Unemployment Insurance is available to Hoosiers whose employment has been interrupted or ended due to COVID-19 you should file for UI and your claim.

941 Employers Quarterly Federal Tax Return. If you are self-employed you may now file for unemployment insurance benefits. Note that you must apply for traditional unemployment compensation benefits first before you can apply for PUA.

The federal Pandemic Unemployment Assistance or PUA program provides benefits for many individuals ineligible for state unemployment benefits including self-employed workers 1099 tax filers and part-time workers. The new federal CARES Act extensions make this possible. - I was a 1099 employeeself-employed so ineligible for regular state UI.

Expanded Eligibility Resource Hub. Unemployment is measured by the unemployment rate which is the number of. Schedule SE Form 1040 or 1040-SR Self-Employment Tax.

To be eligible claimants must have earned both employment wages and self employment income at least 5000 in NET SELF-EMPLOYMENT income in the completed taxable year prior to. 943 Employers Annual Federal Tax Return for Agricultural Employees. Please use our Quick Links or access one of the images below for additional information.

Individuals who are self-employed. Unemployment umemployment rate 51 hai na kh 445 according to Awais according to the OECD Organisation for Economic Co-operation and Development is persons above a specified age usually 15 not being in paid employment or self-employment but currently available for work during the reference period. The federal government has temporarily expanded unemployment insurance eligibility to self-employed workers freelancers and independent contractors.

This includes business owners self-employed workers independent contractors and those with a limited work history who are out of business or have significantly reduced their services as a.

Pin On Starting A Business Side Hustles After Divorce

Pin On Starting A Business Side Hustles After Divorce

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Quickbooks Self Employed Review Best For Self Employed 2019 Quickbooks Small Business Accounting Small Business Organization

Quickbooks Self Employed Review Best For Self Employed 2019 Quickbooks Small Business Accounting Small Business Organization

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

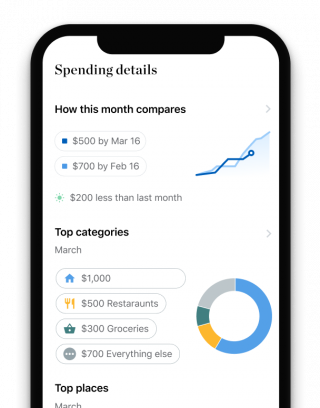

Easy Bookkeeping For Entrepreneurs Tax Software Quickbooks Self Employment

Easy Bookkeeping For Entrepreneurs Tax Software Quickbooks Self Employment

Ui Online Reporting Self Employment And Commissions Using Ui Online Youtube

Ui Online Reporting Self Employment And Commissions Using Ui Online Youtube

Self Employed How To Claim 600 Week Unemployment Youtube

Self Employed How To Claim 600 Week Unemployment Youtube

Can I Get Unemployment If I M Self Employed Credit Karma

Can I Get Unemployment If I M Self Employed Credit Karma

Make Free Paystubs Create A Pay Stub For Free On Paystub Generator Online Tool Payroll Template Payroll Software Online Tools

Make Free Paystubs Create A Pay Stub For Free On Paystub Generator Online Tool Payroll Template Payroll Software Online Tools

Quickbooks Self Employed Save More With Quickbooks Turbotax Iphone Apps App Iphone Apps Free

Quickbooks Self Employed Save More With Quickbooks Turbotax Iphone Apps App Iphone Apps Free

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Filing For Coronavirus Unemployment If You Re Self Employed Nerdwallet

Self Employed Unemployment Insurance Can Business Owners File

Self Employed Unemployment Insurance Can Business Owners File

Massachusetts Rolls Out New Unemployment System For The Self Employed In Response To Covid 19

Massachusetts Rolls Out New Unemployment System For The Self Employed In Response To Covid 19

Customizing You To Your Market Resume Examples Sample Resume Resume

Customizing You To Your Market Resume Examples Sample Resume Resume

Seo For The Self Employed Non Techie Maggie Karshner Self Employment Coach Entrepreneurial Coach Website Optimization Self Seo

Seo For The Self Employed Non Techie Maggie Karshner Self Employment Coach Entrepreneurial Coach Website Optimization Self Seo

Quickbooks Playbook Hr Acquisition Adds Contractor Management Quickbooks Online Quickbooks Online Self

Quickbooks Playbook Hr Acquisition Adds Contractor Management Quickbooks Online Quickbooks Online Self

Post a Comment for "Self Employment And Ui"