Self Employment Unemployment Dc

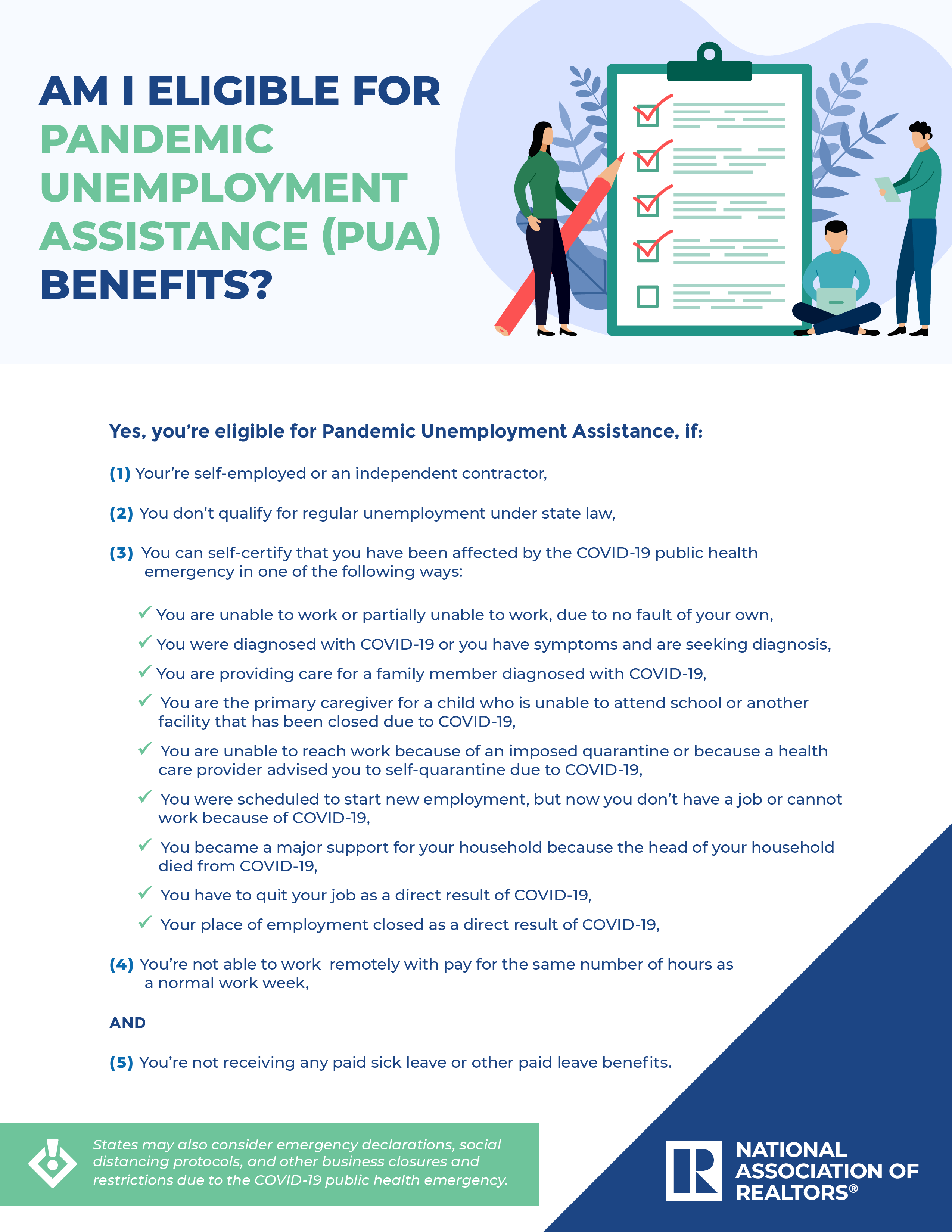

Under PUA individuals who do not qualify for regular unemployment compensation and are unable to continue working as a result of COVID-19 such as self-employed workers independent contractors and gig workers are eligible for PUA benefits. Welcome to the DC Department of Employment Services Unemployment Compensation Program.

Pandemic Unemployment Assistance Pua Benefits Checklist

Pandemic Unemployment Assistance Pua Benefits Checklist

The Department of Employment Services DOES issues monthly bills to all employers with balances due.

Self employment unemployment dc. If you were previously self-employed starting with week ending January 2 2021 you may be eligible for an additional 100 supplemental payment under the Mixed Earners Unemployment Compensation MEUC program. FEDERAL PANDEMIC UNEMPLOYMENT COMPENSATION FPUC. Begin here to start the process of filing reviewing or just checking the status of your claim for your unemployment benefits.

Pandemic Unemployment Assistance is a new federal program that is part of the Coronavirus Aid Relief and Economic Security CARES Act that provides extended eligibility for individuals who have traditionally been ineligible for Unemployment Insurance benefits eg self-employed workers independent contractors. Under new coronavirus laws self-employed workers are now eligible for unemployment benefits. Historically self-employed individuals were excluded from receiving unemployment benefits.

If you are a self-employed worker independent contractor or business owner report your income in the weeks you actually received payment no matter when you performed the service. To expedite the roll out of the PUA program all claimants were given the DCs minimum weekly benefit amount of 179 but would receive an email asking if they would like their claim to be reevaluated for a higher benefit amount that was based on. Claimants must provide documentation substantiating their self-employment income.

To be eligible claimants must have earned both employment wages and self employment income at least 5000 in NET SELF-EMPLOYMENT income in the completed taxable year prior to their Regular UI application. The CARES Act creates a temporary Pandemic Unemployment Assistance PUA program which allows self-employed workers who are otherwise ineligible for unemployment benefits under state and federal. 27 2020 federal law extended Pandemic Unemployment Assistance PUA benefits through the week ending March 13 2021.

To begin the process of filing for your unemployment benefits you will need to have the following information readily available. Your Social Security Number. Eligible claimants can file for Mixed Earners Unemployment Compensation MEUC.

Mixed Earner Unemployment Compensation MEUC - Those who earned employment and self-employment wages at least 5000 in self-employment income in the tax year prior to their regular UI application and also receive benefits through regular UI PEUC Extended Benefits or Work Share programs. Unemployment benefits are available for Washingtonians who have lost work because of the COVID-19 crisisincluding freelancers independent contractors and other self-employed workers. Your most recent 30-day employers name address phone number and dates of employment.

Unemployment insuranceUI is not available to people who are self-. Claimants who receive PUA do not qualify for MEUC. Page 1 A QUICK GUIDE TO APPLYING In order to be eligible for unemployment insurance benefits you must have either lost your job through no fault of your own or had your wages or salary limited.

CORONAVIRUSDCGOV ACCESSING UNEMPLOYMENT BENEFITS. The District offers multiple ways to file for unemployment compensation. These balances are generated from the District of Columbia Unemployment Insurance Tax system of record not the online Employer Self-Service Portal ESSP.

However the government has stepped in and worked to provide relief for gig workers in the face of coronavirus. The new federal CARES Act extensions make this possible. If you performed services but didnt receive income that week then you do not need to report any income for that week.

Luckily the Pandemic Unemployment Assistance PUA program was put in place which allowed those who were 1099gig workers to be eligible. Therefore your account in ESSP may indicate discrepancies in balances due. Gig workers independent contractors and self employed persons are also eligible for unemployment assistance through the Pandemic Unemployment Assistance Program scroll down for those details.

You may be eligible for PUA if you are self-employed seeking part-time work do not have sufficient work history to qualify for regular UI or have exhausted your rights to.

Unemployment Help Metro Washington Council Afl Cio

How D C Is Responding To Covid 19 Updated D C Policy Center

How D C Is Responding To Covid 19 Updated D C Policy Center

More Self Employed Workers Are Filing For Unemployment Benefits In Maryland And Virginia Dcist

More Self Employed Workers Are Filing For Unemployment Benefits In Maryland And Virginia Dcist

Https Does Dc Gov Sites Default Files Dc Sites Does Page Content Attachments 9 12 19 20ui 20claimant 27s 20rights 20and 20responsibilities Pdf

Https Does Dc Gov Sites Default Files Dc Sites Does Publication Attachments Ui Federal 20lost 20wages 20assistance 20program V6 Final Pdf

Unemployment Compensation Does

Unemployment Compensation Does

Https Does Dc Gov Sites Default Files Dc Sites Does Publication Attachments Eligibility 20for 20federal 20supplemental 20lost 20wages 20assistance 20 28lwa Pdf

Https Does Dc Gov Sites Default Files Dc Sites Does Publication Attachments 2021 20unemployment 20insurance 20 20continued 20assistance 20act 20updatesv3 Pdf

![]() Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

Your Guide To Getting Unemployment And Other Relief In D C Virginia And Maryland Wamu

Your Guide To Getting Unemployment And Other Relief In D C Virginia And Maryland Wamu

Dc Unemployment Questions Help And Resources Washingtondc

Dc Unemployment Questions Help And Resources Washingtondc

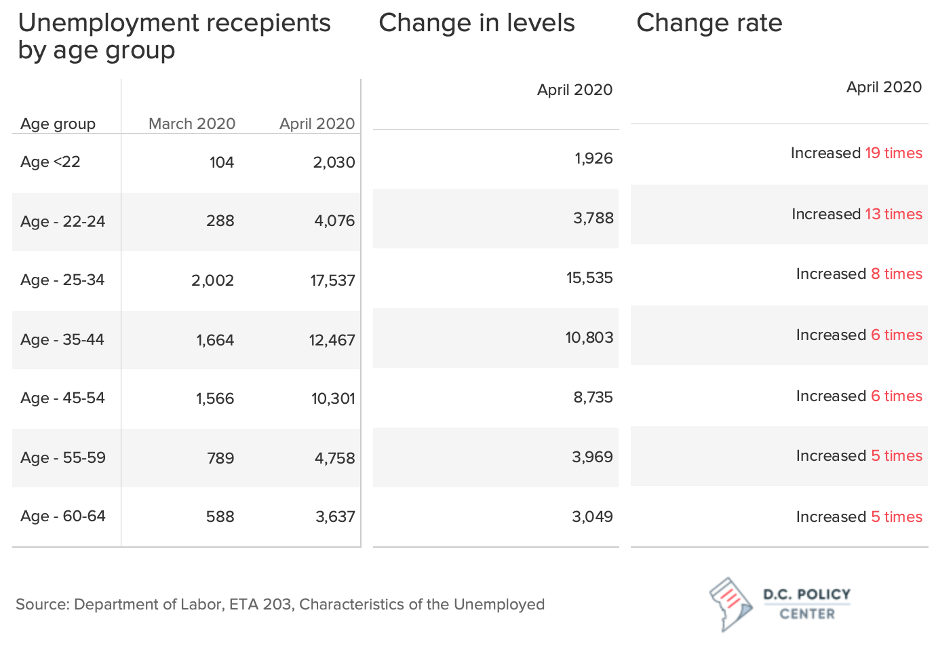

Pandemic Induced Unemployment Has Hit The District S Hispanic Latino And Younger Workers More Intensely D C Policy Center

Pandemic Induced Unemployment Has Hit The District S Hispanic Latino And Younger Workers More Intensely D C Policy Center

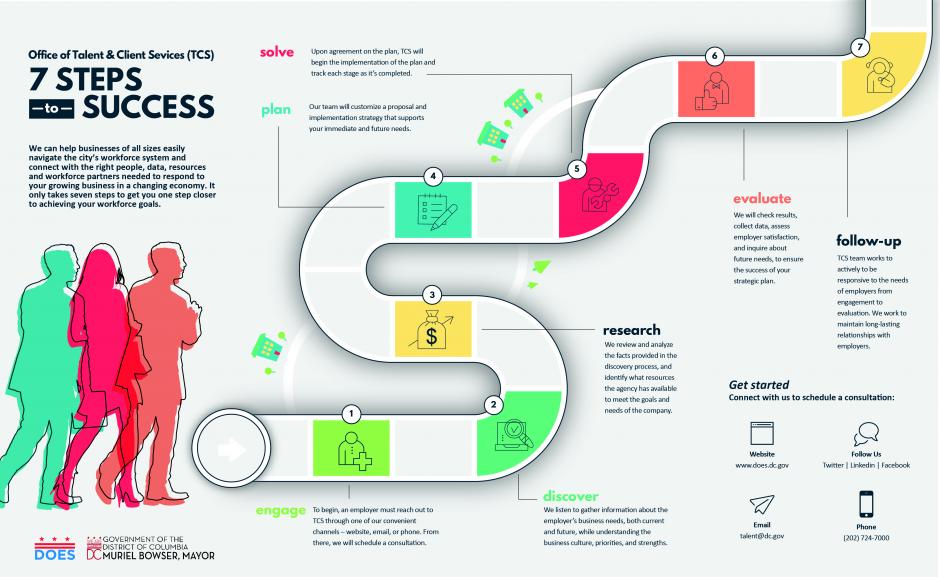

Office Of Talent Client Services Does

Office Of Talent Client Services Does

Unemployment Benefits Will End For Millions Without More Stimulus

Unemployment Benefits Will End For Millions Without More Stimulus

Unemployment Benefits Covid 19 Dc Jobs With Justice

Unemployment Benefits Covid 19 Dc Jobs With Justice

Post a Comment for "Self Employment Unemployment Dc"