Self Employment Guide Cra

The T4002 contains information for self-employed business persons commission sales persons and for professionals on how to calculate the income to report on your income tax return. Generally if you set aside at least.

10 Can T Miss Tax Deductions For Small Businesses Self Employed Persons Tax Deductions Deduction Health Savings Account

10 Can T Miss Tax Deductions For Small Businesses Self Employed Persons Tax Deductions Deduction Health Savings Account

To ask for a CPPEI ruling you can.

Self employment guide cra. For more information see Chapter 5 Eligible capital expenditures in guide T4002 Self-employed Business Professional Commission Farming and Fishing Income. Requesting a ruling If a worker or payer is not sure of the workers employment status either can ask the CRA for a ruling. Quebec workers including the self-employed are covered under the Quebec Pension Plan QPP.

For most companies this process involves registering your company name with the proper government authorities registering your business as a legal entity registering with tax authorities and applying for the appropriate permits and licenses. The CRA and Service Canada will return any repaid amounts to impacted individuals For more information on personal income tax and Covid benefits visit the CRA website. These expenses are necessary to offset your net income lowering your income and reducing your taxes owing.

Self-employed attorneys doctors contractors subcontractors and auctioneers. You are otherwise in business for yourself including a part-time business. As the employer you can deduct your part of the following amounts payable on employees remuneration.

However whether such persons are employees or independent contractors depends on the facts of each case. For more information visit Revenu Québec at rqapgouvqccaen. As a result its important to have your return ready to be filed by April 30 if you suspect you might owe taxes to the CRA.

If you need more information the CRA has an in-depth guide that covers these topics in. A ruling shows whether a worker is an employee or self-employed and. You are a member of a partnership that carries on a trade or business.

Generally you are self-employed if any of the following apply to you. Generally an individual is considered an independent contractor if. The CRA self-employment income Guide T4002 Self-Employed Business Professional Commission Farming and Fishing Income provides the tax information you need for all types of self-employment.

In particular the CRA is focused on contacting CERB recipients for whom it cannot confirm 1 employment or 2 net self-employment income of at least 5000 earned in 2019 or the 12 months prior to applying to CERB which is one of CERBs eligibility criteria. Your obligations to the Canada Revenue Agency CRA may seem like a tangle of red tape and paperwork but it doesnt have to be that way. Once you learn the basics of how Canadian self-employed taxes work and which CRA forms to bookmark tax filing is as straightforward as Sidney Crosby puttin the.

Honoraria and fees that you receive from individuals for marriages baptisms funerals masses etc are usually. If you are a member of the clergy you should receive a Form W-2 Wage and Tax Statement from your employer reporting your salary and any housing allowance. This short guide covers the basics of filling out your T2125 for small business and self-employment income.

Requesting a ruling If a worker or payer is not sure of the workers employment status either can ask the CRA for a ruling. You carry on a trade or business as a sole proprietor or an independent contractor. In particular the CRA focused on contacting CERB recipients for whom it could not confirm 1 employment or 2 net self-employment income of at least 5000 earned in 2019 or the 12 months prior to applying.

Whether you are fully self-employed or have a full-time job and earn self-employed income on the side the Income Tax Act ITA provides guidelines which allow you to deduct a range of business expenses. Once you earn self-employment income your tax return is due to the CRA by June 15 of the following year unless June 15 falls on a weekend or holiday however any taxes owing to the CRA are due by April 30. Some qualifying self-employed individuals whose net self-employment income was less than 5000 may have already voluntarily repaid the CERB the release said.

CPP or QPP contributions. Self-employed individuals in Quebec may be eligible for benefits under the Quebec Parental Insurance Plan QPIP. Dont let tax season spoil that.

A ruling shows whether a worker is an employee or selfemployed and whether that workers employment is pensionable or insurable. As a self-employed sole proprietor you pay federal taxes by reporting your income or loss on a T1 income tax and benefit return with the CRA. In December 2020 the Canada Revenue Agency CRA issued over 650000 letters to many self-employed Canadians regarding the repayment of the Canada Emergency Response Benefit CERB.

Being self-employed is about enjoying your independence. If youre a self-employed business owner in Canada youre legally required to register your business. Treat the value of the inventory as a purchase of goods for resale and include it in the calculation of cost of goods sold in your income statement at the end of the year.

A Guide to Self-Employment Tax Deductions for Clergy and Ministers.

Notional Assessments When The Cra Decides On Their Own What You Owe Them If You Have Been Notionally Assessed Or If You Are Be Tax Advisor Tax Services Tax

Notional Assessments When The Cra Decides On Their Own What You Owe Them If You Have Been Notionally Assessed Or If You Are Be Tax Advisor Tax Services Tax

How To File Self Employed Taxes In Canada Quickbooks Canada

How To File Self Employed Taxes In Canada Quickbooks Canada

Displaying Canadian Tax Checklist Jpeg Business Tax Small Business Tax Tax Deductions

Displaying Canadian Tax Checklist Jpeg Business Tax Small Business Tax Tax Deductions

Best Tax Tips For Students And First Time Filers Income Tax Tax Deadline Tax Forms

Best Tax Tips For Students And First Time Filers Income Tax Tax Deadline Tax Forms

How Canadian Are You Eh Food Recalls Emergency Preparedness Emergency

How Canadian Are You Eh Food Recalls Emergency Preparedness Emergency

How To Think Big As A Small Business Owner Small Business Tips Small Business Owner Start Up Business

How To Think Big As A Small Business Owner Small Business Tips Small Business Owner Start Up Business

Freelance Taxes In Canada 10 Things You Need To Know Income Tax Small Business Tax Small Business Canada

Freelance Taxes In Canada 10 Things You Need To Know Income Tax Small Business Tax Small Business Canada

Income Verification Letter Samples Proof Of Income Letters With Verification Of Employment Loss Income Employment Letter Sample

Income Verification Letter Samples Proof Of Income Letters With Verification Of Employment Loss Income Employment Letter Sample

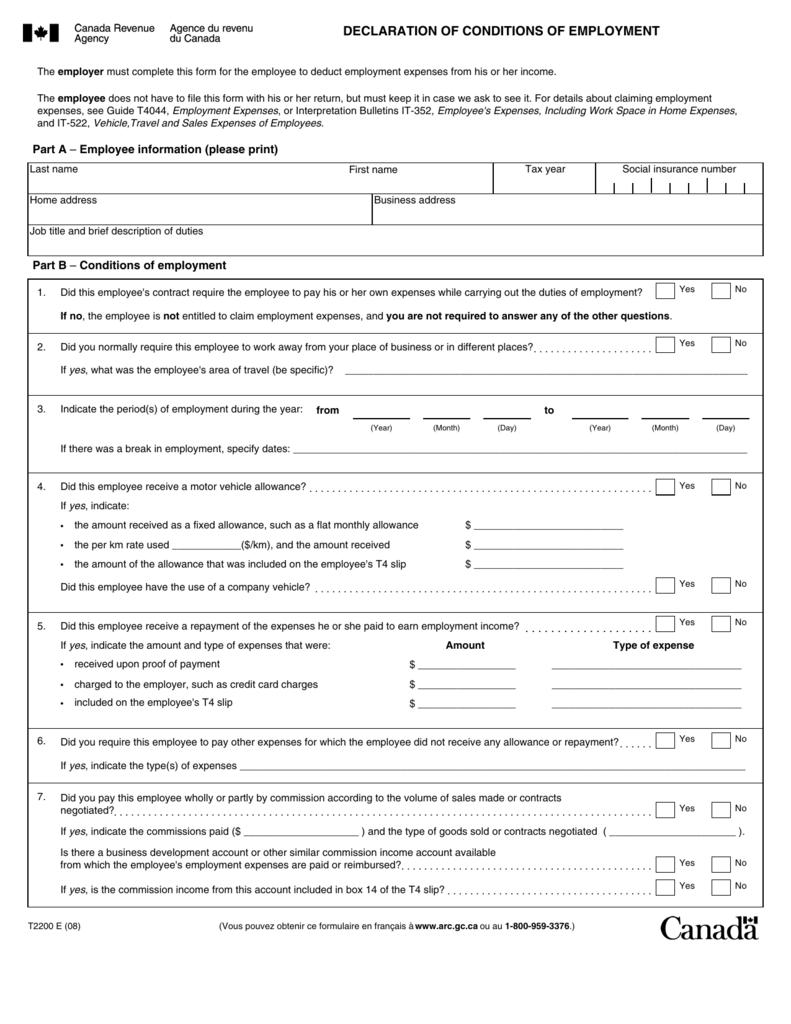

Declaration Of Conditions Of Employment Cra

Declaration Of Conditions Of Employment Cra

Cra Form T2125 Everything You Need To Know Bench Accounting

Cra Form T2125 Everything You Need To Know Bench Accounting

Personal Tax Returns Can Be As Simple As Having A T4 Slip Or It May Be Very Complex Having Investments R Self Employment Professional Accounting Rental Income

Personal Tax Returns Can Be As Simple As Having A T4 Slip Or It May Be Very Complex Having Investments R Self Employment Professional Accounting Rental Income

Https Cdn2 Hubspot Net Hubfs 1577306 2020 20tax 20forms Self 20employment 20worksheet Fillable Pdf

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Filing Your Tax Return Don T Forget These Credits Deductions Business Tax Small Business Tax Business Tax Deductions

Question About Self Employed Income And Expenses T2125 Personalfinancecanada

Know More About The Warrants Search In City Of Harris County Tx When Any Complaint Or One Or More This Or That Questions Stock Illustration Interesting Things

Know More About The Warrants Search In City Of Harris County Tx When Any Complaint Or One Or More This Or That Questions Stock Illustration Interesting Things

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

5 Key Tips To Increase The Value Of Your Accounting Bookkeeping Business Firm Of The Future Bookkeeping Business Accounting Bookkeeping

5 Key Tips To Increase The Value Of Your Accounting Bookkeeping Business Firm Of The Future Bookkeeping Business Accounting Bookkeeping

2018 Tax Deadline For Contractors Coming Up Debtcare Tax Deadline Tax Filing Taxes

2018 Tax Deadline For Contractors Coming Up Debtcare Tax Deadline Tax Filing Taxes

Post a Comment for "Self Employment Guide Cra"