Employment Expenses Motor Vehicle

Flat rate expense allowances. You can deduct expenses you incur to run a motor vehicle that you use to earn business income.

Https Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

Deductible Expenses for Write-Off.

Employment expenses motor vehicle. If a taxpayer uses the car for both business and personal purposes the expenses must be split. If the travel was partly private you can claim only the work-related portion. If you have received a non-taxable motor vehicle allowance and can show that the employment-related motor vehicle expenses are in excess of the allowance and voluntarily include the amount of the allowance in income you can deduct your motor vehicle expenses if employment conditions 1 2 3 and 5 are met.

If you earn self-employed income and use your motor vehicle for the purpose of earning a profit then you will be able to claim the related business expenses on your income tax return and use them to reduce the amount of taxable business income you earned. Motor vehicle expenses may be deducted by an employee on Line 22900 line 229 prior to 2019 of their tax return if the employee. Travel and subsistence exemptions for certain employments.

Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship or Schedule F Form 1040 Profit or Loss From Farming if youre a farmer. Generally any mandatory car expense that you incur enabling your vehicle to be on the road is usually deductible. The types of expenses you can claim on Line 9281 Motor vehicle expenses not including CCA of form T2125 or form T2121 or line 9819 of form T2042 include.

An employee required to work away from the employers establishment may deduct motor vehicle expenses if such expenses have to be paid by himher under the terms of hisher employment contract and heshe does not receive a non-taxable allowance in respect thereof see point 3 of this section. You have a formal telework arrangement with your employee that allows this employee to work at home. Therefore only the expenses incurred in connection with the.

Removal and relocation expenses. However several factors can affect your deduction. Motor Vehicle Expenses Updated.

The deduction is based on the portion of mileage used for business. New Ohio residents guide to obtaining a driver license vehicle title and license plates. Deduct your self-employed car expenses on.

You are not considered to have paid your own motor vehicle expenses if your employer reimburses you or you refuse a reimbursement or reasonable allowance from your employer. These expenses are not deductible even if the private cars were used for business purposes. Was normally required to carry on the duties of employment away from the employers place of business or in different places and.

This information relates to car expenses only. On line 9281 of your T2125 form Motor vehicle expenses you may be eligible to claim. Completing your tax return.

You did not receive a non-taxable allowance for motor vehicle expenses. Vehicle owned by your employee If your employee uses their own vehicle for business-related purposes and you pay them a motor vehicle allowance or reimburse them their costs your business can claim a deduction for the allowance or expenses reimbursed such as the. Expenses incurred directly or in the form of reimbursement on using private hire cars or private cars E Q or S-plate cars such as repair maintenance parking fees petrol costs are disallowable.

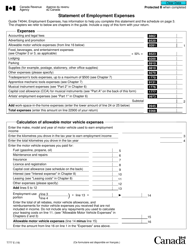

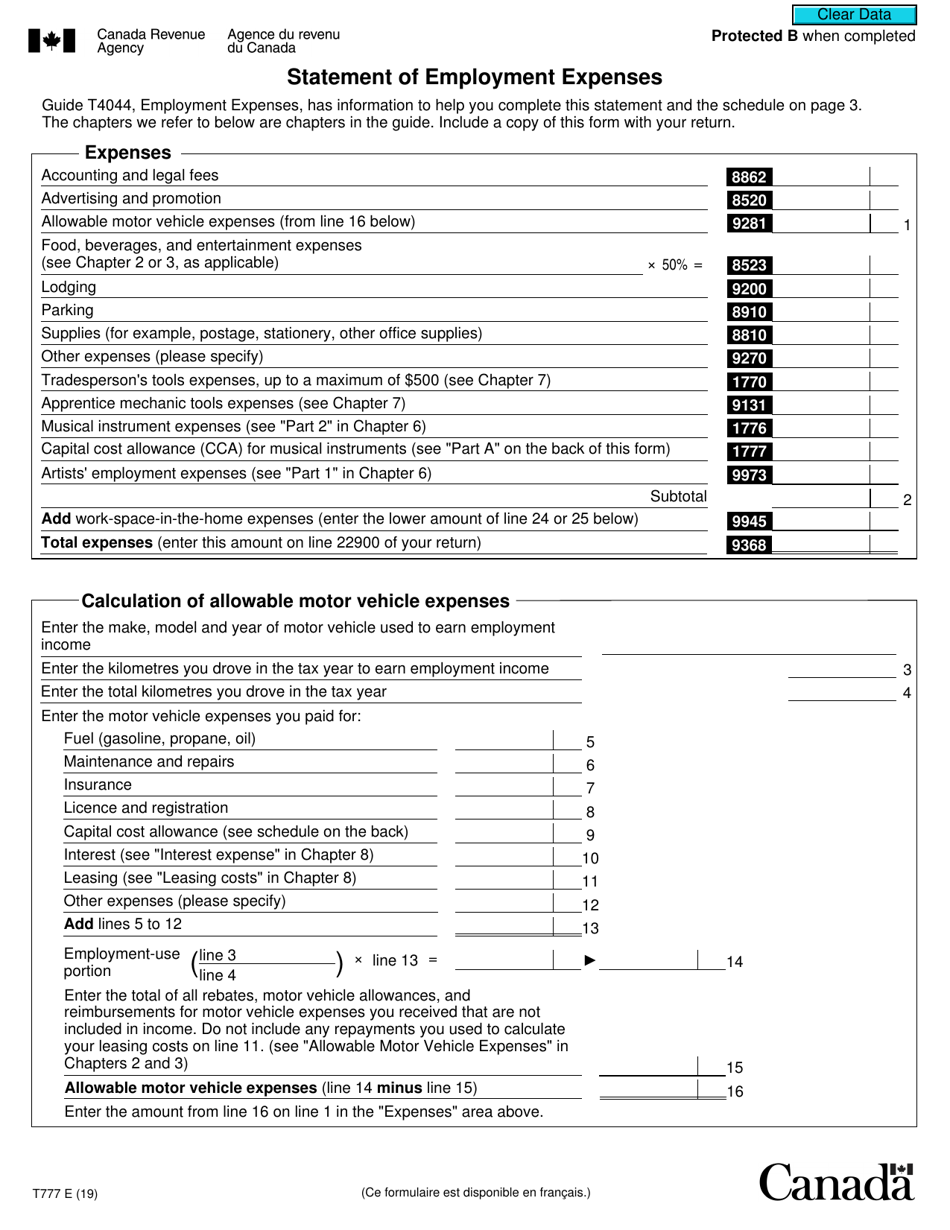

EWorking and home workers. On your personal tax return youll populate all of the car expenses and related KMs on Schedule T777 - Statement of Employment Expenses. Employee expenses overview.

Licence and registration fees. Under your contract of employment you had to pay your own motor vehicle expenses. You allow your employee to use his personal motor vehicle for business and pay him a monthly motor vehicle allowance to pay for the operating expenses and you include the allowance in the employees employment income as a taxable benefit.

The running expenses of a vehicle that is owned or leased by your business. The BMV licenses and regulates people and businesses operating in motor vehicle sales leasing distributing and salvage. There are two methods for figuring car expenses.

New to Ohio Information. Records to be kept. Car expenses If you use your own car in performing your work-related duties including a car you lease or hire you may be able to claim a deduction for car expenses.

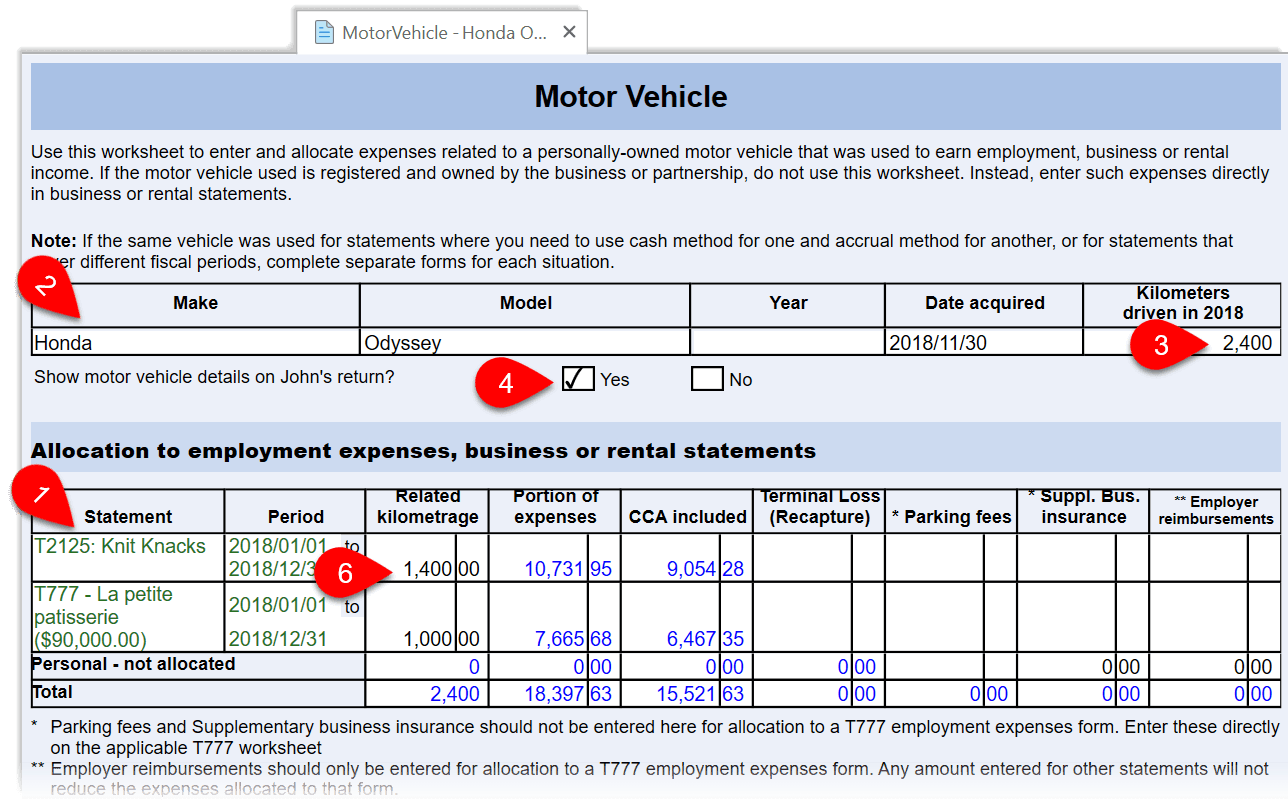

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. When to use a Motor Vehicle worksheet. 2020-07-22 Use the Motor Vehicle worksheet to enter details of vehicle expense and associate them with an income statement T776 T2125 T2121 T2042 T1163 or employment expenses claim T777WS.

Https Www Winthrop Edu Uploadedfiles Controllersoffice Banneraccountcodes Pdf

Form T777 Download Fillable Pdf Or Fill Online Statement Of Employment Expenses Canada Templateroller

Form T777 Download Fillable Pdf Or Fill Online Statement Of Employment Expenses Canada Templateroller

Motor Vehicle Expenses Taxcycle

Motor Vehicle Expenses Taxcycle

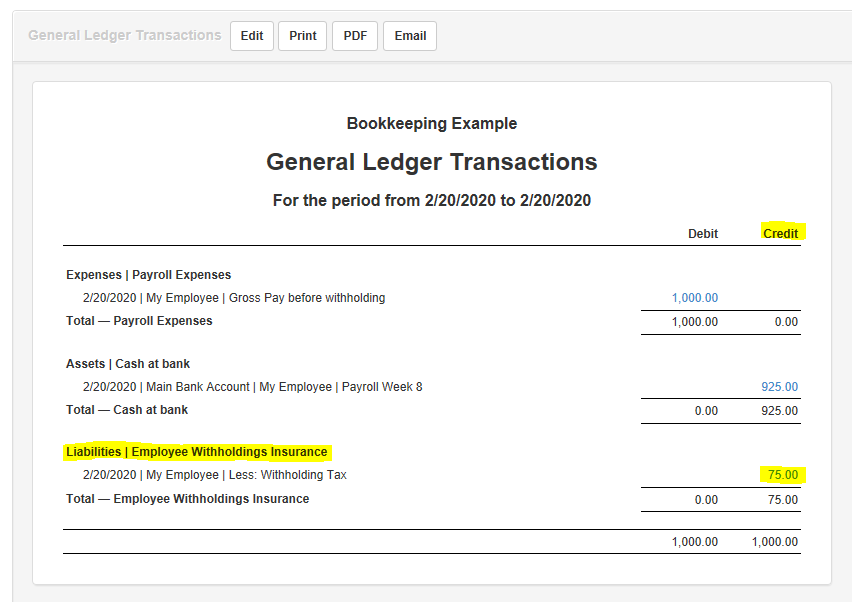

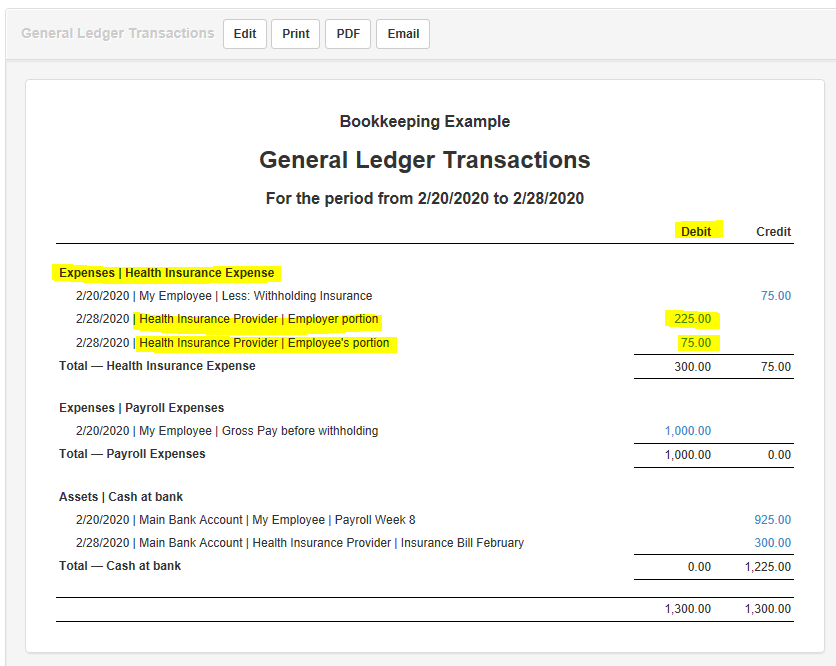

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

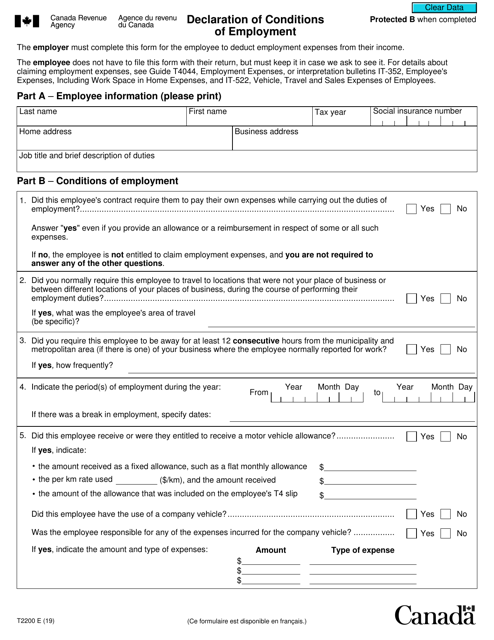

2019 2021 Form Canada T2200 Fill Online Printable Fillable Blank Pdffiller

2019 2021 Form Canada T2200 Fill Online Printable Fillable Blank Pdffiller

Please Research And Provide The Following Informat Chegg Com

Please Research And Provide The Following Informat Chegg Com

This Checklist Offers A Starting Point For Preparing To File Your Taxes Detailing The Information And Documentation Y Tax Checklist Income Tax Return Tax Prep

This Checklist Offers A Starting Point For Preparing To File Your Taxes Detailing The Information And Documentation Y Tax Checklist Income Tax Return Tax Prep

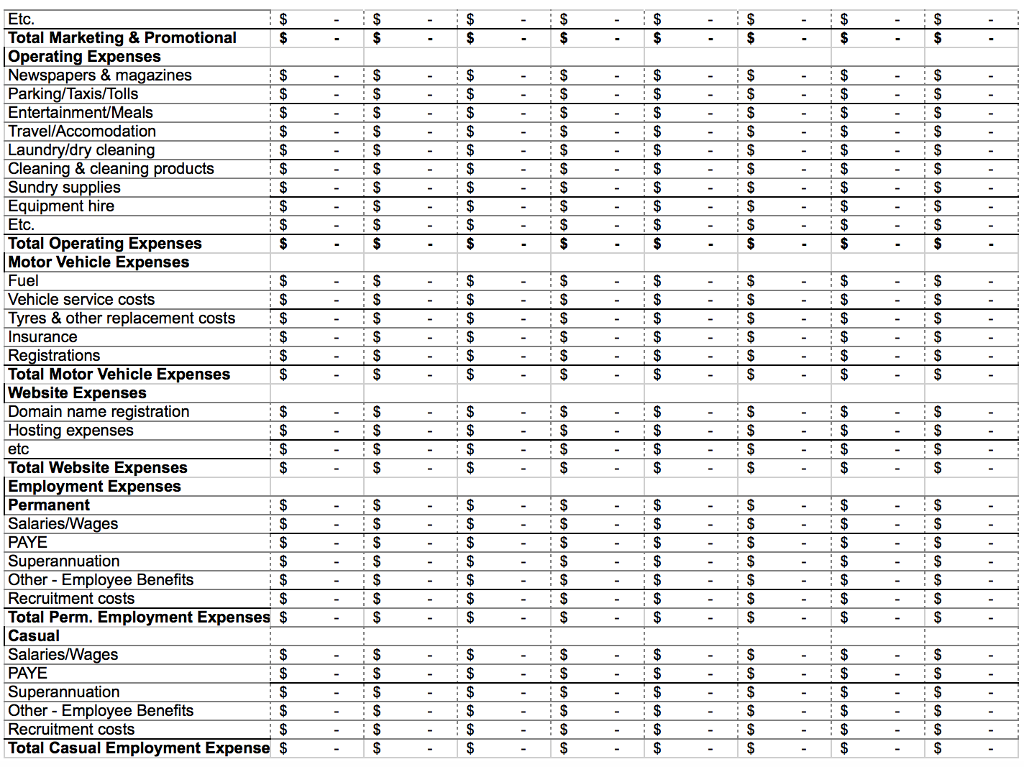

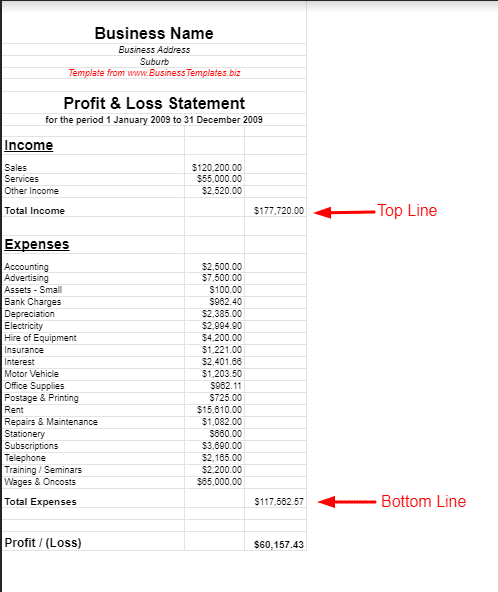

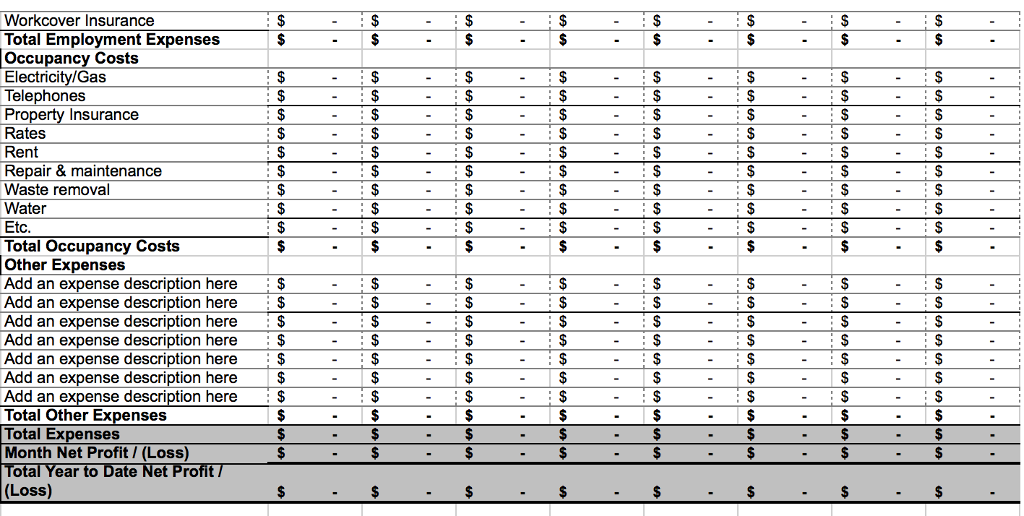

What Is A Profit And Loss Statement Shared Economy Tax

What Is A Profit And Loss Statement Shared Economy Tax

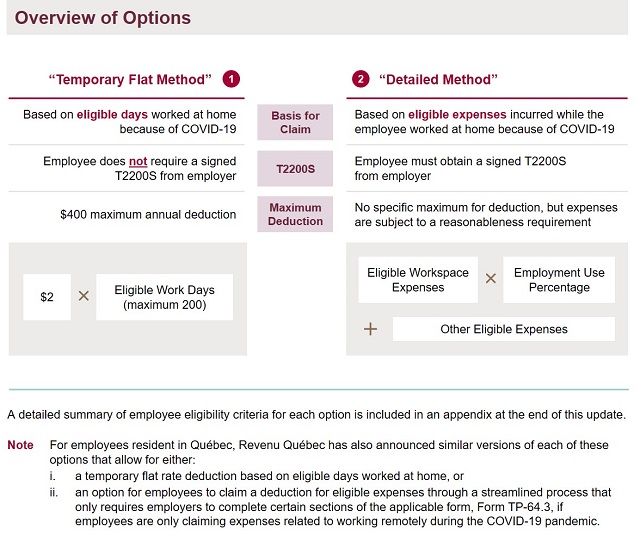

Https Ca Rbcwealthmanagement Com Documents 634020 2734902 The Navigator Deducting Home Office Expenses For 2020 Pdf 70e6a4d7 Dcb0 4fb5 9a4b 900323848c4e

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

How To Write Off Vehicle Expenses In Canada Mileiq Canada

How To Write Off Vehicle Expenses In Canada Mileiq Canada

Form T777 Download Fillable Pdf Or Fill Online Statement Of Employment Expenses Canada Templateroller

Form T777 Download Fillable Pdf Or Fill Online Statement Of Employment Expenses Canada Templateroller

Statement Of Employment Expenses T777 And Tp 59 H R Block Canada

Statement Of Employment Expenses T777 And Tp 59 H R Block Canada

Employer Update Navigating The New Home Office Expense Deductions Announced By Cra Employment And Hr Canada

Employer Update Navigating The New Home Office Expense Deductions Announced By Cra Employment And Hr Canada

Business Use Of Vehicles Turbotax Tax Tips Videos

Business Use Of Vehicles Turbotax Tax Tips Videos

Form T2200 Download Fillable Pdf Or Fill Online Declaration Of Conditions Of Employment Canada Templateroller

Form T2200 Download Fillable Pdf Or Fill Online Declaration Of Conditions Of Employment Canada Templateroller

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Please Research And Provide The Following Informat Chegg Com

Please Research And Provide The Following Informat Chegg Com

Https Www Irs Gov Pub Irs Prior I2106 2014 Pdf

Post a Comment for "Employment Expenses Motor Vehicle"