Georgia Self Employment Tax Forms

The Georgia Department of Labor GDOL Employer Portal provides self-service options with a single sign-on for UI services. More In Forms and Instructions.

Georgia W2 Form Fill Online Printable Fillable Blank Pdffiller

Georgia W2 Form Fill Online Printable Fillable Blank Pdffiller

Get peace of mind at tax time.

Georgia self employment tax forms. Pre-Employment and Background Check Consent. The payment must be reported as Social Security and Medicare wages on Form W-2 per Sections 6041 a and 6051 a. Doing Business in the State.

You are limited to one EIN per responsible party per day. UI tax related and partial claims filing services will now be accessible only by registering and using the Portal which has the following services. Medical and Physical Examination Program.

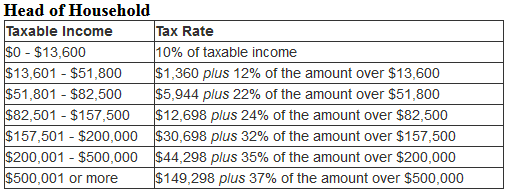

No income tax withholding is applicable but. That rate is the sum of a 124 for Social Security and 29 for Medicare. In general any full-year resident can choose to file Long Form 500 instead of Short Form 500EZ.

The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest. File Quarterly Tax and Wage Reports. Before sharing sensitive or personal information make sure youre on an official state website.

To pay your Georgia self employment tax quarterly you will use Form 1040-ES Estimated Tax for Individuals. Individuals who have already filed a claim with the GDOL and have been determined not eligible for state unemployment benefits but may be potentially eligible to receive benefits under this program do NOT have to refile a claim. Self-employment tax applies to net earnings what.

What is self-employment tax. The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN. Fillable forms do not work reliably with all the different browsers but they do work reliably with Adobe Acrobat Reader.

Register a New Business in Georgia Secretary of State - Corporations Division Department of Economic Development. Use Schedule SE Form 1040 to figure the tax due on net earnings from self-employment. Local state and federal government websites often end in gov.

Form W-4 and Form G-4. This tax applies no matter how old you are and even if you are already getting social. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

The MEUC Program is currently under development and updates on how to apply and submit documents will be posted once the program has been implemented. Security Questionnaire and Loyalty Oath. Before sharing sensitive or personal information make sure youre on an official state website.

The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest. Form CD-14C 82432 KB. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Georgia State Website. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. The self-employment tax rate is 153.

About Schedule SE Form 1040 Self-Employment Tax. Local state and federal government websites often end in gov. 2021 500-ES Estimated Tax for Individuals and Fiduciaries 212 MB 2020 500-ES Estimated Tax for Individuals and Fiduciaries 206 MB.

To file your annual tax return you will use Schedule SE Form 1040 or 1040-SR Self-Employment Tax to report your Social Security and Medicare taxes. Department of Labor Unemployment Insurance New Hire Reporting Program. You must have earned at least 5000 in net income from self-employment in the applicable tax year.

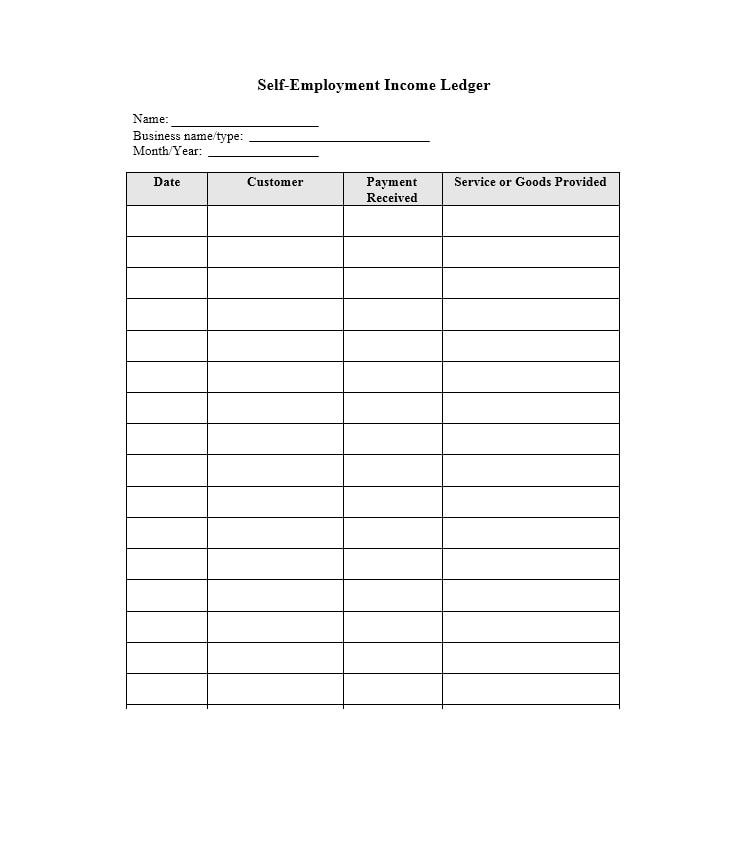

For information related to unemployment income please read FAQ 3. Submit a tax payment. If you are self-employed you can send IRS Form 1040 and a copy of Schedule 1 2 C F or SE tax return.

You do not have to file the Short Form for example. You must apply for the MEUC program and submit documentation which clearly shows 5000 net income. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

Small Business Events in Your Area. Taxpayers with simple returns have the option to use GA Form 500EZ Short Individual Income Tax Return. Form CD-14C - Collection Information Statement for Wage Earners and Self-Employed Individuals Use this form to provide financial information related to your offer in compromise if you are an individual who is either self-employed or a wage earner.

You may apply for an EIN online if your principal business is located in the United States or US.

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

Irs Audit Letter 2205 A Sample 5

Https Dor Georgia Gov Document Document 2019 It 711 Partnership Income Tax Booklet Download

How To Complete The W 4 Tax Form The Georgia Way

How To Complete The W 4 Tax Form The Georgia Way

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Llc Georgia How To Form An Llc In Georgia

Llc Georgia How To Form An Llc In Georgia

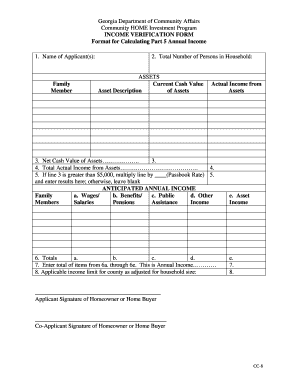

19 Printable Proof Of Income Form Templates Fillable Samples In Pdf Word To Download Pdffiller

19 Printable Proof Of Income Form Templates Fillable Samples In Pdf Word To Download Pdffiller

Tax Return Fake Tax Return Income Tax Return Income Statement

Tax Return Fake Tax Return Income Tax Return Income Statement

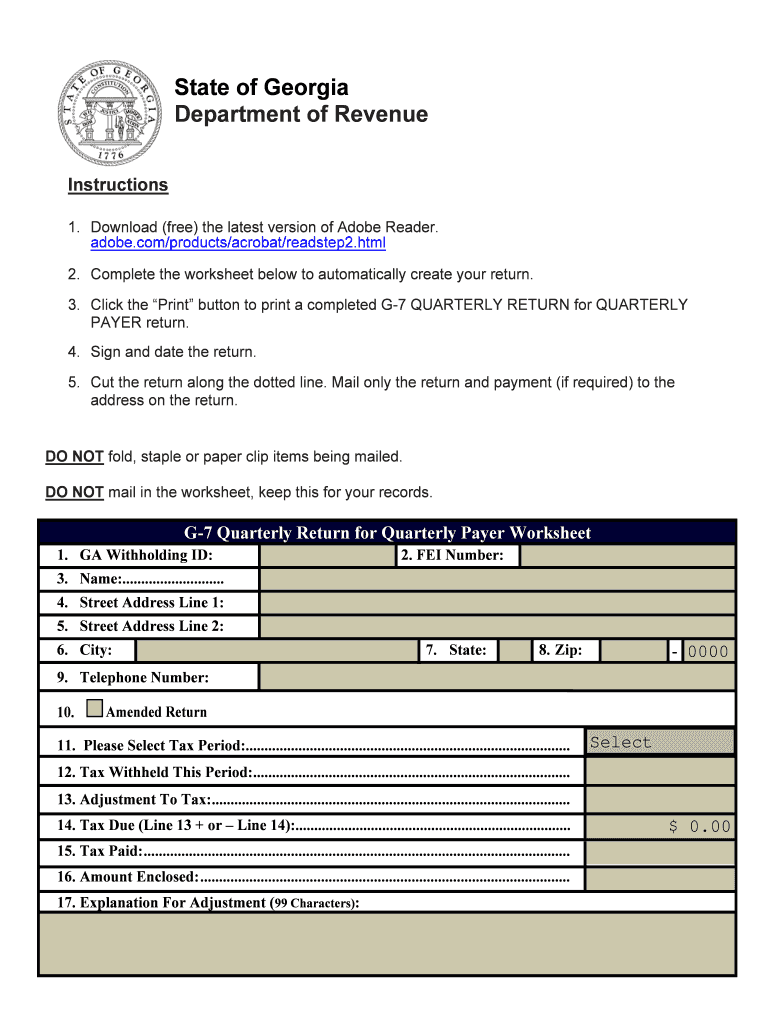

Ga Dor G 7 2019 2021 Fill Out Tax Template Online Us Legal Forms

Ga Dor G 7 2019 2021 Fill Out Tax Template Online Us Legal Forms

Stumped How To Form A Georgia Llc The Easy Way

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

How To Complete The W 4 Tax Form The Georgia Way

How To Complete The W 4 Tax Form The Georgia Way

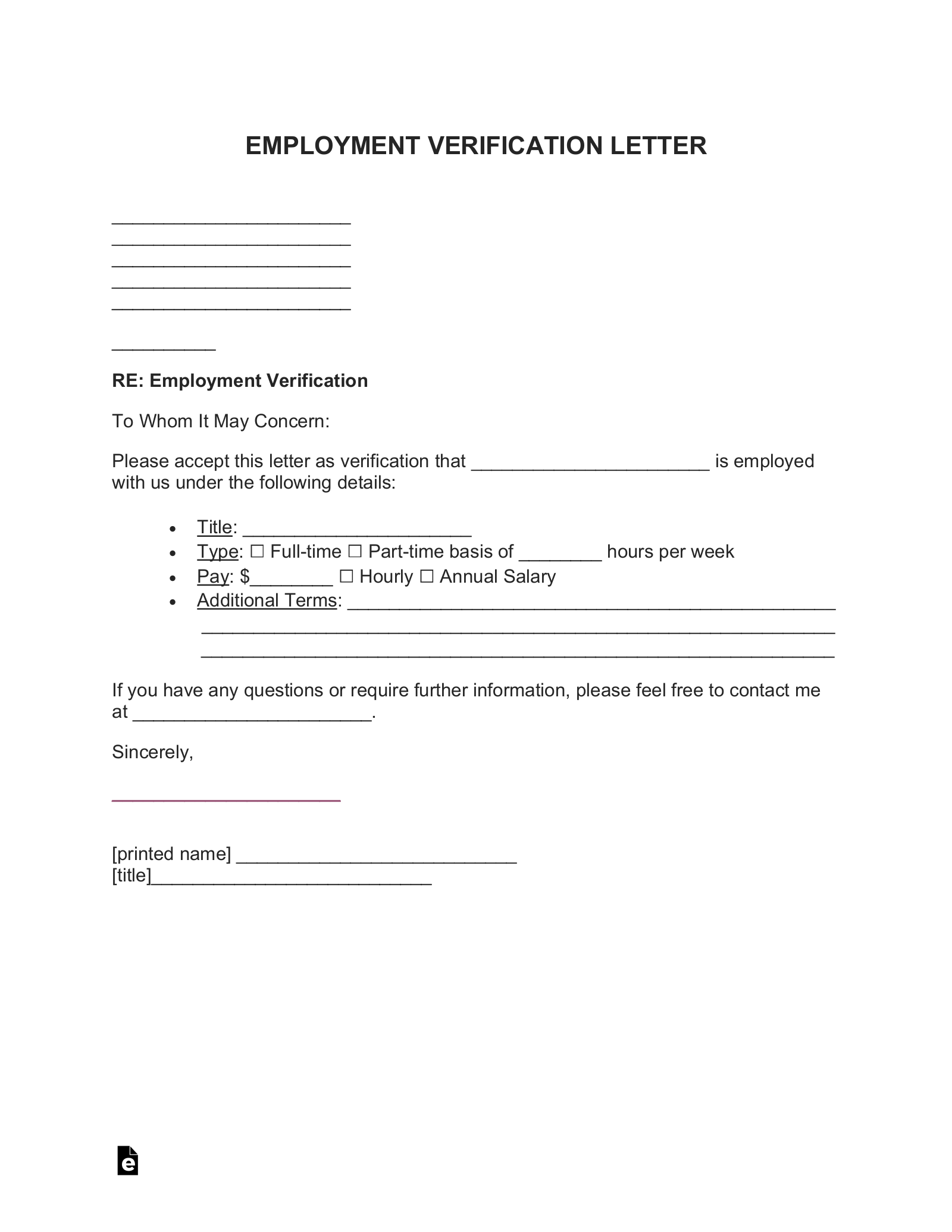

Free Employment Income Verification Letter Pdf Word Eforms

Free Employment Income Verification Letter Pdf Word Eforms

2005 2021 Form Ga Dol 800 Fill Online Printable Fillable Blank Pdffiller

2005 2021 Form Ga Dol 800 Fill Online Printable Fillable Blank Pdffiller

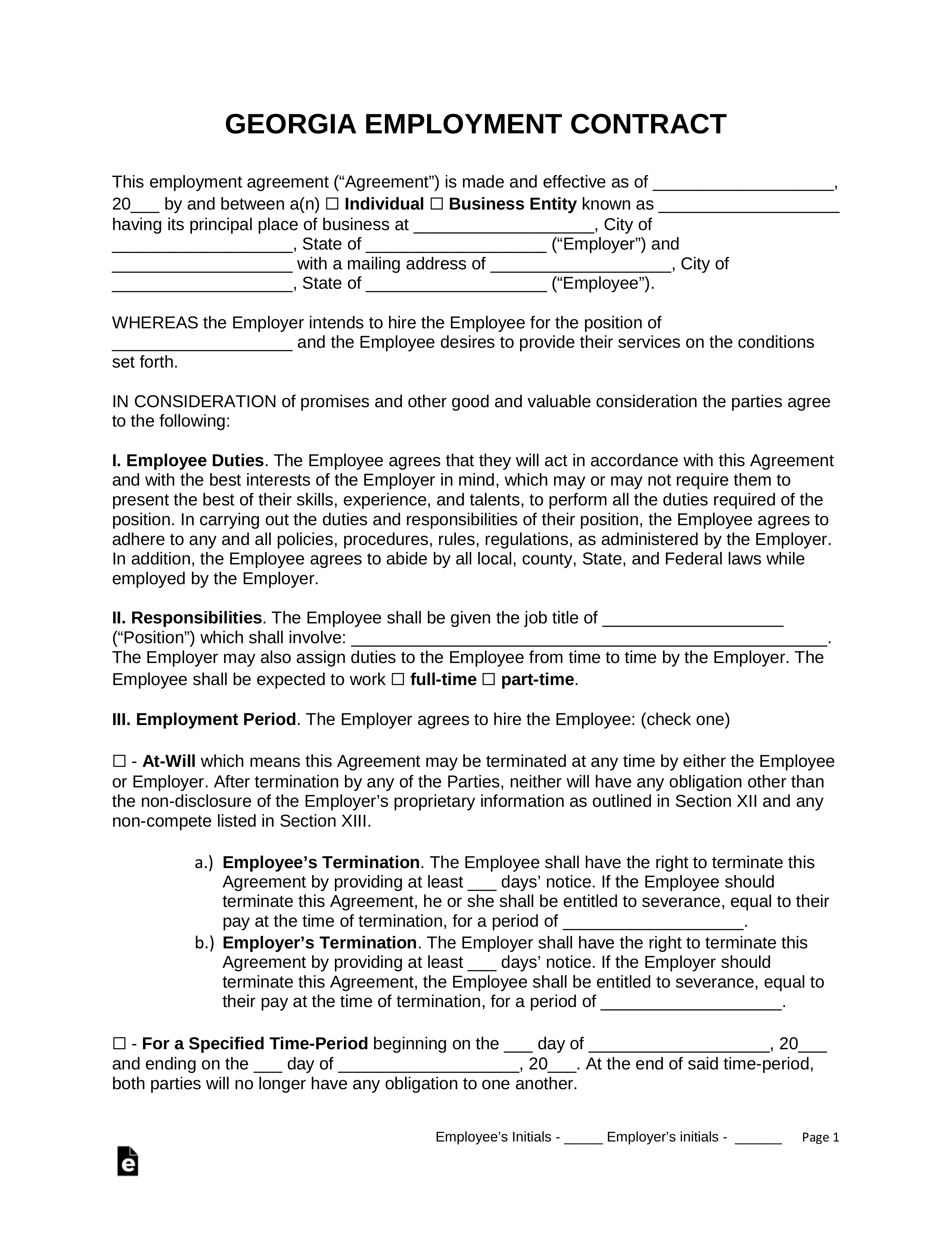

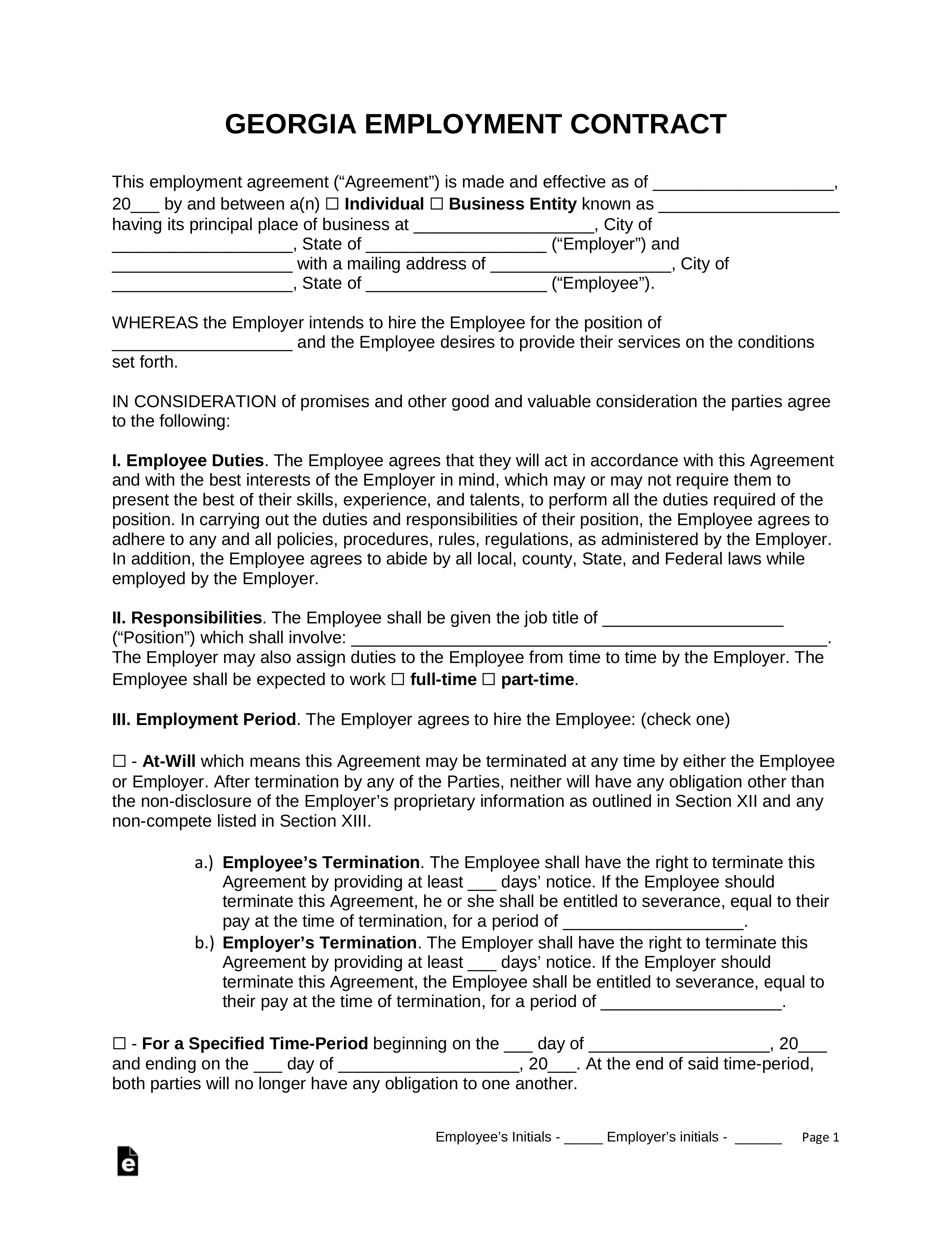

Free Georgia Employment Contract Templates Pdf Word Eforms

Free Georgia Employment Contract Templates Pdf Word Eforms

19 Printable Proof Of Income Form Templates Fillable Samples In Pdf Word To Download Pdffiller

19 Printable Proof Of Income Form Templates Fillable Samples In Pdf Word To Download Pdffiller

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Self Employment Ledger 40 Free Templates Examples

Self Employment Ledger 40 Free Templates Examples

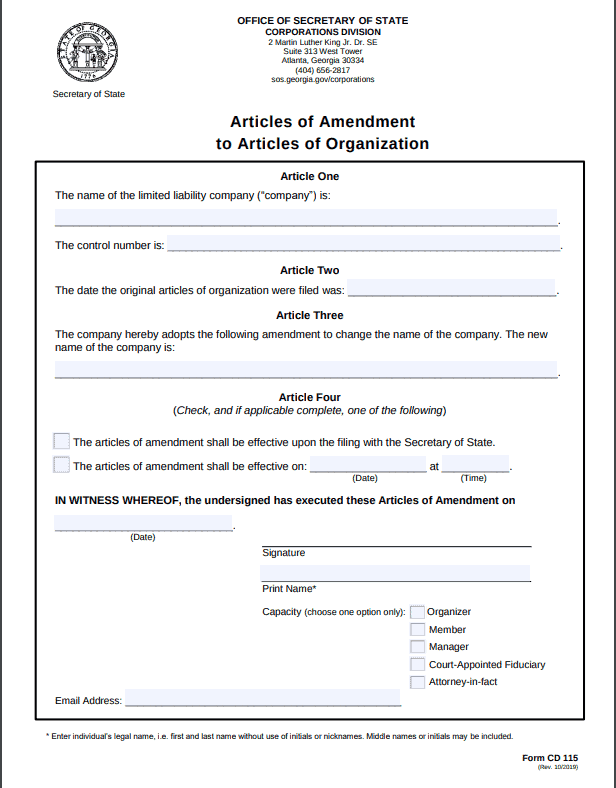

How To File A Georgia Llc Amendment With The Secretary Of State

How To File A Georgia Llc Amendment With The Secretary Of State

Post a Comment for "Georgia Self Employment Tax Forms"