Self Employed Tax Rates Australia

Working a second job could also end up increasing the total tax you owe. Sole traders pay tax at the individual income rate.

Opening A Bank Account And The Tax System In Australia Internations Go

Opening A Bank Account And The Tax System In Australia Internations Go

In addition unless you earn less than AU27068 per year you will also need to pay the 2 Medicare levy in Australia.

Self employed tax rates australia. The full company tax rate is 30. If youre self-employed you need to pay your own income tax. No matter how much you earn as a sole trader you will still need a tax file number TFN and an Australian business number ABN and youll have to submit an annual income tax return.

Those aged 65 to 74 will still need to meet the work test in order to be eligible to make a contribution and claim a tax. Like everything to do with tax law the regulations applying to the self-employed are complicated and time-consuming and are estimated to cost some 7bn a year in lost time. If you dont get your self employment tax obligations in.

Put money aside as you earn it rather than waiting to receive a big tax bill. 19 cents owed for each 1 over 18200. Starting a business is one of the most exciting decisions you can make but its critical you understand which self employment taxes apply when venturing out on your own.

With tax time looming here are some of the top expenses you may be eligible for as someone who is self-employed. As a sole trader you. If you operate your business under a company structure you will pay a flat tax rate of 275 for businesses with a turnover of less than 50 million or 30 for a business with a turnover of more than 50 million.

Not surprisingly some 90 percent of. For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad retirement tier 1 tax. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

The tax-free threshold for individuals is 18200 in the 201920 financial year. That rate is the sum of a 124 for Social Security and 29 for Medicare. Australian zone listThis list can be used to find out whether an Australian place is located in a zone for the purposes of the zone tax offset.

You stand to make 25000 over the 90000 threshold and the ATO requires you to pay 37c for each dollar in that amount. A sole trader business structure is taxed as part of your own personal income. Your fund can only accept personal contributions from you if it has your tax file number.

Open a savings account and transfer a percentage each time you get paid. From 1 July 2017 regardless of whether youre self-employed or not most people will be able to claim a full deduction for contributions they make to their super until they turn 75 years old. The Australian Taxation Office ATO outlines the individual income tax rates for the next year.

First you know youll owe 20797thats the base rate anyone in this tax bracket will pay. 9 Things to Claim on Tax as an Australian Self-Employed Posted on June 25 2019 July 22 2019 by Taral Khandheriya Every day there are thousands of people who want to quit their boring job and want to start their own venture. The self-employment tax rate is 153.

For example if you are working in the UK and pay 20 income tax but the rate in Australia for the same income bracket is 25 then youll need to pay the additional 5 in your Australian tax return. Report all your income in your individual tax return using the section for business items to show your business income and expenses there is no separate business tax. No taxes owed as this is the tax-free threshold rate.

Use your individual tax file number when lodging your income tax return. Vehicle and travel Consider if you can claim any deductions for travel expenses that directly relate to your work. It can be used for the.

Self employment tax guide. Its important to obtain expert legal advice before establishing a business or starting work as a self-employed person in Australia. That comes to 9250 meaning your total tax for the year would be 30047.

Self-employment tax applies to. Make this account for tax payments only and off limits for other spending. The rate consists of two parts.

However you may want to consider super as a way of saving for your retirement. If you earn 75000 or more each year youll also need to register for goods and services tax GST and submit a business activity statement BAS either. If youre self-employed that is a sole trader or a partner in a partnership you dont have to make super contributions to a super fund for yourself.

Zone or overseas forces tax offsetThis calculator will help you work out your eligibility for a zone or overseas forces tax offset and the tax offset amount that you can claim. There is no tax-free threshold for companies you pay tax on every dollar the company earns. The self-employment tax rate is 153.

How Fortune 500 Companies Avoid Paying Income Tax

Income Tax Australian Tax Brackets And Rates 2020 21 Superguide

Income Tax Australian Tax Brackets And Rates 2020 21 Superguide

Self Employment Tax Calculator For 2020 Good Money Sense Self Employment Small Business Tax Deductions Money Sense

Self Employment Tax Calculator For 2020 Good Money Sense Self Employment Small Business Tax Deductions Money Sense

Paying Tax In Ireland What You Need To Know

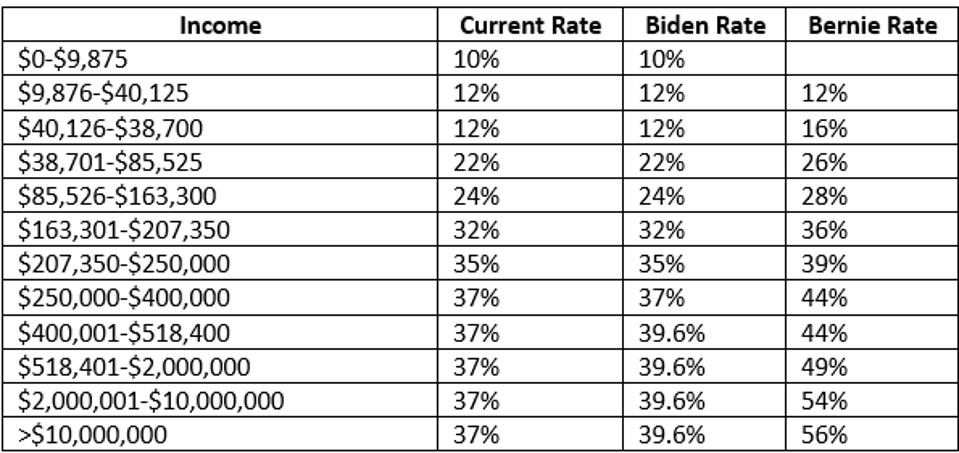

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

Tale Of The Tape Comparing The Tax Plans Of Joe Biden And Bernie Sanders

The Top 10 Best Self Employed Jobs Smartasset

The Top 10 Best Self Employed Jobs Smartasset

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

Some Self Employed Taxpayers Get A Big Break Under New Law Sales Jobs Financial Management Corporate Tax Rate

Some Self Employed Taxpayers Get A Big Break Under New Law Sales Jobs Financial Management Corporate Tax Rate

What Are The Current Marginal Tax Rates Canstar

What Are The Current Marginal Tax Rates Canstar

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

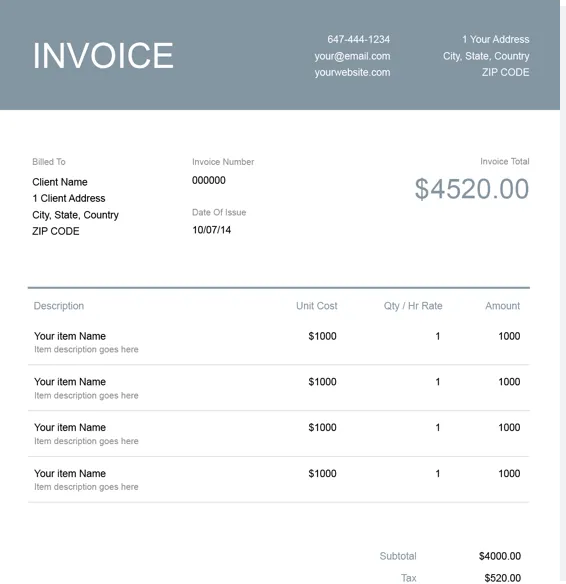

How To Invoice As A Sole Trader Invoicing Guide For Beginners

How To Invoice As A Sole Trader Invoicing Guide For Beginners

Payroll Tax Wikipedia Income Tax Payroll Payroll Taxes

Payroll Tax Wikipedia Income Tax Payroll Payroll Taxes

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Make 80 000 In Crypto Profits And Pay Zero Tax

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Post a Comment for "Self Employed Tax Rates Australia"