Self Employed Tax Rates Germany

Claiming education and training costs as a tax deductions. Düsseldorf has a multiplier of 440.

Germany S Short Time Work Scheme Can Its Past Success Be Replicated Ecoscope

Germany S Short Time Work Scheme Can Its Past Success Be Replicated Ecoscope

The rate of income tax in Germany ranges from 0 to 45.

Self employed tax rates germany. The value added tax must be stated on customer bills. The rate consists of two parts. Being self-employed in Germany is necessarily tied to residence.

This means for every euro you earn above 52552 the tax man takes 44 -cents. Your income tax ranges between 0 and 45 of your taxable income. Without some sort of residence permit it will be difficult if not impossible for an individual to establish a business in which they are self-employed.

Most of the time the added value tax is 19 except for some special services such as translation journalism food trades and art works. Self-employed income tax allowances in Germany. The more you earn the higher your tax rate will be.

Germany has a base rate of 14 of the income tax which can go up to 42. Effective rate including trade tax assessed independently by each municipality from 7 to 175 is estimated at about 30-33 Tax Rate For Foreign Companies There is no distinction between German companies and foreign companies. It can vary from 14 to 45.

In Germany self-employed workers are subject to the same 9744 allowance as other workers but they also get a 2800 allowance for health insurance. Each community has its own multiplier for trade tax. The minimum taxable income is 9169 no tax is charged under this amount.

To get an idea of how much tax you will have to pay enter your income in the tax calculator. Standard rate is 15 15825 including a 55 solidarity surcharge. Deducting health insurance contributions as a self-employed person.

The tax rate starts at 14 rising in a series of income tax brackets to 45 for the highest earners over 265327. The amount of tax payable is calculated on the value of the property and the local tax rate which varies from 026 to 1 Double taxation agreements. Real property tax Grundsteuer This tax is imposed by municipalities on properties in Germany.

This percent depends on several factors like marital status income of your significant other number of children etc. A solidarity surcharge of 55 is also included in this tax. This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property.

As a self-employed person you can deduct up to 4000 a year but only as long as the tax office sees a recognisable connection to your activity. The German income tax is a progressive tax which means that the average tax rate ie the ratio of tax and taxable income increases monotonically with increasing taxable income. Progressive tax rates of 7 up to 50 and tax-free amounts between EUR 20000 and EUR 500000 apply depending on the value and the degree of the relationship between donor and beneficiary.

124 for social security old-age survivors and disability insurance and 29 for. Based on your taxable income you are put into one of five zones. Another way self-employed workers can reduce their tax bill is to offset work-related outgoings against their overall tax bill.

The German income tax progression is very steep - it tops out at a marginal rate of 42 plus 55 of your tax burden as unification tax so 44 effectively at 52552. This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2019. Freelancers will need to pay this tax on a quarterly basis.

Freelancers need to prepare VAT declarations periodically declaring their revenue. Also due to the Corona situation the value added tax is temporarily set to 16. Self-Employment Tax Rate The self-employment tax rate is 153.

As trade and business sole proprietor you have to pay trade tax when the profit is exceeding 24500. You can offset a part of the paid trade tax deductible multiplier is 350 as expenses in your income tax return. The tax rate varies from 7 to 50 depending on the value of the inheritance.

For a surviving spouse an additional tax-free allowance of EUR 256000 is granted. See the separate article on Residence Permits. Those making less than 9169 are exempt from the income tax.

Simple Tax Guide For Americans In Germany

Simple Tax Guide For Americans In Germany

Taxes In Germany What American Expats Should Know

Taxes In Germany What American Expats Should Know

Social Security Taxes Expatrio Com

Social Security Taxes Expatrio Com

German Income Tax Calculator Expat Tax

German Income Tax Calculator Expat Tax

German Tax System Taxes In Germany

German Tax System Taxes In Germany

Annual German Tax Return Einkommensteuererklarung

Annual German Tax Return Einkommensteuererklarung

Simple Tax Guide For Americans In Germany

Simple Tax Guide For Americans In Germany

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

Statutory Health Insurance In Germany A Health System Shaped By 135 Years Of Solidarity Self Governance And Competition The Lancet

In Tax Gender Blind Is Not Gender Neutral Why Tax Policy Responses To Covid 19 Must Consider Women Ecoscope

In Tax Gender Blind Is Not Gender Neutral Why Tax Policy Responses To Covid 19 Must Consider Women Ecoscope

Taxes In Germany A Guide For Expat Employees Expatica

Taxes In Germany A Guide For Expat Employees Expatica

German Tax System Taxes In Germany

German Tax System Taxes In Germany

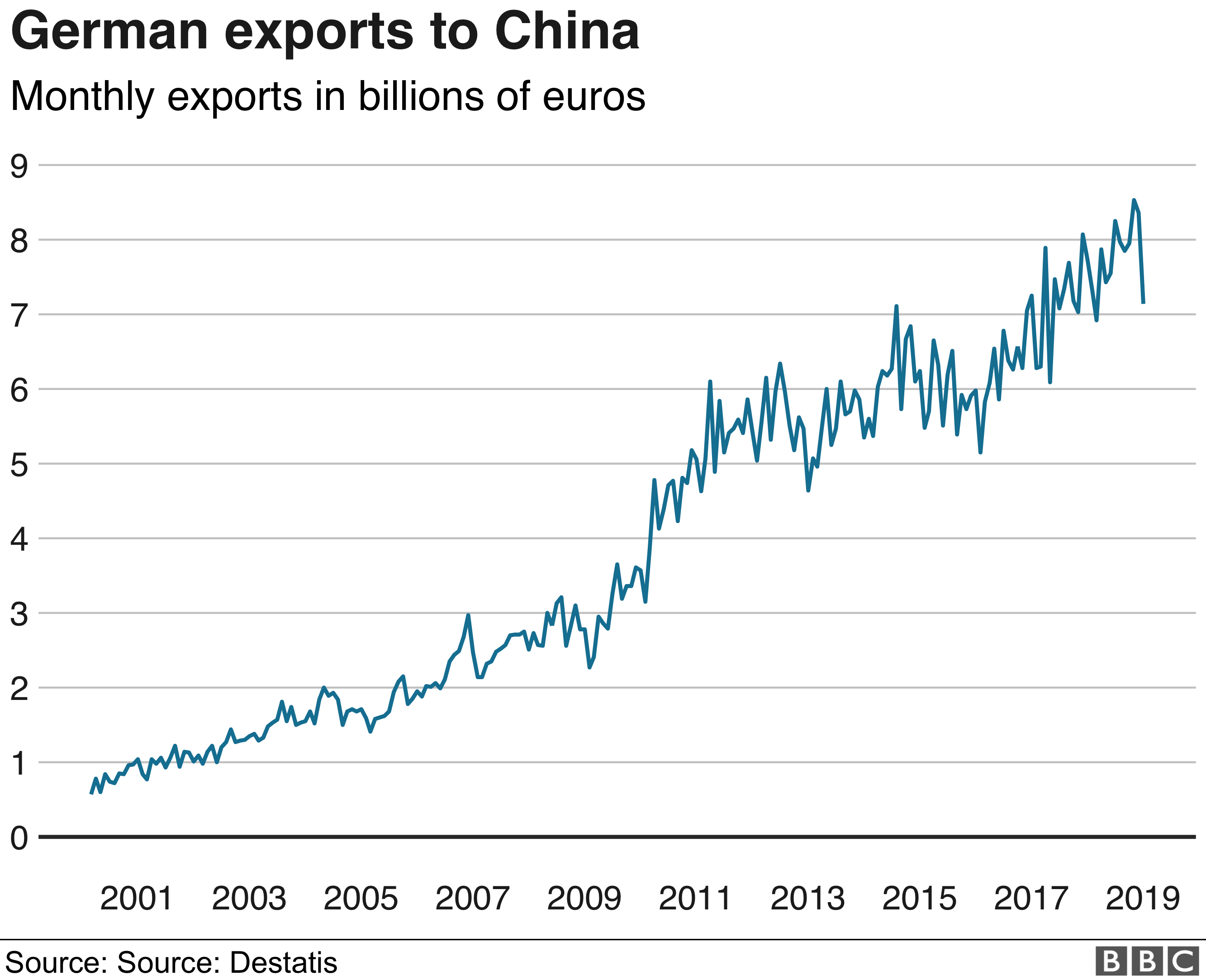

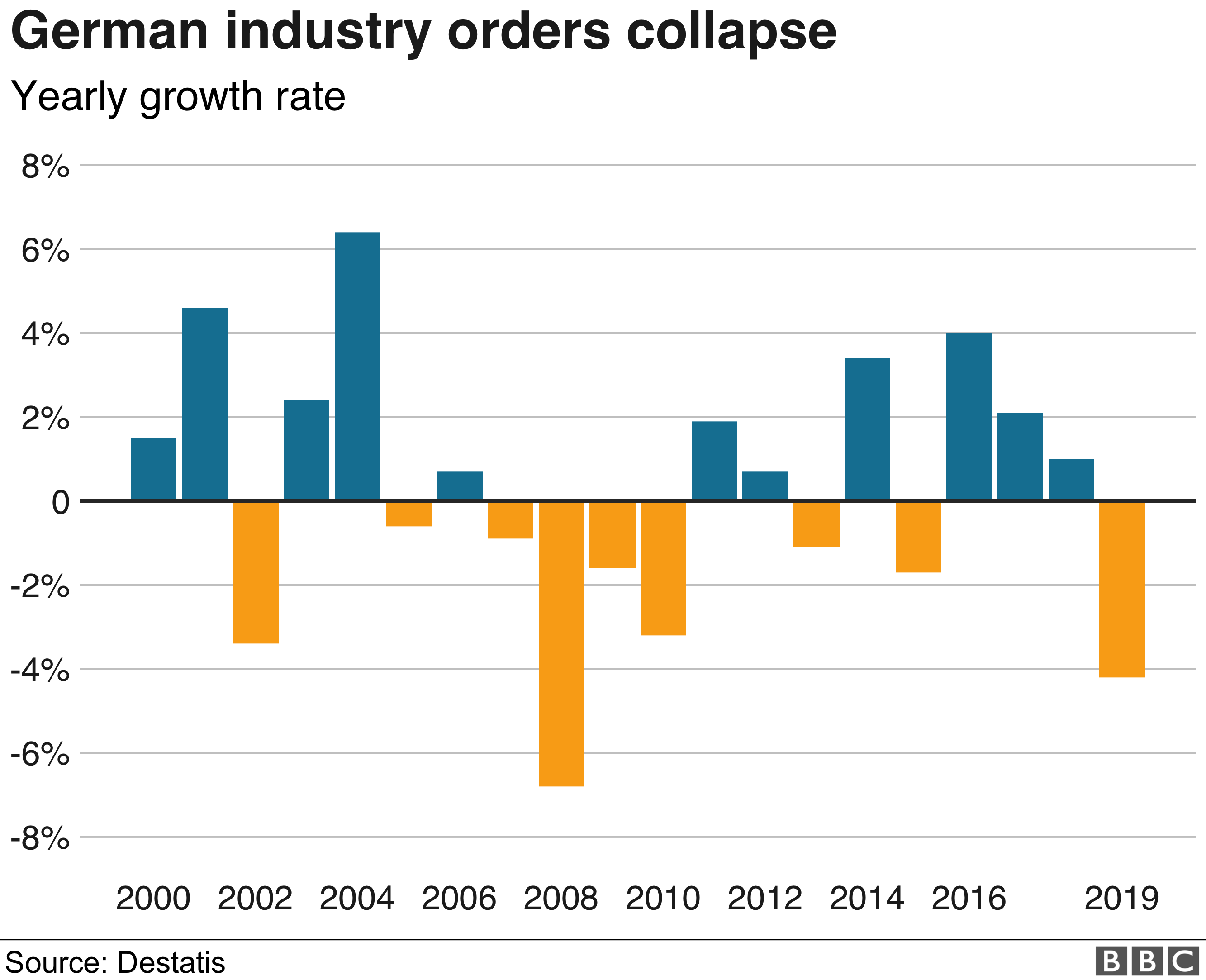

Germany S Economy Should We Be Worried Bbc News

Germany S Economy Should We Be Worried Bbc News

German Self Employment Visa For Non Eu Nationals Do You Meet All The Requirements By Yamini Von Gotham Medium

German Self Employment Visa For Non Eu Nationals Do You Meet All The Requirements By Yamini Von Gotham Medium

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

Ultimate Guide To German Tax Class And How To Change It Johnny Africa

Simple Tax Guide For Americans In Germany

Simple Tax Guide For Americans In Germany

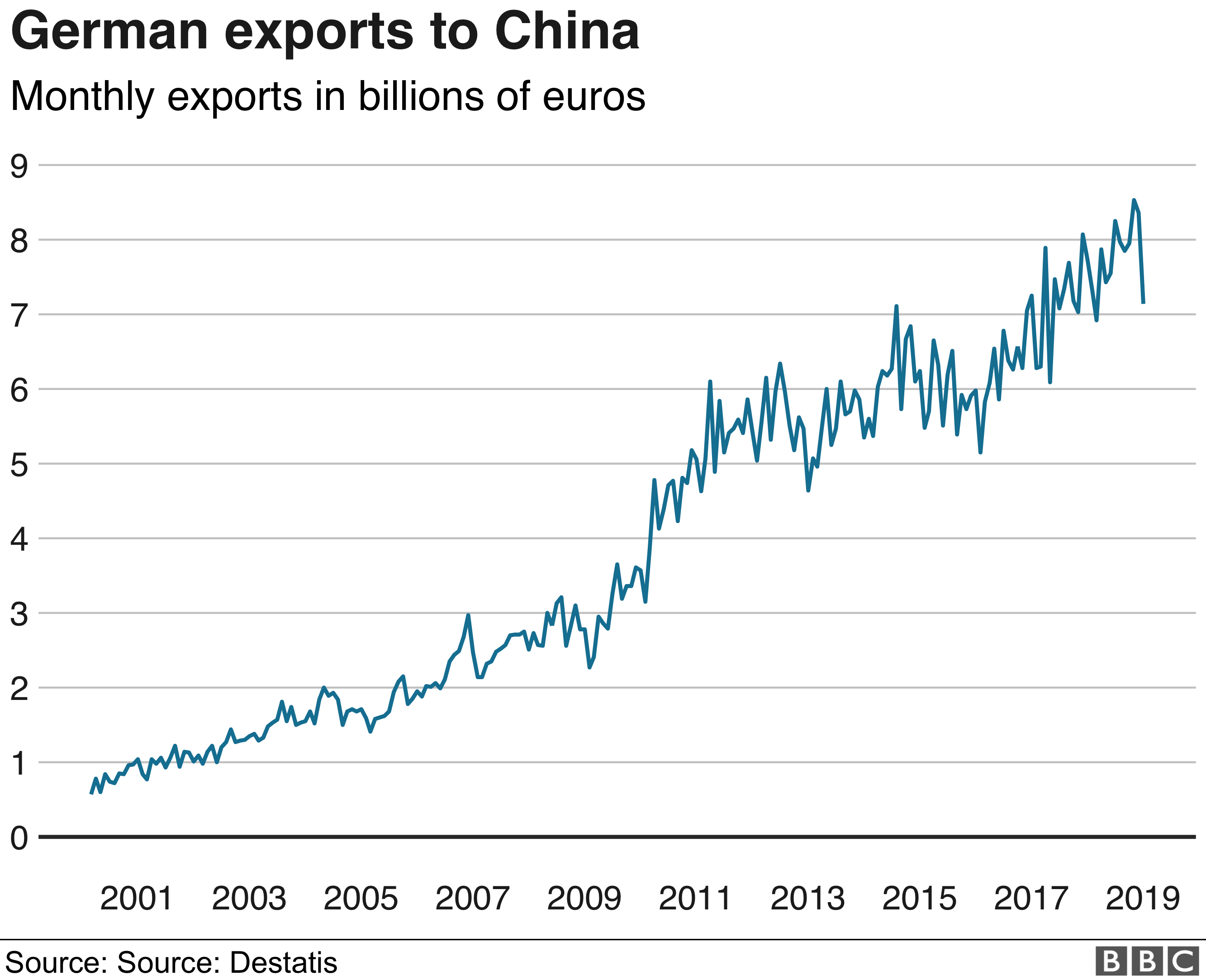

Germany S Economy Should We Be Worried Bbc News

Germany S Economy Should We Be Worried Bbc News

How To Germany Self Employment In Germany

How To Germany Self Employment In Germany

Post a Comment for "Self Employed Tax Rates Germany"