Withholding Rates Tax Year 2019

425 Personal Exemption. Calendar Year 2018 Information.

2019 Irs Federal Income Tax Brackets And Standard Deduction Updated Tax Brackets Federal Income Tax Income Tax Brackets

2019 Irs Federal Income Tax Brackets And Standard Deduction Updated Tax Brackets Federal Income Tax Income Tax Brackets

The changes apply to payments received by employees who are dismissed or retire on or after 1 July 2019.

Withholding rates tax year 2019. Taxpayers can avoid a surprise at tax time by checking their withholding amount. 000 20 over P4808. Rates for Withholding Income Tax Updated to the Effect of Proposed Changes vide the Finance Bill 2018 APPLICABLE FOR TAX YEAR 2019 Nature of Payment Tax Rate Nature of Tax Filer Non-filer Advance Final Minimum Tax Page 2 SHIPPING OR AIR TRANSPORT INCOME OF NON-RESIDENTS Section 7 Division V Part I First Schedule Shipping income 8.

The non-resident alien withholding rates are set forth by the IRS and can be found in IRS. Theyre the same as the seven tax rates in effect for the 2019 tax year. Tax Brackets and Tax Rates.

Of the penalty doesnt. Federal Board of Revenue FBR has issued withholding tax card for tax year 20182019 as per the amendments made through Finance Act 2018 to Income Tax Ordinance 2001. 5 percent of the gross amount exceeding Rs.

Total withholding for 2019 will be 4390. 2019 Tax Brackets for Single Filers Married Couples Filing Jointly and Heads of Households. However the tax bracket ranges.

For the Year 2020. In this very simple scenario the employee is pretty close. P35616 30 over P2192.

10 12 22 24 32 35 and 37. There are still seven 7 tax rates. It is rare that an employee would wind up having withholding and a tax liability that match exactly.

10 12 22 24 32 35 and 37 there is. The information summarized herein is general and based on our interpretation of the Income Tax Ordinance 2001 and significant amendments thereto vide the Act effective from July 01 2019becoming Tax ie. Taxpayers pay the tax as they earn or receive income during the year.

The IRS urges everyone to do a Paycheck Checkup in 2019. 2019 federal income tax withholding. Where the gross amount of rent exceeds Rs 200000 but does not exceed Rs 600000.

7 rows 2021 income tax withholding tables The Tax Cuts and Jobs Act of 2017 brought about a number of. The withholding tax card is updated up to June 30 2018. Calendar Year 2019 Information.

P660274 35 over P21918. 4400 2019 Michigan Income Tax Withholding Tables. 4050 2019 Michigan Income Tax Withholding Tables.

Rate For Unmarried Individuals Taxable Income Over For Married Individuals Filing Joint Returns Taxable Income Over For Heads of Households Taxable Income Over. Withholding Tax Rates Applicable Withholding Tax Rates. 2019 Percentage Method Tables and Wage Bracket Ta-bles for Income Tax Withholding.

Notice 2018-92 2018-51 IRB. August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool. 8 rows Federal income tax brackets and rates for 2019 are shown below.

And treatment of withholding income tax taking into account the amendments vide the Finance Act 2019 the Act. For Wages Paid in 2019 The following payroll. P134247 32 over P5479.

P8219 25 over P1096. Updated up to June 30 2020. The standard withholding rate is 30 however there are countries that may be taxed at a reduced rate.

This may impact withholding calculations for some employees when using Schedule 7 Tax table for unused leave payments on termination of employment and Schedule 11 Tax table for employment termination payments. FS-2019-4 March 2019 The federal income tax is a pay-as-you-go tax. 425 Personal Exemption.

4 rows Tables for Percentage Method of Withholding. Steves employer will use the 2019 withholding table for the entire year. 000 20 over P685.

The big news is of course the tax brackets and tax rates for 2019. 1038 available at IRSgovirb 2018-51_IRBNOT-2018-92 provides that until April 30 2019. The withholding agent is responsible for collecting under Section 155 of Income Tax Ordinance 2001 from recipient of rent of immovable property at the time the rent is actually paid according to withholding tax card for tax year 2019 issued by the FBR.

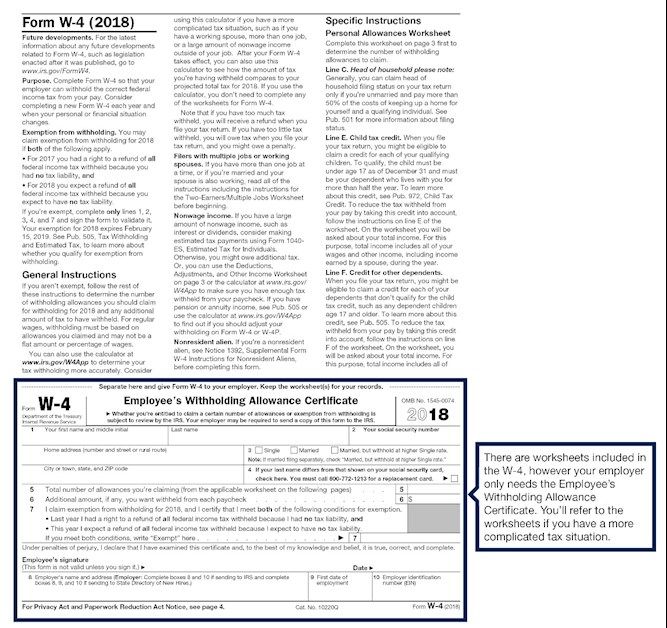

2018 W 4 Form With Instruction Page And Employee S Withholding Allowance Certificate Allowance Liberty Tax Instruction

2018 W 4 Form With Instruction Page And Employee S Withholding Allowance Certificate Allowance Liberty Tax Instruction

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

How Much Tax Should I Withhold How To Set Tax Withholding Debt Com Payroll Taxes Irs Taxes Tax Money

How Much Tax Should I Withhold How To Set Tax Withholding Debt Com Payroll Taxes Irs Taxes Tax Money

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Tax Refund Federal Income Tax Irs Taxes

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Tax Refund Federal Income Tax Irs Taxes

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms Income Tax Return Virginia

West Virginia Tax Forms 2019 Printable State Wv It 140 Form And Wv It 140 Instructions Tax Forms Income Tax Return Virginia

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Welcome To The Tax Profiling Website Of Pakistan Fbr Launched The New Atl For Tax Year 2019 Small Business Tax Business Tax Property Tax

Welcome To The Tax Profiling Website Of Pakistan Fbr Launched The New Atl For Tax Year 2019 Small Business Tax Business Tax Property Tax

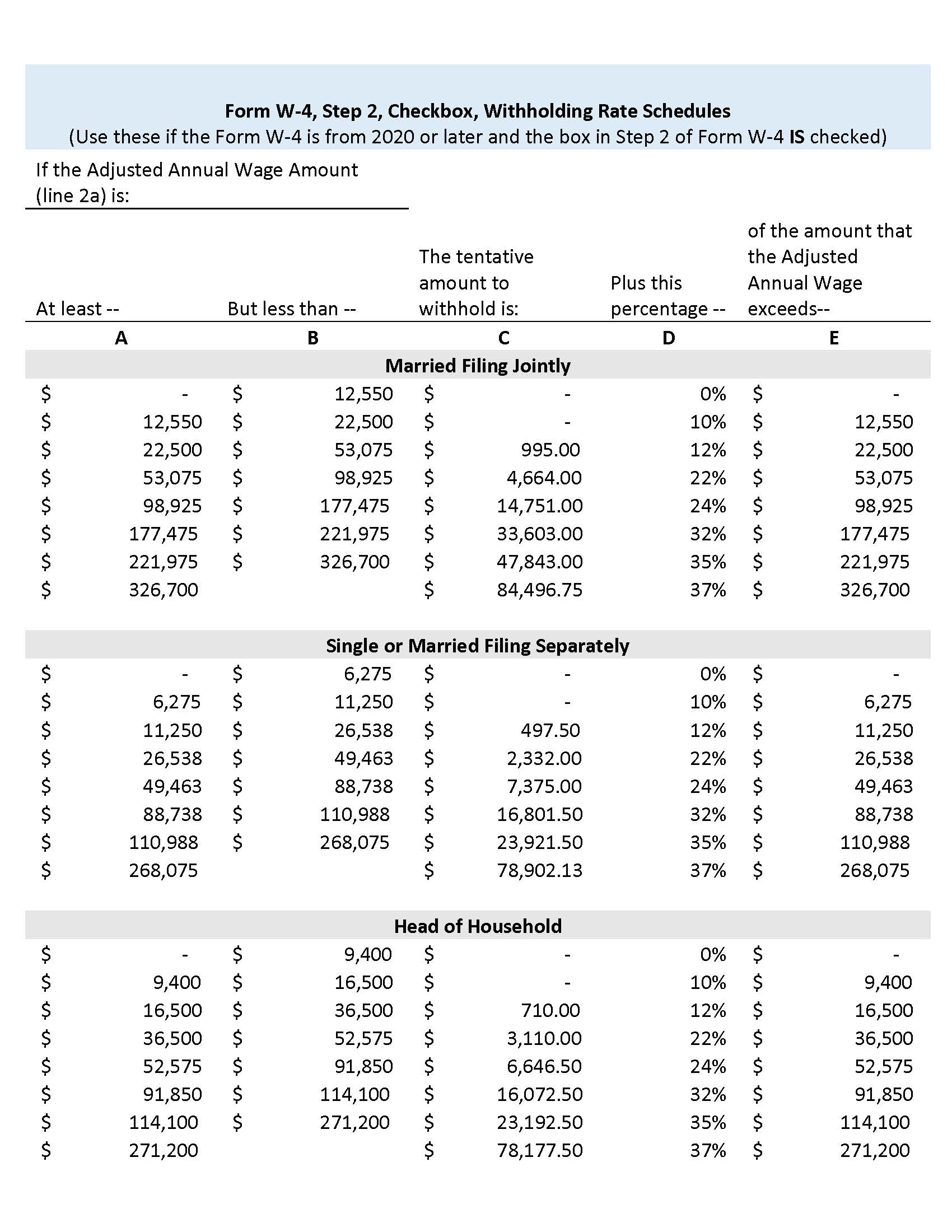

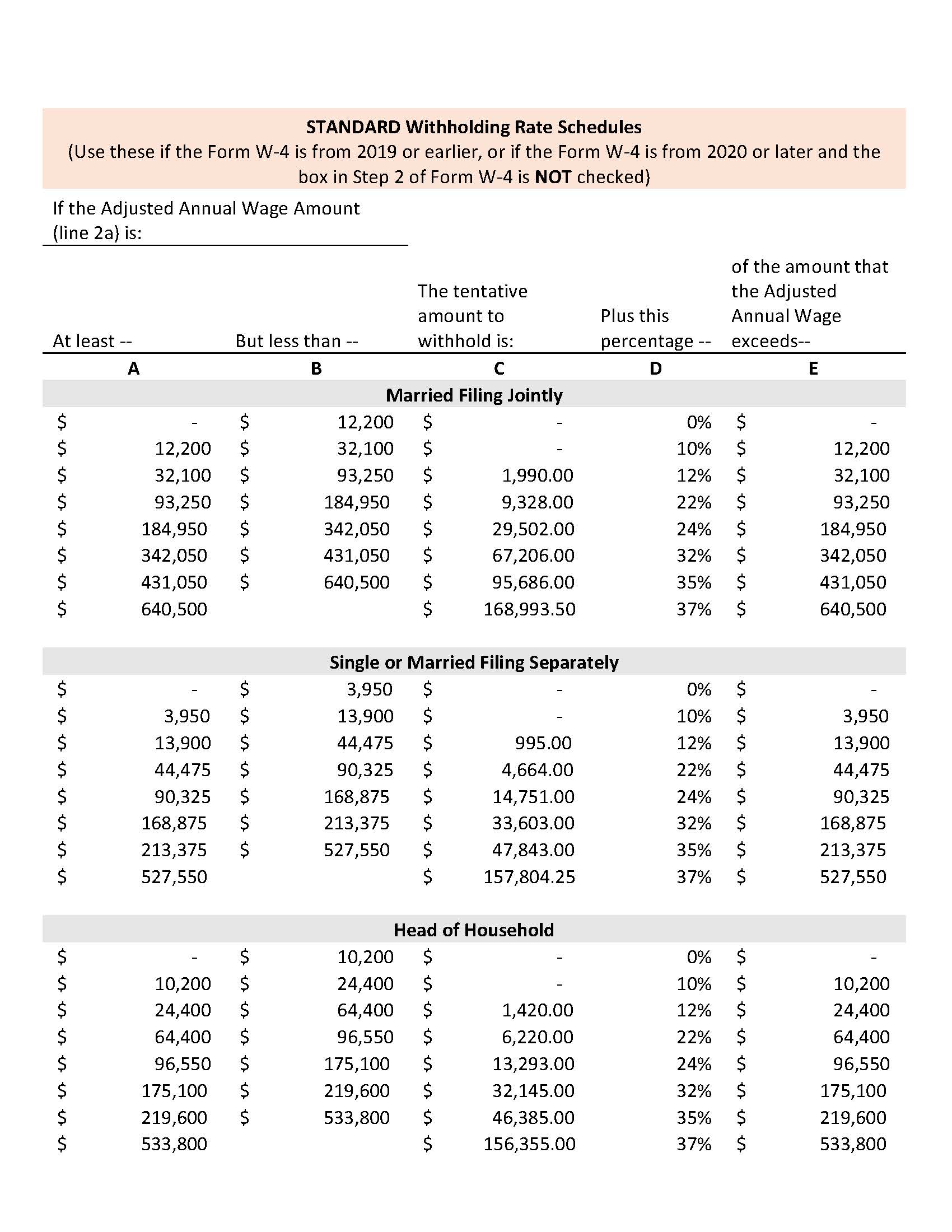

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

New Federal Income Tax Brackets 2019 How Much Am I Paying In Taxes

A Simple Explanation Of Tax Withholding Tax Returns And Tax Refunds Tax Refund Tax Return Money Management

A Simple Explanation Of Tax Withholding Tax Returns And Tax Refunds Tax Refund Tax Return Money Management

Irs Raises Standard Mileage Rates For 2019 Shrm Hr News In 2020 Irs Mileage Raising

Irs Raises Standard Mileage Rates For 2019 Shrm Hr News In 2020 Irs Mileage Raising

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Oregon Revenue Online Https Oregonrevenueonline Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Tax Free Tax

Oregon Revenue Online Https Oregonrevenueonline Freetaxfree Com Tax Refund Freetax Irs Irstax Wheresmyrefund Irs Taxes Tax Free Tax

Post a Comment for "Withholding Rates Tax Year 2019"