Employment Allowance Claim Each Year

Each tax year the availability of the allowance must be tested by looking at the secondary contributions in the previous tax year. Employers who qualify can claim the Employment Allowance at any time during the financial year.

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

How To Fill Out A W 4 Form Without Errors Pt Money Employee Tax Forms Job Application Form Math Models

The claim for employment allowance EA should be a simple procedure for employers but from 6 April 2020 two further conditions for claims were added.

Employment allowance claim each year. Claiming the Employment Allowance after the start of the tax year You can make a claim at any time during the tax year as long as your business or charity has employer Class 1 NICs liabilities and is eligible to claim the Employment Allowance. For example you want to make a claim for the Employment Allowance for the tax year 2014 to 2015. From 6 April 2020 employment allowance for eligible businesses is increasing from 3000 to 400000 per year.

You need to claim Employment Allowance every tax year to ensure youre still eligible. The method of claiming through the Employer Payment Summary remains the same but the employer will have to make a new claim for the Employment Allowance to HMRC each tax year. If the employee leaves the employment before the tax year has ended and before the company has used up all of the Employment Allowance for that tax year then the company may continue to claim the Employment Allowance to be set against any secondary class 1 NICs liabilities arising on the directors earnings up until when the allowance has been exhausted or the tax year has ended whichever is.

The amount you can claim is then offset against your Employers Class 1 NIC Liability to HMRC. If you stop your claim before the end of the tax year 5 April any allowance youve been given that year will be removed. You can only claim against your employers Class 1 National Insurance liability up to a maximum of 4000 each tax year.

Youll need to make a new claim for EA each year. Of EA for the claim year into euros using the exchange. Beneficial to entrepreneurs who employ others the Employment Allowance could be worth up to 4000 each year 3000 pre-April 2020 against your limited companys Employers National Insurance bill.

To help you work out whether your company could be eligible lets examine the rules in a little more detail. You can claim at any time in the tax year but the earlier you claim the sooner you will get the allowance. If your companys national insurance NI bill was 100000 or more in the previous tax year your company can no longer claim employment allowance.

Yes you can make a claim up to 4 years The earliest you can claim employment allowance for is 20142015 tax year after the end of the tax year in which the allowance applies. Relief cant be carried over between tax years. If your situation changes and youre no longer eligible for the allowance youll be required to make repayments.

The employment allowance is applied in full to the contributions each month or quarter until it is exhausted. Youll have to pay any employers secondary Class 1 National. The business must not receive state aid in excess of its trade sector threshold as the EA now counts as state aid.

Employment allowance is now considered a type of State Aid. The amount of allowance you can claim for each payment period must be the same as your employer secondary Class 1 NICs liability for the same period - subject to the 4000 Employment Allowance. But this is changing from 6th April 2020 onwards.

Payroll Manager will automatically calculate the Employers Allowance up to the maximum limit in each tax year the limit for 2020-21 is 4000 the limit for 2021-22 is also 4000. A report showing the amount of EA claimed month by month below can be produced by selecting Analysis then Employers NIC Allowance from the main menu in Payroll Manager. From the 20202021 tax year you need to claim employment allowance each tax year.

In the tax years before 2020-21 the Employment Allowance claim auto-renewed as in the employer did not have to make separate claims every tax year. HMRC estimates this will affect around 7 of employers currently claiming the allowance. The employers class 1 NIC liability for the previous tax year must be less than 100000.

More guidance on the existing restrictions for 201920 can be found on GOVUK here. If you claim late and do not use. If this is the case then you have a couple of options.

There may be occasions where you make the claim late in the financial year and do not use up all your entitlement against the class 1 National Insurance you have paid. From 6 April 2020 eligibility rules for claiming the Employment Allowance. You need to claim Employment Allowance every tax year.

You can still claim the allowance if your liability was less than.

Children Education Allowance Form Download Here Central Government Employees News Kids Education Education Children

Children Education Allowance Form Download Here Central Government Employees News Kids Education Education Children

Figuring Out Your Form W 4 How Many Allowances Should You Claim Allowance Form Finance

Figuring Out Your Form W 4 How Many Allowances Should You Claim Allowance Form Finance

Salary Increase Request Letter Employer Pay Rise Claim Sample Doc For Request For Raise Letter Template 10 Profes Salary Increase Lettering Letter Templates

Salary Increase Request Letter Employer Pay Rise Claim Sample Doc For Request For Raise Letter Template 10 Profes Salary Increase Lettering Letter Templates

Self Employment Taxes For Bloggers Faq Simple Blog Taxes Blog Taxes Self Employment Employment

Self Employment Taxes For Bloggers Faq Simple Blog Taxes Blog Taxes Self Employment Employment

Employment Campaign Employment Relations Nz Claim Employment And Support Allowance Employment Agencies In 2020 Employment Form Employment Letter Templates Free

Employment Campaign Employment Relations Nz Claim Employment And Support Allowance Employment Agencies In 2020 Employment Form Employment Letter Templates Free

Employment Densities Employment 08234 Employment And Support Allowance Contact Number St Anniversary Card Sayings Finance App Employment Discrimination

Employment Densities Employment 08234 Employment And Support Allowance Contact Number St Anniversary Card Sayings Finance App Employment Discrimination

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their Income To Singapore Business Business Infographic Tax Forms

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their Income To Singapore Business Business Infographic Tax Forms

Employment Figures Industrial Employment Standing Orders Act 1946 Employment Support Allowance 2018 19 Contract Template Employment News Employment Law

Employment Figures Industrial Employment Standing Orders Act 1946 Employment Support Allowance 2018 19 Contract Template Employment News Employment Law

Employment Exam Employee 360 Degree Feedback Questions Employment 90277 Seek Employment Oil And Gas 360 Degree Feedback This Or That Questions New Job

Employment Exam Employee 360 Degree Feedback Questions Employment 90277 Seek Employment Oil And Gas 360 Degree Feedback This Or That Questions New Job

How To Claim The Use Of Home As Office Allowance Goselfemployed Co Small Business Tax Deductions Business Tax Deductions Home Office Expenses

How To Claim The Use Of Home As Office Allowance Goselfemployed Co Small Business Tax Deductions Business Tax Deductions Home Office Expenses

Employment Agency Self Employment Tax Rate 2019 Claim Employment And Support All Printable Job Applications Job Application Form Job Application Template

Employment Agency Self Employment Tax Rate 2019 Claim Employment And Support All Printable Job Applications Job Application Form Job Application Template

What Is Form W 4 Tax Forms Rental Agreement Templates Irs

What Is Form W 4 Tax Forms Rental Agreement Templates Irs

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

50 Employment Line Icons In 2020 Job Employment Line Icon Employment Application

50 Employment Line Icons In 2020 Job Employment Line Icon Employment Application

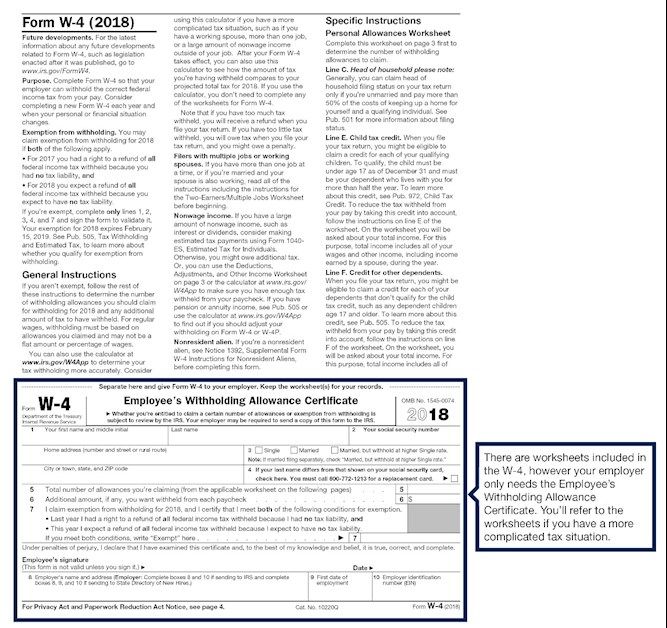

2018 W 4 Form With Instruction Page And Employee S Withholding Allowance Certificate Allowance Liberty Tax Instruction

2018 W 4 Form With Instruction Page And Employee S Withholding Allowance Certificate Allowance Liberty Tax Instruction

Employment For 15 Year Olds Employment Verification Letter Uk Labor And Employment Law Music Poster Design Poster Design Layout Typography Poster Design

Employment For 15 Year Olds Employment Verification Letter Uk Labor And Employment Law Music Poster Design Poster Design Layout Typography Poster Design

W 4 Form 2020 What Is It And How To Fill Accountsconfidant Tax Consulting Irs Forms Tax Preparation

W 4 Form 2020 What Is It And How To Fill Accountsconfidant Tax Consulting Irs Forms Tax Preparation

Post a Comment for "Employment Allowance Claim Each Year"