Self Employed Tax Rates Ireland

Mark earns a salary of 54000 a year working for himself self-employed. If you are self-employed in Ireland its important you are aware of what you can and cant expense.

Payroll And Tax Services In Malaysia Tax Services Payroll Payroll Taxes

Payroll And Tax Services In Malaysia Tax Services Payroll Payroll Taxes

Income Tax 20 up to 34550 and 40 for income above 34550 PRSI 4.

Self employed tax rates ireland. USC 5 25 5 8 and 11 depending on the income levels 11 applies over 100000 Income tax rates for the year 2018. Balance of income over 44300. Income up to 44300.

Learn more by speaking to our tax experts today. Liability on deposit interest. The self-employment tax rate is 153.

Income tax rates for the year 2017. Earned income credit cannot be transferred to your spouse or civil partner. The USC does not apply to social welfare or similar payments.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Assuming the 40 tax rate applies Income Tax 40. In Ireland there are specific things which you can and cant expense.

Income Tax 20 up to 33800 and 40 for income above 33800 PRSI 4. MEMBERS OF CHARTERED ACCOUNTANTS IRELAND. MEMBERS OF IRISH TAX INSTITUTE.

There are two income tax rates. Single and widowed person. Need further Tax advice on Self Employed Income.

Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill. Class S PRSI contributions are paid at a rate of 4 on all income or 500 whichever is the greater. The tax band represents the amount that is taxable at the lower rate.

Schedule F WH Withholding Tax 25 WH. Tax relief for PRSA AVCs is based on the appropriate age-related percentage limit of the income from the employment in question. For starters the Earned Income Tax Credit applies to most self-employed people.

The downside of this is that you wont get all. Special Savings Account SSA 33. Income up to 35300.

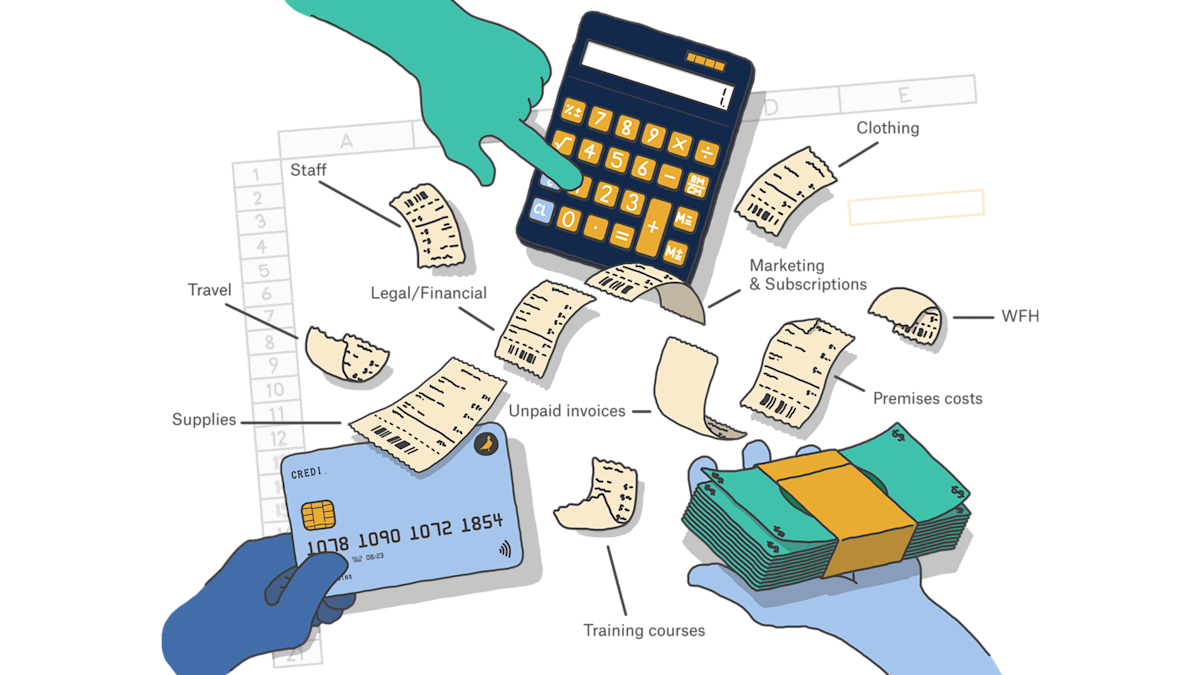

One of the best ways to lower your tax liability is to ensure you have captured fully all of your business expenses. If you are self-employed you pay Class S PRSI contributions. The rate consists of two parts.

Self-employed persons whose income from all sources is less than EUR 5000 per year are not liable to PRSI. This tax credit is worth 1500 for 2029 1350 for 2019 and you can subtract this figure from your tax liability. As reduced by any employee contributions to the pension scheme relating to the employment You may pay a once-off or special pension contribution after the end of a tax year but before the following 31 October.

This entitles you to a limited range of social insurance payments. As a contractor you will be self-employed which means that you will pay class S PRSI at a rate of 4 per cent. For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad retirement tier 1 tax.

An extra charge of 3 applies to any self-employed income over 100000 regardless of age. Balance of income over 35300. The standard rate is 20 and the higher rate is 40.

A reduced rate of employer PRSI of 88 applies where earnings are below the threshold of EUR 398 from 1 January 2021 onwards. In 2015 2016 for a single person the first 33800 of income is taxable at the lower rate and the balance is taxable at the higher rate. Average percentage taxation of self-employed persons.

We can provide further advice on all tax matters by way of consultation. This means he pays on three brackets of USC- 05 on the first 12012 6006 2 on the following 7862 15724 and finally 45 on the last 34126 of his salary 153567. This means that self-employed people pay a total of 11 USC on any income over 100000.

If youre self-employed in Ireland then youre obliged to file a self-assessed tax return usually by the deadline of October 31 or by the pay and file deadline of Nov 10. Balance of income over 70600. Two incomes of at least EUR 26300 each Income up to 70600.

Self Employed Invoice Template Best Free And Simple Templates

Self Employed Invoice Template Best Free And Simple Templates

The Top 10 Best Self Employed Jobs Smartasset

The Top 10 Best Self Employed Jobs Smartasset

Freelance Tax In Spain For Self Employed Expats Expatica

Freelance Tax In Spain For Self Employed Expats Expatica

5 Things Americans Abroad Should Know About Self Employment Tax

5 Things Americans Abroad Should Know About Self Employment Tax

Gender Gaps In Entrepreneurship Are Large And Persistent Oecd Self Employment Gender Gap Employment

Gender Gaps In Entrepreneurship Are Large And Persistent Oecd Self Employment Gender Gap Employment

Self Employed Tax In Portugal A Guide For Freelancers Expatica

Self Employed Tax In Portugal A Guide For Freelancers Expatica

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Free Download Send In Minutes

Tax Tips For Self Employed Nail Techs Nailtechs Manicurist Www Onemorepress Com Business Nails Home Nail Salon Nail Tech School

Tax Tips For Self Employed Nail Techs Nailtechs Manicurist Www Onemorepress Com Business Nails Home Nail Salon Nail Tech School

How To Claim Expenses When You Re Self Employed Courier

How To Claim Expenses When You Re Self Employed Courier

Pin On Self Assessed Tax Return

Pin On Self Assessed Tax Return

Payroll And Tax In Ireland Tax Services Payroll Payroll Taxes

Payroll And Tax In Ireland Tax Services Payroll Payroll Taxes

What Is Self Employment Tax And What Are The Rates For 2020 Workest

What Is Self Employment Tax And What Are The Rates For 2020 Workest

Self Employment Tax Calculator For 2020 Good Money Sense Self Employment Small Business Tax Deductions Money Sense

Self Employment Tax Calculator For 2020 Good Money Sense Self Employment Small Business Tax Deductions Money Sense

Law Decree N 34 Of 2019 Modified Again The Regime And Increased The Abatement Of Taxable Income To 70 Percent For P Capital Gains Tax Income Tax Return Income

Law Decree N 34 Of 2019 Modified Again The Regime And Increased The Abatement Of Taxable Income To 70 Percent For P Capital Gains Tax Income Tax Return Income

What Is Self Employment Tax And What Are The Rates For 2019 Workest

What Is Self Employment Tax And What Are The Rates For 2019 Workest

Payroll Tax Wikipedia Income Tax Payroll Payroll Taxes

Payroll Tax Wikipedia Income Tax Payroll Payroll Taxes

Post a Comment for "Self Employed Tax Rates Ireland"