Withholding Tax Rates Hmrc

Income tax withholding schedules provide graduated tax rates to be withheld by employers each pay period giving considerations to a wage earners marital status and the number of withholding allowances claimed. For help with your withholding you may use the Tax Withholding Estimator.

Bloomsbury Professional Tax Insight Withholding Tax Bloomsbury Professional Tax Insights Parkes Andrew 9781526515759 Amazon Com Books

Bloomsbury Professional Tax Insight Withholding Tax Bloomsbury Professional Tax Insights Parkes Andrew 9781526515759 Amazon Com Books

You find that this amount of 2020 falls in the At least 2000 but less than 2025 range.

Withholding tax rates hmrc. Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly. HMRC can assess and recover the. You are required to make quarterly estimated tax payments if you can reasonably expect your tax liability to exceed the amount withheld by 500 or more and you expect your withholding to be less than the smaller of 70 of your current years liability or the tax liability shown on your return for the preceding taxable year of twelve months.

B Payments for the use or the right to use copyright on any literary artistic or scientific work if the BO. Estimated Income Tax Payments. A pass-through entity is not required to withhold income tax with regard to any nonresident member who submits a Nonresident Member Withholding Exemption Affidavit Form OW-15.

For non-residents tax withheld is the final tax except for property income in which case it is a payment on account. The amount of income tax your employer withholds from your regular pay depends on two things. If you are a non-resident individual.

The current rate of withholding tax is 10 but note that this is a general reduction from a higher rate of 20 and could change in the future. Countries with Double Taxation Agreements with the UK rates of withholding tax. 2005 Oklahoma Income Tax Withholding Tables.

A Payments for the use or the right to use International News. The amount you earn. Not subject to WHT in the case of holdings of at least 10 owned for at least one year.

Under the Income Withholding Tax Law of Oklahoma every person who as an officer of a corporation a member of a partnership or as an individual employer is under a duty to withhold and remit Oklahoma Income Withholding Tax may be personally liable to the State of Oklahoma for the taxes. 2006 Oklahoma Income Tax Withholding Tables. The income would have been taxed at a lower rate in the UK.

20 20 See the Withholding taxes. Rates Rebates Royalty Interest to Nonresident Interest Owners Forms Rules. A clearance application - for S874 no longer to apply or only to apply to a lower rate of withholding specified in the relevant tax treaty to a specific loan.

Using the chart you find that the Standard withholding for a single employee is 176. These withholding rates are designed to cover the approximate tax that will be due for taxpayers with standard deductions. Objects of income tax for enterprises with foreign investment and foreign enterprises in China.

Homa income tax at a rate of 5 of the Oklahoma share of income distributed to each nonresident member partner member shareholder or beneficiary. Directly or directly and indirectly holds at least 10 of the share capital or of voting rights in the Portuguese subsidiary 25 in the case of a parent company resident for tax purposes in. 15 residual tax for companies with more than 10 shareholding if the company receiving the dividend is directly or indirectly controlled by a shareholder not resident in the European Union or Switzerland and cannot prove that the company is not set up only to benefit from the 0 WHT on dividends.

General 10 withholding tax rate. 2004 Oklahoma Income Tax Withholding Tables. Between 1 and 20 Non-resident.

In the table the Claim form column shows the form to use when making a treaty claim to relief from UK tax on interest royalties pensions or annuities for example form DT-Individual or DT-Company. 2003 Oklahoma Income Tax Withholding Tables. Last Modified on 01052021.

139 rows In particular non-resident companies that are subject to UK income tax on UK-source rental profits see the Taxes on corporate income section for more information will find their letting agent or tenants are obligated to withhold the appropriate tax at source currently 20 without any allowances from their rental payments unless the recipient has first applied and been given permission to receive. Back to Top. If payments to you are more than the UK personal tax allowance the person who pays you will deduct tax in advance and pay it to HM Revenue and Customs HMRC.

This is called withholding tax and. The information you give your employer on Form W4. 5 May 2015.

You can use the Tax Withholding Estimator to estimate your 2020 income tax. HMRC has guidance on how Foreign Tax Credit Relief is calculated including the special rules for interest and dividends in Foreign. Addition of link to National Archive page on rates and allowances for previous years.

The 2015 to 2016 rates and thresholds for employers have been added. Most DTAs provide for the following structure with different withholding tax rates.

What Is Withholding Tax Employment Accounting Tax

What Is Withholding Tax Employment Accounting Tax

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Withholding Tax On Interest Payments Fkgb Accounting

Withholding Tax On Interest Payments Fkgb Accounting

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Withholding Tax Sap Help Portal

Withholding Tax Sap Help Portal

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Sa302 Tax Calculation Request Form Tax Self Assessment This Or That Questions

Sa302 Tax Calculation Request Form Tax Self Assessment This Or That Questions

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Oracle Fusion Financials For Emea Reports Chapter 16 20c

Oracle Fusion Financials For Emea Reports Chapter 16 20c

Uk Payroll And Tax Information And Resources Activpayroll

Uk Payroll And Tax Information And Resources Activpayroll

Revised Withholding Tax Table For Compensation Withholding Tax Table Tax Table Compensation

Revised Withholding Tax Table For Compensation Withholding Tax Table Tax Table Compensation

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

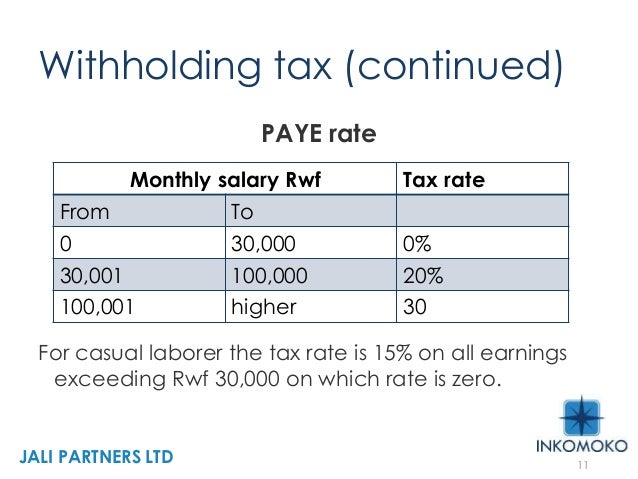

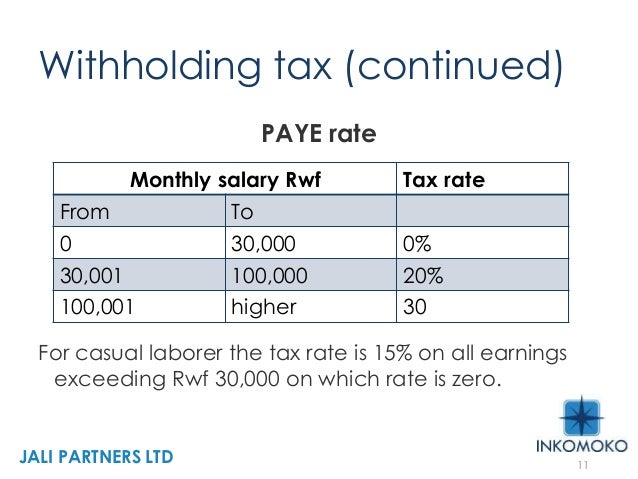

How To Calculate Withholding Tax In Rwanda Tax Walls

How To Calculate Withholding Tax In Rwanda Tax Walls

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

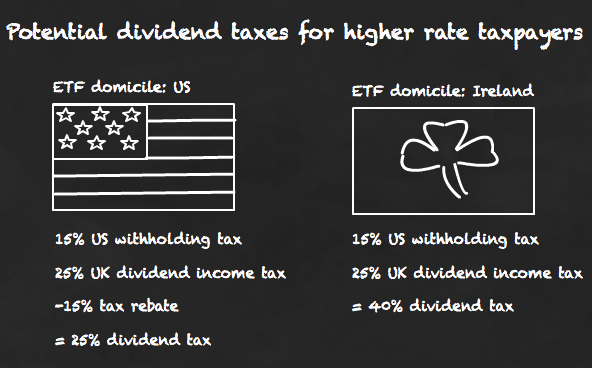

Etfs And The Peculiar Effects Of Withholding Tax Monevator

Etfs And The Peculiar Effects Of Withholding Tax Monevator

Post a Comment for "Withholding Tax Rates Hmrc"