Withholding Tax Rates Under Section 153

It mainly revolves around the obligations of the withholding agents as to collection or deduction of tax at source ie. The IRS urges everyone to do a Paycheck Checkup in 2019.

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

The applicable tax rate is to be increased by 100 Rule-1 of Tenth Schedule to the Ordinance ie.

Withholding tax rates under section 153. WITHHOLDING TAX RATES SECTION WITHHOLDING AGENT Rate 1531a sales of goodsEvery Prescribed Person section 1537 Company 4 of the gross amount Other than company 45 of the gross amount No deduction of tax where payment is less than Rs. Taxpayers pay the tax as they earn or receive income during the year. O Persons from whom tax is to be deducted or collected.

In the case of non-resident individuals who do not qualify for the exemption provided for by this section the charge to income tax is confined to a rate of 25. The rate of deduction withholding tax under clause a of sub-section 1 of section 153 has been reduced from 35 to 1 in case of local purchases of scrap steel made by the steel melters who. The Income Tax Ordinance 2001 Section.

Received by Company 15 30 Adv. The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US. 500000 10 Final Tax Others.

Where yield is up to Rs. For purchase of Services from Non-Company exceeding Rs30000-if Income tax status is Active deduct 10 of Gross invoice amount and if status is Inactive deduct 5. The companies mentioned in clause 94 were required to pay tax 2 of the gross amount of turnover from all sources and where such tax 2 of gross turnover was paid such companies could obtain exemption certificate from the Commissioner under sub-section 4A of.

Pursuant to paragraph 153 1 g of the Act and Regulation 105 a withholding of 15 is required from the payment of fees commissions or other amounts paid or allocated to a non-resident person in respect of services provided in Canada. Taxpayers can avoid a surprise at tax time by checking their withholding amount. Ordinance 2001 governing withholding tax in a simple and concise manner.

Gross Invoice amount means invoice amount inclusive of Sales Tax. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or. In case of rendering or providing of services other than as mentioned at i above.

In effect this means that the deduction of dividend withholding tax DWT from distributions received by such persons is a final liability tax. The exemption certificate was granted subject to the condition that tax payable or paid on the income from the companys services should not be less than two percent of the gross. Tax Rate Nature of Tax Advance Final Minimum Tax appearing in ATL Person not appearing in ATL Page 4 PAYMENTS FOR SERVICES Section 1531b 1532 Division III Part III First Schedule Division IV Part III First Schedule Person providing advertising services electronic print media services 15 3 Minimum Tax.

1M 10 machinery20 PROFIT ON DEBT st Section 151 Div. IA Part III 1 Sch. A In case of company 8 percent of the gross.

Under Section 1531a for sale of rice cotton seed oil and edible oil the tax rate shall be 15 percent of the gross amount. WITHHOLDING AGENTS Sales Tax. O Applicable rates of withholding taxes.

Withholding Tax Rates Applicable Withholding Tax Rates. Tax Received by individuals or AOPs and the profit is above Rs. The tax rate shall be 3 percent of the gross amount and the rate shall be 6 percent in case persons not on the ATL.

75000- in aggregate during a financial year S1531a. Income taxes on certain income profit or gain from sources within the United States. 14 153 Payment for goods services 1531a 1531b 1531c.

O Identifying the withholding agents. FS-2019-4 March 2019 The federal income tax is a pay-as-you-go tax. Through this clause companies avoided the eight percent withholding tax by obtaining an exemption from withholding of tax certificate from the Commissioner under section 153 read with section 159 of the Ordinance.

Updated up to June 30 2020. Importer of goods on the value of the goods at the rate specified in. The importer has paid tax under section 148 in respect of the goods.

1M 125 25 Final Tax Received by individuals or AOPs and the profit is up to Rs. 43E The provisions of clause a sub-section 1 of section 153 shall not apply in case of goods transport contractor provided that such contractor pay tax at the rate of 25 on payments for rendering or providing of carriage services TRAVELLING AGENTS 43B The provisions of clause a sub-section 1 of section 153 shall not apply. At the time of collection or deduction of tax the rate of withholding tax shall be two per cent over and above the rates specified in Division III of Part III of the First Schedule.

The tax required to be collected from a person under this section shall be minimum tax for a tax year on the import of. August 2019 this Fact Sheet has been updated to reflect changes to the Withholding Tool. Persons not appearing in the Active Taxpayers List.

We Make A Personalized High Quality Paycheck Stub W Company Logo For You Including Income Taxes Deductions Ytd Totals Credit Card App Paycheck Income Tax

We Make A Personalized High Quality Paycheck Stub W Company Logo For You Including Income Taxes Deductions Ytd Totals Credit Card App Paycheck Income Tax

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Tax Terms Cheat Sheet Adulting Asu

Tax Terms Cheat Sheet Adulting Asu

How To Become A Millionaire By Investing In A Roth Ira Roth Ira Roth Ira Investing Become A Millionaire

How To Become A Millionaire By Investing In A Roth Ira Roth Ira Roth Ira Investing Become A Millionaire

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

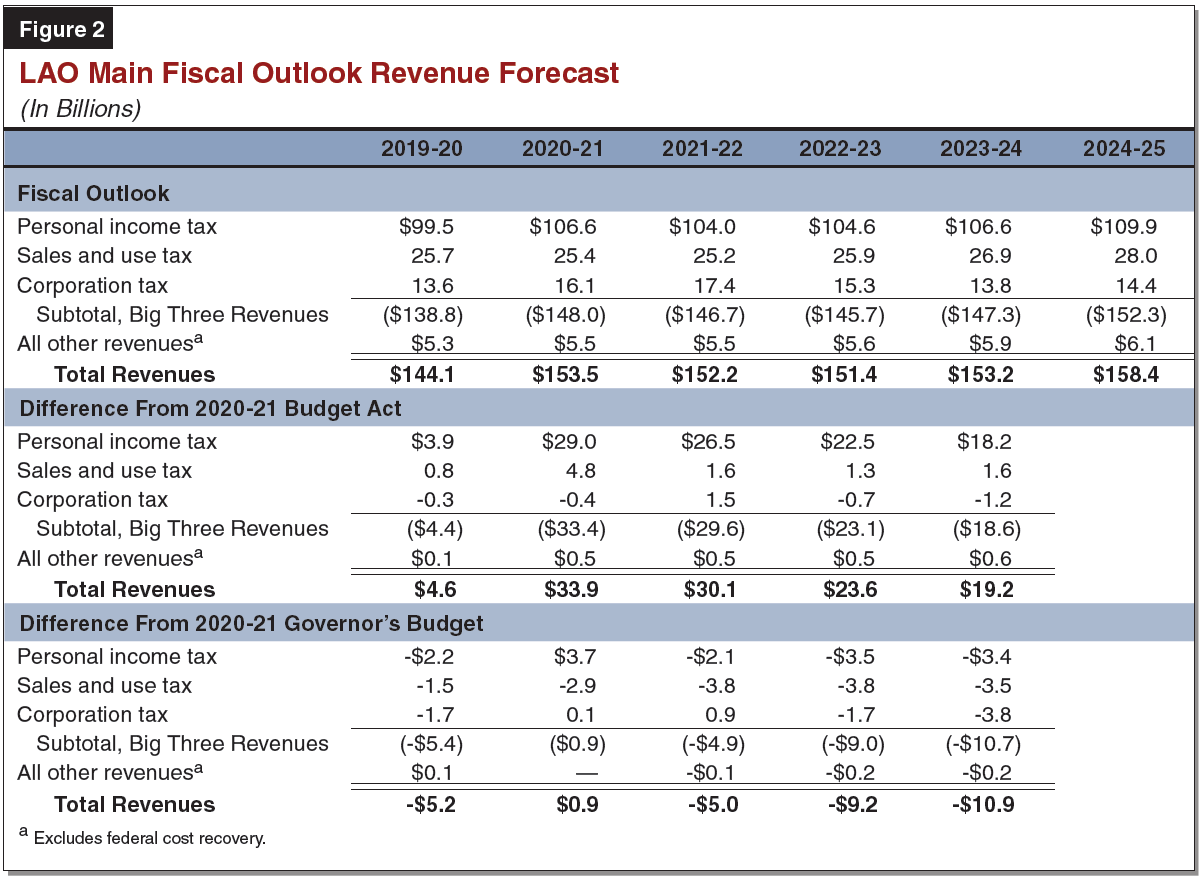

Understanding The Budget Revenues

Understanding The Budget Revenues

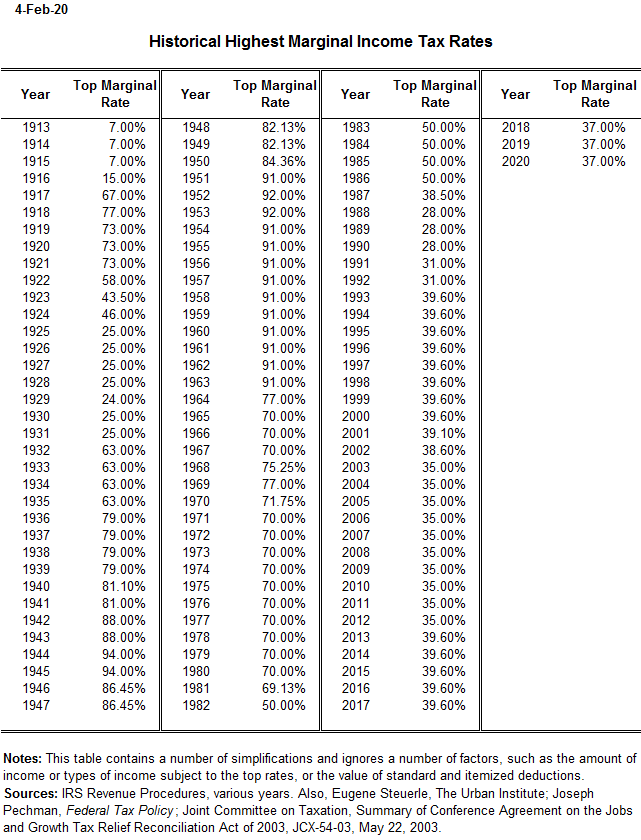

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Compounding Can Grow Tiny Amounts Into Millions Money Market Fund Management Money Market Account

How Compounding Can Grow Tiny Amounts Into Millions Money Market Fund Management Money Market Account

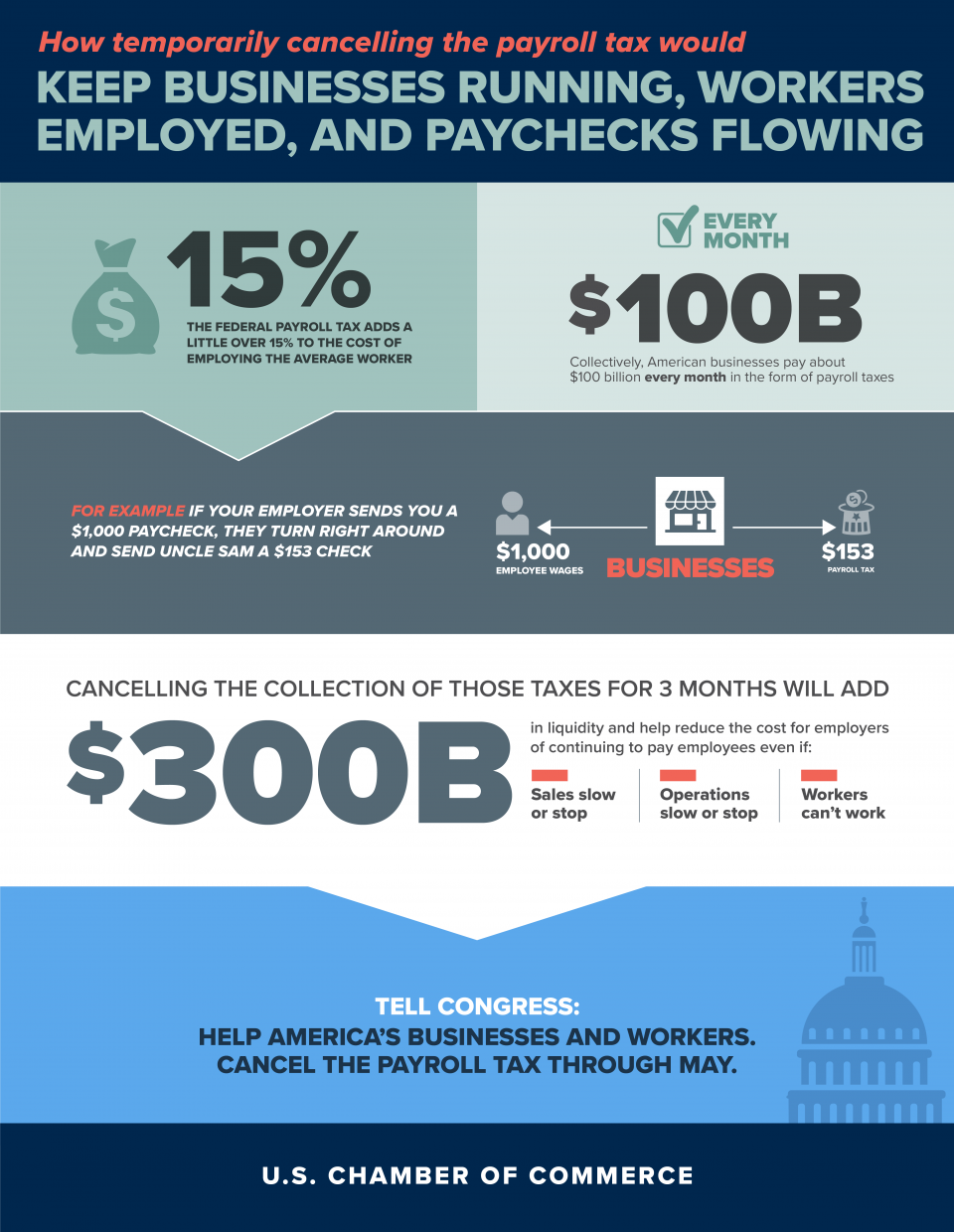

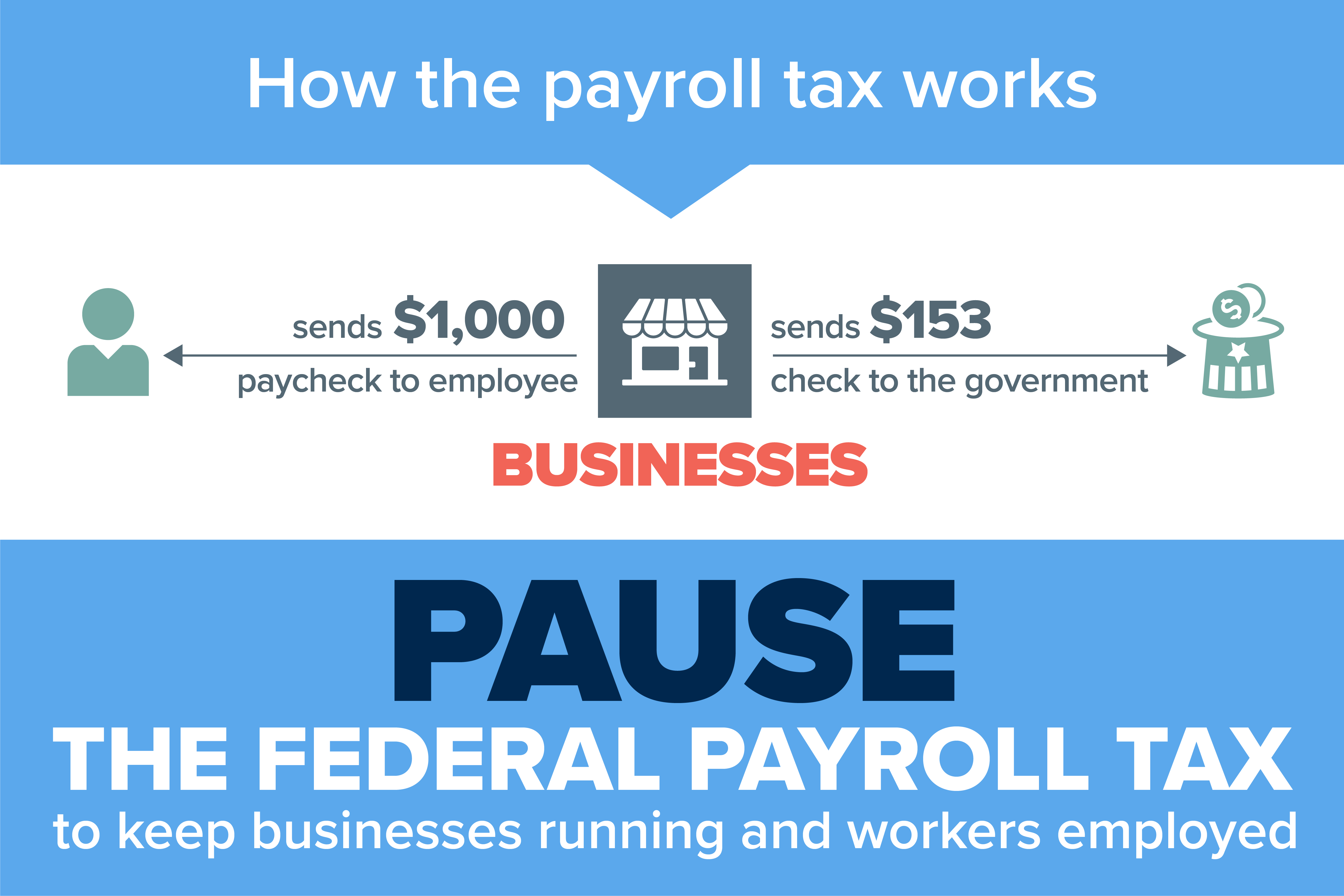

How Pausing The Payroll Tax Will Help Businesses Keep Workers Employed And Paychecks Flowing Amid The Coronavirus Pandemic U S Chamber Of Commerce

How Pausing The Payroll Tax Will Help Businesses Keep Workers Employed And Paychecks Flowing Amid The Coronavirus Pandemic U S Chamber Of Commerce

May 2019 Condo Stat Maui Kaanapali Kapalua Wailea

May 2019 Condo Stat Maui Kaanapali Kapalua Wailea

The Election Your Taxes Single Point Partners

The Election Your Taxes Single Point Partners

Take Advantage Of The New Tax Bracket Sweet Spots

Take Advantage Of The New Tax Bracket Sweet Spots

How Pausing The Payroll Tax Will Help Businesses Keep Workers Employed And Paychecks Flowing Amid The Coronavirus Pandemic U S Chamber Of Commerce

How Pausing The Payroll Tax Will Help Businesses Keep Workers Employed And Paychecks Flowing Amid The Coronavirus Pandemic U S Chamber Of Commerce

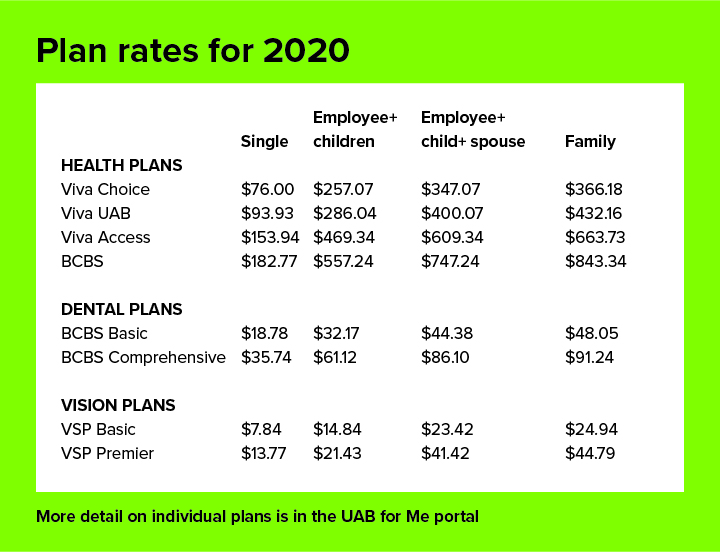

Premiums For Health Dental And Vision Available For 2020 The Reporter Uab

Premiums For Health Dental And Vision Available For 2020 The Reporter Uab

Taxes From A To Z 2019 B Is For Bracket Creep

Taxes From A To Z 2019 B Is For Bracket Creep

How Do Marginal Income Tax Rates Work And What If We Increased Them

How Do Marginal Income Tax Rates Work And What If We Increased Them

Understanding Provisions Of Withholding Taxes Under The Income Tax Ordinance 2001

Understanding Provisions Of Withholding Taxes Under The Income Tax Ordinance 2001

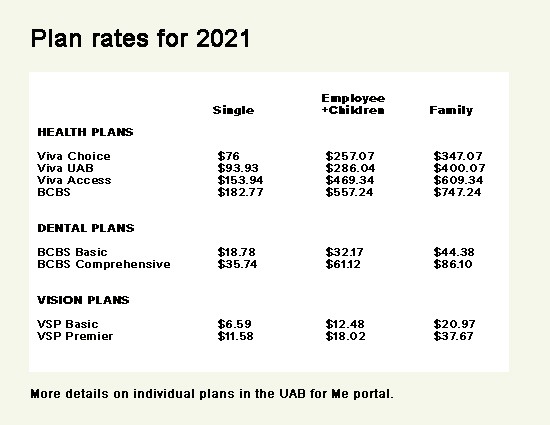

Premiums For Health Dental And Vision Available For 2021 The Reporter Uab

Premiums For Health Dental And Vision Available For 2021 The Reporter Uab

Post a Comment for "Withholding Tax Rates Under Section 153"