Withholding Tax Table Yearly

This may impact withholding calculations for some employees when using Schedule 7 Tax table for unused leave payments on termination of employment and Schedule 11 Tax table for employment termination payments. All companies remitting withholding tax of 10000 or more per month are required to file and remit according to the Federal semi-weekly schedule.

Real Estate Related Taxes And Fees In Japan

To calculate withholding tax the employer first needs to gather relevant information from the W-4 form review any withholding allowances and then use the IRS withholding tables to calculate withholding tax.

Withholding tax table yearly. For employees withholding is the amount of federal income tax withheld from your paycheck. 51 Agricultural Employers Tax Guide. In addition to withholding Medicare tax at 145 you must withhold a 09 Additional Medicare Tax from wages you pay to an employee in excess of 200000 in a calendar year.

Every employerwithholding agent that has an employee earning wages in South Carolina and who is required to file a return or deposit with the IRS must make a return or deposit to the SCDOR for any taxes that have been withheld for state purposes. The rates influence how much staff member incomes or wages that you require to keep. Such exemptions are not separately indicated in the tables below.

The following images are the BIR Withholding Tax Tables. Under the Income Withholding Tax Law of Oklahoma every person who as an officer of a corporation a member of a partnership or as an individual employer is under a duty to withhold and remit Oklahoma Income Withholding Tax may be personally. Take your employees Forms W-4 and determine how much federal income tax needs to be withheld for the 2021 tax year.

Tax Tables 2021 The total directions of Federal Income Tax Withholding are provided by the IRS Internal Revenue Service each year. 2003 Oklahoma Income Tax Withholding Tables. The information you give your employer on Form W4.

In addition most of the UK treaties provide for a zero-rate of withholding on interest paid to governmental and quasi-governmental lenders. Withholding Tax is taken out of taxpayer wages to go towards the taxpayers total yearly income tax liability. A Basic Amount of Annual Income P102500.

Using the new graduated income tax tables for 2023 onwards the new income tax payable is as follows. First gather all the documentation you need to reference to calculate withholding tax. Federal income tax table changes.

2020 Federal Tax Tables It is vital to recognize just how employment tax rates are determined and also restored each year if you are an employer. This year of 2021 is additionally not an exemption. Youre required to begin withholding Additional Medicare Tax in the pay period in which you pay wages in excess of 200000 to an employee and continue to withhold it each pay period until the end of the calendar year.

B Additional Rate 25. Employer Federal Income Tax Withholding Tables 2021 is out now. For help with your withholding you may use the Tax Withholding Estimator.

This publication supplements Pub. The deadline for first quarter tax year 2021 individual estimated tax payments remains April 15 2021. A withholding table shows payroll service providers and employers how much tax to withhold from employee paychecks given each employees wages marital status and the number of withholding allowances they claim.

Effective January 1 2018 to December 31 2022. C Of the Excess over P800000 P200000. 12 rows REVISED WITHHOLDING TAX TABLE.

2004 Oklahoma Income Tax Withholding Tables. So if you do not file a new Form W-4 for 2020 your withholding might be higher or lower than you intend. The federal income tax table brackets change annually.

Last Modified on 01052021. Annual Reports Commission Agendas - Archive Commission Meeting Minutes Motor Vehicle Annual Report PAYRight Final Report. A mid-year withholding change in 2019 may have a different full-year impact in 2020.

Use the 2021 tables to figure out how much tax you need to withhold from an employees income. Banks and similar financial institutions are also normally able to pay annual interest to non-UK residents free of WHT. The amount of income tax your employer withholds from your regular pay depends on two things.

Here are the steps to calculate withholding tax. INCOME TAX DUE P102500 25 P200000 P152500. The withholding tax is remitted monthly by companies withholding more than 500 per quarter.

It describes how to figure withholding using the Wage Bracket Method or Percentage Method describes the alternative methods for figuring withholding and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members. Companies withholding less than 500 remit on a quarterly basis. 15 Employers Tax Guide and Pub.

Also if you had a major life change such as marriage the birth of a child adoption or bought a home. Rate and bracket updates. And due to the 2020 changes surrounding the repeal of withholding allowances and the redesign of Form W-4 you might still have questions about which table to reference.

Due to COVID-19 ADORs in-person lobby services are by appointment only and in compliance with local municipal and county face covering policies. For those of you who havent recognized enough with the way withholding taxes are done on this year of 2020 you might discover it from Federal Tax Withholding. The amount you earn.

Arizona has moved the individual income taxes deadline to May 17 2021 without penalties and interest. Check out better to understand how the procedure functions officially. Annual Withholding Tax Table can be derived by multiplying all values in Monthly Table by twelve 12 EXCEPT the percentages.

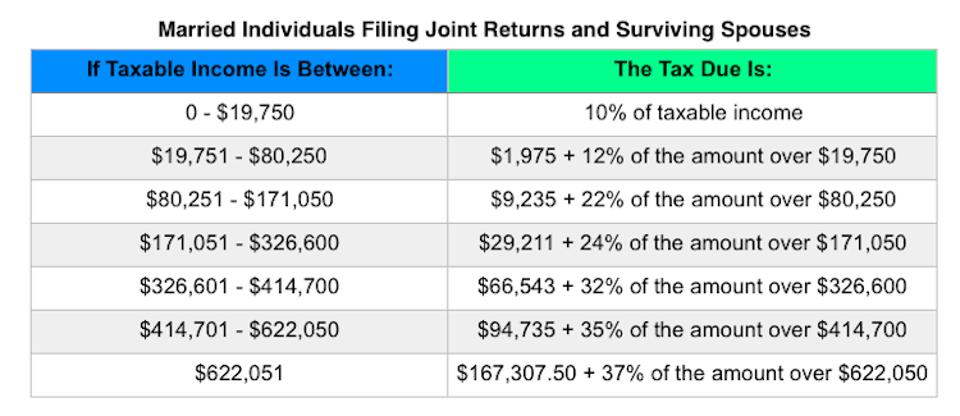

2021 Federal Tax Brackets What Is My Tax Bracket

2021 Federal Tax Brackets What Is My Tax Bracket

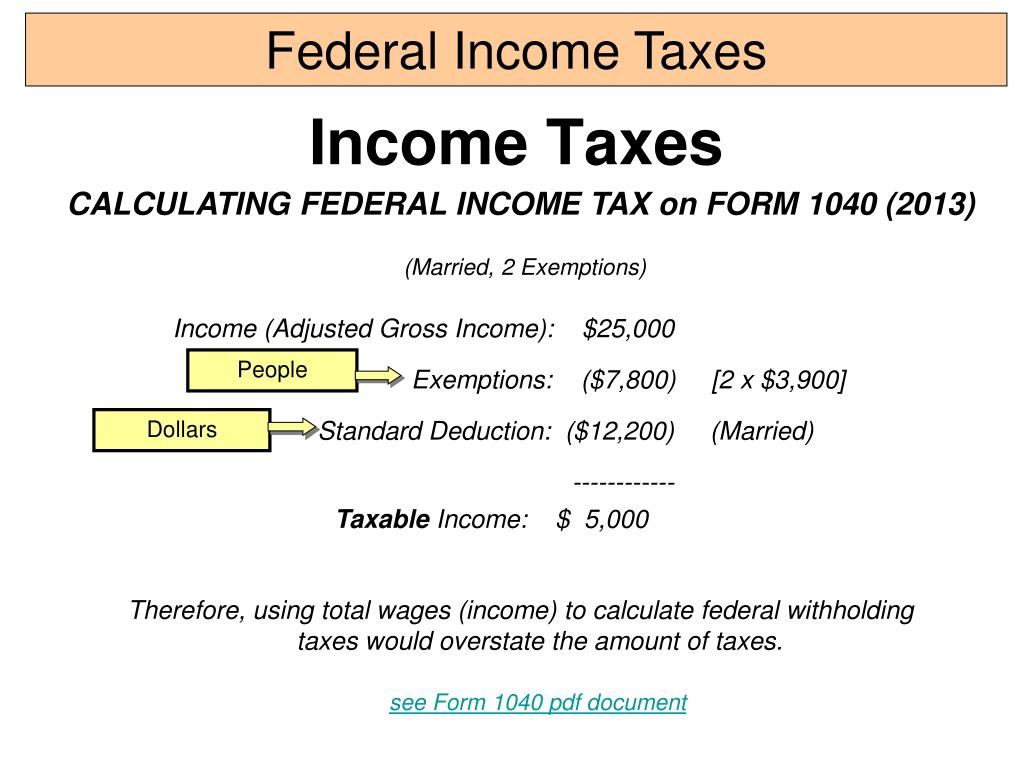

Ppt Income Taxes Powerpoint Presentation Free Download Id 1087068

Ppt Income Taxes Powerpoint Presentation Free Download Id 1087068

What Are Employee And Employer Payroll Taxes Ask Gusto

What Are Employee And Employer Payroll Taxes Ask Gusto

Removing Withholding Tax Line From Theme Manager Forum

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

New Federal Income Tax Brackets 2019 How Much Am I Paying In Taxes

Tax Withholding Calculator For W 4 Form In 2021

Tax Withholding Calculator For W 4 Form In 2021

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Business Payroll How To Withhold Income Tax From Employee S Paychecks

Business Payroll How To Withhold Income Tax From Employee S Paychecks

Yearly Income Tax Table Page 4 Line 17qq Com

Yearly Income Tax Table Page 4 Line 17qq Com

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Removing Withholding Tax Line From Theme Manager Forum

Removing Withholding Tax Line From Theme Manager Forum

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Post a Comment for "Withholding Tax Table Yearly"