Employment Gap Conventional Loan

Refer to Guide Section 53032ai for complete requirements and guidance. If your employment gap is six months or less youre eligible for most mortgage programs if you have a full-time job and can provide pay stubs covering 30 days of wages.

Getting A Mortgage With Employment Gaps Az Mortgage Brothers

Getting A Mortgage With Employment Gaps Az Mortgage Brothers

Note that for DU loan casefiles only the most recent year of tax returns may be required.

Employment gap conventional loan. The Borrower has been employed in the current job for at least six. A gap in employment or a reduction in income due to COVID-19 cannot be excluded from the calculation and the year to date income must continue to be calculated over the entire time period. PMI will be canceled once the loan-to-value ratio reaches 78.

Neither the FHA nor the VA would allow for this situation. If you have been unemployed for six or more months then youll have to work for at least six months at your new job before most lenders will consider you for a home loan. Temporary Leave Income.

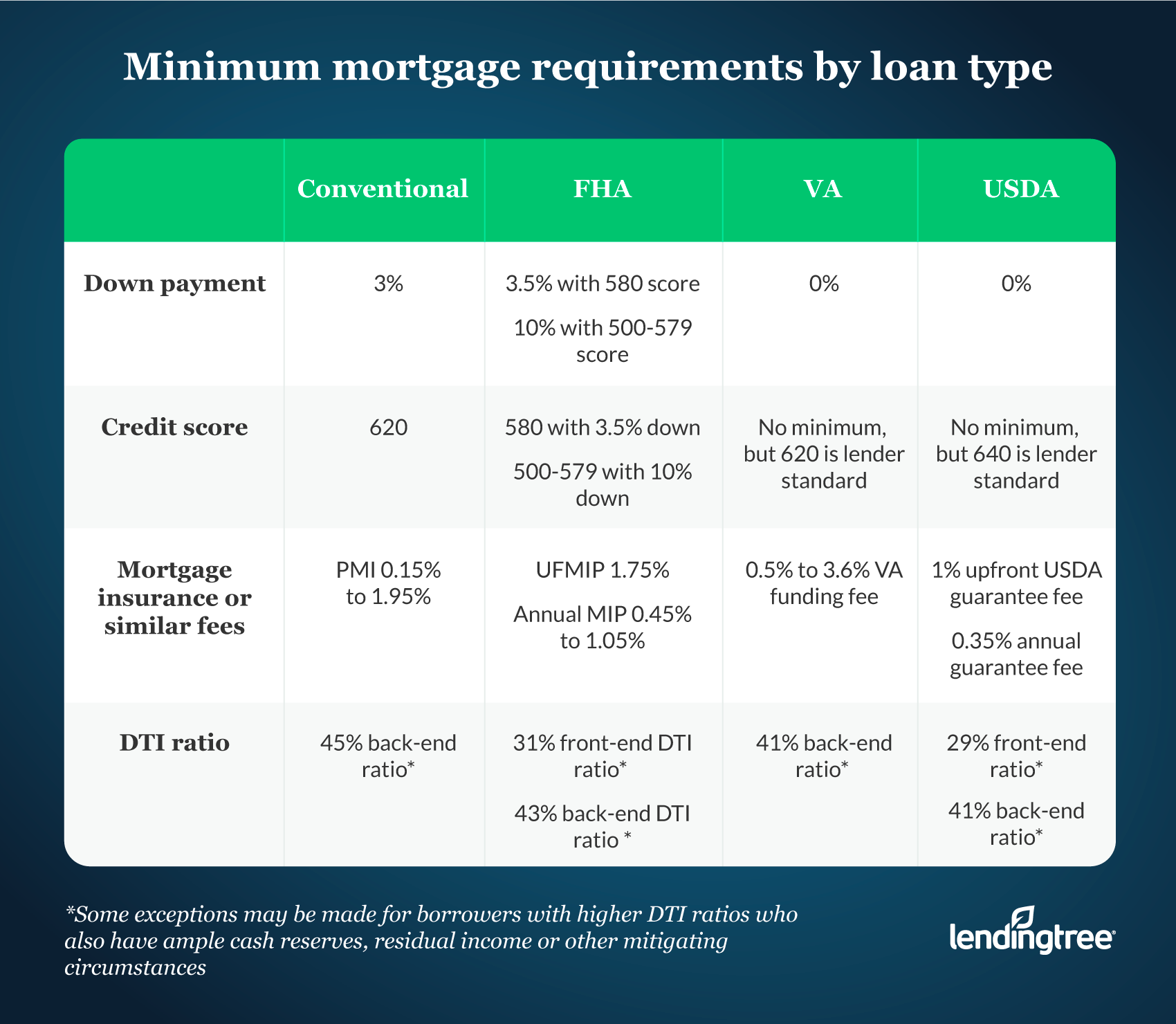

Minimum 620 credit score. The lender must document and underwrite the loan application using the requirements for self-employed borrowers as described in Section B332 Self-Employment Income. Temporary disability is considered to be a gap but lenders will look at your.

In other words a gap of less than six months may not significantly impact your loan application whilst one of a year will likely cause problems. If the borrower will return to work as of the first mortgage payment date the lender can consider the borrowers regular employment income. If youre going to depend on a lender to help youbuy a home your employment history is one of the most.

Private Mortgage Insurance PMI Conventional home loans require private mortgage insurance PMI with less than a 20 down payment. The applicant must provide an explanation letter for employment gaps in excess of 30 days unless their income history is clearly seasonal in nature. The Loan Originator must review the employment gap explanation to make a determination on the applicants ability to receive stable and dependable income.

Who experienced recent employment gaps eg 30 days although a letter of explanation is not required the Seller remains responsible for establishing the employment is stable which may require analysis of recent employment gaps. Maximum 43 debt-to-income ratio. Types of Conventional Loans Traditional Conventional Loan.

Refer to B3-31-01 General Income Information. Two years of stable employment history. If the borrower will not return to work as of the first mortgage payment date the lender must use the lesser of the borrowers temporary leave income if any or regular employment income.

36-48 month waiting period after a bankruptcy or foreclosure. Lenders will look at the two years before the gap to see if your employment was stable up until that point. If the borrower will return to work as of the first mortgage payment date the lender can consider the borrowers regular employment income in qualifying.

Documentation is provided to support a stable employment history that directly preceded New to the workforce provide documentation supporting the borrowers recent attendance Who experienced recent employment gaps eg 30 days documentation is obtained from the borrower explaining the circumstances surrounding the gaps. For Borrowers with gaps in employment of six months or more an extended absence the Mortgagee may consider the Borrowers current income as Effective Income if it can verify and document that. When income from temporary leave is being used to qualify for the mortgage loan the lender must enter the appropriate qualifying income amount into DU based on the requirements provided in B3-31-09 Other Sources of Income.

If someone has had a gap in employment for a long time say 10 years and they just got back into the workforce a month ago we would put them into a conventional loan. How do lenders determine stability of variable income when a borrower has been impacted by COVID-19. 3 20 down payment.

You can have one or more gaps in employment in the past 24 months and qualify for a home mortgage Per agency mortgage guidelines of FHA VA USDA Fannie Mae Freddie Mac borrowers can qualify for an owner-occupant primary home loan. A gap in employment can be a tough thing to explain especially on amortgageapplication. Ask your lender to verify your former employment with a VOE -- a Verification of Employment form.

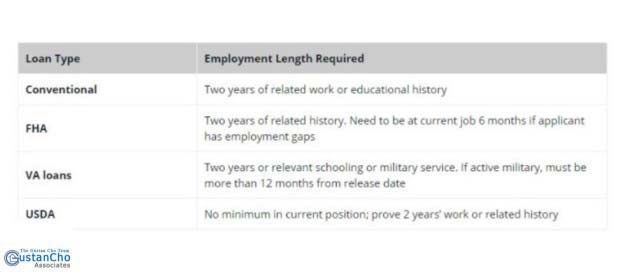

You can have gaps in employment in the past two years and qualify for conventional loans As with FHA loans if the borrower has been unemployed for six or more months the borrower needs to be on the new job for six or more months. Conventional is going to be flexible because theyre going to be able to look at someones situation case by case. This definition is used by the FHA and thus is commonly used by lenders.

The employer should list your termination date as. Private mortgage insurance companies base their rates on the borrowers risk profile including credit score down payment and income. Proof of income W2s tax returns Conventional loan requirements and guidelines.

Employment Gaps Mortgage Guidelines For Home Buyers

Employment Gaps Mortgage Guidelines For Home Buyers

2021 Minimum Mortgage Requirements Lendingtree

2021 Minimum Mortgage Requirements Lendingtree

Mortgage After Unemployment And Employment Gaps

Mortgage After Unemployment And Employment Gaps

Getting A Mortgage During A Job Transition Az Mortgage Brothers

Getting A Mortgage During A Job Transition Az Mortgage Brothers

Employment Gaps Mortgage Lending Guidelines On Borrowers

Employment Gaps Mortgage Lending Guidelines On Borrowers

Va Manual Underwriting Employment Gap Find My Way Home

Va Manual Underwriting Employment Gap Find My Way Home

Fha Loans After Unemployment And Employment Gaps

Fha Loans After Unemployment And Employment Gaps

Getting A Mortgage What Is Income Stability

Getting A Mortgage What Is Income Stability

Will An Employment Gap Hurt My Chances For Mortgage Approval

Will An Employment Gap Hurt My Chances For Mortgage Approval

Employment Gaps Mortgage Lending Guidelines On Borrowers

Employment Gaps Mortgage Lending Guidelines On Borrowers

Employment Gaps Mortgage Guidelines For Home Buyers

Employment Gaps Mortgage Guidelines For Home Buyers

Fha Guidelines On Income And Employment Gaps

Fha Guidelines On Income And Employment Gaps

Employment Gaps Mortgage Lending Guidelines On Borrowers

Employment Gaps Mortgage Lending Guidelines On Borrowers

How Job Gaps Job Changes Can Affect Your Va Loan Eligibility

How Job Gaps Job Changes Can Affect Your Va Loan Eligibility

Buying House With New Job And Gaps In Employment

Buying House With New Job And Gaps In Employment

Can I Get A Mortgage If I Have Gaps In My Job History Keystone Alliance Mortgage

Can I Get A Mortgage If I Have Gaps In My Job History Keystone Alliance Mortgage

Employment Gaps Mortgage Lending Guidelines On Borrowers

Employment Gaps Mortgage Lending Guidelines On Borrowers

Fha Guidelines On Income And Employment Gaps

Fha Guidelines On Income And Employment Gaps

Employment Gaps Mortgage Lending Guidelines On Borrowers

Employment Gaps Mortgage Lending Guidelines On Borrowers

Post a Comment for "Employment Gap Conventional Loan"