Employment History Through Irs

Amounts of tips reported. Click Forms and Publications on the left hand navigation sidebar.

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Job seekers typically include work history in the Experience or Related Employment section of a resume.

Employment history through irs. This form includes all income you earned with that employer as well as how much was withheld for taxes. Only you would know your employment history with start and end dates or you could contact your former employers. No Freedom of Information Act FOIA request is required for these records.

Please see the table below for. These should be available for IRS review. IRS Free File or e-file get your tax record and view your account.

For over 50 years Tingle Tables have saved taxpayers millions of dollars by reducing the time it takes IRS employees to sort through individual paper-filed returns. You can obtain your employment history by researching tax records obtaining your credit report or even performing a background check on yourself. An acceptable employment situation includes an individual who took several years off from employment to raise children then returned to.

If youre a business or an individual who filed a form other than 1040 you can obtain a transcript by submitting Form 4506-T Request for Transcript of Tax Return. One additional element to your resume work history is a list often a bulleted list of your achievements and responsibilities at each job. Your employer identification number.

In 1962 James Tingle invented the table while working in an IRS Service Center. WORK HISTORY REPORT- Form SSA-3369-BK READ ALL OF THIS INFORMATION BEFORE YOU BEGIN COMPLETING THIS FORM IF YOU NEED HELP If you need help with this form complete as much of it as you can. How to get your employment history Fill in the application form and send it to HMRC.

You can also complete IRS Form 4506 to request prior years W2s but keep in mind that the IRS may charge you 30 for each form depending on your reason for the request. IRS records Another option to obtain your full employment history is to request your IRS records. Routine Access to IRS Records Many types of IRS records are available through routine procedures designed to make access quick and easy.

To order transcripts of tax returns print and complete IRS Form 4506 and mail it to the IRS at the address provided on the form along with. Current DOL and Federal Employment Records Current DOL employees can access their Official Personnel Folder OPF via the eOPF system on LaborNet. Businesses and Self-Employed Get your Employer ID Number EIN find Form 941 prepare to file.

Amounts and dates of all wage annuity and pension payments. In return you will receive detailed information about your work history including employment dates employer names and addresses and earnings. Can document a two year work history prior to an absence from employment using traditional employment verifications andor copies of W-2 forms or pay stubs.

Your State Unemployment Office. Then call the phone number provided on the letter sent with the form or the phone number of the person who asked you to complete the form for help to finish it. Obtaining Employment History from the Internal Revenue Service Visit the Internal Revenue Services website at wwwIRSgov.

The fair market value of in-kind wages paid. There is a fee of 115 to receive this detailed list of employers. Or you can use the Social Security Form SSA-7050-F4 to request your employment history to include employer name and addresses - httpswwwssagovformsssa-7050pdf There is a 91 fee for this information from Social Security.

The 4506 series is used to request a transcript or copy of past income tax returns. Simply fill out a Request for Social Security Earnings Information form and submit it. Whether you work as a full- or part-time employee your employer has to provide you with a Form W-2 at the end of each tax year.

Find more assistance. Corrections to your records should be discussed with your servicing personnel office. Keep all records of employment taxes for at least four years after filing the 4th quarter for the year.

In this section list the companies you worked for your job titles and the dates of employment. The address is on the form. Past employment dates dating back 10 years are available from the IRS by requesting a copy of your tax return and attached documents.

If youre applying through a solicitor or tax agent youll first need to give them. Other federal employees should have access to the eOPF system from their current employer. Search for IRS Form 4506.

9 Tax Records You Should Keep In Your Business To Avoid Irs Audit 9 Tax Records That Should Always Be At Your Employment Records Business Tax Deductions Irs

9 Tax Records You Should Keep In Your Business To Avoid Irs Audit 9 Tax Records That Should Always Be At Your Employment Records Business Tax Deductions Irs

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Credit Card Hacks Irs Irs Forms

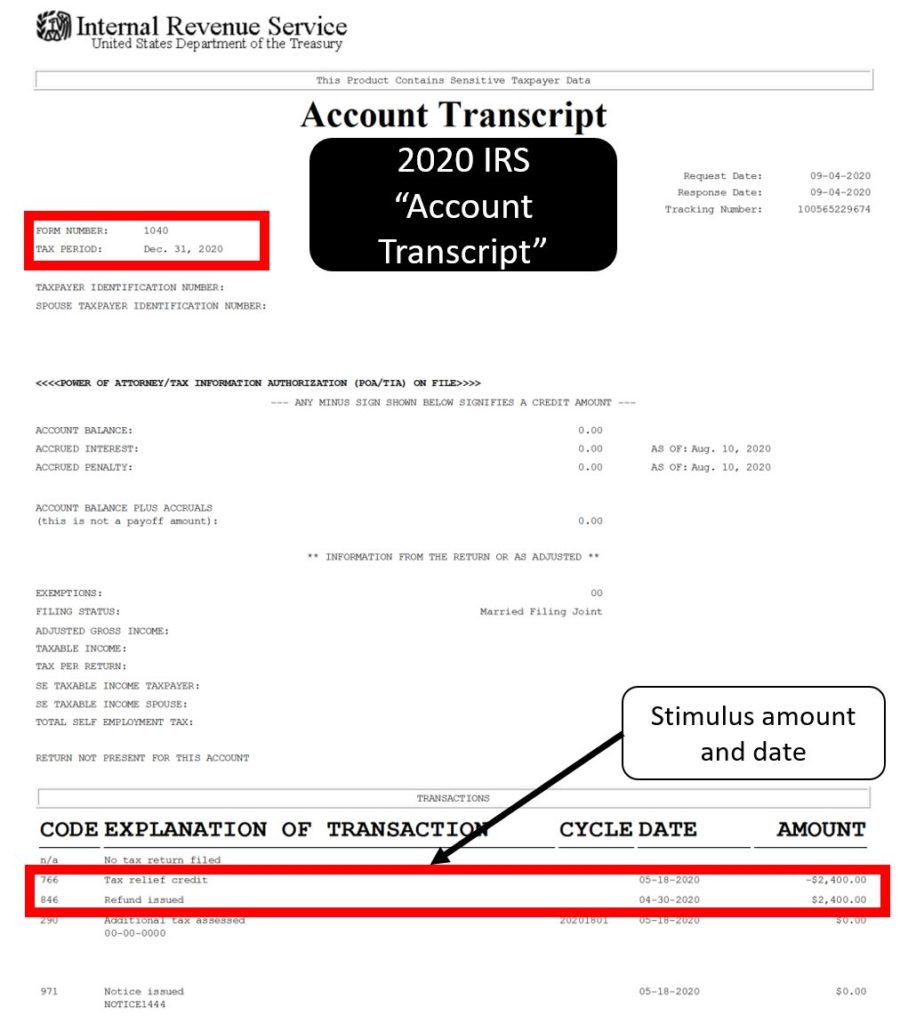

Irs Transcripts Now Provide Stimulus Payment Information Irs Mind

Irs Transcripts Now Provide Stimulus Payment Information Irs Mind

Irs Budget And Workforce Internal Revenue Service

Irs Budget And Workforce Internal Revenue Service

Editable 1099 Form 2016 Beautiful Irs Fillable Tax Forms 2016 Models Form Ideas Tax Forms Employee Tax Forms Tax Refund

Editable 1099 Form 2016 Beautiful Irs Fillable Tax Forms 2016 Models Form Ideas Tax Forms Employee Tax Forms Tax Refund

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

Important Changes For 2019 And 2020 Filing Forms 1099 Misc Irs Forms Irs Efile

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

What Is A Schedule B On Form 941 The Irs Form 941 Schedule B Is A Tax Form For The Reporting Of Tax Liability For S Payroll Taxes Federal Income Tax Payroll

What Is A Schedule B On Form 941 The Irs Form 941 Schedule B Is A Tax Form For The Reporting Of Tax Liability For S Payroll Taxes Federal Income Tax Payroll

Updated Version Of Irs2go Now Available For Download Irs2go Is A Mobile Application That Lets You Interact With The Irs Irs Internal Revenue Service Tax Guide

Updated Version Of Irs2go Now Available For Download Irs2go Is A Mobile Application That Lets You Interact With The Irs Irs Internal Revenue Service Tax Guide

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Accountant Hialeah Turbo Tax Irs Audit Letter Must Read To Under Sta Free Basic Templates Audit Internal Revenue Service

Accountant Hialeah Turbo Tax Irs Audit Letter Must Read To Under Sta Free Basic Templates Audit Internal Revenue Service

W 2g User Interface Certain Gambling Winnings Data Is Entered Onto Windows That Resemble The Actual Forms Imports Winner Irs Federal Income Tax Irs Forms

W 2g User Interface Certain Gambling Winnings Data Is Entered Onto Windows That Resemble The Actual Forms Imports Winner Irs Federal Income Tax Irs Forms

Account Abilitys W 2c User Interface Corrected Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Business Tax Tax Accountant Irs Forms

Account Abilitys W 2c User Interface Corrected Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Business Tax Tax Accountant Irs Forms

How Do I Reach A Real Person At The Irs Amy Northard Cpa The Accountant For Creatives Irs Person Taxes History

How Do I Reach A Real Person At The Irs Amy Northard Cpa The Accountant For Creatives Irs Person Taxes History

Want To Know If Your Meals Are Tax Deductible Use This Chart From The Irs Tax Deductions How To Apply Irs

Want To Know If Your Meals Are Tax Deductible Use This Chart From The Irs Tax Deductions How To Apply Irs

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs Payroll Taxes Payroll Employment

Payroll Tax What If Employer Didn T Pay Withheld Tax To Irs Payroll Taxes Payroll Employment

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Post a Comment for "Employment History Through Irs"