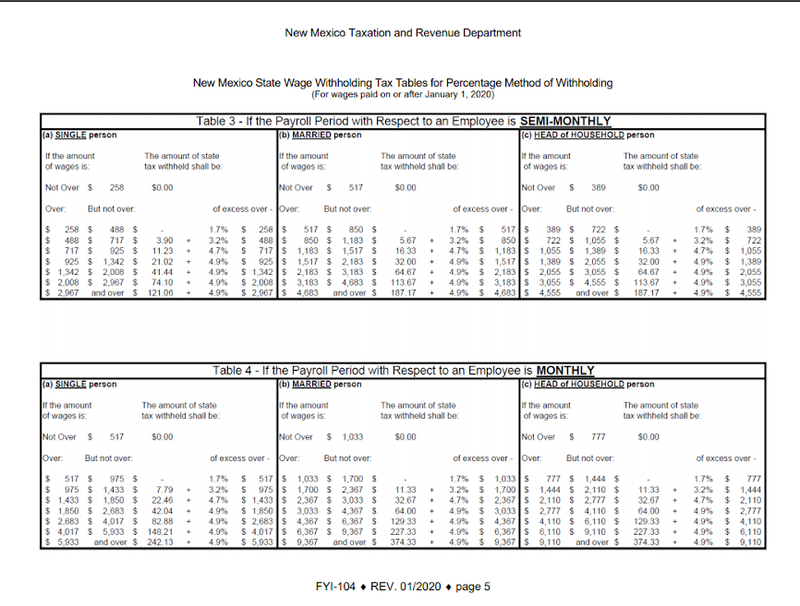

Employment Tax Tables 2020

In 2020 the maximum level of Monthly Gross Wages for an employed person subject to the 62 Social Security tax is 137700 per year or 11475 per month 137700 12 11475. 2021 Oklahoma Income Tax Withholding Tables.

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

2020 tax tables Select the return you file below IT-201 for New York State residents or IT-203 for New York State nonresidents or part-year residents for more information on where to find the tax rates and tables for New York State New York City Yonkers and metropolitan commuter transportation mobility tax MCTMT.

Employment tax tables 2020. Tax Brackets for Self-Employed Individuals in 2020. The total self-employment tax rate is 153 comprising of 124 for Social Security and 29 for Medicare for both 2020 and 2019. 205 on the next 49020 of taxable income on the portion of taxable income over 49020 up to 98040 plus.

Income Tax Withholding Assistant for Employers. Packet OW-2 Revised 12-2019 Oklahoma Income Tax Withholding Tables 2020 Effective Date. The rate consists of two parts.

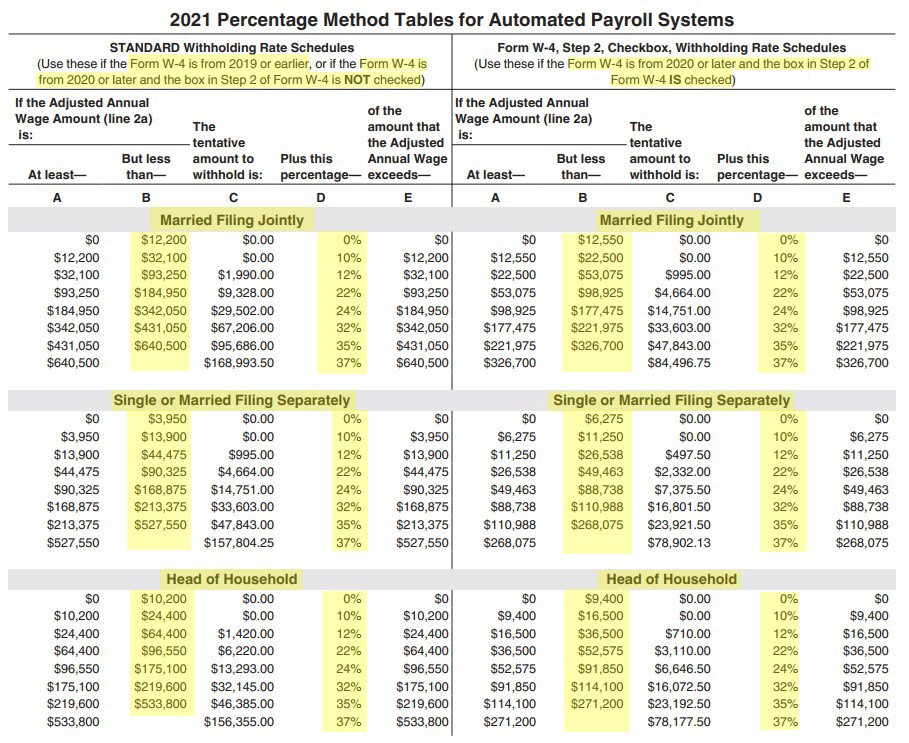

The deferred amount of the employer share of social security tax is only available for deposits due on or after March 27 2020 and before January 1 2021 as well as deposits and payments due after January 1 2021 that are required for wages paid on or after March 27 2020. Instructions for Completing the 511NR Income Tax Form Form 511NR. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages.

The Oklahoma State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Oklahoma State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. 15 on the first 49020 of taxable income plus. For 2020 the first 137700 of earnings was subject to the Social Security portion.

An asterisk beside a county name indicates the rate has changed since the last Departmental Notice 1 was published on Oct. Use the Income Tax Withholding Assistant if you typically use Publication 15-T to determine your employees income tax. Oklahoma Nonresident and Part-Year Resident Income Tax Return Form 2020 Income Tax Table This form is also used to file an amended return.

The self-employment tax rate is 153. See page 4 for information regarding extended due date for electronically filed returns. Both the county of residence and the county of principal business or employment of an individual are.

Federal tax rates for 2021. Tax season is approaching fast so you should get focused on your taxes. 2020 Oklahoma Income Tax Withholding Tables.

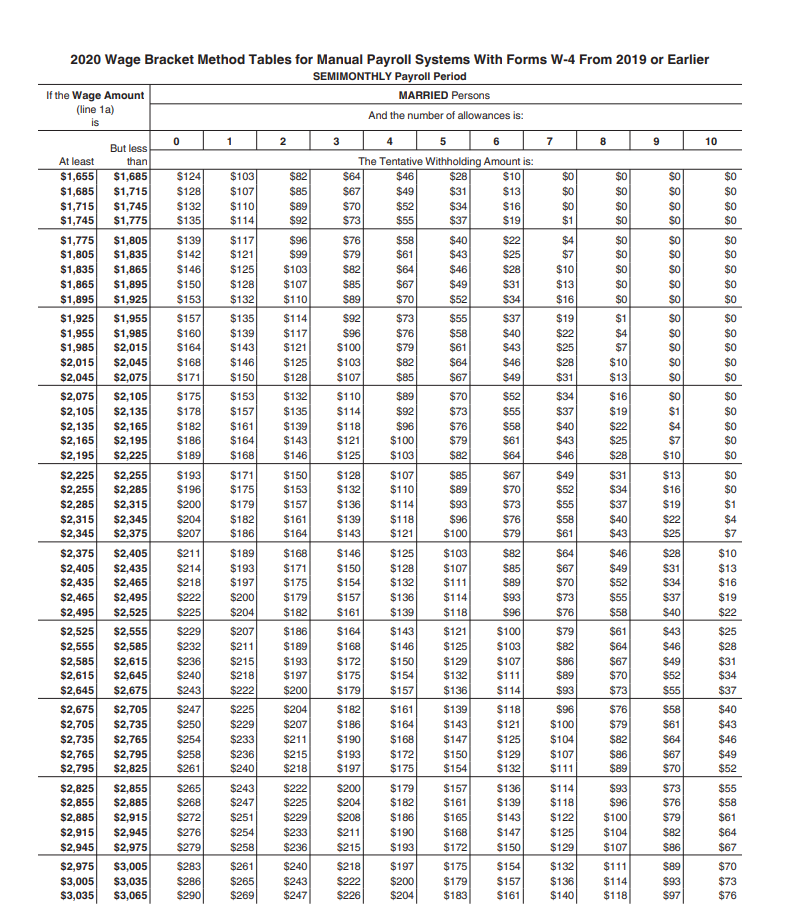

However for the second adjustment of the computational bridge always enter 4300 in step 4a on a 2020 or later Form W-4. 2020 OKLAHOMA RESIDENT INDIVIDUAL INCOME TAX PACKET TABLE OF CONTENTS HELPFUL HINTS File your return by the same due date as your federal income tax return. Jan 4 2020 Tax Tips.

Your taxable income will determine your final year-end tax bill. System Outage for Vehicle Emissions Tests. 2019 Oklahoma Income Tax Withholding Tables.

The Oklahoma Department of Revenue is responsible for publishing the latest Oklahoma State Tax. If you convert a nonresident alien employees 2019 or earlier Form W-4 to a 2020 or later Form W-4 be sure to use Table 2 when adding an amount to their wages for figuring federal income tax withholding. 26 on the next 53939 of taxable income on the portion of taxable income over 98040 up to 151978 plus.

County income tax to withhold from an employees wages by providing the tax rate for each county. For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad. Your adjusted gross income will include income from all sources including from your job self-employed.

Oklahoma Tax Commission Website. What is the self-employment tax rate. Mce-spellchecker-word data-mce-bogus 1 data-mce-word mce-spellchecker-word data-mce-index 0 mce-spellchecker-word mce.

The maximum Social Security Tax in 2020 is 71145based on the maximum OASDI Contribution and Benefit Base amount of 137700 for 2020. But note that social security tax is applied on maximum maxed 137700 for. 2020 Oklahoma Individual Income Tax Forms and Instructions for Nonresidents and Part-Year Residents This packet contains.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. The deferred amount is reported on your 2020 employment tax return. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

To determine taxable income subtract your allowed deductions from your total income. If you need to file for an extension use Form 504-I and then later file a Form 511. January 1 2020 Oklahoma Tax Commission 2501 North Lincoln Boulevard.

29 on the next 64533 of taxable income on the portion of taxable income over 151978 up to 216511 plus. For 2021 the first 142800 of earnings is subject to the Social Security portion. It will help you as you transition to the new Form W-4 for 2020 and 2021.

Governor Mike Dewine Signs 2020 2021 Ohio Budget With Several Significant Tax Changes What To Look For Cohen Company

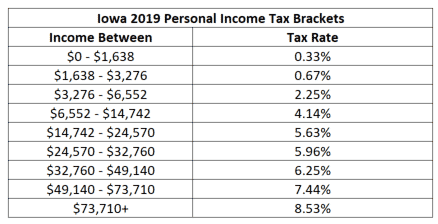

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

Iowans Here Is How The 2019 Tax Law Affects You And Your 2020 And 2021 Iowa Tax Brackets Arnold Mote Wealth Management

395 11 Federal State Withholding Taxes

2021 Tax Brackets How They Actually Work White Coat Investor

2021 Tax Brackets How They Actually Work White Coat Investor

Revised Withholding Tax Table Bureau Of Internal Revenue

Revised Withholding Tax Table Bureau Of Internal Revenue

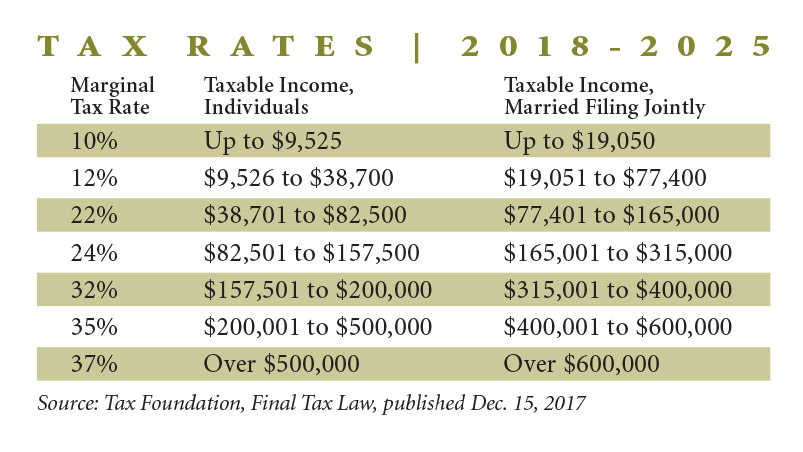

What The New Tax Law Means For Agriculture And Rural Landowners

What The New Tax Law Means For Agriculture And Rural Landowners

Your Guide To 2020 Federal Tax Brackets And Rates Incfile

Your Guide To 2020 Federal Tax Brackets And Rates Incfile

How To Comply With The 2020 W 4 And Withholding Changes

How To Comply With The 2020 W 4 And Withholding Changes

2020 Tax Preview Carlile Patchen Murphy

2020 Tax Preview Carlile Patchen Murphy

Find Your Tax Rate And Tax Bracket Block Advisors

Find Your Tax Rate And Tax Bracket Block Advisors

How To Calculate Payroll Taxes For Your Small Business The Blueprint

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Missouri Income Tax Rate And Brackets H R Block

Missouri Income Tax Rate And Brackets H R Block

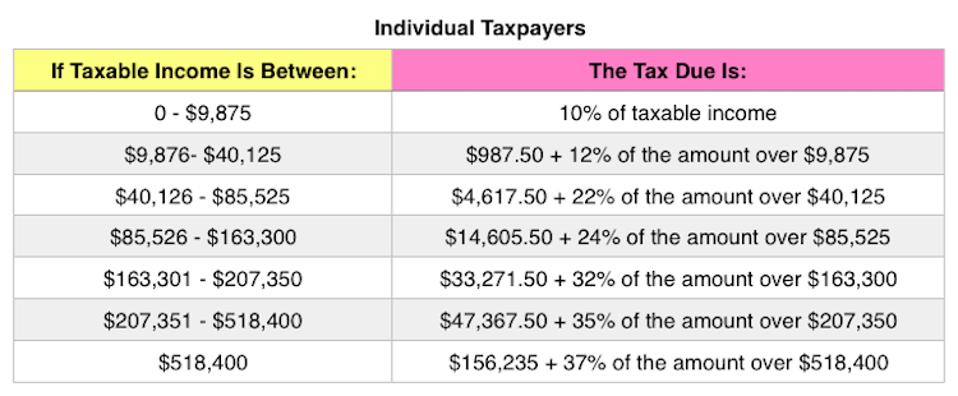

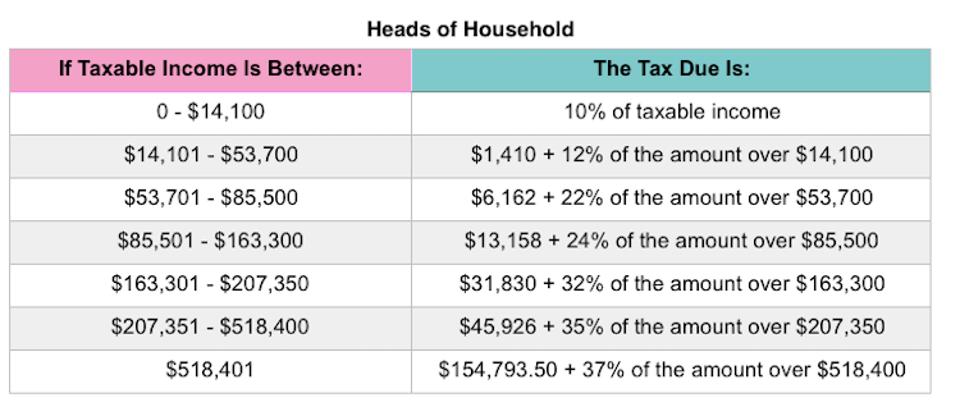

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How To Calculate Payroll Taxes For Your Small Business The Blueprint

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Powerchurch Software Church Management Software For Today S Growing Churches

Powerchurch Software Church Management Software For Today S Growing Churches

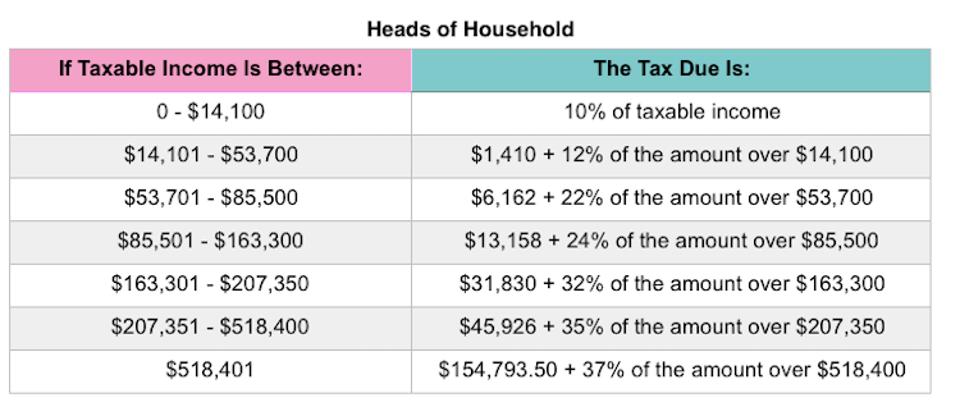

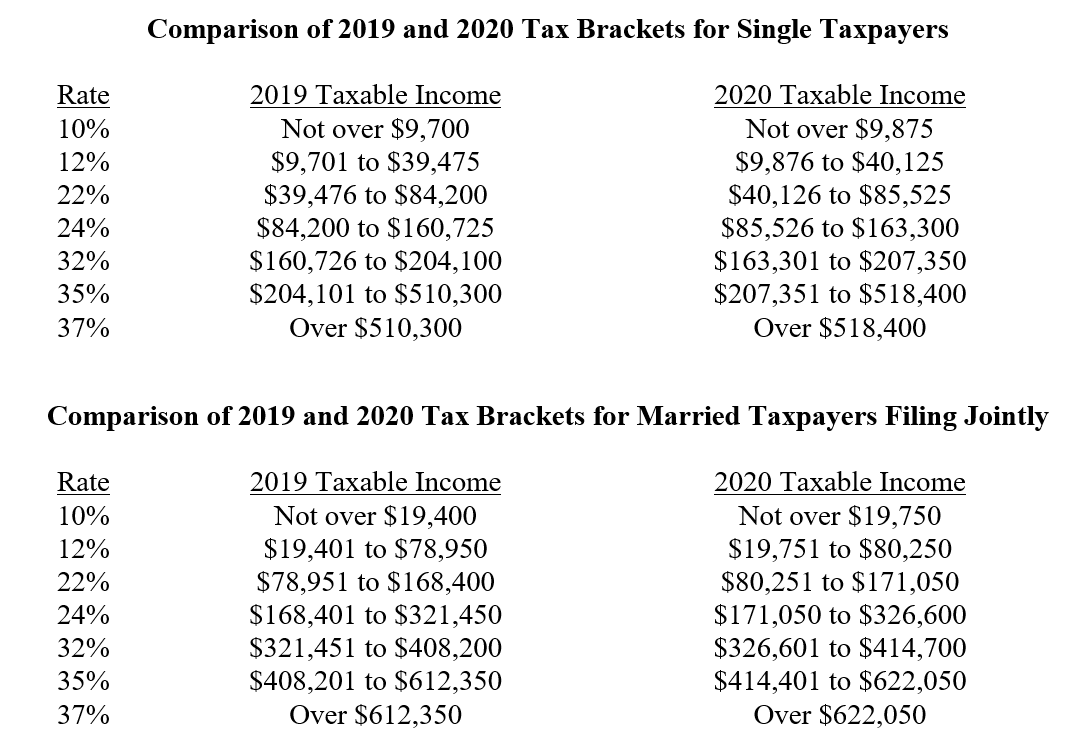

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Tncpa

Post a Comment for "Employment Tax Tables 2020"