How Does The Employer Retention Credit Work

Qualified wages are limited to 10000 per employee per calendar quarter in 2021. This credit is used to offset employment taxes paid by an employer to offer relief due to the coronavirus pandemic.

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Click Claim credit on the tile called Claim the employee retention tax credit Read through the FAQs and eligibility requirements.

How does the employer retention credit work. The Employee Retention Credit is a CARES Act relief measure for businesses. Employee Retention Credit Eligible employers can claim the employee retention credit a refundable tax credit equal to 50 percent of up to 10000 in qualified wages including health plan expenses paid after March 12 2020 and before January 1 2021. Background Congress included the ERC in the CARES Act to encourage businesses to retain employees.

The credit is equal to 50 of qualified wages paid to an employee between March 12 2020 and Jan. Employers can get a maximum reimbursement of 5000 for every employee for all quarters. Generally this allows an employer to get a refundable tax credit for up to 70 of the qualified wages paid to employees during the closure up to a maximum of 10000 wages per employee which.

The credit will reduce your employer Social Security tax liability. The Employee Retention Credit under the CARES Act encourages businesses to keep employees on their payroll. The refundable tax credit is 50 of up to 10000 in wages paid by an eligible employer whose business has been financially impacted by COVID-19.

How Does the Credit Work. Under the CARES Act an eligible employer may be able to offset the impact of COVID-19 with an Employee Retention Credit. Each employees allowable wage amount is.

The Employee Retention Credit is a refundable tax credit for employers that was put into law through the CARES Act. The Employee Retention Credit ERC is a refundable tax credit intended to encourage business owners to keep their employees on the payroll and minimize the number of workers filing for unemployment benefits. The credit allows employers to get a 50 percent credit up to a maximum of 10000 of their member of staffs qualifying wage.

Request an advance payment of the tax credits for qualified sick and qualified family leave wages and the employee retention credit that you will claim on Form 941 Form 941-PR Form 941-SS Form 943 Form 943-PR Form 944 Form 944SP or Form CT-1. When youre ready to move forward click Claim credit. For the purposes of the employee retention credit a full-time employee is defined as one that in any calendar month in 2019 worked at least 30 hours per week or 130 hours in a month this is the monthly equivalent of 30 hours per week and the definition based on the employer shared responsibility provision in the ACA.

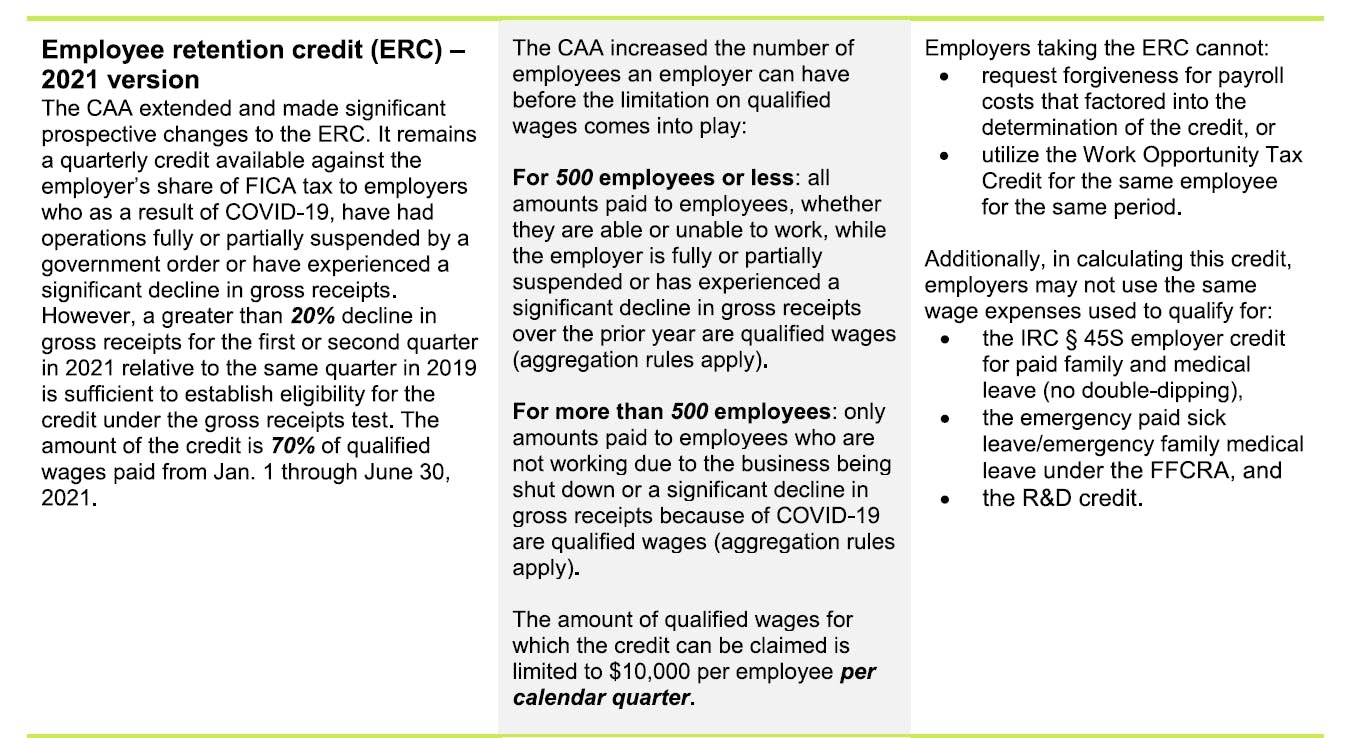

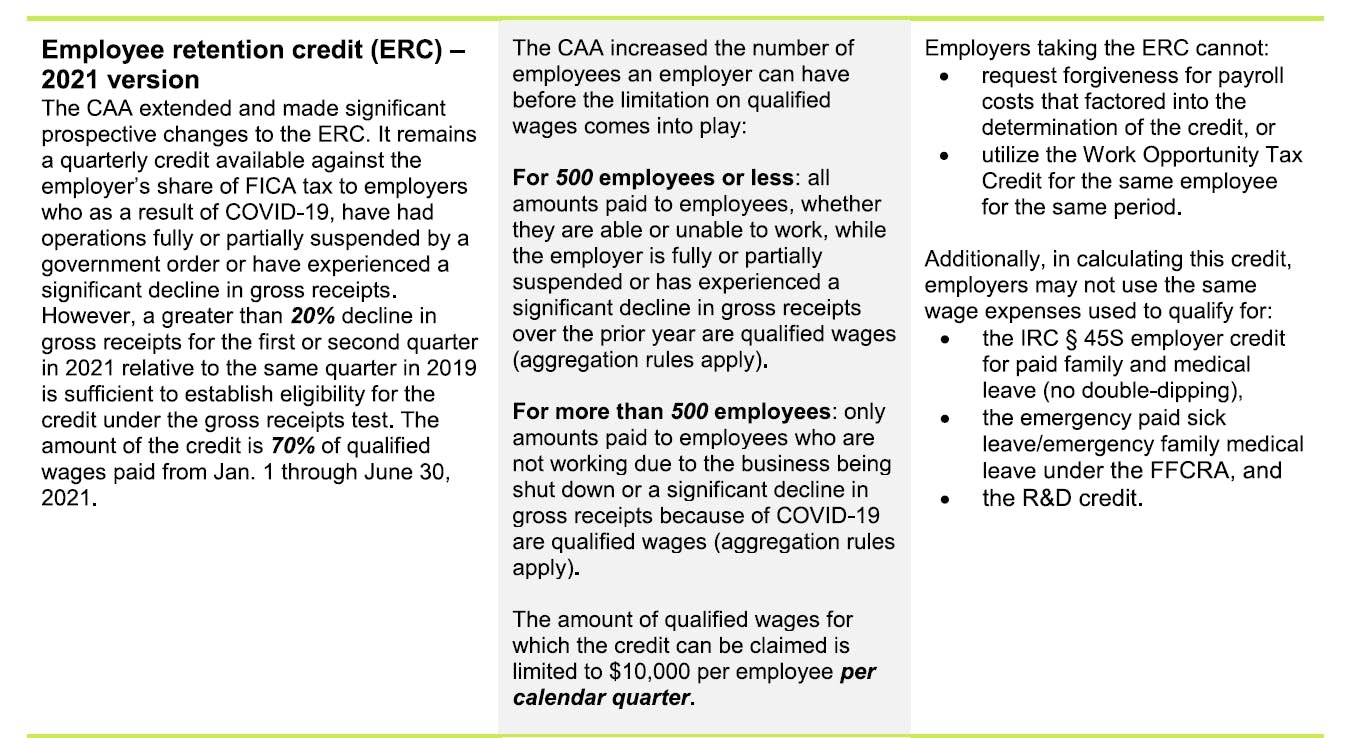

Select the calendar quarter that youd like to claim the ERC and click Claim credit. The Consolidated Appropriations Act CAA or the Act also expanded the Employee Retention Credit in December 2020. The credit applies against the employers 62 share of Social Security tax but it is fully refundable and covers 50 of qualified wages up to 10000 per employee.

The Employee Retention Credit lets employers take a 50 credit up to 10000 of an employees qualifying wage. The Employee Retention Tax Credit ERTC is one of many relief provisions included in the CARES Act to encourage small businessesto keep employees on staff instead of furloughing or laying them off. The Employee Retention Credit is an incentive for employers to keep employees on staff.

The credit will reduce the employers Social Security SS tax liability. As a result of the new legislation eligible employers can now claim a refundable tax credit against the employer share of Social Security tax equal to 70 of the qualified wages they pay to employees after December 31 2020 through June 30 2021. 1 2021 including qualified health plan expenses.

If your credit ends up being more than your Social Security tax liability you will receive a refund. How Does the Employee Retention Credit Work. Whats the Employee Retention Credit under the CARES act.

The tax credit is equal to 50 of qualified wages that eligible employers pay their employees in a calendar quarter. It is a fully refundable tax credit that eligible employers who are able to keep employees on payroll can claim. The credit is 70 of Qualified Wages for the allowed amount per quarter paid between January 1 2021 and before July 1 2021.

The Consolidated Appropriations Act 2021 CAA 2021 broadened the applicability of the employee retention credit ERC bringing eligible employers greater potential for savings and more questionsWhile we wait for the IRS to update its official frequently asked questions there are common questions we can address now with some clarity.

Employee Retention Credit Erc Solutions Baker Tilly

Employee Retention Credit Erc Solutions Baker Tilly

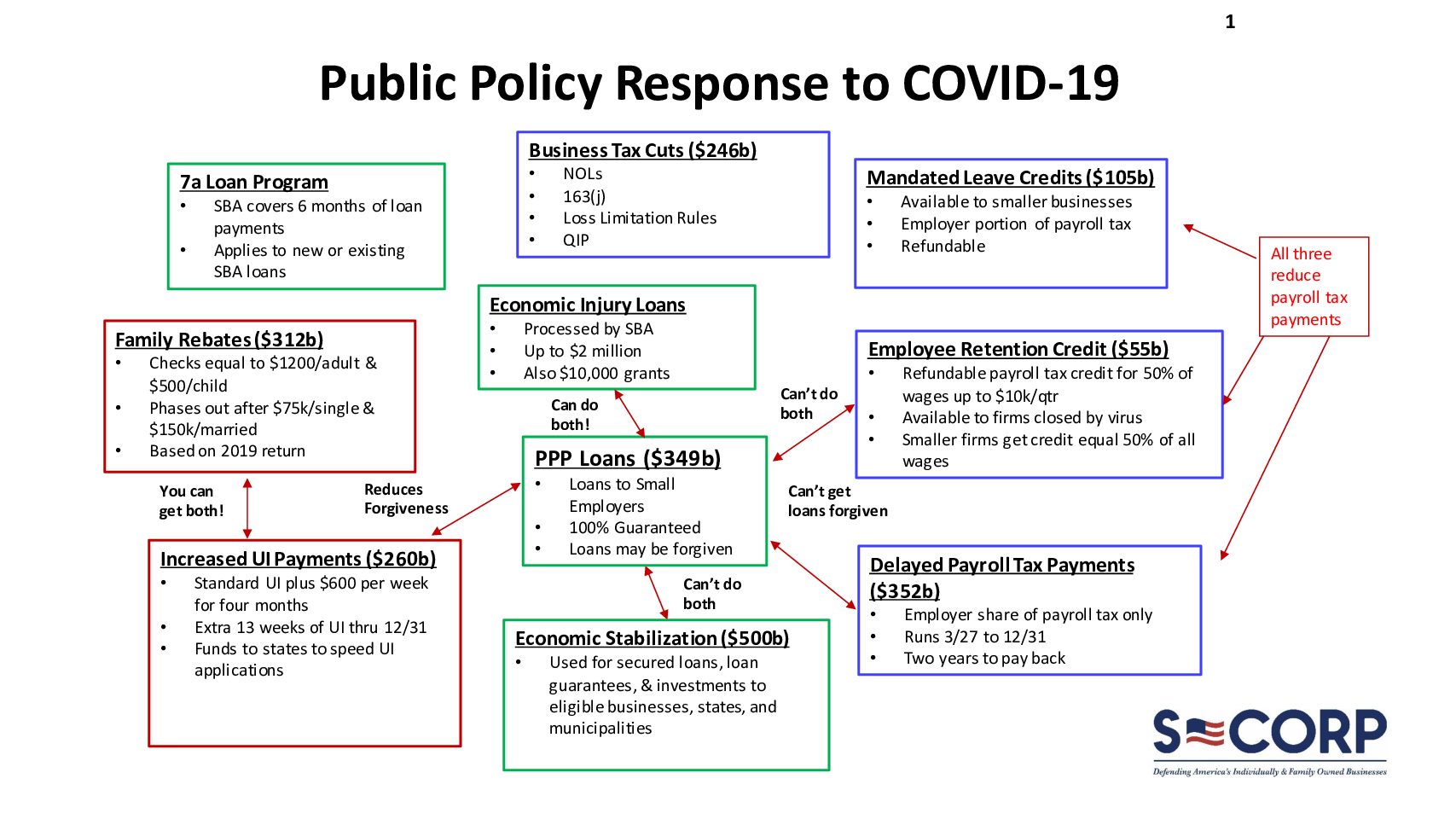

An Employer S Guide To The Cares Act Ppp Erc More

An Employer S Guide To The Cares Act Ppp Erc More

Employee Retention Credit Cos Accounting Tax

Employee Retention Credit Cos Accounting Tax

Us Employee Retention Credit Erc Help Center

Us Employee Retention Credit Erc Help Center

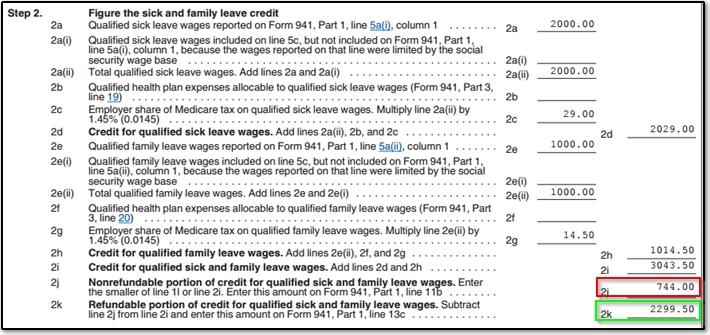

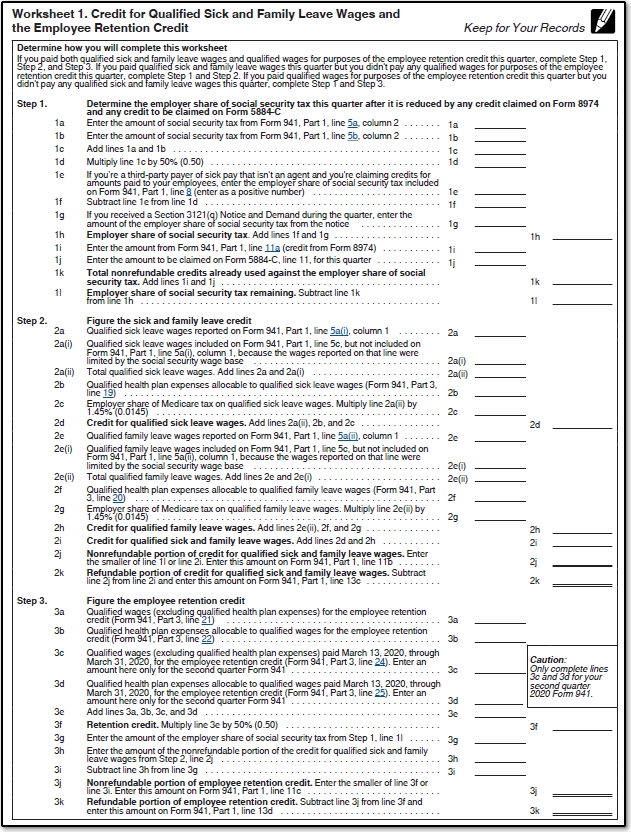

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Payroll Tax Deferral Retention Credit S Corps Molen Associates

Payroll Tax Deferral Retention Credit S Corps Molen Associates

Using Economic Injury Disaster Loans And Payroll Tax Breaks

Using Economic Injury Disaster Loans And Payroll Tax Breaks

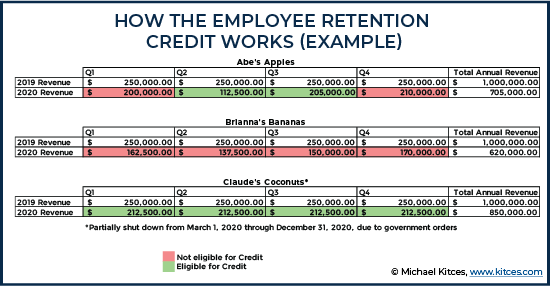

Planning To Maximize Your Employee Retention Credit

Planning To Maximize Your Employee Retention Credit

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Enhancements To The Employee Retention Credit Aprio

Enhancements To The Employee Retention Credit Aprio

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

941 Worksheet 1 Credit For Qualified Sick And Family Leave Wages And The Employee Retention Credit Das

Employee Retention Tax Credit 2020 Made Easy Cares Act Small Business Stimulus Tax Credits Youtube

Employee Retention Tax Credit 2020 Made Easy Cares Act Small Business Stimulus Tax Credits Youtube

The Cares Act Employee Retention Tax Credit Challenges And Opportunities

The Cares Act Employee Retention Tax Credit Challenges And Opportunities

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Https Www Irs Gov Pub Irs Pdf P5420d Pdf

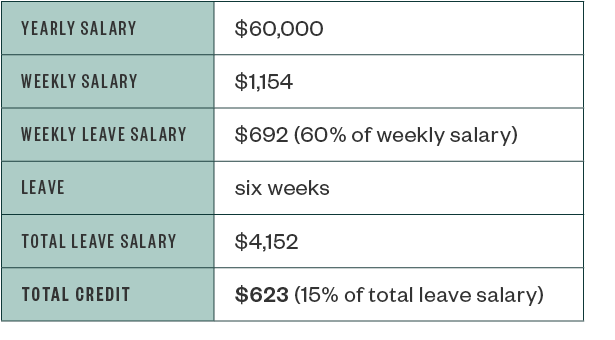

Employer Credit For Family And Medical Leave

Employer Credit For Family And Medical Leave

Post a Comment for "How Does The Employer Retention Credit Work"