How Long Do You Have To Retain Employees For Ppp

If an employer has already let go or furloughed employees at the outset of the coronavirus response hope is not lost. Womply has helped over 200000 businesses get their PPP funding.

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Paycheck Protection Program Round 2 Knowns Unknowns Rkl Llp

Well go over what counts as an employee for your PPP loans and also discuss what you need to do to have your loan forgiven in 2021.

How long do you have to retain employees for ppp. Under PPP2 youre eligible for full loan forgiveness as long as you spend at least 60 of your loan amount on payroll costs. The CARES Act contains a business relief provision known as the employee retention credit. When it comes to calculating your forgivable amount your lender looks at each employees individual compensation.

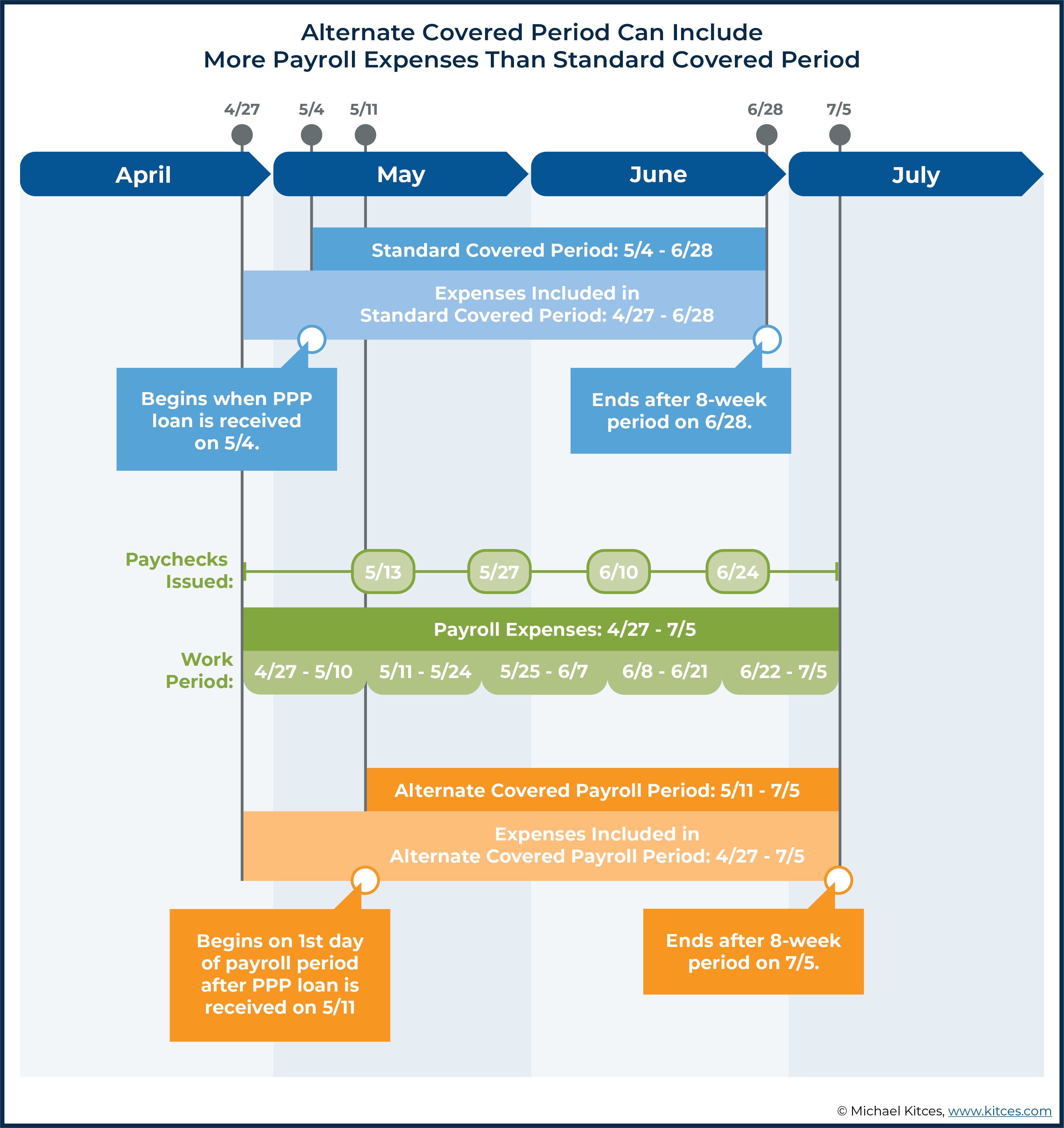

Get your PPP loan or second draw PPP loan through Womply. From the date of origination of the loan your employer has eight weeks to spend the funds if they want the loan to be forgiven by the federal government and. The covered period is a period running from 8 to 24 weeks from the time you receive your loan proceeds.

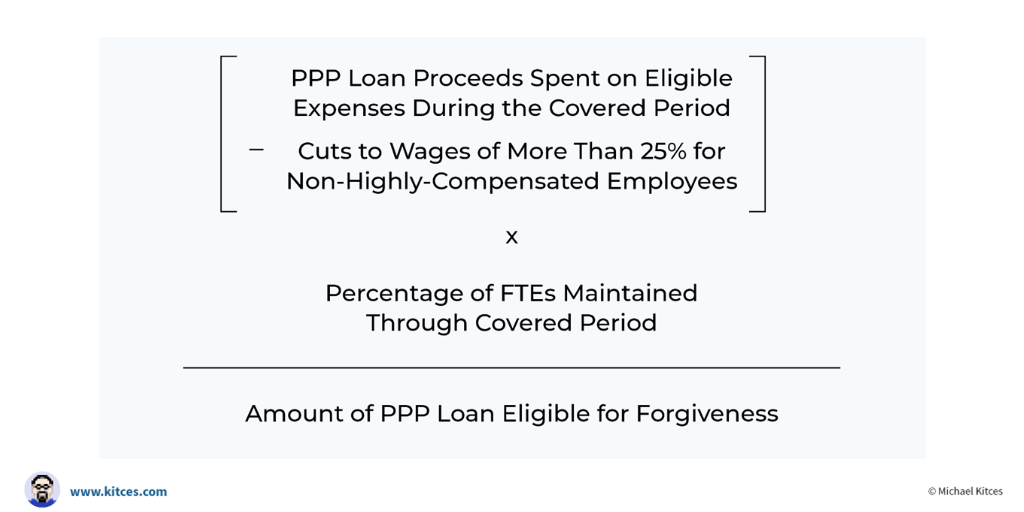

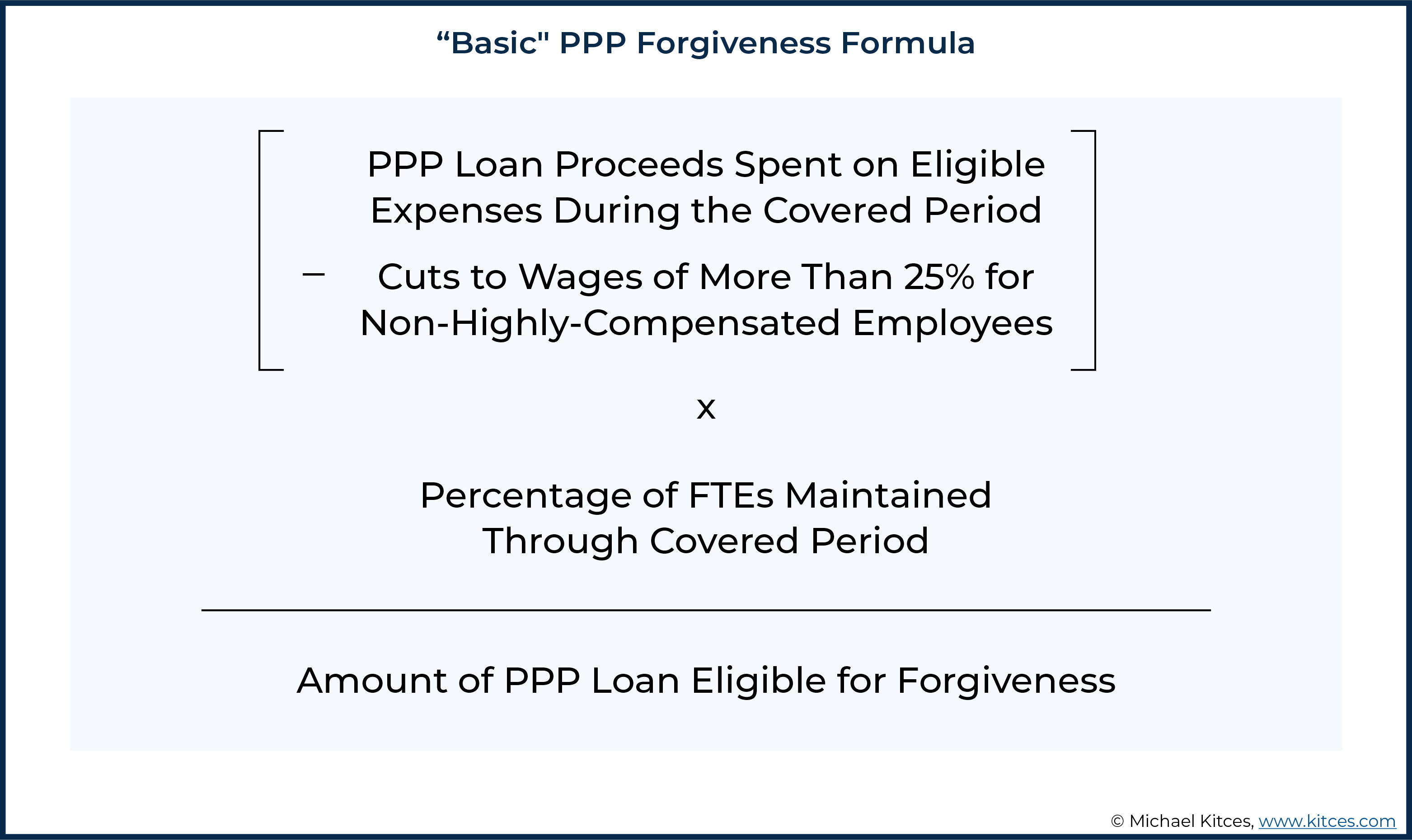

Your forgiveness amount may be reduced based upon reductions in full-time equivalent FTE employees or reductions in employee salaries or wages since the first quarter of 2020. You claim the full 22500 of your PPP loan for forgiveness. This is a refundable payroll tax credit for qualified wages paid to retained employees between March 13 2020 and December 31 2020.

Over the 24 weeks of the PPP coverage period you spend 36000 on your employees more than your PPP loan amount. Please read the details here. The PPP program originally was intended to cover expenses within an eight-week window but the government eventually expanded it to up to 24 weeks of.

A subsequent rule issued by the Small Business Administration SBA the federal agency charged with overseeing PPP clarified that loan recipients dont need to meet the 60 payroll threshold to qualify for partial loan forgiveness as long as they used at least 60 of the forgiven amount for payroll expenses. To date over 250000 employees have been placed through the PPP. Financial circumstances led you to reduce his pay to 3500 per month a 30 decrease.

To be eligible for forgiveness you have to spend the funds over a covered period of your choosing. First Draw PPP loans made to eligible borrowers qualify for full loan forgiveness if during the 8- to 24-week covered period following loan disbursement. However for personal reasons and despite the fact that employee relocation expenses are paid in accordance with the Joint Travel Regulations Volume II some employees are not willing to relocate to other DoD facilities whe re vacancies.

On June 5 2020 President Trump signed into law new updates to PPP loan forgiveness requirements extending the covered period to 24 weeks reducing the minimum loan funding that must be spent on payroll to 60 and easing the requirements for maintaining staffing and compensation levels. Say you were paying an employee 5000 per month when you applied for the PPP loan. Employee and compensation levels are maintained.

The goal of the PPP loan is to maintain employer workforce numbers throughout the eight-week covered period. The program will be open to all eligible entities March 10 through March 31 2021. Between eight and 24 weeks after the loans origination.

Small businesses and non-profits with fewer than 20 employees and sole proprietors can apply for Second Draw PPP loans from February 24 through March 9 2021. The 75 minimum salary is 2250 075 x 3000. More pla cements could have been made.

What is the Employee Retention Credit and how do we get it. Lender Match can help connect you with a lender.

Measuring Full Time Equivalent Employees Vital To Ppp Loan Forgiveness Time Equipment Company

Measuring Full Time Equivalent Employees Vital To Ppp Loan Forgiveness Time Equipment Company

Economic Stimulus Package Signed Into Law Expanding The Cares Act Employee Retention Credit To Ppp Recipients Up To 19 000 Per Employee

Economic Stimulus Package Signed Into Law Expanding The Cares Act Employee Retention Credit To Ppp Recipients Up To 19 000 Per Employee

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

How To Calculate Fte For The Ppp Bench Accounting

How To Calculate Fte For The Ppp Bench Accounting

Straight Outta Congress How To Maximize The Employee Retention Credit Erc Paycheck Protection Program Ppp Wiss Company Llp

Straight Outta Congress How To Maximize The Employee Retention Credit Erc Paycheck Protection Program Ppp Wiss Company Llp

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Paycheck Protection Program Updates The Economic Aid To Hard Hit Small Businesses Nonprofits And Venues Act

Paycheck Protection Program Updates The Economic Aid To Hard Hit Small Businesses Nonprofits And Venues Act

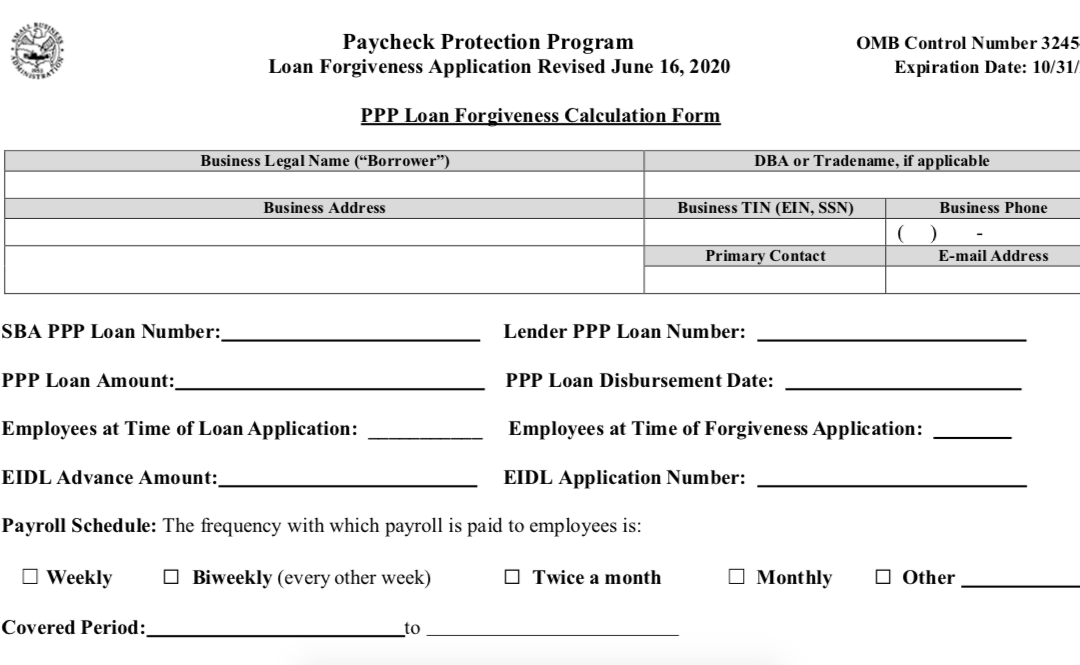

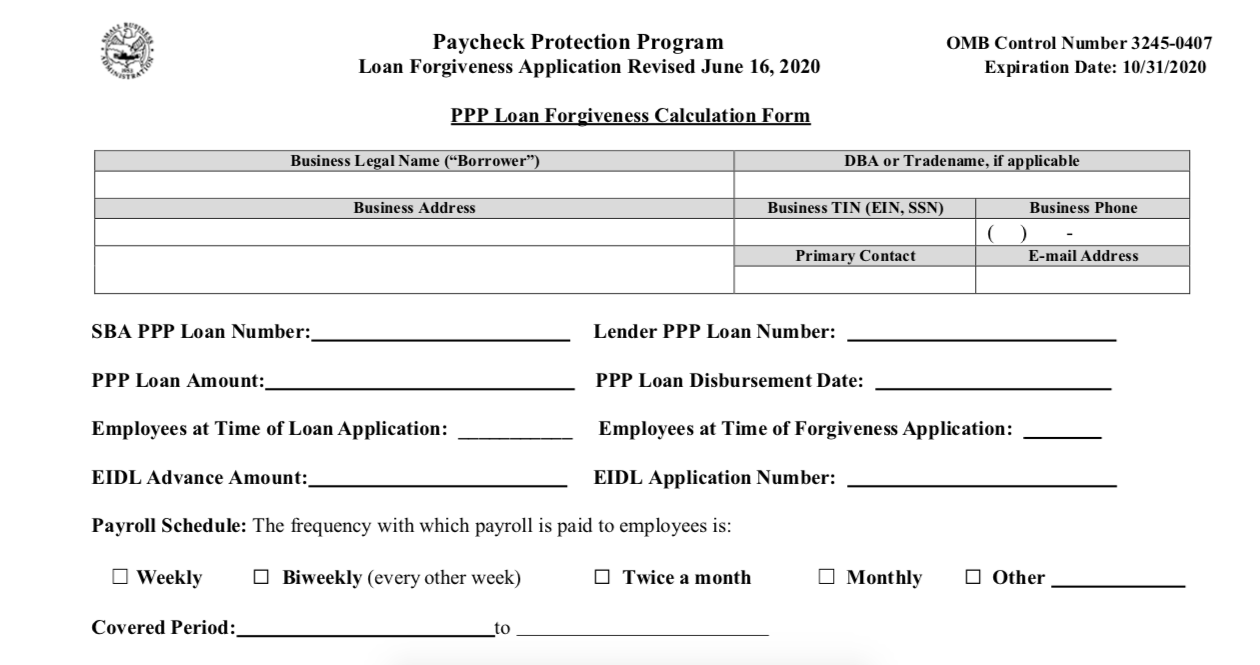

Understanding Ppp Loan Forgiveness Application And Instructions

Understanding Ppp Loan Forgiveness Application And Instructions

Ppp Loan Forgiveness Guidance For Employers

Ppp Loan Forgiveness Guidance For Employers

Ppp Rules On Rehiring Employees Faq Bench Accounting

Ppp Rules On Rehiring Employees Faq Bench Accounting

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Maximize Paycheck Protection Program Ppp Loan Forgiveness

Post a Comment for "How Long Do You Have To Retain Employees For Ppp"