How To Claim Work Expenses On Turbotax

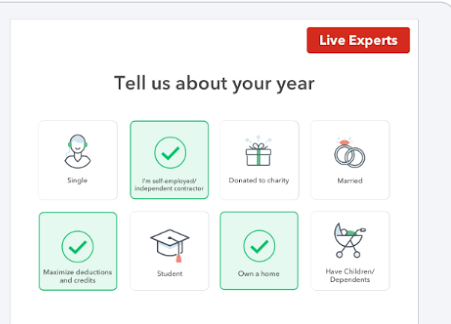

At the Tell us about the occupation you have expenses for screen enter your occupation then select Continue. You would enter your unreimbursed employment expenses under Federal TaxesDeductions and Credits Ill choose what I work on or jump to full list or see all tax breaks scroll down to Employment Expenses Job-related expenses startupdate.

You then take 2 percent of your adjusted gross income and subtract it from the total.

How to claim work expenses on turbotax. Which work clothes are necessary and usable only for work. Why sign in to the Community. Terms and conditions may vary and are subject to change without notice.

To deduct workplace expenses your total itemized deductions must exceed the standard deduction. To claim employment expenses choose the scenario that best describes you below then follow the instructions included in that section. Expenses that qualify for this deduction are those the IRS considers ordinary and necessary for work like uniforms tools union dues licenses and travel between job sites.

To give you an idea if you have an AGI of 40000 your expenses need to be more than 800 before you could begin claiming any deductions. Sign in to the Community or Sign in to TurboTax and start working on your taxes. 400 His total utilities expenses 1200 800 200 2200 His office space expenses 2200 24 5280.

If youre a teacher keep in mind that although you cant deduct work-from-home expenses like the home office deduction you can take the Teachers Educator Deduction worth up to 250 for supplies you buy directly related to teaching. Basically the higher your adjusted gross income is the lower your deduction for employment related expenses will be. Job-related expenses for employees are no longer deductible on most peoples federal return in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA that Congress signed into law on December 22 2017.

Only the items listed on the form may be claimed and its up to you the employee to keep track of your employment expenses for tax time. Open continue your return in TurboTax if its not already open. The result is the amount that you can add to other itemized deductions on Schedule A.

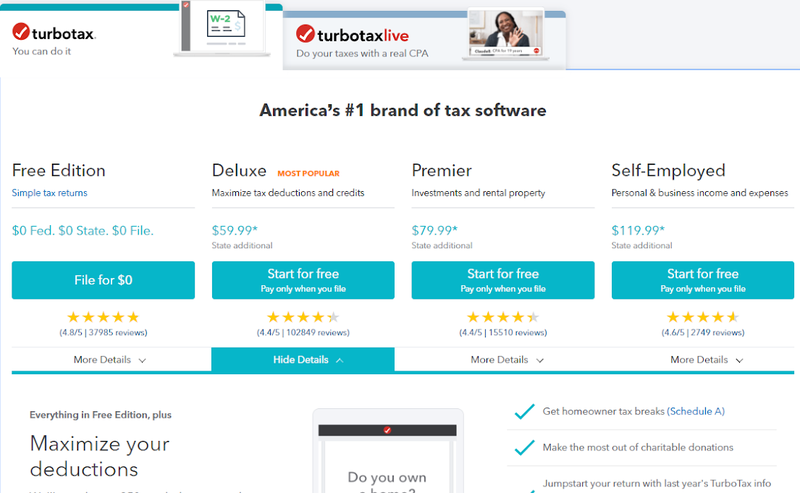

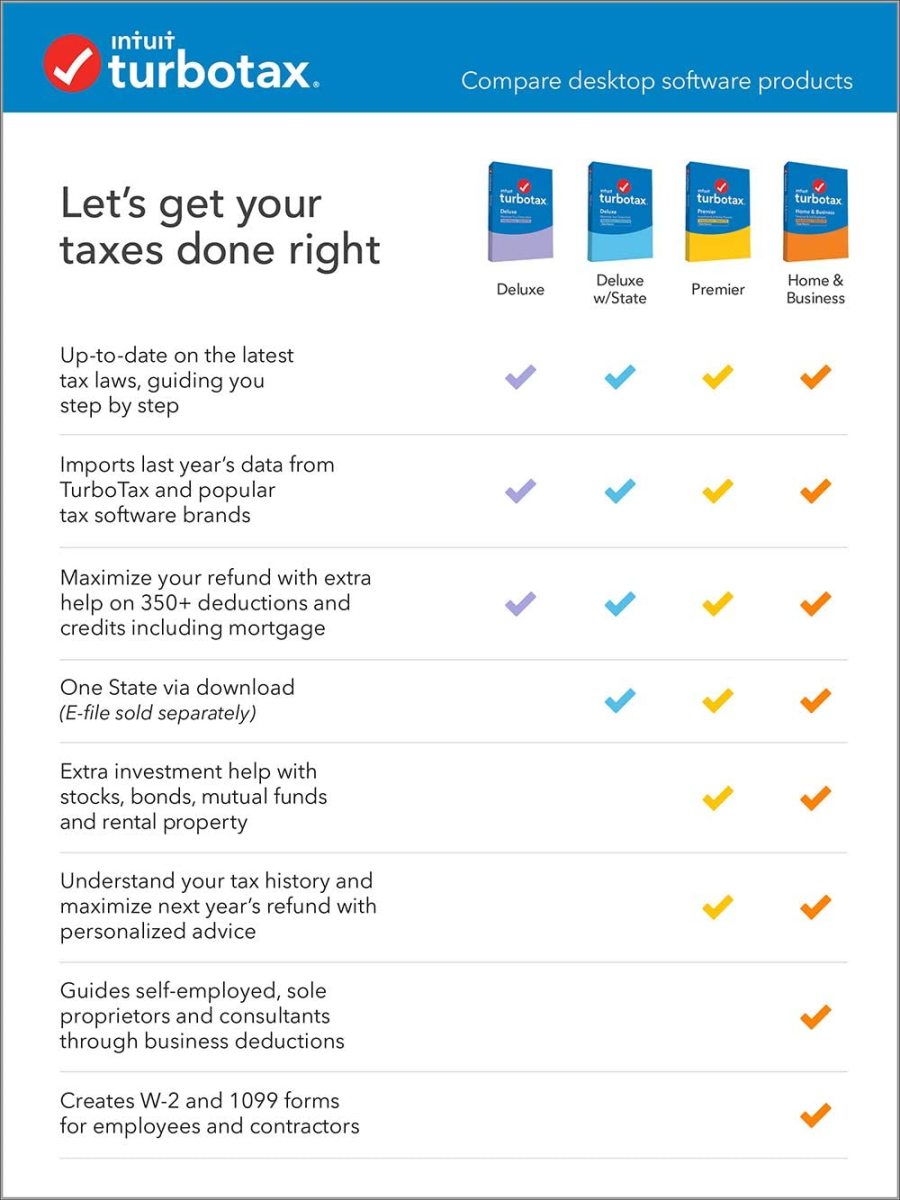

TurboTax packages vary in support of specific tax return features. How to Use Work Clothes as a Tax Deduction. To claim other employment expenses you the employee must have a Form T2200 Declaration of Conditions of Employment completed and signed by your employer.

Select the Federal Taxes tab Select Deductions and Credits If the personal experience question populates select Skip This Next select Ill choose what to work on if the option appears. Enter your expenses and well figure out if you can deduct them. Additionally job-related expenses may be deductible in your state.

Included with all TurboTax Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service or prior year PLUS benefits customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312022. Enter on line 229 the allowable amount of your employment expenses from the total expenses line of Form T777. Paper and ink cartridge.

Enter the lower amount of line 24 or 25 of Form T777 at line 9945. If youre self-employed or own a business enter your business-related expenses on Schedule C instead. In addition to be able to claim these deductions you must itemize on Schedule A and your unreimbursed business expenses must total more than 2 percent of your adjusted gross income AGI.

Software that has been certified by the Canada Revenue Agency and includes support for forms T2200 or T2125 can handle the calculations needed to claim work-at-home expenses for employees and the self-employed respectively. Completing Your Tax Return Complete the Calculation of work-space-in-the-home expenses portion of Form T777 Statement of Employment Expenses. If you are a salaried or commissioned employee If you are self-employed and are using TurboTax Self-Employed Online If you are self-employed and using the Free Standard or Premier versions of TurboTax Online.

Your Employment Status and At-Home Expenses. In TurboTax search for 2106 and then select the Jump to link in the search results. If you and your spouse are both teachers that can be up to a 500 tax deduction.

How can I claim the home expenses. Document your employers policies. You must also meet whats called the 2 floor That is the total of the expenses you deduct must be greater than 2 of your adjusted gross income and you.

Use the TurboTax guide to help you enter these expense.

Turbotax Lyft Reporting Your Rideshare Driver Income On Your Taxes Webinar Youtube

Turbotax Lyft Reporting Your Rideshare Driver Income On Your Taxes Webinar Youtube

Turbotax 2014 Free Download Pc River Turbotax Windows Software Software

Turbotax 2014 Free Download Pc River Turbotax Windows Software Software

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

101 Tax Write Offs For Business What To Claim On Taxes Business Tax Deductions Small Business Tax Deductions Business Tax

Find W 2 Form Online Turbotax And H R Block Are Web Based Tax Preparation Sites Which Have A Search And Import Functi Tax Preparation Termite Problem Diy Taxes

Find W 2 Form Online Turbotax And H R Block Are Web Based Tax Preparation Sites Which Have A Search And Import Functi Tax Preparation Termite Problem Diy Taxes

Turbotax Online Tax Software Review 2021

Turbotax Online Tax Software Review 2021

Taking Business Tax Deductions Turbotax Tax Tips Videos

Taking Business Tax Deductions Turbotax Tax Tips Videos

Turbotax Vs H R Block Which Tax Software Is Best For Filing Your Taxes Online Pcmag

Turbotax Vs H R Block Which Tax Software Is Best For Filing Your Taxes Online Pcmag

Deductions Show Me The Money Accounting Humor Deduction

Deductions Show Me The Money Accounting Humor Deduction

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Review 2021 The Easiest Tax Software To Use

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Amp Videos 1099 Tax Form Quarterly Taxes Tax Forms

Myths About Quarterly Taxes For The 1099 Tax Form Turbotax Tax Tips Amp Videos 1099 Tax Form Quarterly Taxes Tax Forms

Turbotax Review 2020 By A Cpa Pros Cons Where H R Block Online Is Better Turbotax Financial Advice Tax Help

Turbotax Review 2020 By A Cpa Pros Cons Where H R Block Online Is Better Turbotax Financial Advice Tax Help

Five Ways You Re Asking For An Irs Audit This Tax Season The Simple Dollar How Far Back Can The Irs Audit You Http Tax Guide Turbotax Tax Season

Five Ways You Re Asking For An Irs Audit This Tax Season The Simple Dollar How Far Back Can The Irs Audit You Http Tax Guide Turbotax Tax Season

Which Version Of Turbotax Do I Need Toughnickel

Which Version Of Turbotax Do I Need Toughnickel

Should I Use Irs Form 2106 Or 2106 Ez For Non Reimbursed Work Related Expenses Turbotax Tax Tips Videos Irs Forms Irs Form

Should I Use Irs Form 2106 Or 2106 Ez For Non Reimbursed Work Related Expenses Turbotax Tax Tips Videos Irs Forms Irs Form

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

Turbotax Self Employed Review 2021 Features Pricing The Blueprint

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Post a Comment for "How To Claim Work Expenses On Turbotax"