Kansas Employment Tax Rates

06 All employers in Kansas regardless of their experience rate are allowed the 54 percent credit. 60 less Employer Credit.

- 54 Net FUTA Tax.

Kansas employment tax rates. There are no local income taxes on wages in the state though if you have income from other sources like interest or dividends you might incur taxes at the local level. Dedicated operators will be available to assist employers during the hours of 8 am. Kansas taxes unemployment benefits.

State Income Tax Range. Do I have to file or pay unemployment taxes to Kansas. Personal Data forms and employment applications are also available at the nearest job service center.

Since these taxes are only collected at the Federal level Kansas does not have a separate self-employment tax in addition to the state income tax. Kansas residents and nonresidents of Kansas earning income from Kansas sources are required to annually file an income tax return K-40. Kansas income tax conforms to many provisions of the Internal Revenue Service.

Today the Kansas Department of Labor KDOL announced that the agency launched an Employer Help Desk to assist businesses with a variety of labor-related issues. All applicants will be subject to tax clearance approval prior to consideration for any vacancies at the Kansas Department of Revenue. Tax rate of 31 on the first 15000 of taxable income.

All Other Sectors 11 to 81 270 Except Sector 23. All employing units doing business in Kansas are subject to the provisions of the Employment Security law. 930 plus 525 of excess over.

An employer must withhold Kansas tax if the employee is a resident of Kansas performing services inside or outside of Kansas or a nonresident of Kansas performing services in Kansas. Tax rate of 525 on taxable income between 15001 and 30000. However not all are subject to the taxing provisions of the law.

There are three tax brackets in the Sunflower State with your state income tax rate depending on your income level. For single taxpayers living and working in the state of Kansas. Tax rate of 57 on taxable income over 30000.

CST Monday through Friday. New York and Minnesota have top rates of 882 and 985 respectively. The self-employment tax on the Federal return is to be able to pay Social Security and Medicare taxes since these taxes are not withheld from self-employment earnings.

Kansas unemployment tax rates are to be unchanged in 2020 a spokeswoman for the state Labor Department said Oct. Some states have higher rates though. Do I have to file or pay unemployment taxes to Kansas.

Income tax rates in Kansas are 310 525 and 570. Form 940 Employers Annual Federal Unemployment Tax Return must be filed with the. For 2020 as in 2019 a solvency adjustment is in effect that reduces tax rates by 05 the spokeswoman told Bloomberg Tax in an email.

The employer remits the withholding to the state and will issue the employee a W-2 statement indicating the amount of state Income Tax withheld for that employee. The form will include the account number and tax rate how to reach the employers field representative and other information. Hawaii for example has a top tax rate of 11.

Rate Rated Governmental. All employing units doing business in Kansas are subject to the provisions of the Employment Security law. 31 on taxable income from 2501 to 15000 for single filers and from 5001 to 30000.

State Taxes on Unemployment Benefits. For the tax years 2016 and higher the range will be 56 percent to 76 percent plus any solvency adjustment which may apply for that year. You will need to complete your federal income tax return prior to completing your Kansas.

However a lower marginal tax rate. Tax year 2018 and all tax years thereafter taxable income not over 30000. 118 Min North American Industry Classification System.

Recaptured Employers A recaptured employer is an employer subject to the Kansas Employment Security Act that resumes paying wages after not paying wages for a period of at least one year. 79-32110 taxable income over 30000 but not over 60000. July 1 2018 - June 30 2019 Benefit Year.

We Take The Headaches Out Of The Lending Process Callustoday Best Loans Above And Beyond Lending

We Take The Headaches Out Of The Lending Process Callustoday Best Loans Above And Beyond Lending

The Best Places To Be A Liberal Or Conservative Smartasset Safe Cities Retirement Locations Best Cities

The Best Places To Be A Liberal Or Conservative Smartasset Safe Cities Retirement Locations Best Cities

.jpg?sfvrsn=8ccc851f_0) Employer Tax Rates Employers Kdol

Employer Tax Rates Employers Kdol

Characteristics Of Minimum Wage Workers 2016 Bls Reports U S Bureau Of Labor Statistics Minimum Wage Wage Report

Characteristics Of Minimum Wage Workers 2016 Bls Reports U S Bureau Of Labor Statistics Minimum Wage Wage Report

Military Retirees Retirement Military Retirement Military

Military Retirees Retirement Military Retirement Military

Jobs Grow Still Too Slow But Much Better Than Under Bush S Policies Job Infographic American Economy

Jobs Grow Still Too Slow But Much Better Than Under Bush S Policies Job Infographic American Economy

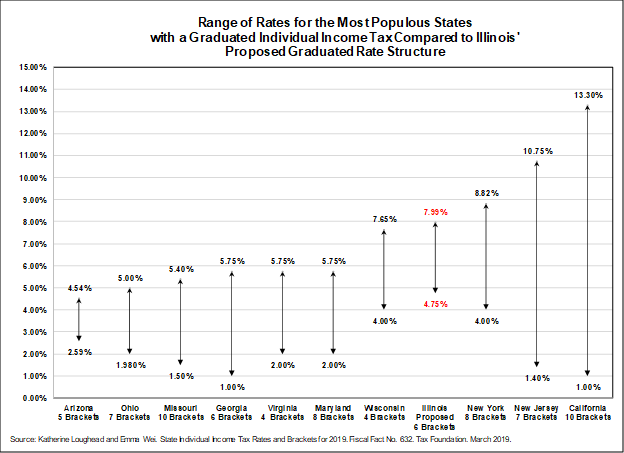

Individual Income Tax Structures In Selected States The Civic Federation

Individual Income Tax Structures In Selected States The Civic Federation

Where The Jobs For The Young Are And Aren T Retirement Locations Retirement Income Tax

Where The Jobs For The Young Are And Aren T Retirement Locations Retirement Income Tax

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Retirement Locations Map

Individual Income Tax Structures In Selected States The Civic Federation

Individual Income Tax Structures In Selected States The Civic Federation

Rising Cost Of Essential Services Putting The Squeeze On Homes Goods And Services Mortgage Interest Rates Public Transport

Rising Cost Of Essential Services Putting The Squeeze On Homes Goods And Services Mortgage Interest Rates Public Transport

State Of Kansas Income Tax Payroll

State Of Kansas Income Tax Payroll

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

These Are The States With The Lowest Costs Of Living Cost Of Living Retirement Locations Financial Literacy Lessons

The Two Americas Of 2016 Middle School Geography International Falls Geography

The Two Americas Of 2016 Middle School Geography International Falls Geography

Individual Income Tax Structures In Selected States The Civic Federation

Individual Income Tax Structures In Selected States The Civic Federation

But A Raise In The Minimumwage That S A Bad Thing Poverty Advocacy Injustice

But A Raise In The Minimumwage That S A Bad Thing Poverty Advocacy Injustice

Post a Comment for "Kansas Employment Tax Rates"