Employee Retention Credit 2017

The credit of up to 2400 per eligible employee will assist employers retain essential staff during the recovery period. Section 503 of the Act provides an employee retention tax credit for qualified wages paid by eligible employers with interrupted business operations due to Hurricanes Harvey Irma and Maria.

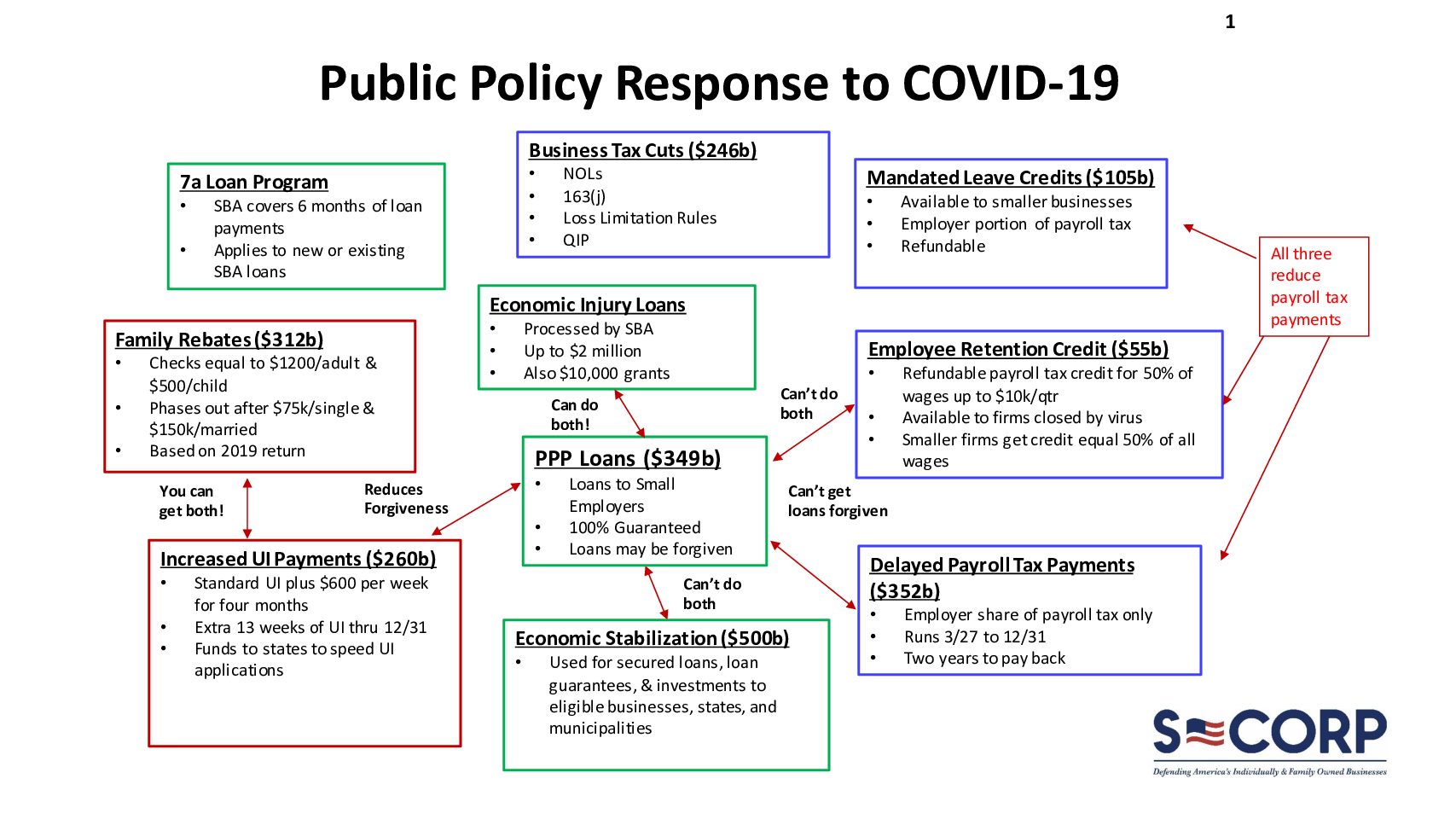

Payroll Tax Deferral Retention Credit S Corps Molen Associates

Payroll Tax Deferral Retention Credit S Corps Molen Associates

Your credit for this employee for Q1 and Q2 exceeds the amount you pay in Social Security taxes.

Employee retention credit 2017. A question has arisen amongst advisors on how to appropriately count employees when determining whether an employer is considered a large or small employer for the Employee Retention Credit. March 2021 Department of the Treasury Internal Revenue Service. The legislation provides a credit equal to 50 percent of the qualified wages paid by a qualified employer to an employee.

The credit is determined based on the amount of employment taxes paid by an employer on qualified wages paid for the calendar quarter. Employee Retention Credit for Employers Affected by Qualified Disasters. The 50 Percent Section 2301 Employee Retention Credit - Evergreen Small Business.

CARES Act and the Tax Cuts and Jobs Act of 2017. WASHINGTON The Internal Revenue Service today issued guidance for employers claiming the employee retention credit under the Coronavirus Aid Relief and Economic Security Act CARES Act as modified by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 Relief Act for calendar quarters in 2020. These FAQs do not reflect the changes made by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 Relief Act enacted December 27 2020 or the American Rescue Plan Act of 2021 ARP Act.

The credit covers 10000 of qualified wages per employee per quarter at a maximum payroll tax credit of 7000 per quarter starting January 1 2021. Notably the employee retention credit ERC provides immediate cash-flow relief to eligible employers that have been impacted by the COVID-19 pandemic. With the Employee Retention Credit your payroll costs drop to 553440.

For the purposes of the employee retention credit a full-time employee is defined as one that in any calendar month in 2019 worked at least 30 hours per week or 130 hours in a month this is the monthly equivalent of 30 hours per week and the definition based on the employer shared responsibility provision in the ACA. This Page is Not Current. The maximum amount of wages eligible to be considered for the credit is 10000 per employee.

In my free time. CARES Act and the Tax Cuts and Jobs Act of 2017. Please see Notice 2021-20 PDF for guidance on the Employee Retention Credit as it applies to qualified wages paid after March 12 2020 and before January 1 2021.

The Section 2301 employee retention credit provides a big cash infusion for some small businesses struggling to make it through the COVID-19 crisis. MORE FROM FORBES Breaking Down Changes To The Employee Retention Tax Credit In The New Covid Relief Bill Part 1 By Tony Nitti. Qualifying businesses are allowed a refundable tax credit against employment taxes equal to 50 of qualified wages not to exceed 10000 in wages per employee.

The employer may claim the HDZ Employee Retention Credit for wages paid during the period beginning on November 1 2017 and ending on December 31 2017. President Trump on September 29 2017 signed into law the Disaster Tax Relief and Airport and Airway Extension Act of 2017 Act. 1061 available at IRSgovirb2017-14_IRBRP-2017-28 provides guidance to employers on the requirements for employee consents used by an employer to support a claim for refund of overcollected social security tax and Medicare tax.

Such cash-flow relief comes in the form of a refundable employment tax credit up to 5000 per impacted employee for 2020 and up to 28000 per impacted employee for 2021. The revenue procedure clarifies the basic requirements for both a request for employee consent and for the employee consent and. IR-2021-48 March 1 2021.

Like the PPP loan program the Employee Retention Credit ERC is aimed at encouraging eligible employers to continue to pay employees during these difficult times. An eligible employer will adequately substantiate eligibility for the employee retention credit if the employer creates and.

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Ppp Loan And Employee Retention Credit Your Top 5 Questions Answered Accountalent

Ppp Loan And Employee Retention Credit Your Top 5 Questions Answered Accountalent

Https Www Irs Gov Pub Irs Pdf I943sr Pdf

Using Economic Injury Disaster Loans And Payroll Tax Breaks

Using Economic Injury Disaster Loans And Payroll Tax Breaks

A Guide To The Employee Retention Tax Credit Cerini Associates Llp Blogs

A Guide To The Employee Retention Tax Credit Cerini Associates Llp Blogs

Irs Provides Guidance For Employers Claiming The Employee Retention Credit For 2020 Tax Pro Center Intuit

Irs Provides Guidance For Employers Claiming The Employee Retention Credit For 2020 Tax Pro Center Intuit

A Guide To The Employee Retention Tax Credit Cerini Associates Llp Blogs

A Guide To The Employee Retention Tax Credit Cerini Associates Llp Blogs

Strategies To Maximize Ppp2 And Employee Retention Credit Accountalent

Strategies To Maximize Ppp2 And Employee Retention Credit Accountalent

Tax Insights Timely Industry News Thought Leadership Kbkg

Tax Insights Timely Industry News Thought Leadership Kbkg

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Irs Defines Nominal For Purposes Of The Employee Retention Tax Credit The Definition Might Surprise Essential Businesses

Irs Defines Nominal For Purposes Of The Employee Retention Tax Credit The Definition Might Surprise Essential Businesses

Payroll Tax Deferral Retention Credit S Corps Molen Associates

Payroll Tax Deferral Retention Credit S Corps Molen Associates

Disaster Tax Credit For Businesses

Disaster Tax Credit For Businesses

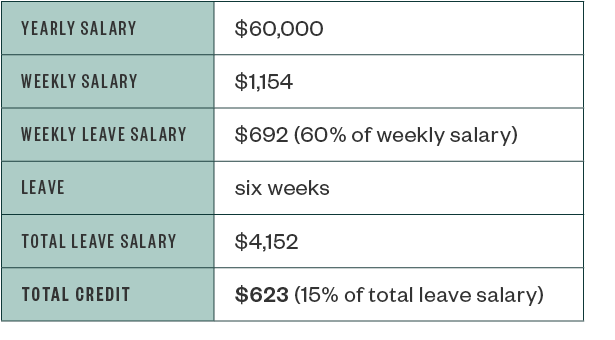

Employer Credit For Family And Medical Leave

Employer Credit For Family And Medical Leave

How You Losing Thousands On Employee Scheduling Credit Cards Technology Finance Banking Fi Credit Card Technology Life Insurance Companies Financial Planning

How You Losing Thousands On Employee Scheduling Credit Cards Technology Finance Banking Fi Credit Card Technology Life Insurance Companies Financial Planning

Expanded Employee Retention Credit Erc For Private Companies Pwc

Expanded Employee Retention Credit Erc For Private Companies Pwc

A Guide To The Employee Retention Tax Credit Cerini Associates Llp Blogs

A Guide To The Employee Retention Tax Credit Cerini Associates Llp Blogs

Enhancements To The Employee Retention Credit Aprio

Enhancements To The Employee Retention Credit Aprio

Post a Comment for "Employee Retention Credit 2017"