How To Calculate Ei Claim

Even though EIS is not meant to replace your income. Therefore your EIC was denied in December 2020.

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

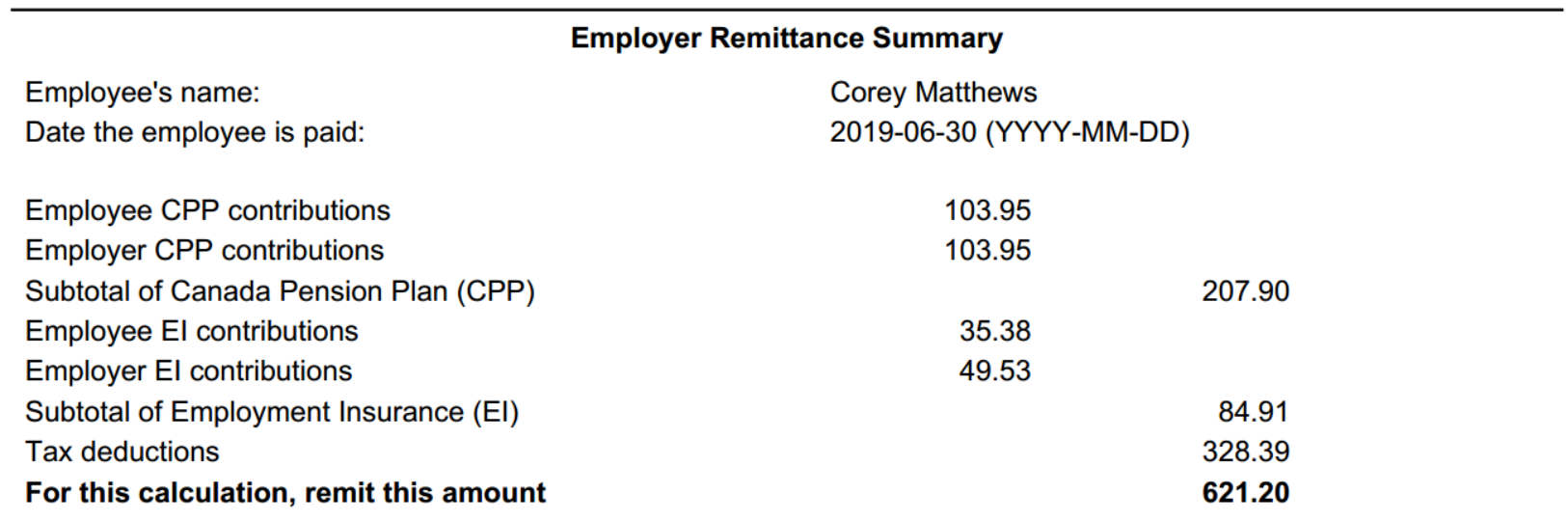

The Payroll Deductions Tables help you calculate the Canada Pension Plan CPP contributions employment.

How to calculate ei claim. 6 There have been numerous cases of fish harvesters who failed to qualify for a winter claim. This is how we calculate your weekly benefit amount. We divide that amount by the number of best weeks based on where you live.

Your earning threshold is 90 of the average weekly earnings used to calculate your EI benefits. We determine the divisor number of best weeks that corresponds to your regional rate of unemployment. Will be used to calculate your benefit rate for the winter claim.

Your winter claim is based on only 5000 income instead of 13500. Both your employer and yourself would contribute 02 of your salary to the scheme total 04 monthly. Part 2 of 3 have helped to shed some light on what EIS is all about.

The following changes are in effect until September 2021 and could apply to you. As of January 1 2021 the maximum yearly insurable earnings amount is 56300. We calculate your total earnings for the required number of best weeks based on the information you provide andor your Record of Employment.

To claim the EIC with a qualifying child on your 2020 return you must complete and attach Form 8862 to that return. EIbenefit payment amounts arecalculated based on yourhighest weeks known as best weeks of earnings over the past 52 weeks or since the start of your last claim. Average weekly income The smallest number between.

Monthly contributions start from 10 sen for workers earning RM30 a month while the maximum amount of contribution is capped at. To figure out your qualifying period start on the Sunday before your interruption of earnings and then count backwards 52 weeks from there. The waiting period may be waived a minimum unemployment rate of 131 applies to all regions across.

Heres how it works. You didnt act on this notice within 90 days. 500 x 90 450.

Weekly income Best weeks annual income Number of best weeks. 500 per week x 90. In Canada you can apply for Employment Insurance EI if you were recently let go or laid off.

Employment Department Unemployment. Maximum EI insurable income for 202052 weeks Weekly benefits Average weekly income x Basic benefit rate 55 Benefits on the period Weekly benefits x Number of payable weeks. I hope this article as well as the previous ones EIS PERKESO Malaysia.

Part 1 of 3 and EIS PERKESO Malaysia. How to calculate the EIS contribution. 43 rows For most people the basic rate for calculating EI benefits is 55 of their average insurable weekly earnings up to a maximum amount.

Your qualifying period can sometimes be shorter than 52 weeks. Skip to the main content of the page. MAP4CThis video shows a simplified version see free tax forms for a more accurate version of how to.

This means that you can receive a maximum amount of 595 per week. Enough for a decent EI claim may cost you thousands of down the road in EI benefits. EI 400 x 152 or 400 x 0152 608 608 x 14 851 EI 608 851 1459 608 is the employees weekly EI contribution which you withhold from his gross salary.

However to claim the EIC without a qualifying child on your 2020 return you dont need to. For example if you have been on EI in the past year your qualifying period will only go back to the start of your last EI claim. We then multiply the result by 55.

It calculates payroll deductions for the most common pay periods such as weekly or biweekly based on exact salary figures. You may also qualify for EI if you are a new parent or if you need sickness benefits to care for yourself or a. Eligibility is based on how you lost your job and how long you were working before your job ended.

You can use our Payroll Deductions Online Calculator PDOC to calculate payroll deductions for all provinces and territories except Quebec. For example if Service Canada staff calculates that you earned an average of 500 each week before you applied for EI your earning threshold will be 450. To get generic estimates if youre applying for regular or sickness benefits for most people the basic rate used for calculation is 55 of your average insurable weekly earnings up to 54200 annually as of January 1 2020 or a maximum amount of 573 per week.

Weve come to the end of the 3-part series on EIS PERKESO Malaysia. How to Get Employment Insurance. How do you calculate the amount of my benefits.

Temporary changes have been made to the Employment Insurance EI program to help you access EI regular benefits. We add your insurable weekly earnings from your best weeks based on information provided by you and your record of employment. What is the Employment Insurance System.

Free Numerology Reading Numerology Secrets Astrology Dates Astrology Numerology Astrology

Free Numerology Reading Numerology Secrets Astrology Dates Astrology Numerology Astrology

Numerology By Horoscope Com Get Your Free Numerology Horoscope Numerology Numerology Life Path Numerology Numbers

Numerology By Horoscope Com Get Your Free Numerology Horoscope Numerology Numerology Life Path Numerology Numbers

Chinese Gender Calendar 2018 The First Chinese Civilization Dates Back More Than 5 000 Years Chinese Gender Calendar Gender Calendar Chinese Gender Prediction

Chinese Gender Calendar 2018 The First Chinese Civilization Dates Back More Than 5 000 Years Chinese Gender Calendar Gender Calendar Chinese Gender Prediction

How To Calculate Retroactive Pay Payroll Management Inc

How To Calculate Retroactive Pay Payroll Management Inc

2019 Canadian Tax Tips My Road To Wealth And Freedom In 2021 Canadian Money Tax Refund Finances Money

2019 Canadian Tax Tips My Road To Wealth And Freedom In 2021 Canadian Money Tax Refund Finances Money

How To Write A Bad Faith Demand Letter Lettering Faith Writing

How To Write A Bad Faith Demand Letter Lettering Faith Writing

Astrological Cosmology Drake Bear Stephen Innerprizes Past Life Astrology Numerology Life Path Astrology Chart

Astrological Cosmology Drake Bear Stephen Innerprizes Past Life Astrology Numerology Life Path Astrology Chart

Mathematics For Work And Everyday Life

Mathematics For Work And Everyday Life

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Canada Canada Emergency Wage Subsidy Help Center

Canada Canada Emergency Wage Subsidy Help Center

Pin On Fat Burning Detox Diets

Pin On Fat Burning Detox Diets

How To Stop Worrying About Sales Tax Plus Free Calculator Business Tax Deductions Small Business Tax Deductions Small Business Tax

How To Stop Worrying About Sales Tax Plus Free Calculator Business Tax Deductions Small Business Tax Deductions Small Business Tax

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Mathematics For Work And Everyday Life

Mathematics For Work And Everyday Life

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Pin On Eat Less And Move More D

Pin On Eat Less And Move More D

Health Care Costs Stethoscope And Calculator Symbol For Health Care Costs Or Medical Insurance R R Ad Sponsored Costs Ste Health Care Health Stethoscope

Health Care Costs Stethoscope And Calculator Symbol For Health Care Costs Or Medical Insurance R R Ad Sponsored Costs Ste Health Care Health Stethoscope

Post a Comment for "How To Calculate Ei Claim"