Rrsp Withholding Tax Rates

Non-residents of Canada pay a flat withholding tax of 25. Amount of RRSP Withdrawal All Provinces Except Quebec Quebec.

Photo Shared By Makemorecapital On April 02 2020 Tagging And Poss

Photo Shared By Makemorecapital On April 02 2020 Tagging And Poss

Up to an including 5000.

Rrsp withholding tax rates. The withholding tax for periodic payments such as an RRIF which has been annuitized is 15. That definitely stings but were not done yet. 15001 or more 30 15 in Quebec withholding tax.

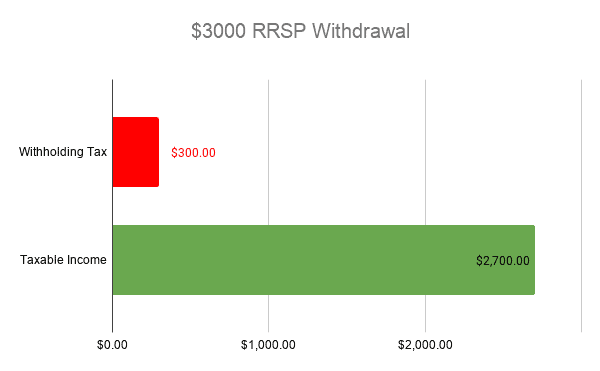

3 rows The effect of the withholding tax is that you dont really get all the money you take out of. See Revenue Quebecs Payments from an RRSP. I understand the current rate of RRSP withholding tax is 10 for withdrawals up to 5000 20 for withdrawals between 5000 and 15000 and 30 for withdrawals over 15000.

Tax resident or non-resident of Canada the Canadian withholding tax imposed on distributions would be 25. When you withdraw funds from an RRSP your financial institution withholds the tax. Effective January 1 2018 the following withholding tax rates apply.

58 rows A 1500 gross withdrawal will deduct 1500 from the RRSP and the. You do have the opportunity to reduce this withholding to 15 if each payment is considered a periodic payment under the Canada-US. Until that announcement is made a payment to a resident of this country is generally subject to withholding tax at the statutory rate generally 25 unless a convention between Canada and this country already exists in which case the appropriate rate should be taken from Appendix A.

Series of withdrawals from an RRSP In a different example if instead the withdrawals were made from an RRSP and a series of separate deregistration requests were placed for successive days it is quite likely that the initial withdrawal would be. To the 30 withholding tax rate. Tax Treaty distributions from RRSPsRRIFs can be reduced.

Estimated Income Tax Payments. The amount withheld probably wont cover your full tax obligations once your RRSP withdrawal gets added to your income for the year. These withholding rates are designed to cover the approximate tax that will be due for taxpayers with standard deductions.

Canada generally does not tax contributions to or accumulations in an RRSP. This is a significant benefit especially if you are in the lower 10 or 12 tax rate. 10 5 in Quebec on amounts up to 5000.

20 10 in Quebec on amounts over 5000 up to including 15000. Withdrawals up to 5000 will have a 10 5 in Quebec withholding tax. The withholding tax is remitted monthly by companies withholding more than 500 per quarter.

A VRSP a PRPP or a RRIF. As a non-resident RRSP holder however each withdrawal will attract a withholding tax of 25. If one were to become a US.

You are required to make quarterly estimated tax payments if you can reasonably expect your tax liability to exceed the amount withheld by 500 or more and you expect your withholding to be less than the smaller of 70 of your current years liability or the tax liability shown on your return for the preceding taxable year of twelve months. There are three tiers as follows. For residents of Canada the rates are.

The rates depend on your residency and the amount you withdraw. The amount you pay in RRSP withholding tax is dependent on the amount of your withdrawal. 1 For a single withdrawal from RRSP funds held in the province of Quebec there will be 15 provincial income tax withheld in addition to the above 5 10 or 15 federal tax withheld.

If you have an RRSP you have the option to convert to an RRIF and start yearly distributions. Companies withholding less than 500 remit on a quarterly basis. 30 15 in Quebec on amounts over 15000.

Under the Convention Canada generally will impose a withholding tax of 25 percent on distributions to non-residents. The benefit of doing this is that there is only a 15 foreign tax withholding on the RRIF. Under Article XVIII 2 of the Canada-US.

Pensions and Annuities Subject to Part XIII Tax. Back to Top. 2 rows RRSP withholding tax is charged when you withdraw funds from your RRSP before retirement.

5001 to 15000 20 10 in Quebec withholding tax.

Https Ca Rbcwealthmanagement Com Delegate Services File 775143 Content

Rrsp Withholding Tax How Much You Ll Pay Wealthsimple

Rrsp Withholding Tax How Much You Ll Pay Wealthsimple

Rrsp Dividends Are They Taxable The Financial Geek Make The Most Of Your Money

Rrsp Dividends Are They Taxable The Financial Geek Make The Most Of Your Money

Can Debtors Anonymous Help You Smart Money Personal Finance Bloggers Finance Bloggers

Can Debtors Anonymous Help You Smart Money Personal Finance Bloggers Finance Bloggers

How Do Rrsp Withdrawals Work Ratehub Ca

How Do Rrsp Withdrawals Work Ratehub Ca

Https Ca Rbcwealthmanagement Com Delegate Services File 270009 Content

Everything Canadians Need To Know About Rrsps

Everything Canadians Need To Know About Rrsps

Https Ca Rbcwealthmanagement Com Delegate Services File 634527 Content

Should You Dip Into Your Rrsp To Pay For Your Loan Justcompare

Should You Dip Into Your Rrsp To Pay For Your Loan Justcompare

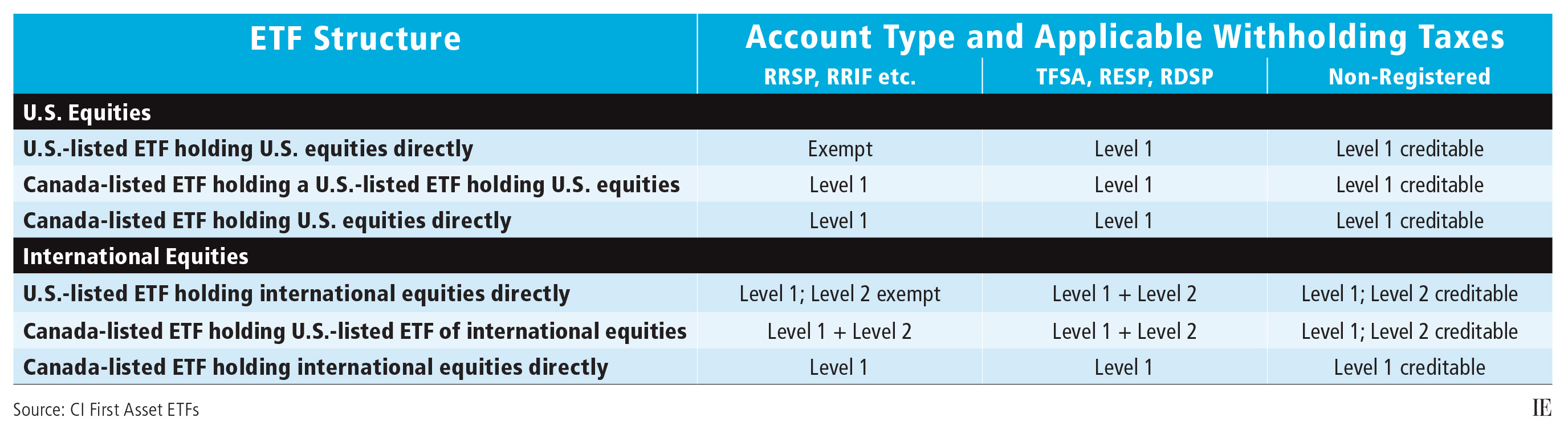

Etfs And Foreign Withholding Taxes Investment Executive

Etfs And Foreign Withholding Taxes Investment Executive

Early Rrsp Withdrawals Cost More Than You May Think

Early Rrsp Withdrawals Cost More Than You May Think

Worthwhile Canadian Initiative The Basic Arithmetic Of Rrsps And Tfsas

Understanding Withholding Tax On Foreign Investments

Understanding Withholding Tax On Foreign Investments

How To Avoid Foreign Dividend Withholding Tax The Motley Fool

How To Avoid Foreign Dividend Withholding Tax The Motley Fool

The Ultimate 5 Step Guide To Maximizing Your Index Etf Returns Trade Finance Business Finance Finance

The Ultimate 5 Step Guide To Maximizing Your Index Etf Returns Trade Finance Business Finance Finance

Understanding Us Dividend Withholding Tax In Tfsa Rrsp Youtube

Understanding Us Dividend Withholding Tax In Tfsa Rrsp Youtube

Https Ca Rbcwealthmanagement Com Documents 536761 1454881 Withholdingtaxesonrrspandrifwithdrawals Pdf Bfdb19fe E8bc 483e 9345 4d1fcea38f81

Understanding Withholding Tax On Rrsp Withdrawals Youtube

Understanding Withholding Tax On Rrsp Withdrawals Youtube

Https Nesbittburns Bmo Com Getimage Asp Content Id 70446

Post a Comment for "Rrsp Withholding Tax Rates"