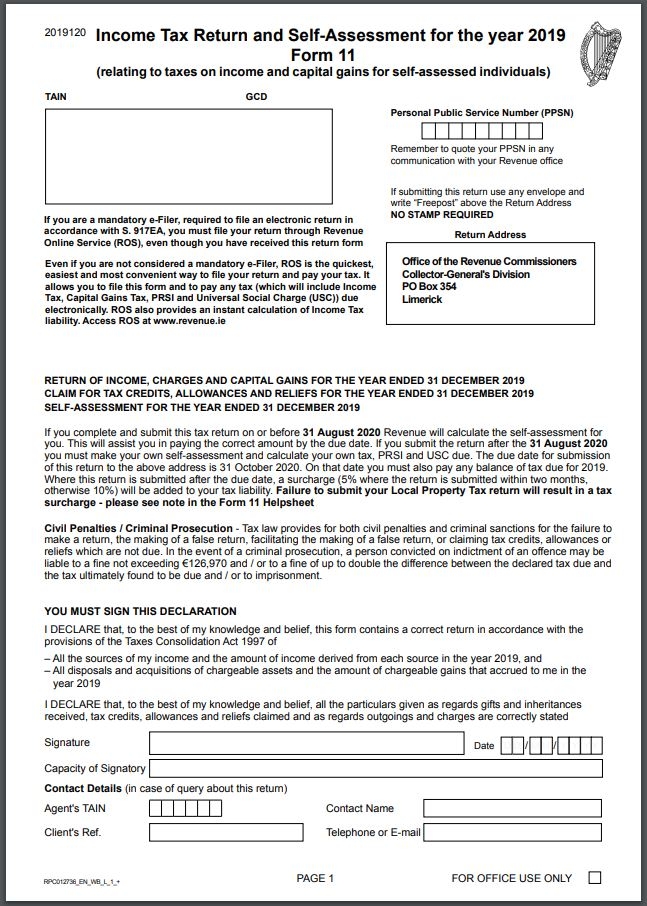

Self Employed Tax Form Ireland

In Ireland there are specific things which you can and cant expense. Being self-employed means you are carrying on your own business rather than working for an employer.

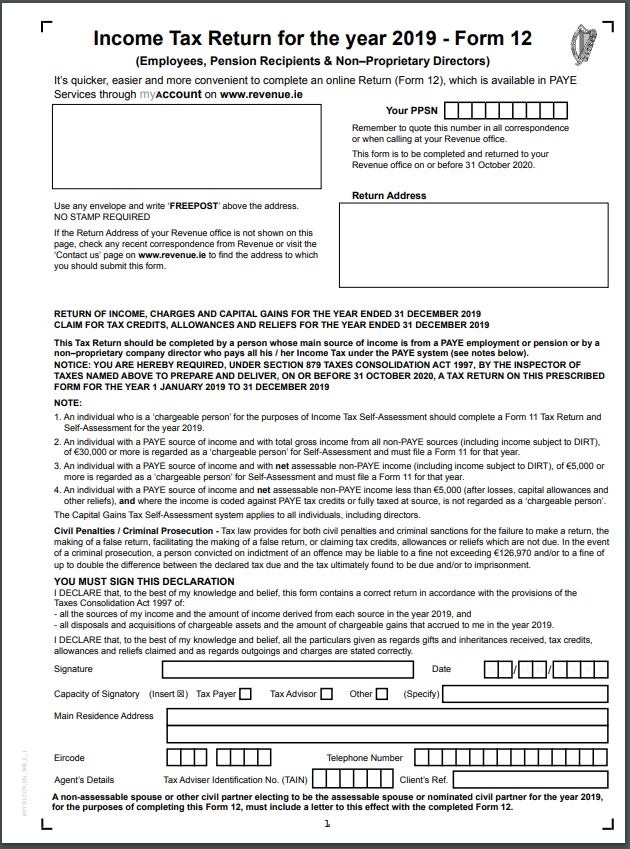

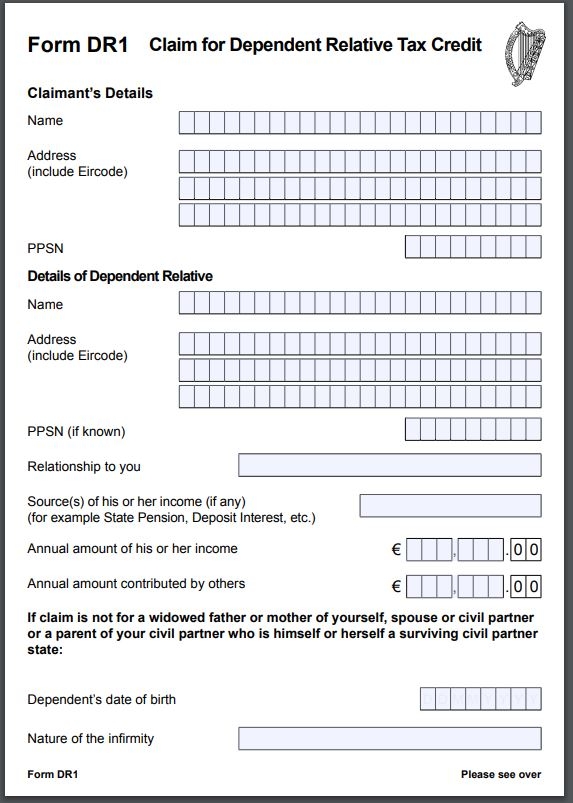

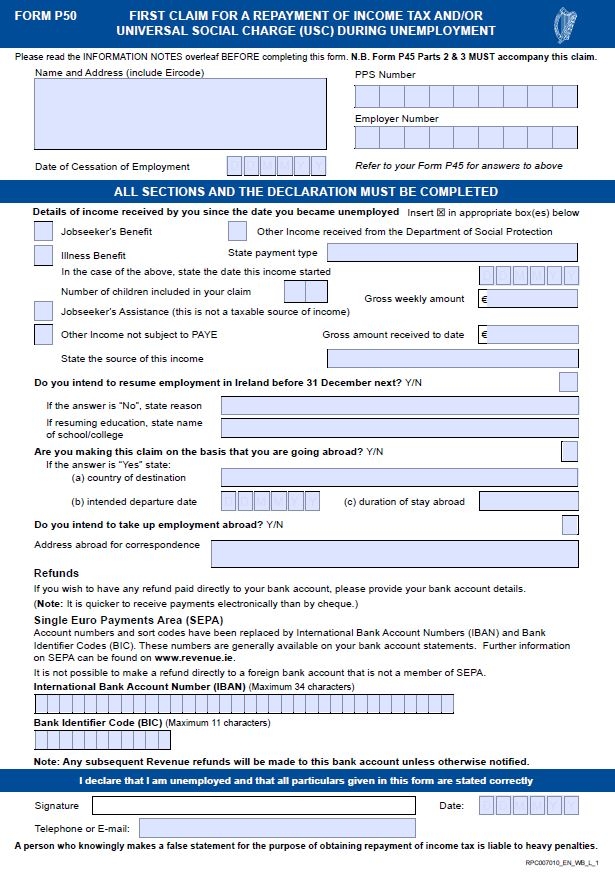

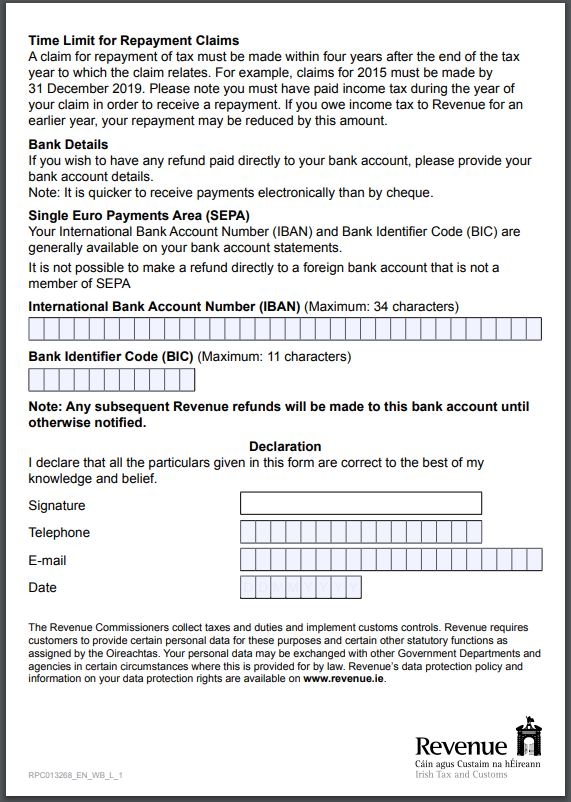

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

The best way to do this is through RosieIf you dont have access to ROS you can complete a TRCN1 available on the Revenues website.

Self employed tax form ireland. If you are self-employed in Ireland its important you are aware of what you can and cant expense. You have the following options. With this there are many advantages and disadvantages.

You cannot claim the tax credit against any passive or investment income eg. Self Employed Tax Return Deadlines Ireland. If youre already a citizen of Ireland or youve moved to Ireland to live there then youll have this already.

Entering PAYE income in your Form 11 including downloading pre-populated pay tax and USC data. It looks like you have JavaScript disabled. If youre self-employed in Ireland then youre obliged to file a self-assessed tax return usually by the deadline of October 31 or by the pay and file deadline of Nov 10.

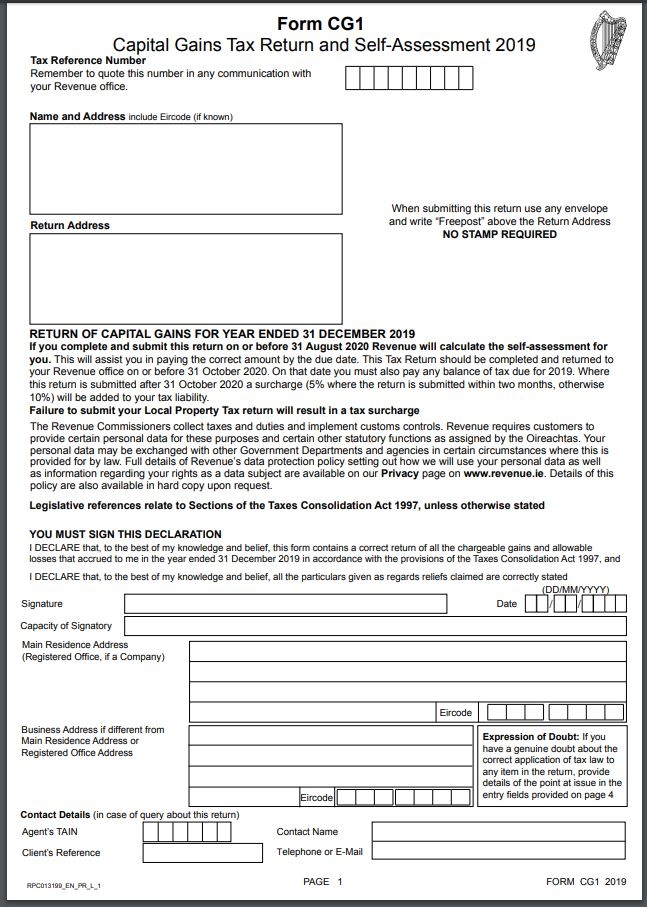

Your tax return is used to declare income you earn and also to claim any tax allowances that can be offset against your tax bill. If you are self-employed you or an agent must make your income tax return and self-assess your tax liability. Property rentals or interest on savings.

The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. You pay Preliminary Tax an estimate of tax due on or before 31 October each year and make a tax return not later than 31 October following the end of the tax year. One of the best ways to lower your tax liability is to ensure you have captured fully all of your business expenses.

Certain parts of this website may not work without it. If you are self-employed in Ireland you pay tax on the profits you make from your business and on any other income that you have. The type of tax return you have to file depends on how much income you earn.

Completing the self-employed income section in the Form 11 including information for farmers completing the rental income section in the Form 11. The process on how to complete on ROS. However there are a number of different details and important dates that you need to be aware of.

Information about tax and tax compliance matters for the self employed including how to calculate and pay your tax and file your tax returns. Your PPSN is your unique number that is used for all dealings with government departments. For more information on filling out the Form 11 please see Filing your tax return.

This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits. Use Schedule SE Form 1040 to figure the tax due on net earnings from self-employment. Individuals who require registration for Income Tax VAT Employers PAYE PRSI and or RCT complete parts A1 A3 and B C D and or E as appropriate.

Pay the balance of tax for that year. Pay preliminary tax for the current year. Schedule SE Form 1040 or 1040-SR Self-Employment Tax PDF Instructions for Schedule SE Form 1040 or 1040-SR Self-Employment Tax PDF Schedule K-1 Form 1065 Partners Share of Income Credits Deductions etc.

As a self-employed individual you pay tax under the self-assessment system. You can use a shorter Form 11E which is. Guide to Income Tax Return Ireland Form 11.

You can fill out a paper Form 11 pdf and send to Revenue. You must keep proper records to allow you to fill out your annual tax return. Claiming tax relief for pension contribution in your Form 11.

Received tax credits allowances and reliefs claimed and as regards outgoings and charges are correctly stated Signature Date Capacity of Signatory RPC012736_EN_WB_L_1_ Income Tax Return and Self-Assessment for the year 2019 Form 11 relating to taxes on income and capital gains for self-assessed individuals Remember to quote your PPSN in any. Each year you must self assess your tax liability and file an income tax return. This form can be used by.

If your taxable non-PAYE income in a year does not exceed 5000 and your gross non-PAYE income does not exceed 50000 you will need to submit a tax return Form. Individuals who require registration for Income Tax only - use eRegistration service. For those who are self-employed you can claim whats called an Earned Income Tax Credit of 1150 or 20 of earned income- whichever is lower for the 2018 tax year.

Before you can use the system you must register with Revenue as self-employed- for which youll need your Personal Public Service Number PPSN. However every self-employed person must file a tax return every year. To make it easier weve put together a list of everything youll need to know about calculating your liability self-assessment and filing your Form 11 to the Revenue.

You must self-assess when filing your annual tax return. If you are no longer self-employed you need to inform Revenue as soon as possible. Making a full self-assessment.

An exception is made where you file a paper return on or before 31 August in the year after the year to which the return relates. Figuring out your tax liability and filing your annual returns can be complicated and stressful particularly if its your first time or if you have more than one type of income to declare. Tax credits aimed at lowering your tax liability.

See our Tax Return Services Get a Quote. Costs allowable under the PAYE system where you are employed by another. From a financial view point the primary advantage of being self-employed is that you are given greater flexibility in the expenses you can claim for tax purposes.

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Small Business Bookkeeping Payroll

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

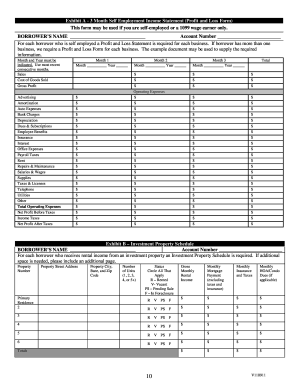

Self Employed Income Statement Fill Out And Sign Printable Pdf Template Signnow

Self Employed Income Statement Fill Out And Sign Printable Pdf Template Signnow

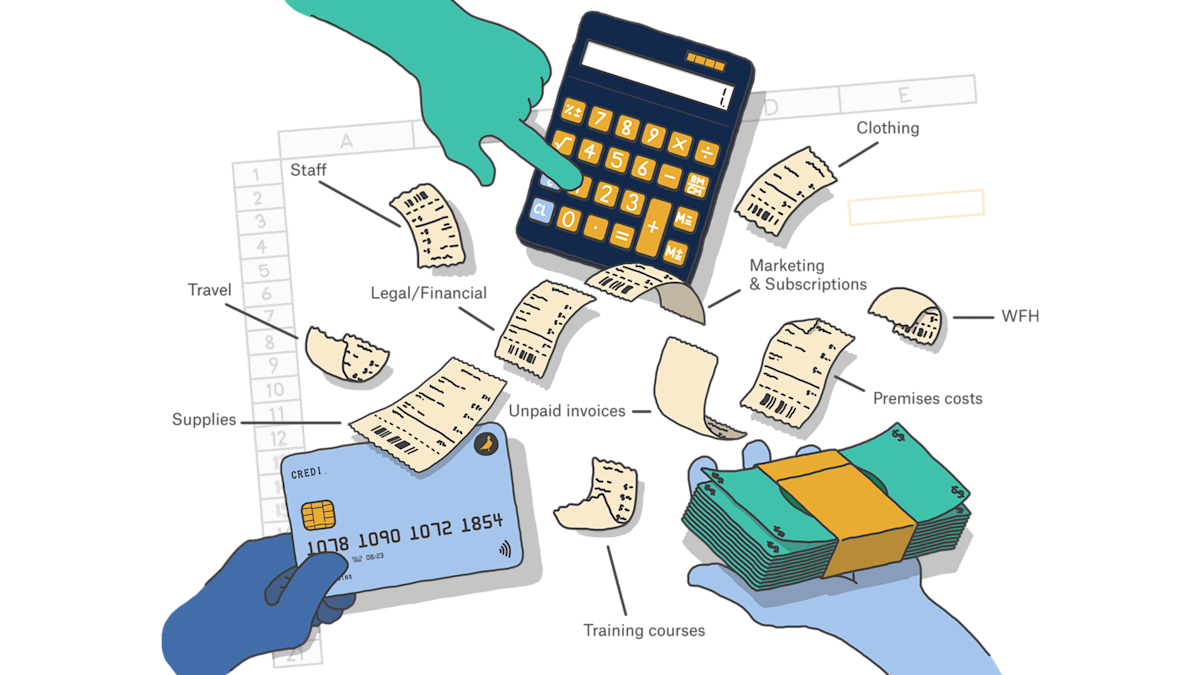

How To Claim Expenses When You Re Self Employed Courier

How To Claim Expenses When You Re Self Employed Courier

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

How To Complete Hmrc S Online Self Assessment Filing Crunch Self Assessment Online Self Business Advice

How To Complete Hmrc S Online Self Assessment Filing Crunch Self Assessment Online Self Business Advice

Tax Return Fake Tax Return Income Tax Return Income Statement

Tax Return Fake Tax Return Income Tax Return Income Statement

Self Employment Tax For U S Citizens Abroad

Self Employment Tax For U S Citizens Abroad

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Tax And Self Employment Visual Artists Ireland

Tax And Self Employment Visual Artists Ireland

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Income Tax Form Self Employed 3 Simple But Important Things To Remember About Income Tax F Tax Forms Employee Tax Forms Income Tax

Income Tax Form Self Employed 3 Simple But Important Things To Remember About Income Tax F Tax Forms Employee Tax Forms Income Tax

Simple Paye Taxes Guide Tax Refund Ireland

Simple Paye Taxes Guide Tax Refund Ireland

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Post a Comment for "Self Employed Tax Form Ireland"