Canada Employment Wages Subsidy

Before you calculate your subsidy make sure you are eligible to apply. This only applies to the federal provincial or territorial income tax portion of the remittance.

Comparing U S Japanese And German Fiscal Responses To Covid 19 Center For Strategic And International Studies

Comparing U S Japanese And German Fiscal Responses To Covid 19 Center For Strategic And International Studies

Canada Emergency Wage Subsidy CEWS 10 Temporary wage subsidy for employers.

Canada employment wages subsidy. When you apply for the Canada Emergency Wage Subsidy CEWS your information is collected under the authority of the Income Tax Act as part of the Government of Canadas response to the COVID-19 pandemic. The total maximum of the temporary subsidy is 25000 per employer. Lived or living outside Canada International Benefits Tax-Free Savings Account TFSA Wage Earner Protection Program.

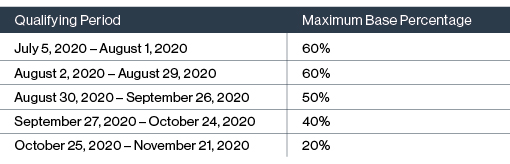

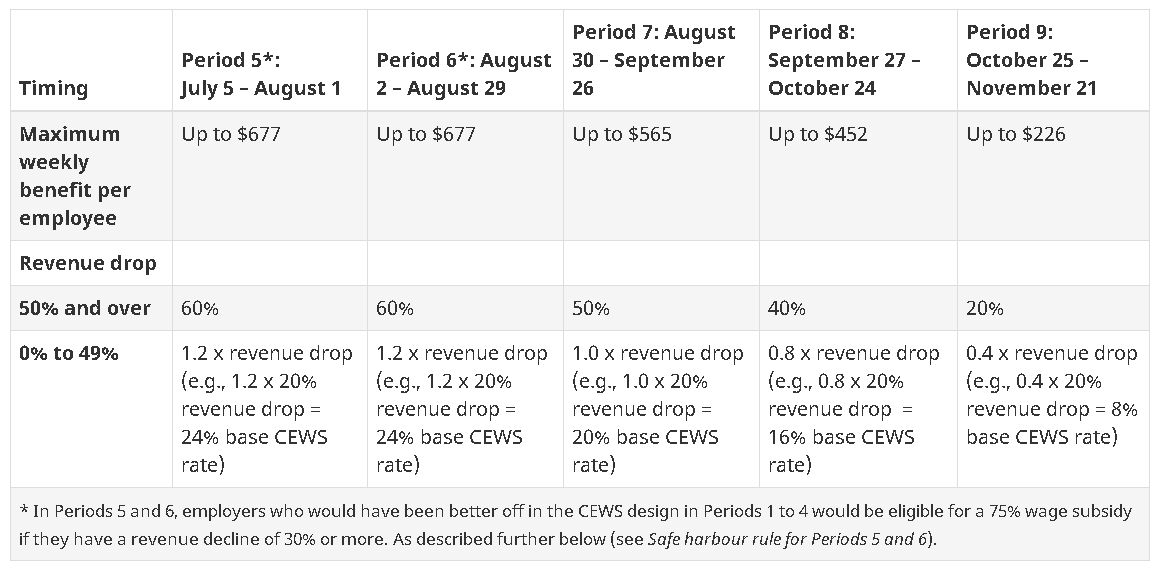

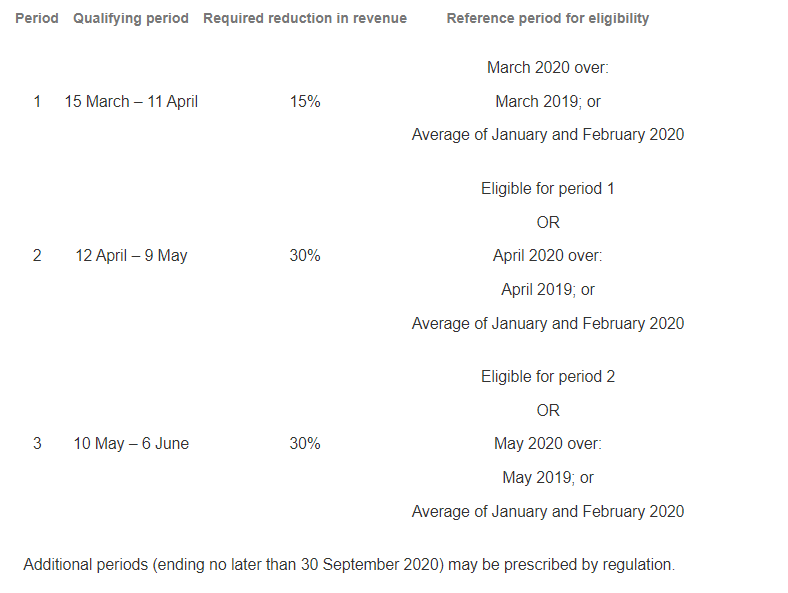

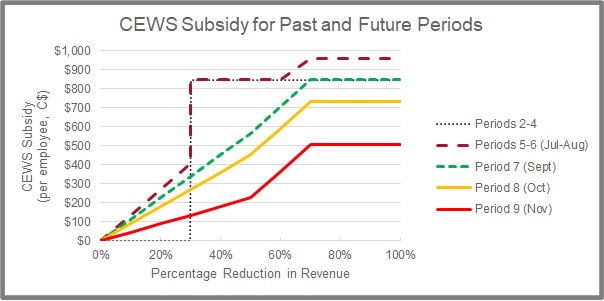

10 of the remuneration you paid from March 18 to June 19 2020 up to 1375 for each eligible employee. The base subsidy rate for Period 8 September 27 to October 24 2020 would continue to apply for Periods 9 and 10 October 25 to December 19 2020. The program which was due to expire at the end of August was extended to December.

As a Canadian employer who has seen a drop in revenue due to COVID-19 you may be eligible for a subsidy to cover part of your employee wages retroactive to March 15. This subsidy will enable you to re-hire workers help prevent further job losses and ease you back into normal operations. It is more accurate to call it a wage-related subsidy because the amount of the subsidy is tied to the remuneration an employer is paying to an employee.

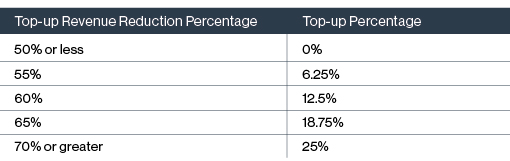

Canada Emergency Wage Subsidy. Employment Insurance Regular Benefits. The wage subsidy includes a base subsidy for all employers whose revenues have been impacted by the pandemic.

When you apply for the Canada Employment Wage Subsidy CEWS you will be asked to enter amounts such as the number of eligible employees and gross payroll. Wage subsidies for internships in the geomatics geology mining forestry or energy industries. Employment Insurance Sickness Benefits.

The Canada Emergency Wage Subsidy was proposed by the Government of Canada to help eligible employers during the COVID-19 outbreak keep employees on payroll and will be retroactive to March 15 2020. Emergency Wage Subsidy Advice The federal government has announced the Canada Emergency Wage Subsidy Bill C-14. The previous version of the wage subsidy program which has had lower-than-hoped-for uptake covered 75 of wages for companies who had lost at least 30 of their revenue for up to C847 per employee per week.

This article outlines this subsidy and how it interacts with the previously introduced ten-percent Temporary Wage Subsidy for Employers. Helping youth to overcome barriers to employment Funding to hire and train youth between the ages of 15 and 30 to work on your projects. As such the maximum base subsidy rate would be set at 40 per cent for this period.

Employment Insurance Fishing Benefits. The 10 Temporary Wage Subsidy for Employers TWS is a 3-month measure that allows eligible employers to reduce the amount of payroll deductions they need to remit to the Canada Revenue Agency CRA. 75 of the amount of eligible remuneration paid per week up to a maximum benefit of 847.

Canada Emergency Wage Subsidy CEWS The latest changes why you should apply and the basics of how it works - Who can apply. Although the CEWS is called a wage subsidy the Government of Canada is not paying employees wages. How Does the Employer Wage Subsidy Work.

The Wage Subsidy will subsidize eligible remuneration paid by an eligible employer to an eligible employee between March 15 and June 6 2020 in an amount equal to the greater of. Canada Emergency Wage Subsidy CEWS As a Canadian employer who has seen a drop in revenue during the COVID-19 pandemic you may be eligible for a subsidy to cover part of your employee wages. This subsidy will enable you to re-hire workers help prevent further job losses and ease your business back into normal operations.

Canada Emergency Rent Subsidy CERS Canada Emergency Wage Subsidy CEWS Use the online calculator or spreadsheet to find out how much you can qualify for. - What the changes are. The payment is made to the employer and the employer pays the employee their wages.

Working Income Tax Benefit WITB See all for Income Assistance for. To get ready you can determine these amounts and preview your subsidy claim now based on the information you enter. Young Canada Works for employers.

CEWS and the 10 Temporary Wage Subsidy for Employers are intended to. Employer Wage Subsidy Advice With the Coronavirus pandemic continuing to grow in Canada the federal government has created an Employer Wage Subsidy to prevent employers from having to lay off workers during this time of economic hardship. Temporary Changes to Canada Summer Jobs Program In previous years private and public sector employers were only eligible to receive a wage subsidy of up to 50 per cent of the provincial or territorial minimum wage.

A new scheme to assist employers who have lost 30 in revenue in light of the ongoing COVID-19 pandemic. The Government announced a 10 temporary wage subsidy for employers for a period of 3. At this time the relevant personal information bank CRA.

Do you have questions on when will employers start to received this aid.

Lewis Silkin International Approaches To Covid 19 Job Retention And Wage Subsidy Schemes

Lewis Silkin International Approaches To Covid 19 Job Retention And Wage Subsidy Schemes

Accountants Talk The Canada Emergency Wage Subsidy

Accountants Talk The Canada Emergency Wage Subsidy

Majority Of Business Leaders Agree The Federal Wage Subsidy Is A Sound Investment In Canada S Economic Recovery Kpmg In Canada Poll

Majority Of Business Leaders Agree The Federal Wage Subsidy Is A Sound Investment In Canada S Economic Recovery Kpmg In Canada Poll

Covid 19 Measures 10 Temporary Wage Subsidy For Employers Youtube

Covid 19 Measures 10 Temporary Wage Subsidy For Employers Youtube

Consequences Of Fraudulent Canada Emergency Wage Subsidy Applications

Consequences Of Fraudulent Canada Emergency Wage Subsidy Applications

Canada Canada Emergency Wage Subsidy Help Center

Canada Canada Emergency Wage Subsidy Help Center

Canada Emergency Wage Subsidy Program Revised And Extended Littler Mendelson P C

Canada Emergency Wage Subsidy Program Revised And Extended Littler Mendelson P C

Proposed Changes To The Canada Emergency Wage Subsidy Cews Employment And Hr Canada

Proposed Changes To The Canada Emergency Wage Subsidy Cews Employment And Hr Canada

Canada Covid 19 And The Labor Market

Canada Covid 19 And The Labor Market

Canada Proposes Sweeping Changes To Canada Emergency Wage Subsidy Insights Dla Piper Global Law Firm

Canada Proposes Sweeping Changes To Canada Emergency Wage Subsidy Insights Dla Piper Global Law Firm

Access The Canada Emergency Wage Subsidy Mentor Works

Access The Canada Emergency Wage Subsidy Mentor Works

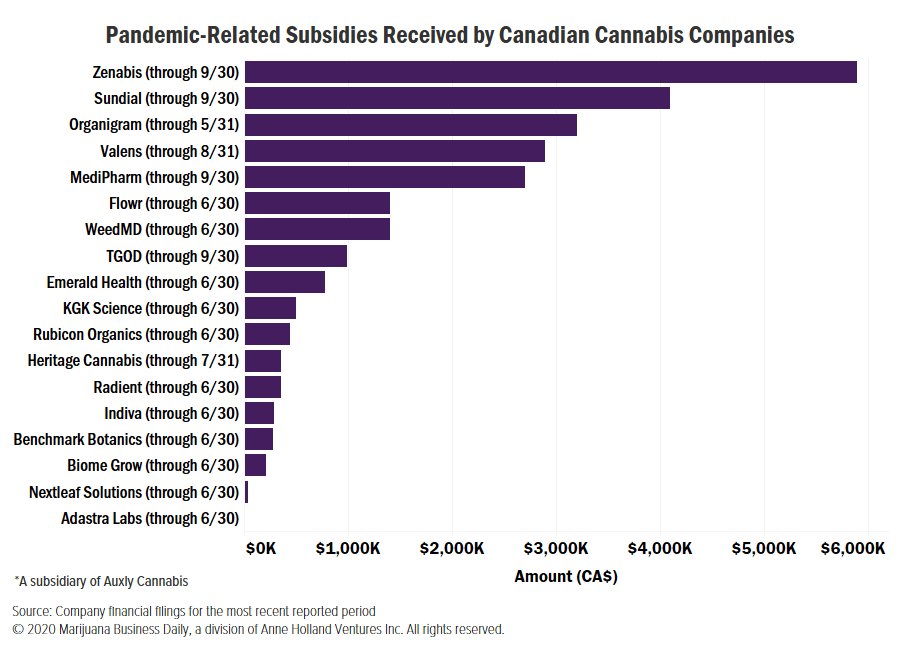

Report Canadian Cannabis Firms Received Millions In Pandemic Subsidies

Report Canadian Cannabis Firms Received Millions In Pandemic Subsidies

Canada Emergency Wage Subsidy Legislation Receives Royal Assent Ey Global

Canada Emergency Wage Subsidy Legislation Receives Royal Assent Ey Global

Government Proposes To Extend And Overhaul The Canada Emergency Wage Subsidy Blakes

Government Proposes To Extend And Overhaul The Canada Emergency Wage Subsidy Blakes

Post a Comment for "Canada Employment Wages Subsidy"