Secondary Employment Tax Rates Nz

In some situations seasonal employment can become a rolling fixed-term employment in which the employee is re-hired at the start of every season. Sophie will be owed a refund on 1625 at the end of the tax year.

An End To Unnecessary Secondary Tax Ird News

An End To Unnecessary Secondary Tax Ird News

33 excludes ACC You can use the PAYE rate of 3445 cents in the dollar if the employee asks you to.

Secondary employment tax rates nz. If an employee has notified their employer that the employees tax code is SB under section 24C of the Tax Administration Act 1994 the basic tax rate amount for a payment of secondary employment earnings is set by applying the rate of 0105 for each dollar of the payment. Get their tax number and ask them to fill in tax forms. You take on a second job earning 5000 per year.

The Taxation Annual Rates for 2018-19 Modernising Tax Administration and Remedial Matters Bill passed its third reading and will come into effect on 1 April. Calculate your take home pay from hourly wage or salary. You can choose to have tax deducted at any rate -.

Such as New Zealand superannuitants and beneficiaries. New Zealands Best PAYE Calculator. So in practise the income from a persons second job should be taxed at the correct rate.

Record their age in your wage and time records this is a legal requirement if they are under 20 years. Income from an SB tax code is taxed at 105 for an S code the rate is 175 for an SH code the tax is at 30 and for ST 33. In reality the system works and calculates the tax correctly about 90 of the time.

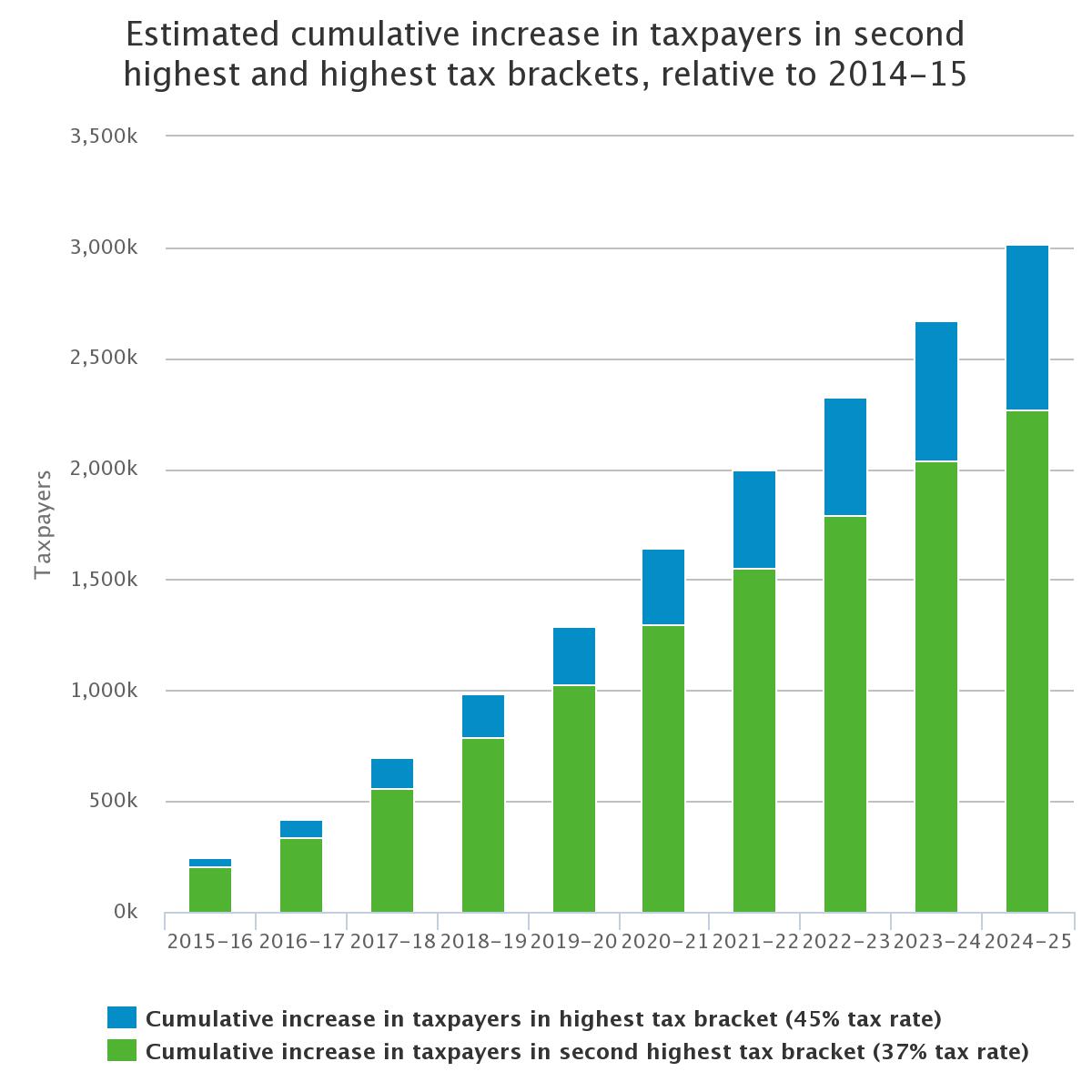

Tax codes help your employer or payer work out how much tax to deduct from your pay benefit or pension. Greater than 70000 but less than the ACC earners levy maximum threshold of 118191 for the 2015 tax year 3445. Workers who are paying too much tax because of incorrect secondary tax codes are in line for relief with the passage of legislation through Parliament late last night.

Secondary tax code Secondary tax rate. Workers who are paying too much tax because of incorrect secondary tax codes are in line for relief with the passage of legislation through Parliament late last night. Tax rates for individuals Main and secondary income tax rates tailored and schedular tax rates and a calculator to work out your tax.

The new bottom rate will be added to this range of rates. Less or equal to 48000 your secondary tax code is S and your NZ Super will be taxed at 175. Income between 14000 and 48000 is taxed at a rate of 175 per cent.

Between 48001 and 70000 your secondary tax code is SH and your NZ Super will be taxed at 30. This is a guide using standard assumptions to estimate your tax breakdownThere are many other possible variables - for a definitive understanding contact the IRD. Right to work in New Zealand There is no general rule preventing a person from having more than one job at the same time.

If the total amount youll earn in a year including your NZ Super is. Get their contact details and give them yours andor their supervisors contact details. Give them a copy of their employment agreement.

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. If you choose to or must have tax deducted from your pay fill out the IR330C and give it to your payer. Get their bank account number for payment.

Between 48000 and 70000 its 30 per cent and over 70000 its. If youre a contractor not working through a labour hire business you can have tax deducted from your pay at a rate you choose if the payer agrees. CAE Casual Agricultural Employee includes shearers or shed hands engaged in casual seasonal work on a day-to-day basis for up to 3-months some shearers get as much as 10 months of employment a year.

The Taxation Annual Rates for 2018-19 Modernising Tax Administration and Remedial Matters Bill passed its third reading and will come into effect on 1 April. The current secondary tax codes are 21 33 and 39. A 125 secondary tax code is being introduced to cater for low income people that have a second job.

Having more than one job might mean working for a second employer or working in the employees own business. 1470 tax paid on the first 14000 at 105 3675 from 1400135000 taxed at 175 and then because a secondary tax code is applied at her marginal rate 18000 from her second job will be taxed at 30 resulting in 5400. This calculator assumes youre employed as being self-employed means hourly weekly fortnightly and monthly income payments will be different depending on when you make tax payments and how much you pay.

The 10 of the time when the secondary tax system doesnt work is when someones income crosses one of. You will pay 105 tax on your income to 14000 then 175 on your income from 14001 to.

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Tax Configuration Chapter 3 R20b

Tax Configuration Chapter 3 R20b

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

How To Report Rental Income On Foreign Property A Guide For Expats

How To Report Rental Income On Foreign Property A Guide For Expats

Http Www Jstor Org Stable 24437312

Tax Rate Change Enacted Along With Big Brother Information Gathering Powers Tax Alert December 2020 Deloitte New Zealand

Tax Rate Change Enacted Along With Big Brother Information Gathering Powers Tax Alert December 2020 Deloitte New Zealand

3 Tax Revenue Effects Of Pillar Two Tax Challenges Arising From Digitalisation Economic Impact Assessment Inclusive Framework On Beps Oecd Ilibrary

3 Tax Revenue Effects Of Pillar Two Tax Challenges Arising From Digitalisation Economic Impact Assessment Inclusive Framework On Beps Oecd Ilibrary

Tax Configuration Chapter 3 R20b

Tax Configuration Chapter 3 R20b

Post a Comment for "Secondary Employment Tax Rates Nz"