Self Employment Government Website

You had church employee income of 10828 or more. More complex issues are discussed in Publication 15-A PDF and tax treatment of many employee benefits can be found in Publication 15.

Self Employed Invoice Template Free Download Send In Minutes

Self Employed Invoice Template Free Download Send In Minutes

Jeevan Pramaan is a biometric enabled digital service for pensioners.

Self employment government website. Business and Economic Development Licensing and Permits Secretary of State -. The checklist provides important tax information. SE tax is a Social Security and Medicare tax primarily for individuals who work for themselves.

Doing Business in the State. Whats new for small businesses and self. The Self-Employment Income Support Scheme claim service is now open.

You can register online with the help of this portal and provide your details to get a digital life certificate. Whats Available Here. Your net earnings from self-employment excluding church employee income were 400 or more.

It describes the barriers experienced by the four grantees the self-employment models tested the achievements of the grant programs and case studies of several individuals with disabilities who successfully became self-employed. If you are starting a small business see the Checklist for new small businesses. PUA is extended in Maryland from Sunday March 14 2021 to Saturday September 4 2021.

You are self-employed if you operate a trade business or profession either by yourself or with a partner. Self-Employment for People with Disabilities PDF is the final report of the START-UP initiative. To be eligible claimants must have earned both employment wages and self employment income at least 5000 in NET SELF-EMPLOYMENT income in the completed taxable year prior to.

Extension of the Pandemic Unemployment Assistance PUA program for self-employed or gig workers Apply for Unemployment Benefits There are a variety of benefit and aid programs to help you if you lose your job. Bureau of Labor Statistics BLS and released by IDES. The UK government recognises the continued impact that coronavirus COVID-19 has had on the self-employed and announced in November that there would be a fourth grant.

If you are incorporated this information does not apply to you. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. Find out the basics of self-employment to help you succeed in the small business world.

The federal government has extended the PUA program by several months. Visit the state websites below and find information on doing business in the state taxation links for employers and more. Starting and Financing a Small Business - Explore opportunities and get tips to help you succeed.

Small Business Events in Your Area. Guidance about the Self-Employment Income Support Scheme Grant Extension has been updated. Grants for businesses that pay little or no business rates Business Interruption Loan Scheme.

Michigan State Website. Self-employed individuals including those earning income from commissions. Training Assistance TUI Self Employment Assistance SEA Find a Job.

The Illinois Department of Employment Security IDES announced today that the unemployment rate decreased -03 percentage point to 74 percent while nonfarm payrolls were up 21100 jobs in February based on preliminary data provided by the US. Publication 15 PDF provides information on employer tax responsibilities related to taxable wages employment tax withholding and which tax returns must be filed. Information about what to do if you were not eligible for the grant or.

Pensioners of Central Government State Government or any other Government organization can take benefit of this facility. 30 October 2020 We have updated the page to tell you when the online service for the next grant will be open. Self-Employment and Working from Home.

Generally your net earnings from self-employment are subject to self-employment tax. You must pay self-employment tax and file Schedule SE Form 1040 or 1040-SR if either of the following applies. Self-employed individuals generally must pay self-employment tax SE tax as well as income tax.

The government is also providing the following help for the self-employed. Instead go to Corporations.

50 Self Employed Business Ideas You Can Start For Under 100 Theselfemployed Com

50 Self Employed Business Ideas You Can Start For Under 100 Theselfemployed Com

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

The Ultimate Self Employment Starter Kit Self Employment Self Employment

The Ultimate Self Employment Starter Kit Self Employment Self Employment

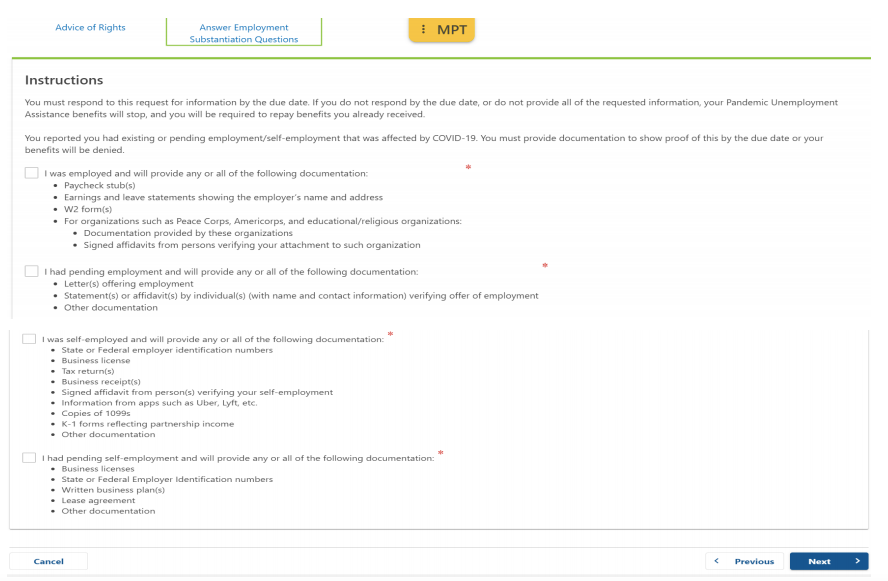

Pandemic Unemployment Assistance Substantiation Proof Of Employment Mass Gov

Pandemic Unemployment Assistance Substantiation Proof Of Employment Mass Gov

6 Steps To Follow When Going Self Employed Sue Foster Money Business Blogging Lifestyle Blog Going Self Employed Business Bank Account Smart Money

6 Steps To Follow When Going Self Employed Sue Foster Money Business Blogging Lifestyle Blog Going Self Employed Business Bank Account Smart Money

January Income Expense Statement For A Cleaning Business Self Employment Income Statement Statement Template

January Income Expense Statement For A Cleaning Business Self Employment Income Statement Statement Template

Self Employment Grant Is Finally Here Check Your Eligibility Now Exchange Accountancy Services

Self Employment Grant Is Finally Here Check Your Eligibility Now Exchange Accountancy Services

Unemployment Insurance Benefits For Self Employed Contractors And Farmers Department Of Labor

Unemployment Insurance Benefits For Self Employed Contractors And Farmers Department Of Labor

Applying For Benefits Sc Department Of Employment And Workforce

Applying For Benefits Sc Department Of Employment And Workforce

Pandemic Unemployment Assistance Pua Expands Benefits To Self Employed Contractors And Gig Workers Senator Vincent Hughes

Pandemic Unemployment Assistance Pua Expands Benefits To Self Employed Contractors And Gig Workers Senator Vincent Hughes

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Coronavirus Covid 19 Tax Relief Taxpayer Advocate Service

Self Employment Taxes For Bloggers Faq Simple Blog Taxes Blog Taxes Self Employment Employment

Self Employment Taxes For Bloggers Faq Simple Blog Taxes Blog Taxes Self Employment Employment

Obamacare Enrollment Opens Today With Impacts For Self Employed Solopreneurs Small Business Trends Small Business Trends Online Jobs How To Apply

Obamacare Enrollment Opens Today With Impacts For Self Employed Solopreneurs Small Business Trends Small Business Trends Online Jobs How To Apply

Secrets Of Self Employment By Paul Edwards Sarah Edwards 9780874778373 Penguinrandomhouse Com Books In 2020 Self Employment Work Online Jobs Be Your Own Boss

Secrets Of Self Employment By Paul Edwards Sarah Edwards 9780874778373 Penguinrandomhouse Com Books In 2020 Self Employment Work Online Jobs Be Your Own Boss

Access Denied Self Internet Income Individuality

Access Denied Self Internet Income Individuality

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

Unemployment Insurance Data Employment Training Administration Eta U S Department Of Labor

Des Covid 19 Information For Individuals

Des Covid 19 Information For Individuals

Post a Comment for "Self Employment Government Website"