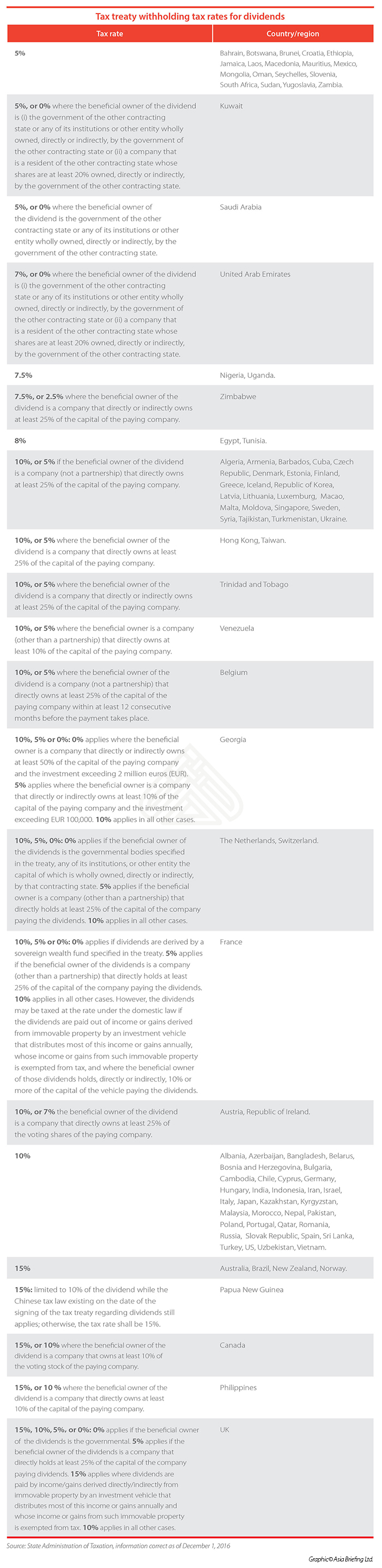

Withholding Tax Rates By Country 2019

Corporate - Withholding taxes. 7 withholding tax applies to dividend distributions from income obtained in two-year period.

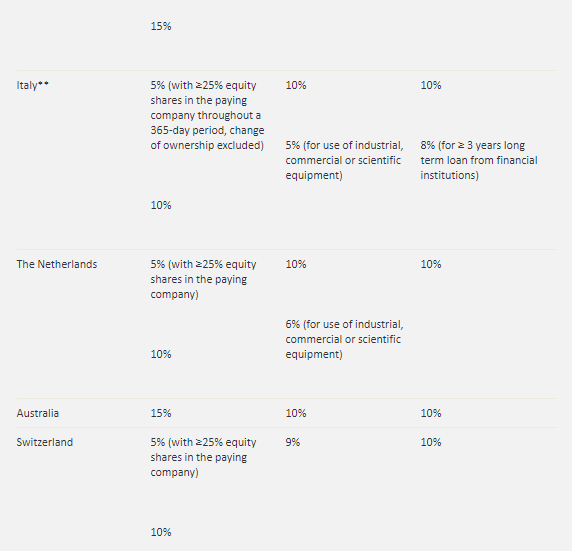

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Here is the withholding tax rate for some of the largest countries.

Withholding tax rates by country 2019. The average tax rate among the 218 jurisdictions is 2279 percent. Withholding Tax Rates 2020. Income taxes on certain income profit or gain from sources within the United States.

List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical. The Finance Act for 2018 provides that the withholding tax applicable to companies on dividend payments will be aligned to the French corporate tax rate as of January 1 2020 see Tax Rates. Twenty-eight countries have effective marginal tax rates higher than 50 percent.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income. P250000 30 over p15385. 226 rows A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in.

P57692 25 over p7692. 25 15 effective rate for Americans due to tax treaty China mainland. Regional differences are analyzed in.

P942308 32 over P38462. P4634615 35 over P153846. Alongside Lithuania and Denmark Turkey 265 Finland 247 and the.

The average of all countries is 56 percent. The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US. The tax rate is 08 on sales below PLN 170 million and 14 for sales above PLN 170 million.

Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or. Tax information last updated on 1182019. The majority of the 218 separate jurisdictions surveyed for the year 2019 have corporate tax rates below 25 percent and 111 have tax rates between 20 and 30 percent.

Luxembourg Tax Filing Extension Individuals can file their 2019 report to March 31 2021 while for 2020 report both individuals and corporate can file their annual reports to June 30 2021. From Bulgaria at 29 percent to Sweden at 76 percent. Feb 2019 This table lists the income tax rates on interest dividends royalties and other income that is not effectiv ely connected with the conduct of.

All rates will be updated using the best information DOR has available. 153 rows The rate has increased from 7 to 10 for 3 years from 1 August 2019 to 31 July 2022 after which. Steves employer will use the 2019 withholding table for the entire year.

Withholding Tax Rates 2020 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. 2019 federal withholding. T The United States has the 84 th highest corporate tax rate with a combined statutory rate of 2589 percent.

8 Withholding Tax Study 2019 The table on the following page sets out the WHT rates applied on dividends distributed to funds resident in the respective countries compared with the WHT rates applicable to Luxembourg-. Lithuania 277 and Denmark 252 make the top five in both this category and the single-with-no-children category. Based on the Steves income the 2019 tax rates higher standard deduction and no exemptions Steves tax liability for 2019 will be 4393.

All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US-source payments such as dividends interest and royalties. There is wide variation in the effective marginal tax rates. 15 falling to zero starting.

The sales tax for the entire State of Indiana is 7. 000 20 over P4808. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Personal Income Tax Rate.

See Information Circular IC76-12 Applicable rate of part XIII tax on amounts paid or credited to persons in countries with which Canada has a tax convention. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Total withholding for 2019 will be 4390.

Therefore except for companies having a turnover equal or exceeding EUR250 million the withholding tax rate on dividends paid as from January 1 2020 is 28 percent. For non-residents of Canada withholding is 25 unless reduced by a treaty.

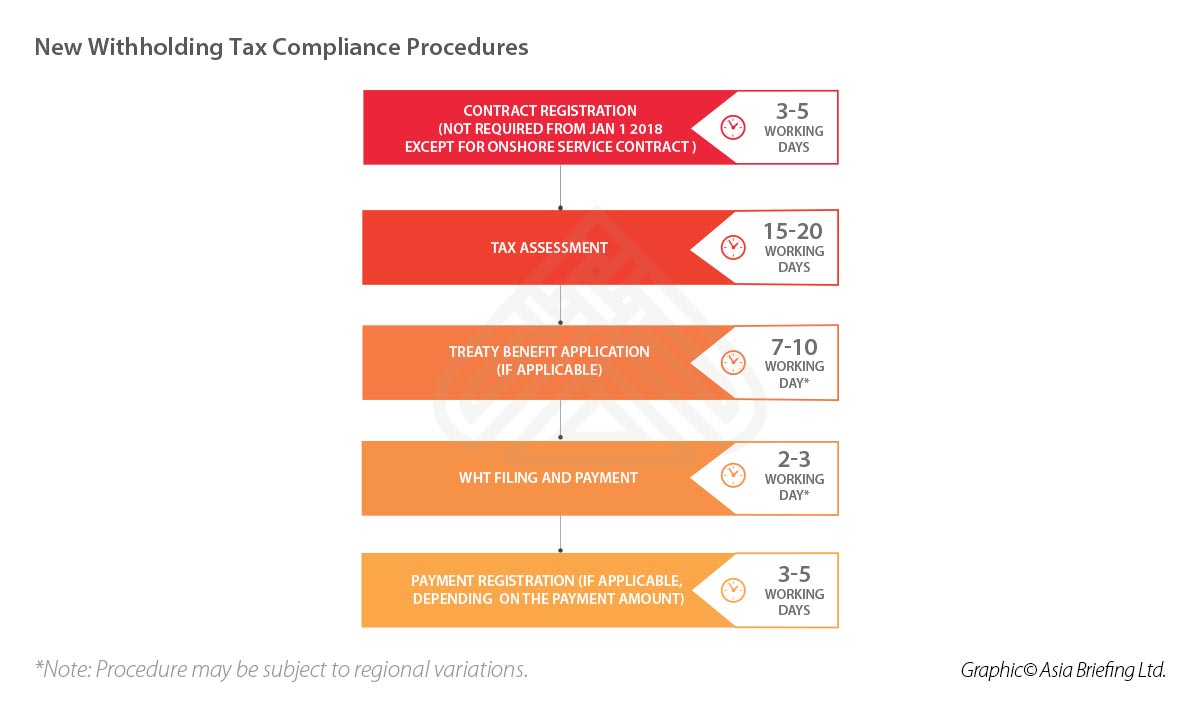

Withholding Tax In China China Briefing News

Withholding Tax In China China Briefing News

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Withholding Corporate Income Tax In China China Briefing News

Withholding Corporate Income Tax In China China Briefing News

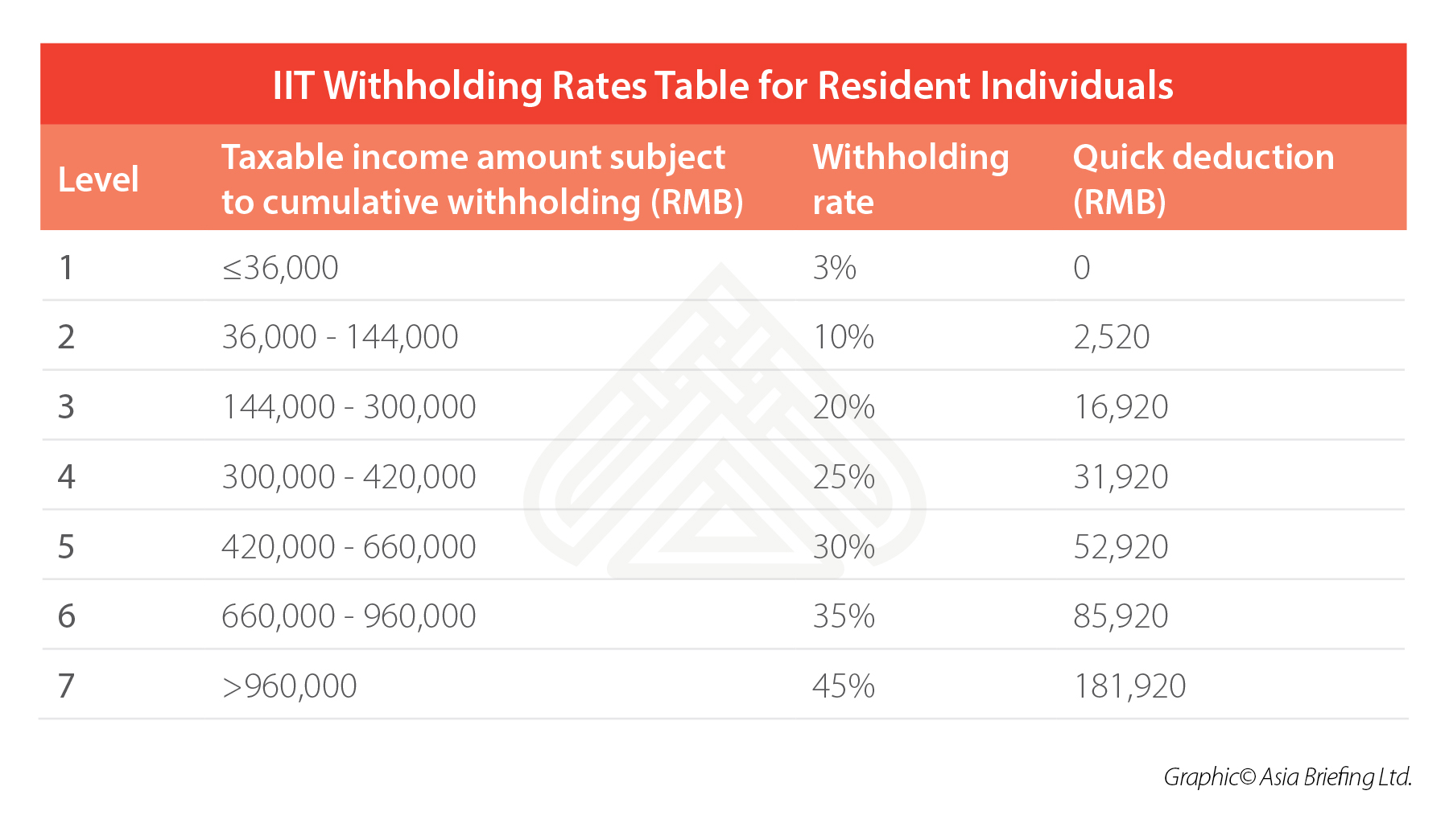

How To Calculate And Withhold Iit For Your Employees In China

How To Calculate And Withhold Iit For Your Employees In China

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Panama Tax Treaties Tax Panama

Panama Tax Treaties Tax Panama

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Current Withholding Tax Rate In Ghana 2018 Rating Walls

Current Withholding Tax Rate In Ghana 2018 Rating Walls

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

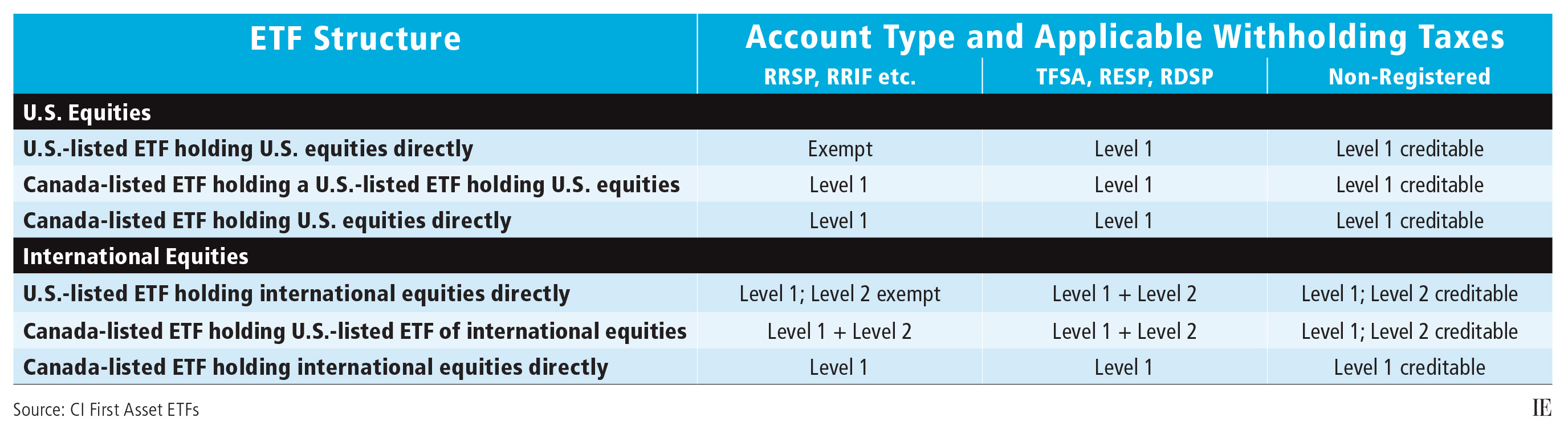

Etfs And Foreign Withholding Taxes Investment Executive

Etfs And Foreign Withholding Taxes Investment Executive

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Tax Refund Federal Income Tax Irs Taxes

Irs Just Released New 2020 Form W 4 Employee S Withholding Certificate Today Which Is The Form For You To Request How Tax Refund Federal Income Tax Irs Taxes

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Post a Comment for "Withholding Tax Rates By Country 2019"