Withholding Tax Rates On Bank Profit

Under Section 1511b banking company or financial institution shall collect the withholding tax from recipient of profit on debt at the time the profit on debt is credited to the account of the recipient or is actually paid whichever is earlier. Tax Received by individuals or AOPs and the profit is above Rs.

Making Sense Of Income And Tax Terms Irs Website Income Employer Identification Number

Making Sense Of Income And Tax Terms Irs Website Income Employer Identification Number

Profit or Yield Where profit or yield paid is up to Rate of Withholding Tax under Section 151 read with Division IA of Finance Act 2019.

Withholding tax rates on bank profit. Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or. Withholding tax collection on profit from bank deposits surges by 194pc. Under Section 151 of Income Tax Ordinance 2001 the withholding tax rate on profit on debt for filers is 10 percent with no limit on earned amount and 10 percent for non-filers up to Rs 05 million.

This method uses the tables that are on. 10 percent of the gross yield paid. Interest on bank deposits are subject to 10 and apply for residents and non-residents.

Like the Federal Income Tax Oklahomas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Ru ees five hundred thousand or less. Withholding Tax Rates Applicable Withholding Tax Rates.

1 st July 2019. Under the Income Withholding Tax Law of Oklahoma every person who as an officer of a corporation. Anjum Shahnawaz October 24 2019.

1M 10 machinery20 PROFIT ON DEBT st Section 151 Div. The tax rate shall be 10 percent of the gross yield profit on debt on payment of up to Rs500000. Received by Company 15 30 Adv.

The rate has increased from 7 to 10 for 3 years from 1 August 2019 to 31 July 2022 after which the 7 rate will apply again. The FBR said that where the profit on debt exceeds Rs36 million in a tax year section 7B will not be applicable and the profit on debt will not be separately taxed for. 10 10 NA.

No personal exemption Recap alert. The United States has income tax treaties or conventions with a number of foreign countries under which residents but not always citizens of those countries are taxed at a reduced rate or are exempt from US. Under US domestic tax.

Libya Last reviewed 03 December 2020 NA. Independent contractors realize a profit or suffer a loss as a result of their services and are legally. Oklahoma collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

P250000 30 over p15385. 10 percent of the gross yield paid. The sources said that the tax rate for non-filers driving profit on debt above Rs05 million may.

The percentage formula is a mathematical formula based on the Oklahoma personal income tax rates. However 175 percent withholding tax rate for non-filers driving profit on debt above Rs05 million. It is further informed that only Nation Tax Number NTN certificate is not sufficient proof for availing the normal rate of tax withholding ie.

The collection of withholding tax from profit on bank deposits registered unprecedented growth of 194 percent during first quarter of first fiscal year as the tax rates increased by 100 percent for persons not on the Active Taxpayers List ATL. Where profit on debt exceeds Rs25 million but does not exceed Rs36 million the tax rate shall be 20 percent. 10 on profit Return on accounts and 03 on cash withdrawal.

1M 125 25 Final Tax Received by individuals or AOPs and the profit is up to Rs. 62 rows Corporate - Withholding taxes. Between 2020 and 2021 many of these changes remain the same.

P57692 25 over p7692. Where profit on debt exceeds Rs5 million but does not exceed Rs25 million the tax rate shall be 175 percent. Income taxes on certain income profit or gain from sources within the United States.

Will be imposed when taxpayer fails to pay tax when due and such failure is not corrected within 15 days after the tax becomes delinquent. Last reviewed - 06 February 2021. IA Part III 1 Sch.

Updated up to June 30 2020. 2001 vide Finance Act 2019 new rates of Withholding Tax on Profit of National Savings Schemes under Section 151 shall be as under wef. No withholding allowances on 2020 and later Forms W-4.

The following are aspects of federal income tax withholding that are unchanged in 2021. P4634615 35 over P153846. These withholding rates are designed to cover the approximate tax that will be due for taxpayers with standard deductions.

Where yield is up to Rs. 500000 10 Final Tax Others. P942308 32 over P38462.

Interest at the rate of 125 per month is due on any amount not paid by the due date. Income tax withholding schedules provide graduated tax rates to be withheld by employers each pay period giving considerations to a wage earners marital status and the number of withholding allowances claimed. Liechtenstein Last reviewed 15 January 2021 NA.

According to withholding tax card for tax year 2019 the Federal Board of Revenue FBR said that profit on debt paid by banking company or financial institutions on account or deposit maintained shall collect withholding tax rates as per following. Notably Oklahoma has the highest maximum marginal tax bracket in the United States. Non-filer up to Rs500000.

Rate TY 2018-19 700 1300 WITHHOLDING TAX DEDUCTION CHART DIVIDEND IN CASH OR IN SPECIE PROFIT ON DEBT Dividend In cash or in specie. 150 236 S Contract for construction assembly installation projects supervisory activities advertisement services rendered by TV Satellite Channels Profit on debt up to Rs. 000 20 over P4808.

Oklahoma Income Withholding Tax may be personally liable to the State of Oklahoma for the taxes. 10 10 75.

Types Of Withholding Tax Malaysia Sap Simple Docs

Types Of Withholding Tax Malaysia Sap Simple Docs

2020 Income Tax Withholding Tables Changes Examples Income Tax Tax Brackets Filing Taxes

2020 Income Tax Withholding Tables Changes Examples Income Tax Tax Brackets Filing Taxes

How To Reduce Withholding Taxes On The Sale Of U S Property Madan Ca

How To Calculate Agi From W 2 Tax Prep Checklist Federal Income Tax Tax Deductions

How To Calculate Agi From W 2 Tax Prep Checklist Federal Income Tax Tax Deductions

Rental Income Tax Everything You Need To Know Fortunebuilders Rental Income Income Tax Tax Refund

Rental Income Tax Everything You Need To Know Fortunebuilders Rental Income Income Tax Tax Refund

Firs S Vat Of N29 2 Million Imposed On Bank Reversed By Tribunal Revenue Capital Market Accounting

Firs S Vat Of N29 2 Million Imposed On Bank Reversed By Tribunal Revenue Capital Market Accounting

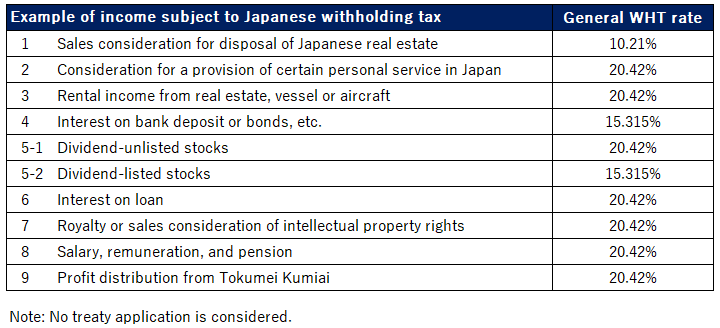

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Pakistan

How To Become Active Taxpayer In Fbr Income Tax Income Tax How To Become Pakistan

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Income Tax Consultant Services In Delhi Income Tax Income Tax Services

Income Tax Consultant Services In Delhi Income Tax Income Tax Services

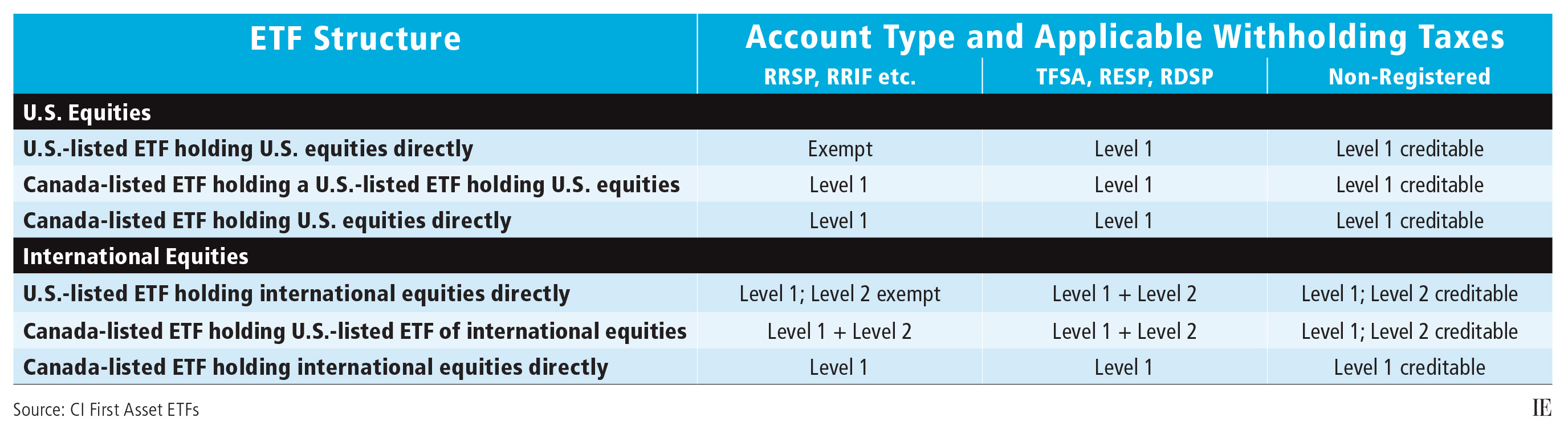

Etfs And Foreign Withholding Taxes Investment Executive

Etfs And Foreign Withholding Taxes Investment Executive

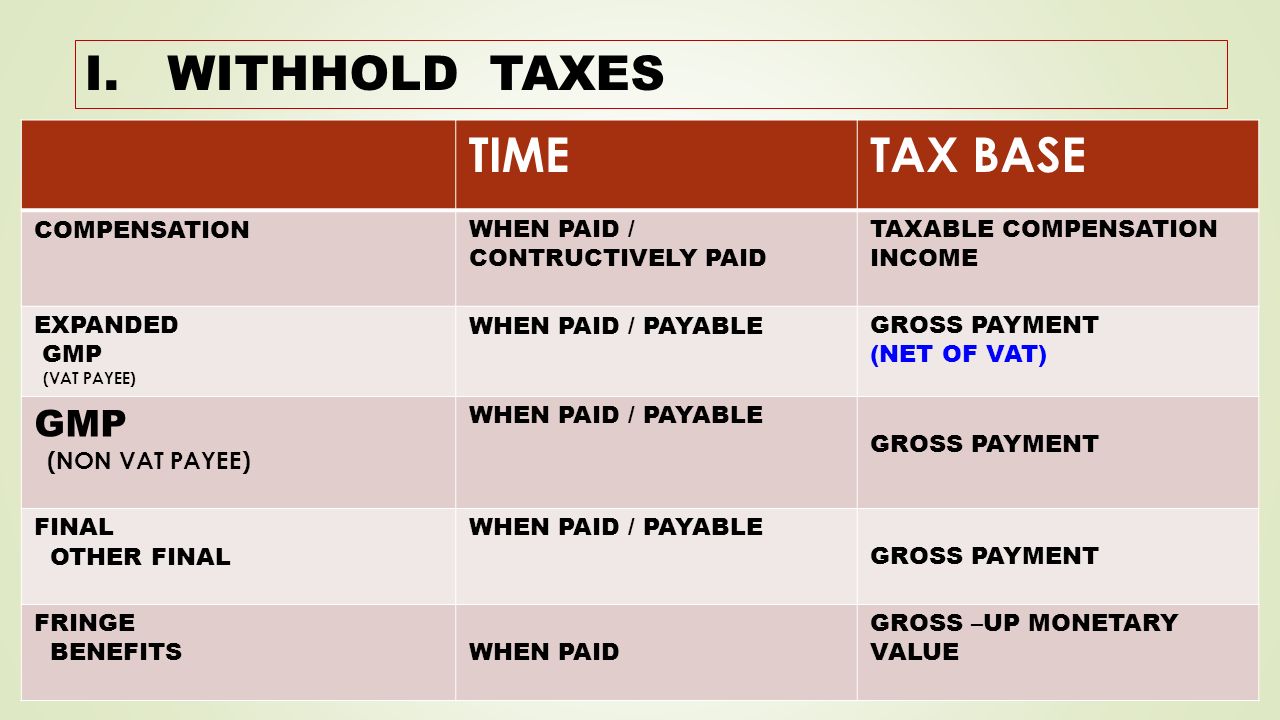

Withholding Tax On Government Money Payments Ppt Video Online Download

Withholding Tax On Government Money Payments Ppt Video Online Download

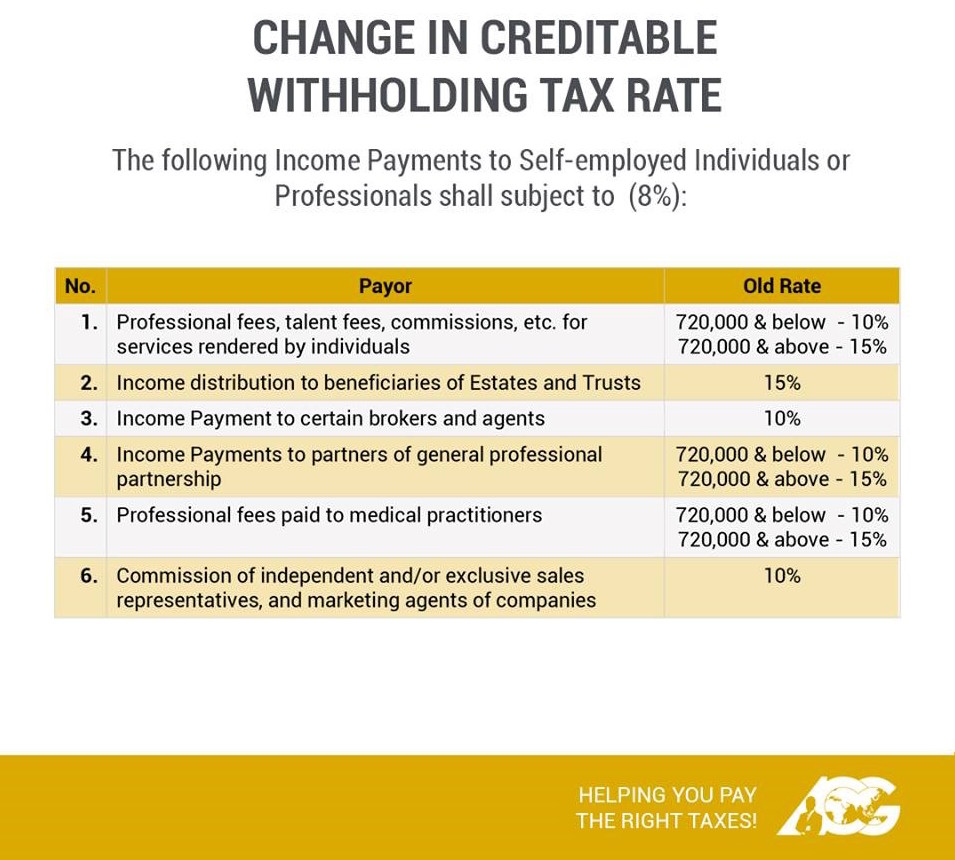

Types Of Withholding Tax Malaysia Sap Simple Docs

Types Of Withholding Tax Malaysia Sap Simple Docs

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Post a Comment for "Withholding Tax Rates On Bank Profit"