Employment Expenses And Work-from-home Reddit

You cannot claim tax relief if you choose to work from home. Its graphics intense work so the power use isnt negligible.

How To Use Quora Reddit And Slideshare As Small Seo Tool Seo Tools Social Sites How To Get Followers

How To Use Quora Reddit And Slideshare As Small Seo Tool Seo Tools Social Sites How To Get Followers

The company behind tax software program TurboTax and business software program QuickBooks has 9400 employees worldwide and was named by Fortune as one of the best companies to work for 19 years.

Employment expenses and work-from-home reddit. My main concern is the considerable amount of electricity to run the computers and screens 8 hours a day. CRA allows all employees who worked from home during the COVID-19 pandemic in 2020 to claim up to 400 in employment expenses as a flat rate. Even though the federal deduction for unreimbursed business expenses was eliminated in 2018 for individual employees some states still allow you to deduct them.

If you carry tools instruments or other items in your car to and from work you can deduct only the additional cost of transporting the items. They must complete Form 2106 Employee Business Expenses to take the deduction. This amount is a tax deduction and not a credit which means you deduct it from your income to.

Technical Recruiting Manager 10. Here are the criteria for deducting home office expenses. Due to the coronavirus COVID-19 pandemic millions of employees who ordinarily work at an office or other workplace provided by their employers are now working at home.

Additionally the following are job-related expenses that were non-deductible in past years and will remain non-deductible for 2020. Claiming other employment expenses on line 22900 for example motor vehicle expenses as well as home work-space-in-the-home office supplies and certain phone expenses filing a 2019 or prior year tax return. Im wondering if any work from home expenses are eligible to claim in my taxes.

CHASING RECRUITMENT THE RESERVE LIST PRE-EMPLOYMENT CHECKS WHEN DO I HAND MY NOTICE IN WHERES MY RUDDY CONTRACT IVE GOT AN INTERVIEW AND IM BRICKING IT 103. The electricity charges for Mar 2020 to Jun 2020 based on actual usage are as follows. You have to be using the workspace to earn your employment income on a regular and continuous basis for meeting clients customers or other people in the course of your employment duties.

Help Reddit App Reddit coins Reddit premium Reddit gifts. My job went work from home as of March 20th. Ms A was required to work from home from 1 Apr 2020 till 30 Jun 2020 and was the only person in the household working from home.

Business Marketing Manager 7. Additional costs include things like heating metered water bills home contents insurance business calls or a new broadband. Work from home expenses.

Learning Experience Designer 9. Employees who receive a paycheck or a W-2 exclusively from an employer are not eligible for the deduction even if they are currently working from home the IRS noted last month. While employees can no longer deduct their work at home expenses make sure you know how you might get reimbursed for these costs including as qualified disaster relief payments.

You have to perform more than 50 of your work or. According to research as much as 84 of remote workers prefer to work from home despite the popular image of remote workers who often travel and work from coffee shops. The employee can be reimbursed for a pro-rata share of their home expenses insurance property tax or rent utilities internet repairs and maintenance and mortgage interest to name the most common.

As sizeable numbers of workers continue to work from home due to the COVID-19 pandemic it may be time for businesses that have not offered to reimburse remote employees work-related expenses to. You must use Form T777 to claim your home office expenses if you are. Cell phone or landline plan.

Communications Senior Associate 5. For the duration of the pandemic many employees will be forced to work from home. If someone falls into one of these employment categories they are considered a qualified employee.

Senior Financial Analyst 6. If youre interested in working from home with Reddit here are some of the best remote job opportunities you can access. While you can no longer get a tax deduction for work at home expenses.

You cannot deduct commuting expenses for transportation between your home and your regular place of work. 170 base month Apr. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions unless they are a qualified employee or an eligible educator.

Employers therefore could be required to reimburse employees who are forced to work from home during the COVID-19 epidemic for their reasonable and necessary home office expenses which may include a portion of the expenses associated with. Employees who worked at home in 2020 due to COVID-19 and meet certain conditions will be eligible to deduct home office expenses work-space-in-the-home expenses office supplies and other expenses such as employment use of a cell phone long distance calls for employment purposes etc. This may have something to do with the fact that you can have some of your home office expenses covered much easier than if you were to make other remote work.

If the home office is a 1010 room 100 square feet and the entire home is 2000 square feet 5 of the home expenses can be reimbursed.

Mckinsey Getting Real About What It S Like To Work There Consulting

Mckinsey Getting Real About What It S Like To Work There Consulting

Reddit Buys 5 Second Super Bowl Ad With Nod To Gamestop Saga In 2021 Marketing Budget How To Raise Money Stock Trading

Reddit Buys 5 Second Super Bowl Ad With Nod To Gamestop Saga In 2021 Marketing Budget How To Raise Money Stock Trading

Quit Your Job When Money Sense Social Media Marketing Business Financial Advice

Quit Your Job When Money Sense Social Media Marketing Business Financial Advice

Home Even Keel Ops Business Savvy Business Expense Small Business Marketing

Home Even Keel Ops Business Savvy Business Expense Small Business Marketing

A Quick And Easy Response To All Those Real Jobs Are Pyramid Schemes People Antimlm Pyramid Scheme Anti Mlm Financial Planning

A Quick And Easy Response To All Those Real Jobs Are Pyramid Schemes People Antimlm Pyramid Scheme Anti Mlm Financial Planning

What Should I Be When I Grow Up Many Kids Ask This Question They Should Be Encouraged To Dream Big And Follow Th Jobs For Teens List Of Jobs List

What Should I Be When I Grow Up Many Kids Ask This Question They Should Be Encouraged To Dream Big And Follow Th Jobs For Teens List Of Jobs List

Resume Format Indeed Resumeformat Job Resume Resume Writing Chronological Resume

Resume Format Indeed Resumeformat Job Resume Resume Writing Chronological Resume

Mom Tells Babysitter To Be Grateful For 8 An Hour To Watch Three Toddlers Babysitter Scary Mommy Post Moms

Mom Tells Babysitter To Be Grateful For 8 An Hour To Watch Three Toddlers Babysitter Scary Mommy Post Moms

Want To Raise Your Credit Score Amazingly Fast Read This Reddit Post Now Credit Score Credit Repair Diy Credit Repair

Want To Raise Your Credit Score Amazingly Fast Read This Reddit Post Now Credit Score Credit Repair Diy Credit Repair

How To Make Money With Reddit 5 Definitive Ways

How To Make Money With Reddit 5 Definitive Ways

Payscale S Salary Negotiation Guide Salary Negotiation Advice From Reddit

Payscale S Salary Negotiation Guide Salary Negotiation Advice From Reddit

Worksource Oregon Employment Department Employment Support Employment And Support Allowance 2019 20 Pers Employment Application Employment Credit Check

Worksource Oregon Employment Department Employment Support Employment And Support Allowance 2019 20 Pers Employment Application Employment Credit Check

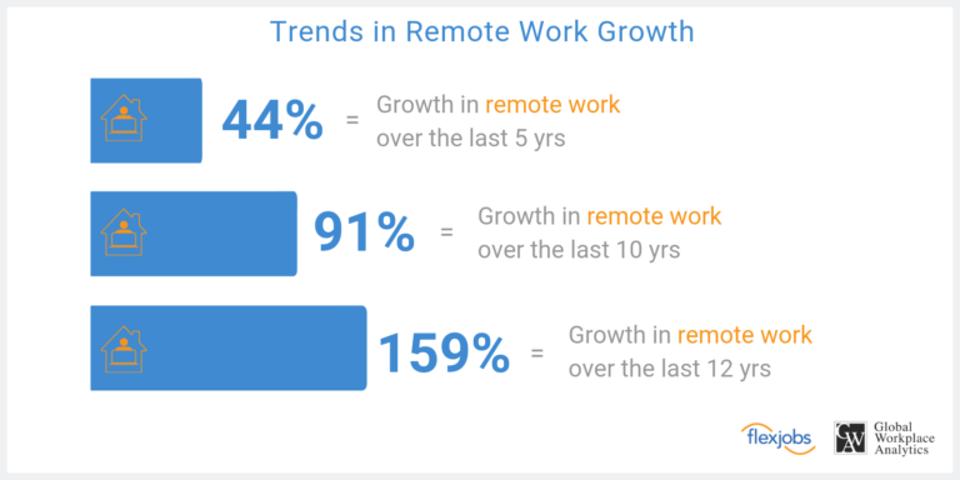

Why Reddit S Remote Work Policy Is Different Axios

Why Reddit S Remote Work Policy Is Different Axios

Work From Home 2020 The Top 100 Companies For Remote Jobs

Work From Home 2020 The Top 100 Companies For Remote Jobs

The Next Hot Job Pretending To Be A Robot Job Pretend Robot

The Next Hot Job Pretending To Be A Robot Job Pretend Robot

Silicon Valley Rethinks The Home Office Wired

Silicon Valley Rethinks The Home Office Wired

Legit Online Jobs For Beginners That Pay So You Can Work From Home Elna Cain

Legit Online Jobs For Beginners That Pay So You Can Work From Home Elna Cain

Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

Post a Comment for "Employment Expenses And Work-from-home Reddit"