Employment Expenses Hmrc Manual

Employee expenses Expenses which are reimbursed. EIM01475 - Employment income.

Funding Report Template 6 Templates Example Templates Example Report Template Templates Report

Funding Report Template 6 Templates Example Templates Example Report Template Templates Report

Office supplies you can reclaim VAT on purchases made by employees directors and contractors.

Employment expenses hmrc manual. 22 May 2014. For expenses necessarily incurred in the performance of the duties and sections 338 and 339 allow a deduction for expenses attributable to the. However the following points are noteworthy.

On 23 November 2020 HMRC updated its employment income manual to confirm that where an annual function is provided virtually using IT then the 150 benefit exemption available to annual parties and social functions cab be applied provided all other conditions are also met. Alison is a sales manager. Introduction You should check the other guidance available on GOVUK from HMRC.

In these situations the strict rules for expenses payments must be satisfied. HMRC internal manual Employment Income Manual. Tax years begin and end on the last Friday in April.

It must not be for example partly for another role or job. HM Revenue Customs Published. HMRC internal manual Employment Income Manual.

This has been reproduced in the Appendix and also be read online at. Reimbursement of pre-employment training expenses. She is asked to attend a special sales event in the evening.

If youre newly self-employed click on the link below to HMRC website. When an expense is reimbursed HMRC has to be satisfied that the expense is allowable for tax purposes otherwise the reimbursement from your employer is treated as additional taxable income. Selecting the right one will depend on your reasons for needing a return.

There is more information in HMRCs employment manual on GOVUK about employment expenses incurred by employees and their reimbursements. HMRC internal manual Employment Income Manual. Payments to reimburse additional costs.

HMRC has published guidance for employers to Check which expenses are taxable if your employee works from home due to coronavirus COVID-19. Claims can be made up to four years after the end of the tax year in which the expense occurred. We have been asked to supplement the guidance in Booklet 490 by explaining our approach to benefits and expenses paid to employees.

HMRC internal manual Employment Income Manual. If you believe you need to complete a tax return you must inform HM Revenue Customs HMRC. EIM01235 - Employment income.

Mostly this is simply a re-statement of the tax rules as they apply generally for all employees. HMRC internal manual Employment Income Manual. Employment expenses P87 particularly as it ensures that HMRC have all the data they need.

EIM01472 - Employment income. There are mainly two forms to use. HM Revenue Customs Published.

22 May 2014. Expenses and benefits HMRC guidance in the Employment Income Manual at EIM 66700ff addresses the tax treatment of expenses and allowances for those working in the NHS. To complete and submit the form online you need to create a Government Gateway account.

In all cases youll need a VAT invoice. In addition HMRC provide details on GOVUK of how to get allowances and reliefs the method can vary depending on whether or not you complete a Self Assessment tax return. Broadband internet charges You should check the other guidance available on GOVUK from HMRC as Brexit updates to those pages are being.

For travel-related expenses eg. Hotel bills you can reclaim the VAT on expenses incurred by employees and directors but not contracted workers. Contents You should check the other guidance available on GOVUK from HMRC as Brexit updates to those pages are being prioritised before manuals.

If goods are for your business eg. Detailed guidance on expenses for specific occupations can be found on the HM Revenue and Customs website at httpwwwhmrcgovukmanualseimanualEIM31623htm. The expense must be less than your earnings in that particular job or role httpwwwhmrcgovukmanualseimanualEIM31658htm The expense must be wholly and exclusively for the particular employment.

Inter-relation with earnings and expenses. She pays a babysitter to look after her children.

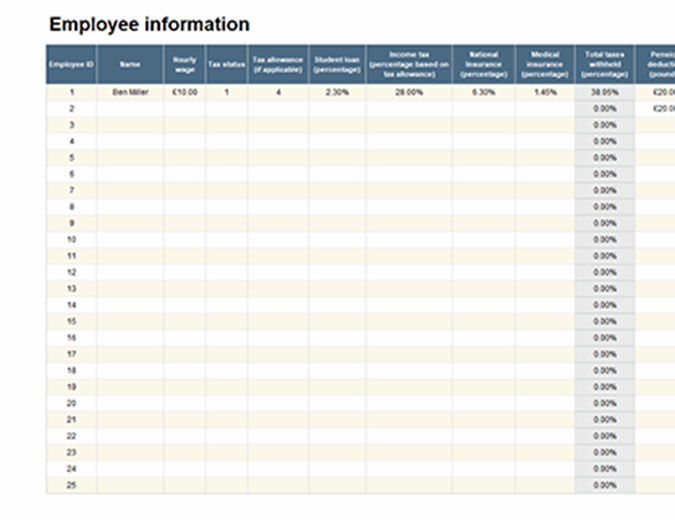

How To Run Standard Payroll Get Started Tutorial Quickbooks Uk

How To Run Standard Payroll Get Started Tutorial Quickbooks Uk

Illustrator Business Card Template With Bleed Illustration Business Cards Free Business Card Templates Business Card Template

Illustrator Business Card Template With Bleed Illustration Business Cards Free Business Card Templates Business Card Template

%20Saves%20You%20And%20Your%20Employee%20Thousands.png) How Temporary Workplace Relief Twr Saves You And Your Employee Thousands

How Temporary Workplace Relief Twr Saves You And Your Employee Thousands

Download Job Rejection Letter Excel Template Exceldatapro Job Rejection Rejection Lettering

Download Job Rejection Letter Excel Template Exceldatapro Job Rejection Rejection Lettering

Hmrc R D Report Template 2 Templates Example Report Template Templates Report

Hmrc R D Report Template 2 Templates Example Report Template Templates Report

Uk Utility Bill Template Bill Template Invoice Template Business Template

Uk Utility Bill Template Bill Template Invoice Template Business Template

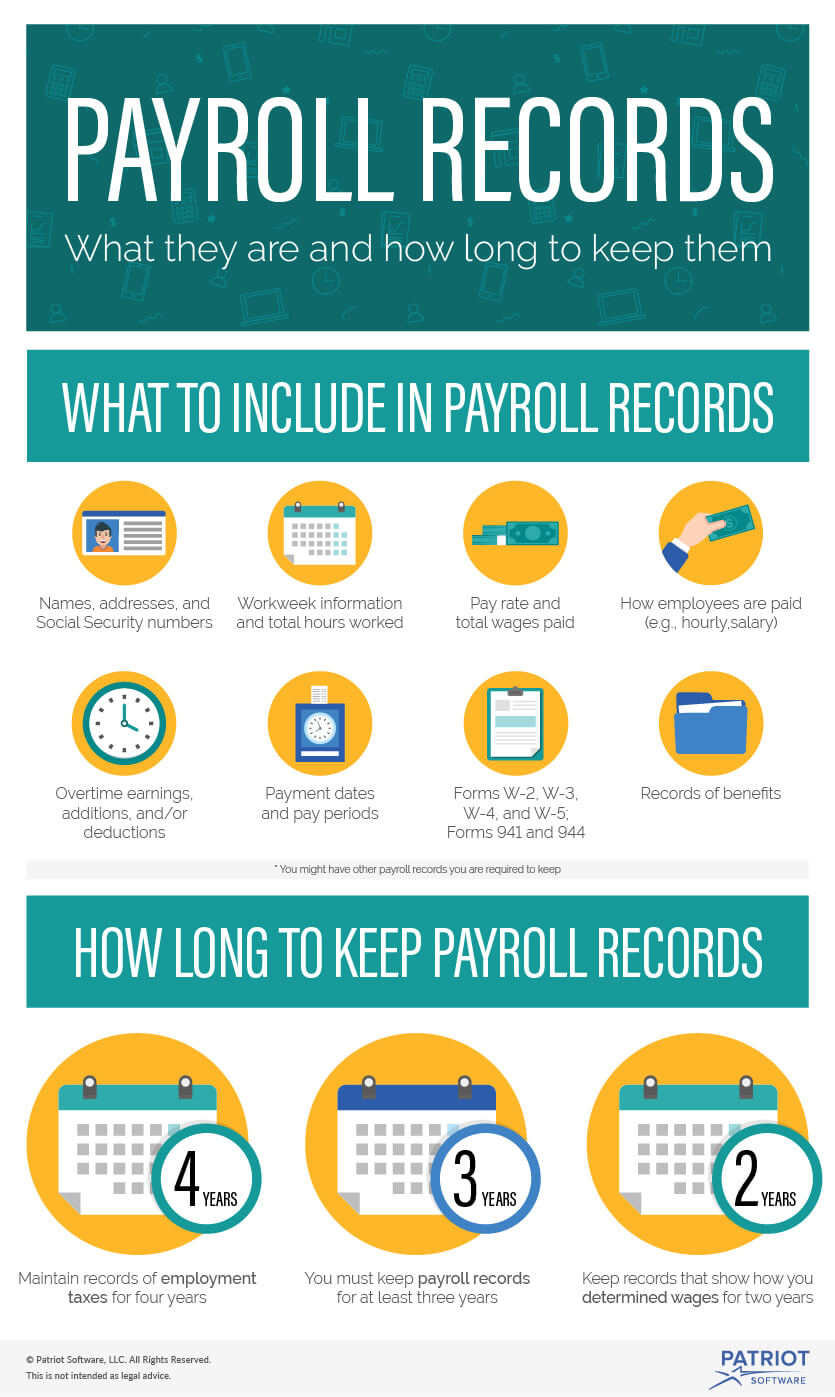

How Long To Keep Payroll Records Retention Requirements

How Long To Keep Payroll Records Retention Requirements

6 Month Progress Report Template 5 Templates Example Templates Example Progress Report Template Progress Report Report Template

6 Month Progress Report Template 5 Templates Example Templates Example Progress Report Template Progress Report Report Template

Pa Employee Email Login To Portal State Pa Us Web Access Email Service Login Page Email

Pa Employee Email Login To Portal State Pa Us Web Access Email Service Login Page Email

Factors In Determining Deemed Employment Status Finance Division

Factors In Determining Deemed Employment Status Finance Division

Self Employed Tax Dummies Guide To Tax And Self Employement

Self Employed Tax Dummies Guide To Tax And Self Employement

Funding Report Template 6 Templates Example Templates Example Report Template Templates Report

Funding Report Template 6 Templates Example Templates Example Report Template Templates Report

Are Directors Employed Or Self Employed Make An Impact Cic

Are Directors Employed Or Self Employed Make An Impact Cic

Tax Relief For Uniforms And Other Expenses Accounts House Ltd Uniform Tax Certified Accountant

Tax Relief For Uniforms And Other Expenses Accounts House Ltd Uniform Tax Certified Accountant

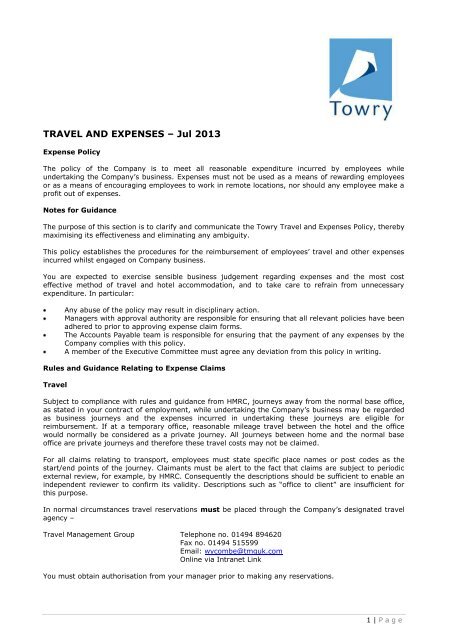

Travel And Expenses Tmg Corporate

Travel And Expenses Tmg Corporate

Post a Comment for "Employment Expenses Hmrc Manual"