Employment Related Expenses Ontario Works

Ontario Works or ODSP with earnings from employment a business or with amounts paid under a training program the exemptions can be applied immediately if the reapplication is made within six months of exiting assistance. Benefits may be available to help you with the costs of taking part in an employment activity getting a job or leaving Ontario Works for employment such as.

Cell Phone Reimbursement Policy For Employees Laws And Best Practices

Cell Phone Reimbursement Policy For Employees Laws And Best Practices

In most cases you must to participate in employment-related activities to get financial help.

Employment related expenses ontario works. Form T777S or Form T777 must be filed with your tax return. For example if the employee contribution is 100 you contribute 140. Application of Employment Supports.

Most employees cannot claim employment expenses. 733 a month for basic needs and shelter. If you are eligible for Ontario Works you could receive.

Help to cover costs when you are taking part in Employment Assistance Activities such as transportation or program fees. Adjusted annually the EI premium rate for employees is 162 as of 2017. Employment Assistance Activities Expenses.

You have to keep records for each year you claim expenses. Other Employment Employment Assistance Benefit OEEAB Full Time Employment Benefit FTEB Discretionary Benefits. You may be able to get help to cover costs eg.

Job-related expenses such as safety boots. Form T2200S or Form T2200 is. However rather than matching these premiums you contribute 14 times the employee contribution.

Program participants receive 250month for training-related expenses and may also qualify for technology supports andor transportation funds to. If you are eligible for Ontario Works the amount of money you get will depend on your specific situation. You cannot deduct commuting expenses for transportation between your home and your regular place of work.

Ontario Works financial assistance is intended to cover basic living expenses such as food clothing shelter and personal needs items. Transportation fees when you are taking part in Employment Assistance Activities. Do not include your supporting documents.

Get a job or. Ontario Works provides two kinds of help. To qualify for Ontario Works OW your family income and asset worth cannot be above a certain amount.

Child Care Costs. You also must withhold Employment Insurance EI premiums from paycheques. For more information see Keeping records.

You cannot deduct the cost of travel to and from work or other expenses such as most tools and clothing. Some examples of mandatory benefits include. Social assistance recipients may qualify for a number of mandatory and discretionary benefits over and above their monthly Ontario Works entitlement.

You may be able to get help to cover the costs of child care if you. Ontario Works Other Employment Employment Assistance Benefit OEEAB Employment Related Expenses ERE Full Time Employment Benefit FTEB 1. Claiming tax relief on expenses you have to pay for your work like uniforms tools travel and working from home costs Claim tax relief for your job expenses - GOVUK Cookies on GOVUK.

Help to cover the costs of child care if you get a job or are involved in an. Financial assistance and employment assistance to people who live in Ontario and are in temporary financial need. Employment Related Expenses.

The list below shows Ontario Works Training Programs to help prepare for employment self-employment or career advancement. If you carry tools instruments or other items in your car to and from work you can deduct only the additional cost of transporting the items such as. Enter the amount from Line 9368 on Form T777S or Form T777 on Line 22900 Other employment expenses on your tax return.

23 rows Money for Employment-Related or Training Costs Employment Related Expenses. For more information please contact your local Ontario Works office. Are involved in an employment activity.

Monthly Expense Report Template Excel Inspirational Expense Report Form Excel Expense Spreadshee Simple Spreadsheet Template Templates Business Template

Monthly Expense Report Template Excel Inspirational Expense Report Form Excel Expense Spreadshee Simple Spreadsheet Template Templates Business Template

Explore Our Sample Of Speaking Engagement Contract Template For Free Contract Template Contract Contract Agreement

Explore Our Sample Of Speaking Engagement Contract Template For Free Contract Template Contract Contract Agreement

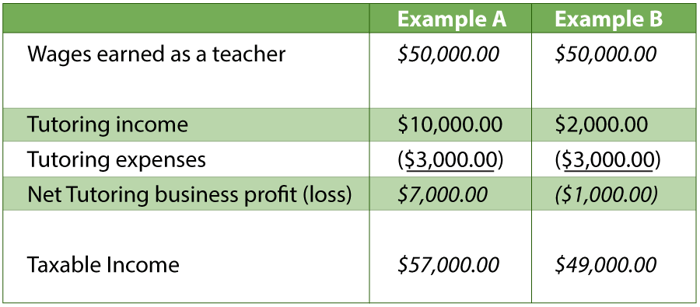

What Are Some Self Employed Tax Deductions In Canada

What Are Some Self Employed Tax Deductions In Canada

Expense Report Sample Template Traveling By Yourself Business Template Templates

Expense Report Sample Template Traveling By Yourself Business Template Templates

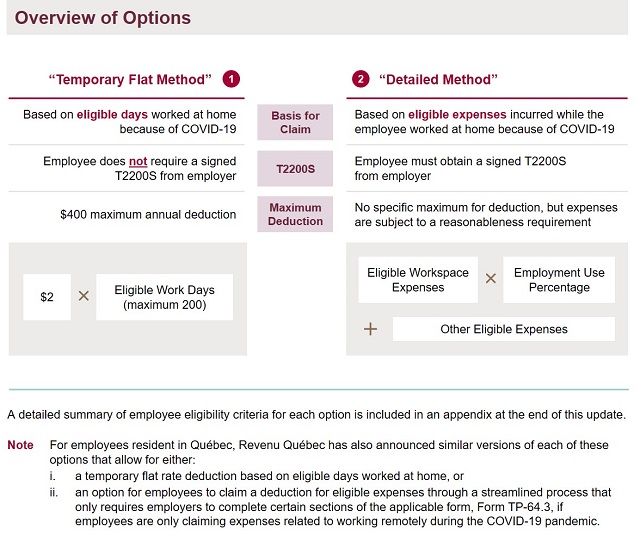

Employer Update Navigating The New Home Office Expense Deductions Announced By Cra Employment And Hr Canada

Employer Update Navigating The New Home Office Expense Deductions Announced By Cra Employment And Hr Canada

Web Development Contractfathatdesign Web Developer Contract With Regard To Website Development Agreement Website Development Web Development Contract Template

Web Development Contractfathatdesign Web Developer Contract With Regard To Website Development Agreement Website Development Web Development Contract Template

This Checklist Offers A Starting Point For Preparing To File Your Taxes Detailing The Information And Documentation Y Tax Checklist Income Tax Return Tax Prep

This Checklist Offers A Starting Point For Preparing To File Your Taxes Detailing The Information And Documentation Y Tax Checklist Income Tax Return Tax Prep

The Engagement Model Works Well For Companies Aiming At Reducing Expenses And For Companies Looking To Hire A Team Of E Dedication Development Engagement Model

The Engagement Model Works Well For Companies Aiming At Reducing Expenses And For Companies Looking To Hire A Team Of E Dedication Development Engagement Model

How Canadians Can Claim The 400 Work From Home Tax Credit Venture

How Canadians Can Claim The 400 Work From Home Tax Credit Venture

This Thursday November 9th 10am At Tcet Bramptonsouth Stop By The Ppg Dulux Hiring Event Hiring Store Sale Education And Training Job Fair Youth Programs

This Thursday November 9th 10am At Tcet Bramptonsouth Stop By The Ppg Dulux Hiring Event Hiring Store Sale Education And Training Job Fair Youth Programs

Project Transition Plan Awesome Project Proposal Plan Template Consumer Proposal Ontario Timesheet Template Budgeting Worksheets Statement Template

Project Transition Plan Awesome Project Proposal Plan Template Consumer Proposal Ontario Timesheet Template Budgeting Worksheets Statement Template

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

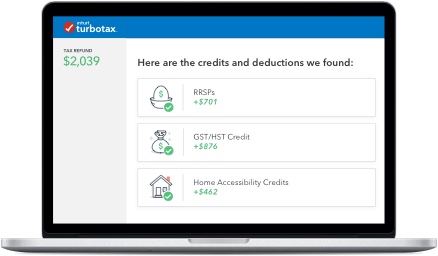

Self Employed Expenses Calculator Maximize Your Tax Savings By Estimating Your Business Expenses Turbotax Canada

Self Employed Expenses Calculator Maximize Your Tax Savings By Estimating Your Business Expenses Turbotax Canada

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Motor Car Tax Prep

Employee Expense Report Template 11 Free Docs Xlsx Pdf Spreadsheet Template Report Template Excel Spreadsheets Templates

Employee Expense Report Template 11 Free Docs Xlsx Pdf Spreadsheet Template Report Template Excel Spreadsheets Templates

Post a Comment for "Employment Related Expenses Ontario Works"