Hmrc Employment Tax Rates

These rates are applied after your tax free allowance has been deducted from your gross wage. Oklahoma collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Uk Payroll And Tax Information And Resources Activpayroll

Uk Payroll And Tax Information And Resources Activpayroll

HMRCs flat rate for employees is 4 per week or 18 per month.

Hmrc employment tax rates. Should you consider using these scale rates rather than reimbursing actual costs. This means that using this method you can only claim up to 216 per year. This represents the 12500 of tax-free income you can earn in this tax year.

Any gains falling above this threshold are subjected to CGT at 20 percent. This method uses the tables that are on pages 8 and 9. 92 if your total Class 1 National Insurance both employee and employer contributions is above 45000 for the previous tax year 103 if your total Class 1 National Insurance for the previous.

These withholding rates are designed to cover the approximate tax that will be due for taxpayers with standard deductions. Highlights from the broader tax news week ending 3 March which includes. Income tax withholding schedules provide graduated tax rates to be withheld by employers each pay period giving considerations to a wage earners marital status and the number of withholding allowances claimed.

Like the Federal Income Tax Oklahomas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. The actual costs method works the same way as it would if you were self employed. Oklahoma employers withholding tax accounts can.

Whilst the new rules from 6 April 2019 will make the use of HMRC scale rates attractive for many employers they will not be appropriate for everyone. From 6 April 2016 CGT is charged at 10 percent for basic rate taxpayers to the extent that their total income plus gains less any allowances are within the basic rate tax band ie. Protesting your Rate If you wish to protest your rate change you may do so by filling out our Employer Contribution Rate Protest Form and submitting to employerratesoescstateokus.

This requirement to limit the tax and NIC free scale rate is often overlooked. Welsh higher tax rate. What we know about claiming the HMRC allowance as new tax year starts According to the Office for National Statistics almost 47 per cent of people in employment.

For the 2020-21 tax year most basic rate HMRC taxpayers will have 1250 as their tax code number. 5 May 2015. If the employer applies to HMRC to bespoke use scale rates subsistence allowances for the purposes of the exemption for deductible expenses HMRC expects the employer to.

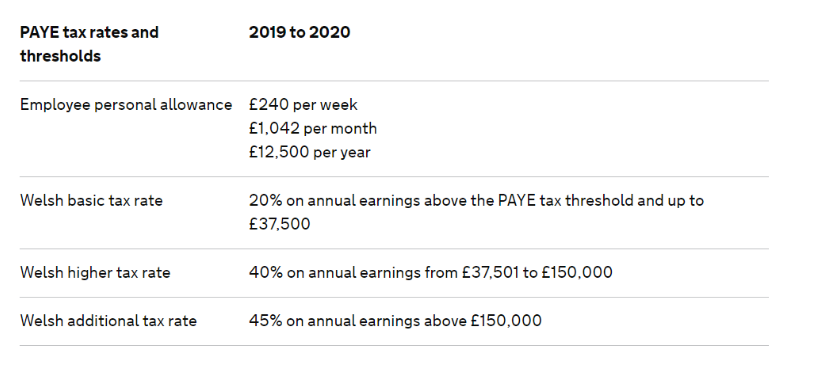

This button will take you to our EZ Tax Portal. 20 on annual earnings above the PAYE tax threshold and up to 37700. The rate is calculated using the information from the table in the Oklahoma Employment Security Act for a contribution rate of 28.

Welsh additional tax rate. 40 on annual earnings from 37701 to 150000. The percentage rate tables are based on the net wage amount.

Employer Contribution Rates for 2021. 200 increase to the Basic Rate tax bracket and a 70 increase in the Basic Personal Allowance means you can earn 270 more a year before crossing into the 40 higher rate threshold for 202122. Keep sufficient records to be able to demonstrate that the employee.

This represents the 12500 of tax-free income you can earn in this tax year. The percentage formula is a mathematical formula based on the Oklahoma personal income tax rates. Working from home tax relief.

This rate covers all expenses and applies irrespective of how many hours you work from home each month. Notably Oklahoma has the highest maximum marginal tax bracket in the United States. To compute the net amount of.

Publication date of Finance Bill 2021 updated guidance on NICs and benefits in kind latest fuel advisory rates and HMRC webinars for agents on off-payroll working and penalties for enabling tax. Addition of link to National Archive page on rates and allowances for previous years. Welsh basic tax rate.

HMRC approval to use advisory benchmark or bespoke scale rate payments. Learn more about the upcoming changes to 2021 rates how they are calculated and how to protest rates. As a for-profit business operating in Oklahoma you are required to pay Unemployment Insurance UI tax.

The 2015 to 2016 rates and thresholds for employers have been added.

Self Employed Tax Dummies Guide To Tax And Self Employement

Self Employed Tax Dummies Guide To Tax And Self Employement

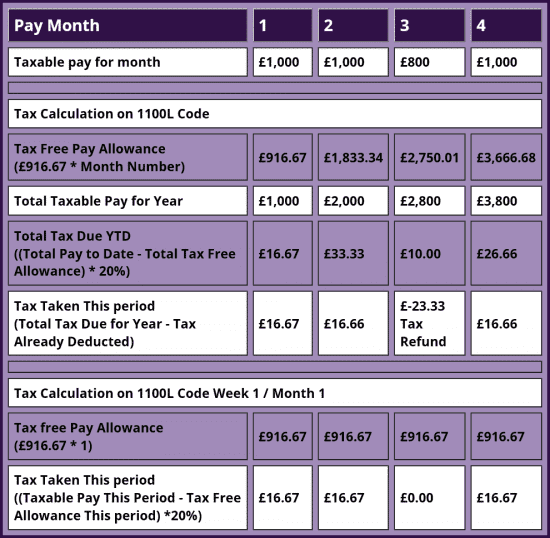

What Is A Week 1 Month 1 Tax Code Iris

What Is A Week 1 Month 1 Tax Code Iris

Uk Income Tax Rates 2019 20 What You Need To Know Mileiq Uk

Uk Income Tax Rates 2019 20 What You Need To Know Mileiq Uk

Uk Payroll And Tax Information And Resources Activpayroll

Uk Payroll And Tax Information And Resources Activpayroll

Understanding Payroll In The United Kingdom What Global Companies Need To Know About Uk Payroll

Understanding Payroll In The United Kingdom What Global Companies Need To Know About Uk Payroll

Uk Payroll And Tax Information And Resources Activpayroll

Uk Payroll And Tax Information And Resources Activpayroll

Https Taxvol Org Uk Wp Content Uploads 2019 10 Completing Your Online Tax Return 2020 Pdf

Uk Payroll And Tax Information And Resources Activpayroll

Uk Payroll And Tax Information And Resources Activpayroll

8 Facts About Per Diem Rates In Uk And Hmrc Guidelines For Companies

8 Facts About Per Diem Rates In Uk And Hmrc Guidelines For Companies

Hmrc Employment Allowance 2021 The Rules How To Claim

Hmrc Employment Allowance 2021 The Rules How To Claim

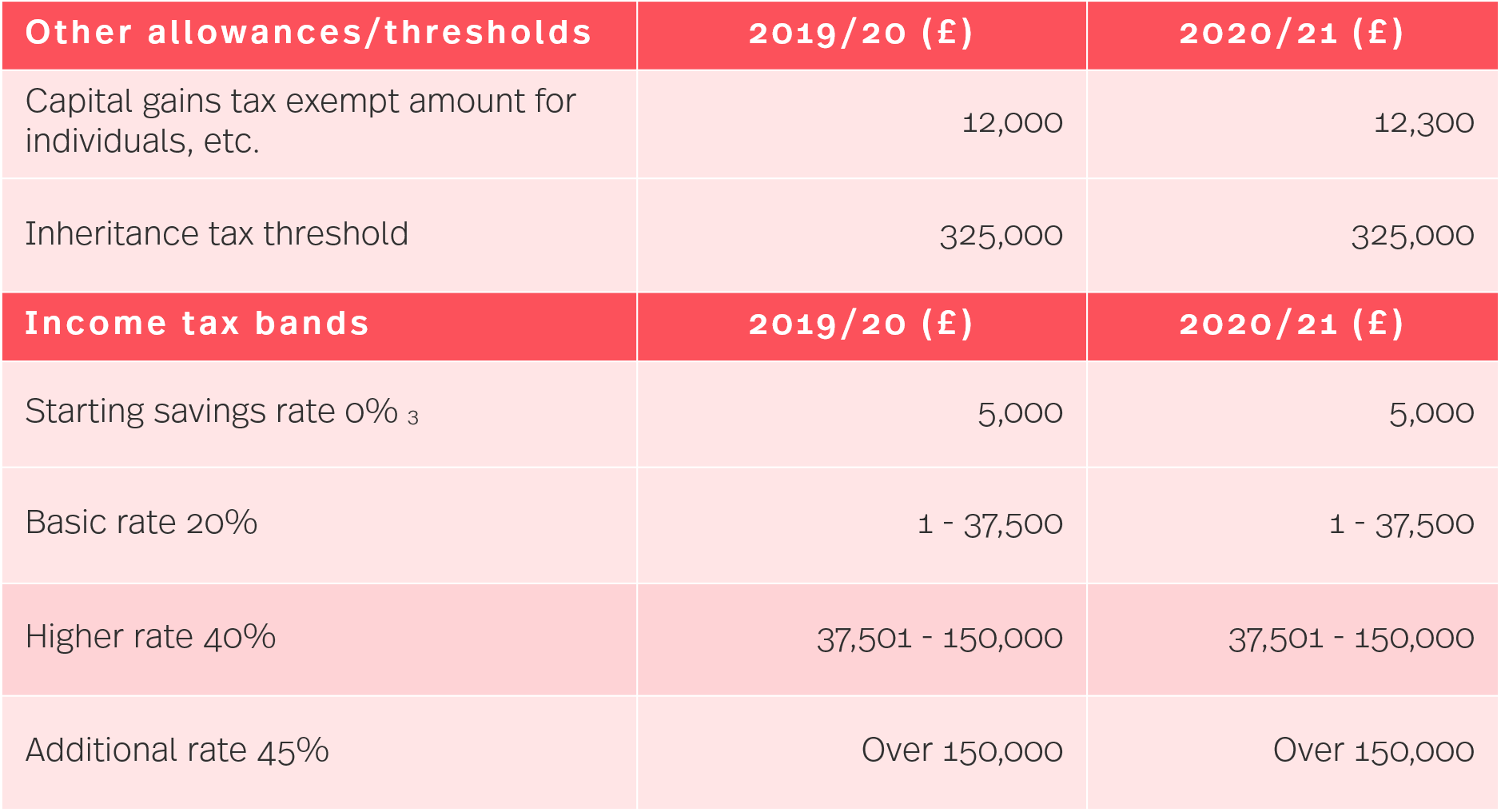

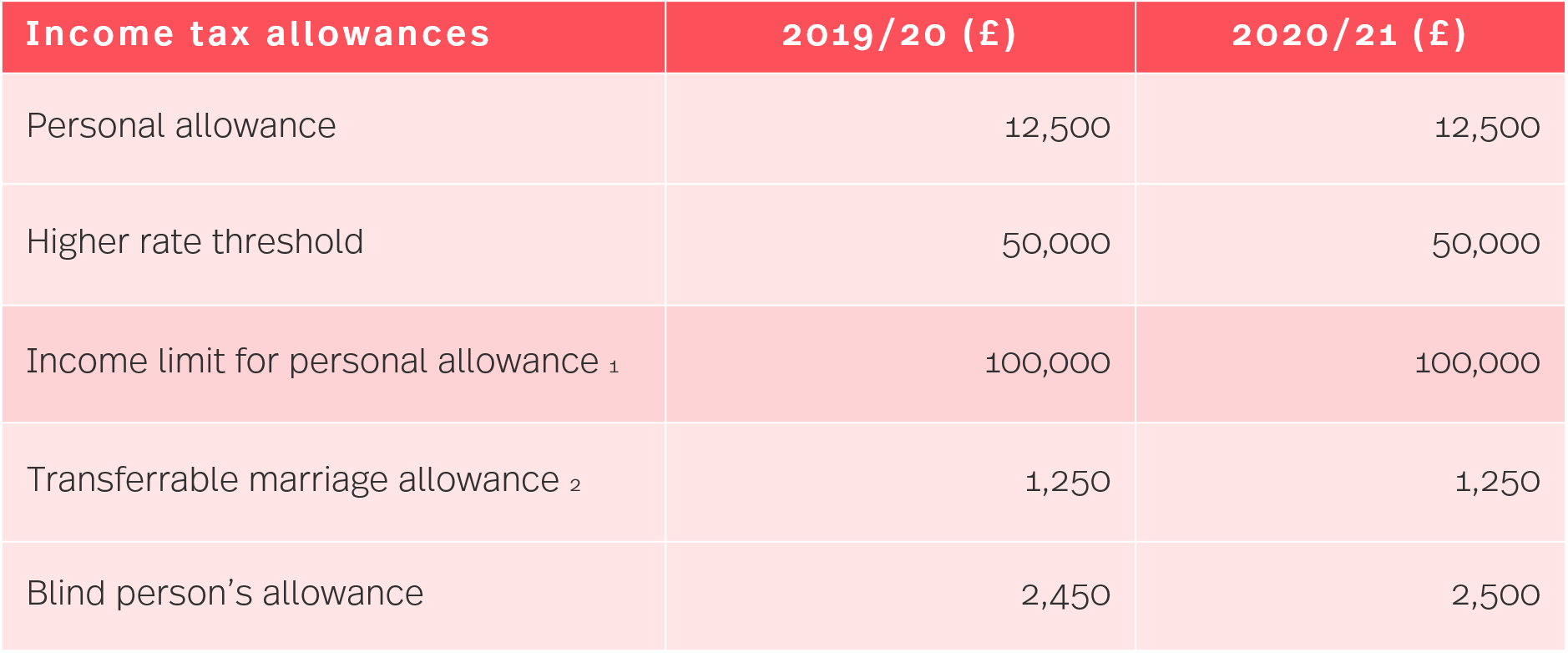

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

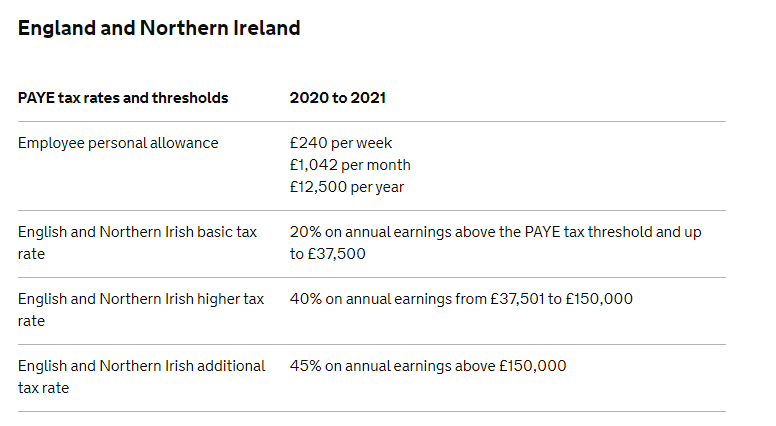

Rates Thresholds 2020 21 Brightpay Documentation

Rates Thresholds 2020 21 Brightpay Documentation

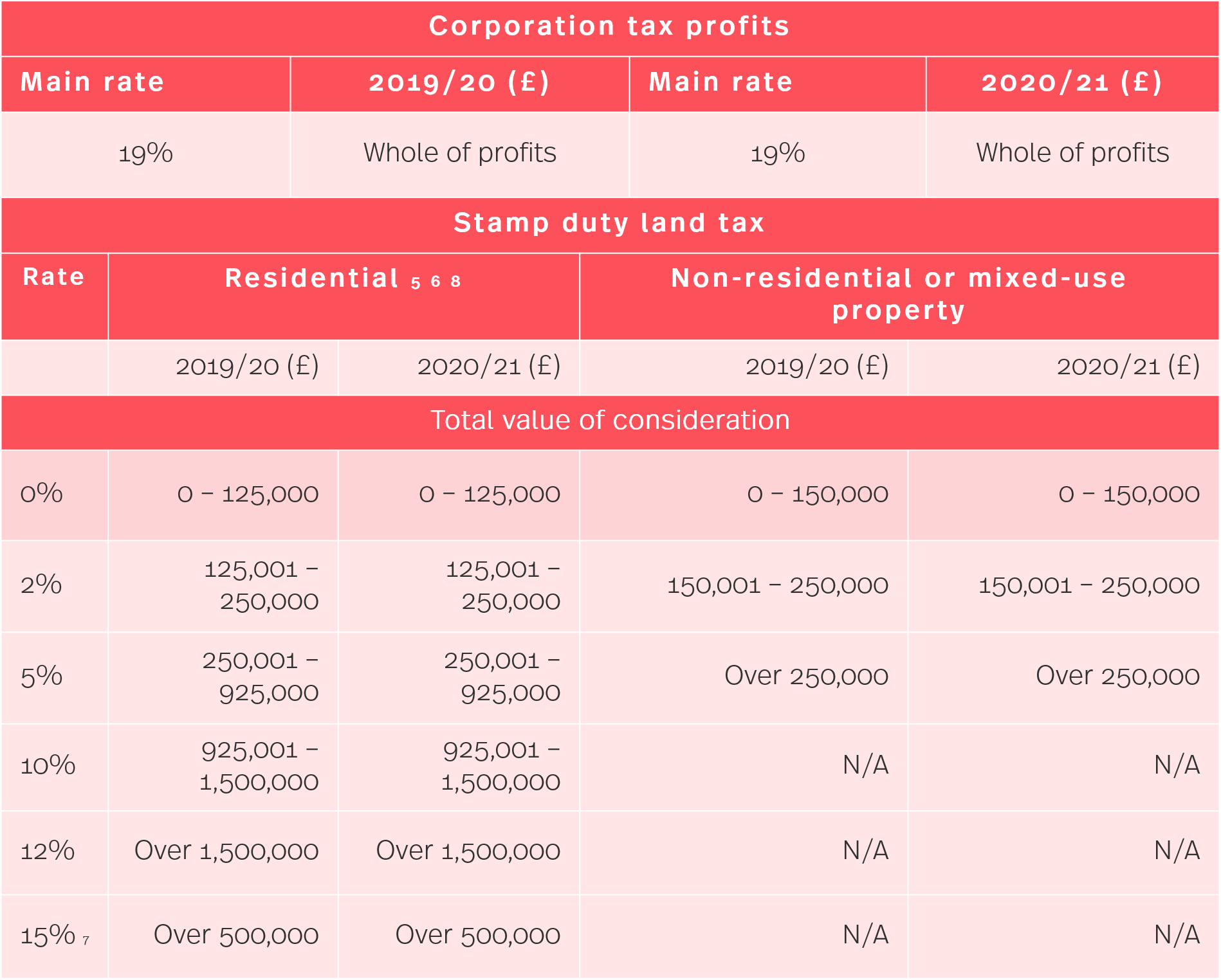

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Simmons Simmons Hmrc Tax Rates And Allowances For 2020 21

Welsh Rate Of Income Tax Brightpay Documentation

Welsh Rate Of Income Tax Brightpay Documentation

Employment Rights Act Zoom Tanzania Jobs And Employment 2018 2019 Employment Tribunal Heari Small Business Bookkeeping Employment Application Business Tax

Employment Rights Act Zoom Tanzania Jobs And Employment 2018 2019 Employment Tribunal Heari Small Business Bookkeeping Employment Application Business Tax

10 Ways To Cut Your Tax Bill Tax The Guardian

10 Ways To Cut Your Tax Bill Tax The Guardian

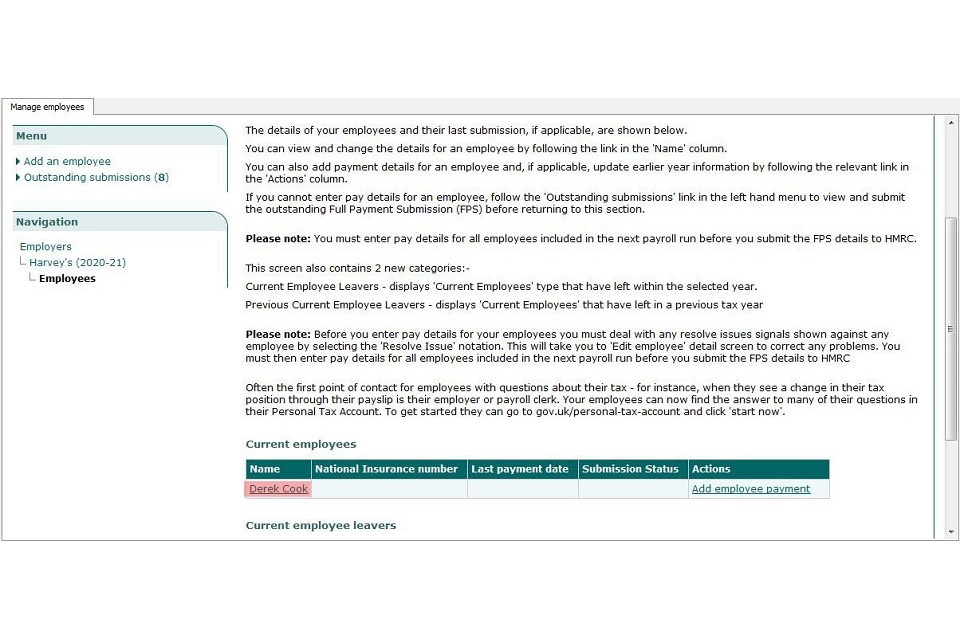

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Post a Comment for "Hmrc Employment Tax Rates"