Missouri Employment Tax Forms

Having trouble viewing a form. The Division of Employment Security administers the Unemployment Insurance benefit and tax system in Missouri.

The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide Form 4282 and withholding tax calculator have been updated.

Missouri employment tax forms. Please visit httpdssmogovchild-supportemployersnew-hire-reportinghtm for additional information regarding new. To search for archived forms from a previous tax year choose a year in the drop down menu. Unemployment Tax Registration MODES-2699 The Division uses the Unemployment Tax Registration to determine whether an entity is liable for unemployment tax as a new or successor employer.

Well answer all your questions and show you how to comply with wage tax and labor laws as a household employer. The form must be completed even if the entity is not liable so that the Division can follow up at a time when liability may have been achieved or eliminate the entity from further follow-ups. The Division of Workforce Development provides support to unemployed workers in finding a new job and advancing their career.

POPULAR FOR TAX PROS. Within 20 days of hiring a new employee send a copy of Form MO W-4 to the Missouri Department of Revenue PO. Division of Employment Security PO.

Be sure to verify that the form you are downloading is for the correct year. Form-4282 Revised 12-2019 Starting a new business. An individual who performs work services on a contract basis a self-employed individual or a sole proprietor file as a Type E-2 return.

Missouri Department of Revenue. Keep in mind that some states will not update their tax forms for 2021 until January 2022. EMPLOYER NAME AND ADDRESS 14FEDERALID NUMBER _____ If mailing return this page with remittance to.

GTM Can Help with Missouri Household Employment. Employers that are liable for Missouri unemployment tax contributions must provide the Division of Employment Security DES information on the wages of their covered employees each quarter. The Missouri Department of Revenue.

Call 800 929-9213 for a free no-obligation consultation with a household employment expert. Division of Employment Security. Form MO-1040ES is a Missouri Individual Income Tax form.

Employees with multiple employers may refer to our Completing a New MO W-4 If You Have More Than One Employer. Partnerships file a Type E-3 return. OF EMPLOYMENT SECURITY UNEMPLOYMENT INSURANCE TAX 573-751-1995 QUARTERLY CONTRIBUTION AND WAGE REPORT File online at uinteractlabormogov 1.

Auxiliary aids and services are available upon request to individuals with disabilities. To search type in a keyword andor choose a category. Division of Workforce Development.

190 rows Request for Photocopy of Missouri Income Tax Return or Property Tax Credit Claim. Individual workers wages are recorded on the DES wage record files and retained for five quarters to be used for determining monetary benefit entitlement should a worker file a claim for unemployment. And the Department of Labor and Industrial Relations Division of Employment Security want to make starting your business as easy as possible.

FORMS. Contact A Claims Center. Box 3340 Jefferson City MO 65105-3340 or fax to 573 526-8079.

In Missouri it is a joint state-federal program funded solely through tax contributions paid by employers so no deductions are made from employees paychecks for this insurance. Form E-234 is a business tax return to report and pay the earnings tax of 1 due. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money that is not subject to withholding such as self employed income investment returns etc are often required to make estimated tax payments on a quarterly basis.

Also issued as part of a kit with the same title and publication number. State of Missouri Employers. Employees should complete this form if they are going to have Kansas taxes withheld on their W-2.

Browser and Display Compatibility The Missouri Division of Employment Security is an equal opportunity employerprogram. Download Adobe Acrobat Reader. The Division of Employment Security DES supports the Departments vision statement by administering the states Unemployment Insurance UI program.

Missouri Form 2643 Use this form to register your business in Missouri for employment taxes sales taxes corporate taxes etc.

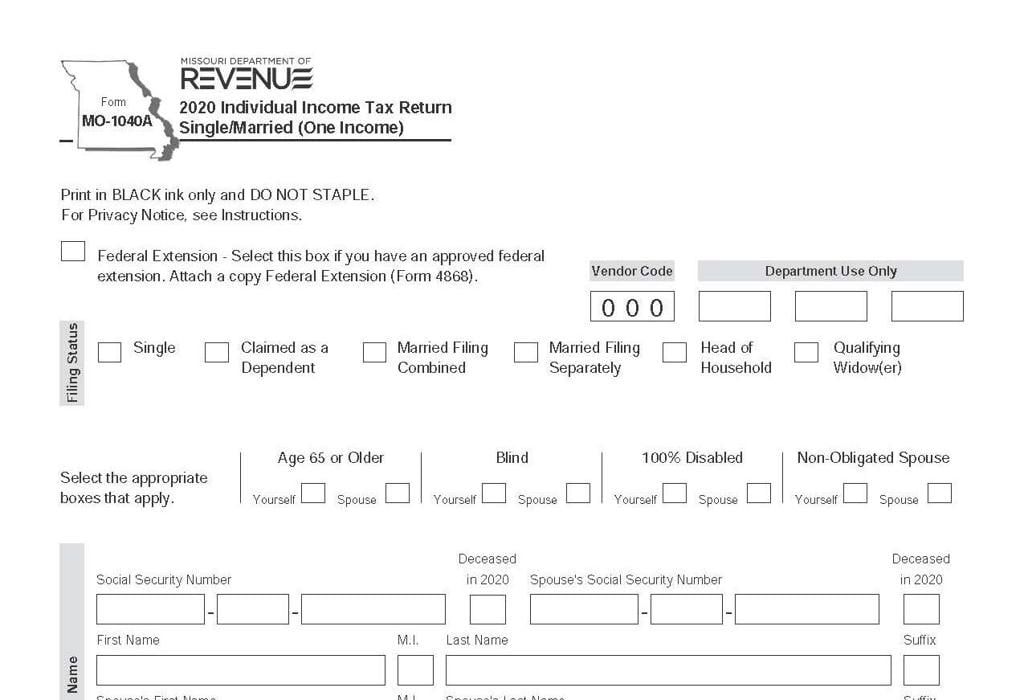

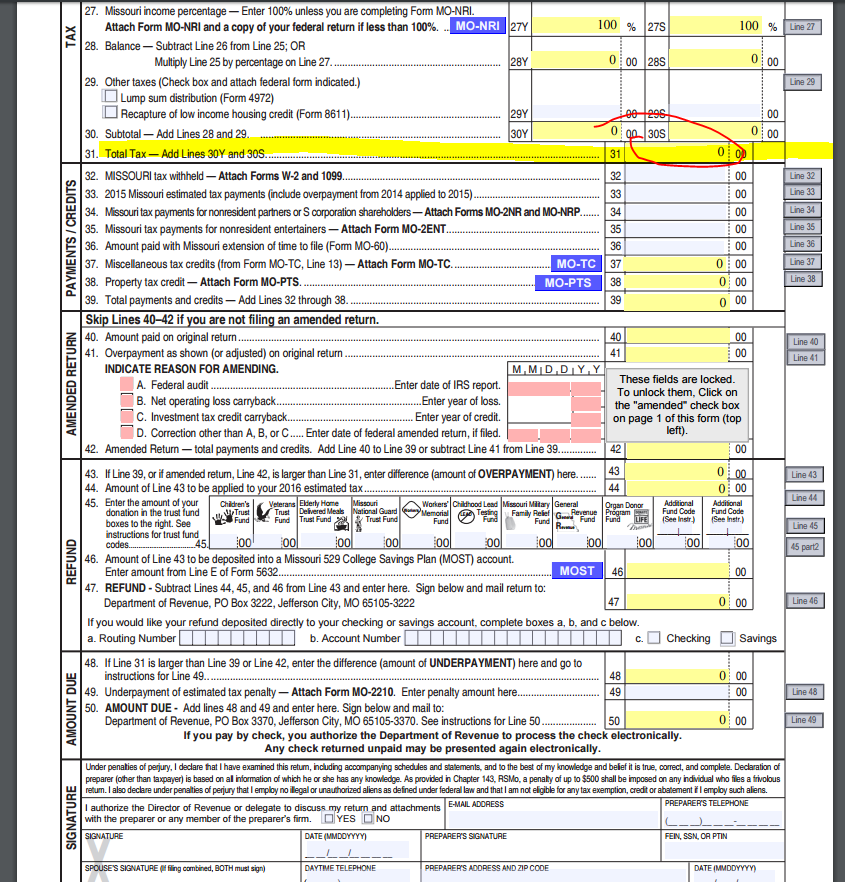

Https Dor Mo Gov Forms 5841 Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Free 7 Sample Unemployment Tax Forms In Pdf

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

Missouri Tax Power Of Attorney Form Power Of Attorney Power Of Attorney Form Attorneys

Missouri Tax Power Of Attorney Form Power Of Attorney Power Of Attorney Form Attorneys

Free Missouri Bill Of Sale Form Pdf Template Legaltemplates

Free Missouri Bill Of Sale Form Pdf Template Legaltemplates

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

Https Www Missouristate Edu Assets Financialservices Updateyourfederalw 4ontheemployeedashboard Pdf

I Live In Kansas But Work In Missouri Dimov Tax Cpa Services

I Live In Kansas But Work In Missouri Dimov Tax Cpa Services

Https Dor Mo Gov Forms Mo 1040 20fillable 20calculating 2014 Pdf

Https Dor Mo Gov Forms Mo 1040 20instructions 2017 Pdf

Online No Tax Due System Information

Online No Tax Due System Information

Https Dor Mo Gov Forms Mo 1040 20fillable 20calculating 2014 Pdf

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

Missouri Stops Printing Income Tax Forms In Bid To Go Online Only Politics Stltoday Com

1099 G Missouri Fill Online Printable Fillable Blank Pdffiller

1099 G Missouri Fill Online Printable Fillable Blank Pdffiller

Post a Comment for "Missouri Employment Tax Forms"