Wages Employment Law Ireland

The full names of the employer and the employee 2. If sick pay is paid it tends to be paid for a capped period of time and net of any benefit receivable from the Department of Employment Affairs and Social Protection the Department.

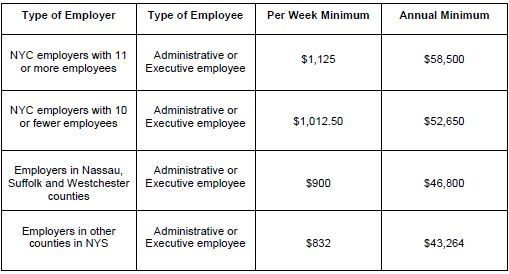

Year End Update On Nys And Nyc Employment Laws Employment And Hr United States

Year End Update On Nys And Nyc Employment Laws Employment And Hr United States

The full contract of employment does not have to be put in writing.

Wages employment law ireland. A Sectoral Employment Order SEO setting legally binding rates of pay and terms and conditions for the Electrical Contracting sector came into effect on the 1 September 2019. Terms of Employment Information Acts 1994 - 2012. Terry Gorry Co.

It follows a meeting between the Deputy Prime Minister and Minister for Trade and Deliveroo riders who were accompanied by union representatives and groups representing immigrants. Updates to Employment Law Explained Since we published our Employment Law Explained in September 2018 there have been changes under employment law. Employment Miscellaneous Provisions Act 2018 The Employment Miscellaneous Provisions Act 2018 was signed into law on 12 December 2018.

The address of the employer 3. Ireland - Government to review employment law - March 31 2021 The government is to review the employment law concerning workers in the gig economy. An experienced adult employee is a worker who has at least 2 years experience since turning 18 years of age.

The expected duration of the contract in the case of a temporary contract or the end date if the contract is a fixed- term contract 4. This legislation requires employers to provide a written statement to employees setting out certain basic terms of employment. Employment Equality Act 1998 to 2011 Irish legislation provides that equality rights and obligations are implied into the employment contract.

The weekly wage is capped to 600. If your employees are working for a regular wage or salary they automatically have a contract of employment. The Act applies to any person working under a contract of employment or apprenticeship or employed through an employment agency or in the service of the State.

An employee who has attained the age of 18 years shall receive at least 80 of the minimum wage in their first year after having commenced employment and at least 90 of the minimum wage in their second year after having commenced employment. Payment of Wages Act 1991. Employers are permitted to pay employees who are under 18 first-time job entrants or those undergoing structured training specified rates below.

SolicitorsThe Man to See. One of the fundamental terms of the contract of employment will be that dealing with paysalary. In Ireland there is no legal obligation for an employer to pay an employee while on sick leave unless the employer has agreed to do so in a contract or policy.

However your employee must receive a written statement of 5 core terms of. Minimum Wage Rates The minimum wage rate in Ireland since July 2011 is 865 for an experienced adult employee. Cutting wages therefore is a variation or change of a fundamental term of the contract and is a dangerous area for the employer.

All About Employment Law in Ireland. This Act establishes a range of rights for all employees relating to the payment of wages and the main rights established are a right to a readily negotiable mode of wage payment a right to a written statement of wages and deductions and protection against unlawful deductions from wages. Most importantly unlike the UK the total redundancy payment has no cap.

Within five days of starting work all employees must get a written statement of the following core terms of employment. Statutory repayments are 2 weeks per year of service plus a bonus weeks pay. It is unlawful for an employer to discriminate on any one of nine grounds in any area of employment including recruitment training and promotion.

Redundancy packages in Ireland are substantially more lucrative than in the UK which can become a bone of contention.

Year End Update On Nys And Nyc Employment Laws Employment And Hr United States

Year End Update On Nys And Nyc Employment Laws Employment And Hr United States

Germany S Minimum Wage Is Barely Above The Poverty Line Business Economy And Finance News From A German Perspective Dw 01 01 2019

Germany S Minimum Wage Is Barely Above The Poverty Line Business Economy And Finance News From A German Perspective Dw 01 01 2019

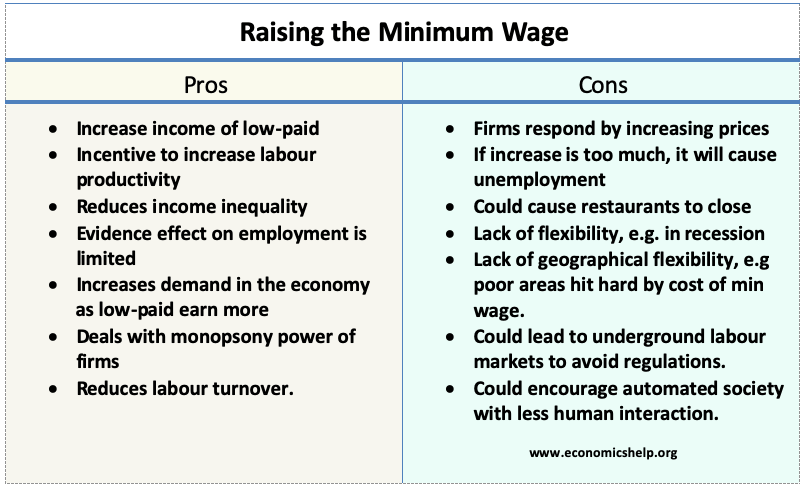

Pros And Cons Of Raising The Minimum Wage Economics Help

Pros And Cons Of Raising The Minimum Wage Economics Help

The National Minimum Wage Public Policy

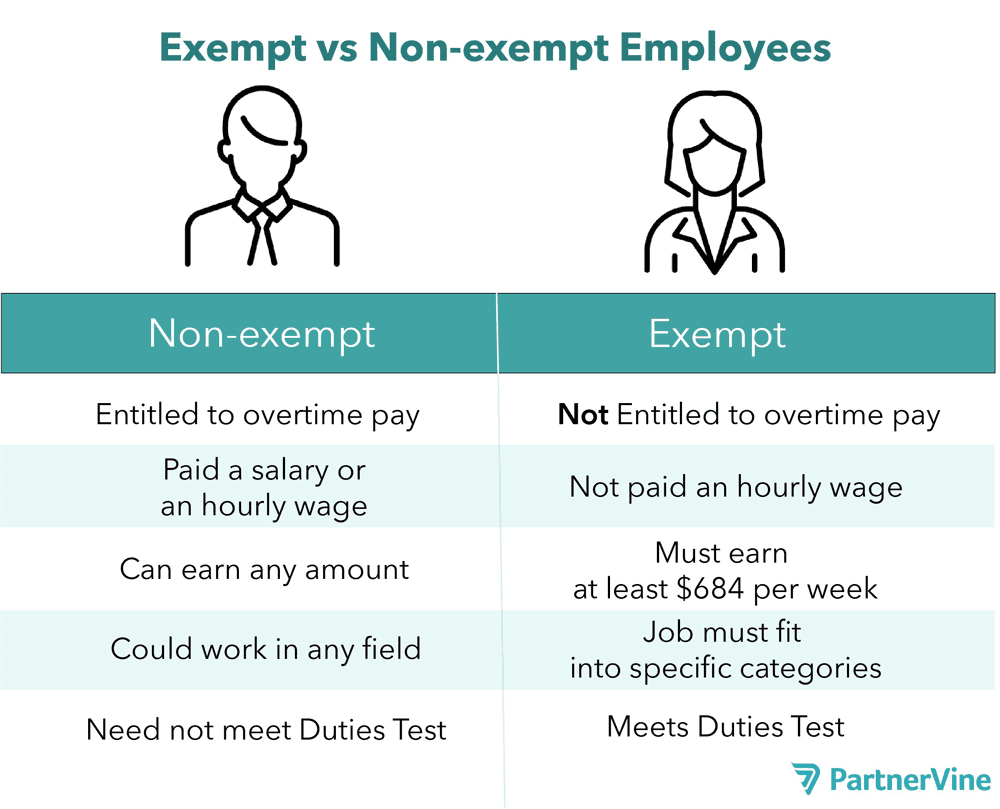

Overtime The Flsa And Exempt Vs Non Exempt Employees Partnervine

Overtime The Flsa And Exempt Vs Non Exempt Employees Partnervine

Lewis Silkin International Approaches To Covid 19 Job Retention And Wage Subsidy Schemes

Lewis Silkin International Approaches To Covid 19 Job Retention And Wage Subsidy Schemes

Minimum Wage Overview Purpose And Exempt Categories

Minimum Wage Overview Purpose And Exempt Categories

Understanding Payroll In Ireland What Global Companies Need To Know About Ireland Payroll

Understanding Payroll In Ireland What Global Companies Need To Know About Ireland Payroll

Irish Payroll And Tax Information And Resources Activpayroll

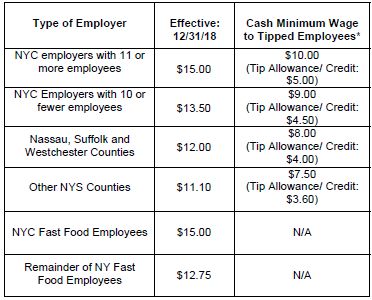

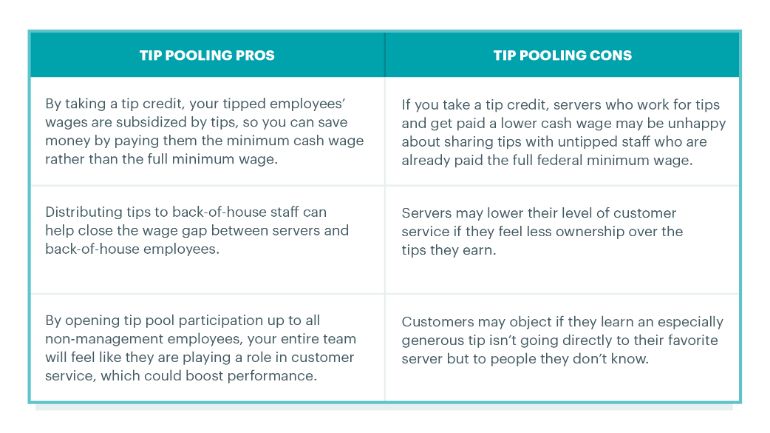

Tip Pooling Laws In Restaurants Everything Employers Need To Know

Tip Pooling Laws In Restaurants Everything Employers Need To Know

Irish Employment Legislation And Rights Relocating To Ireland

Irish Employment Legislation And Rights Relocating To Ireland

French Minimum Wage And Average Salary In France Expatica

French Minimum Wage And Average Salary In France Expatica

Covid 19 Employment Wage Subsidy Scheme Lexology

Covid 19 Employment Wage Subsidy Scheme Lexology

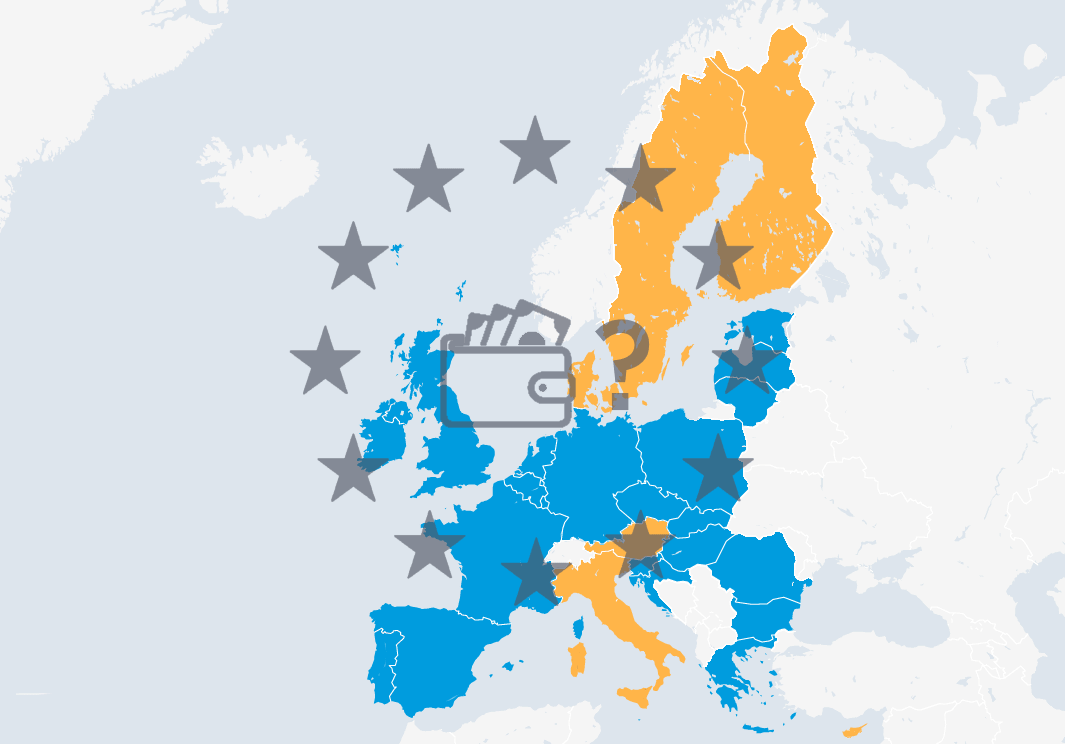

Why Isn T There An Eu Wide Minimum Wage Eca International

Why Isn T There An Eu Wide Minimum Wage Eca International

Employment Labour Laws And Regulations Ireland Gli

Employment Labour Laws And Regulations Ireland Gli

Wages Employmentrightsadvice Ie

National Minimum Wage Economics Online Economics Online

National Minimum Wage Economics Online Economics Online

The National Minimum Wage Public Policy

Post a Comment for "Wages Employment Law Ireland"