Withholding Tax Rates Kenya 2019

How do I pay Withholding Tax. You can also pay via Mpesa.

How Corporations Are Taxed Nolo

How Corporations Are Taxed Nolo

Withholding tax rates The above list contains details on tax rates for both residents and non-residents.

Withholding tax rates kenya 2019. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125 or more of the. Payment of withholding tax is done online via iTax generate a payment slip and present it at any of the appointed KRA banks to pay the tax due. Income Tax Rates and Thresholds Annual Tax Rate.

What is exempt from Withholding Tax. Introduction to What is Minimum Tax In Kenya. In total Kenya Revenue.

The withholding VAT rate has been reduced from 6 to 2 effective 7 th November 2019. Use the KRA Pay bill Number 572572. From 1 st January 2021 the country introduced Minimum tax in Kenya which was contained in the Minimum Tax Bill in 2020 and later published as law in the Finance Act 2020.

Kenya Budget Insights 201920 4 Capital gains tax rate to be increased from 5 to 125 The measure The Bill seeks to increase the Capital Gains Tax CGT rate from the current 5 to 125 Who will be affected Transferors of property When Effective 1 October 2019 Our view The government has indicated its intention to. Interest from banks at 15 dividends at 5 and royalties at 5 insurance commission at 5 and consultancy fee 5 for residents. Withholding Tax is deducted at source from several income like.

Who will be affected Shareholders and property owners intending to make transfers. The new law doubled taxes on members dividends from five to 10 per cent as well as withholding tax rate applicable to the dividends payable by a Sacco as an institution. The Statute Laws Miscellaneous Amendments Act amended the VAT Act to provide for WHVAT refunds.

You can also pay via Mpesa. This is a welcome move as the withholding VAT regime has had a major impact on cash flows for business. 25 rows No Kenya tax is due if subject to tax in Zambia.

Read an October 2019 report PDF 205 KB prepared by the KPMG member firm in Kenya The KPMG logo and name are trademarks of KPMG International. Withholding Tax Transactions in Kenya Withholding Tax transactions in Kenya includes the following. Payment of withholding tax is done online via iTax generate a payment slip and present it at any of the appointed KRA banks to pay the tax due.

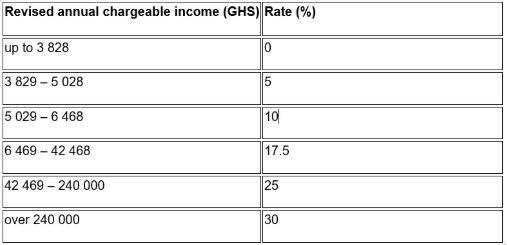

Capital gains tax CGT rate to be maintained at 5 The measure The proposal contained in the Finance Bill 2019 to increase the rate of capital gains tax from 5 to 125 has been dropped. 470 3 26 Income from certain settlements deemed to be income of settlor. Kenya Residents Income Tax Tables in 2019.

Cabinet Secretary by way of notice in the Kenya Gazette. Income Tax Act Cap. It also aligns well with recent proposals under the Finance Bill 2019 to reduce the withholding VAT rate from 6 to 2.

Many people have questions about the Minimum tax in Kenya. Use the KRA Pay bill Number 572572. For instance we can deduce that withholding tax on professional fees in Kenya stands at 5 percent for residents and 20 percent for non-residents.

Any person can be appointed a withholding VAT agent in Kenya by the tax Commissioner. Management or Professional Fee. Withholding VAT provisions only apply to local taxable supplies and not to imported supplies.

Effective 7 November 2019. The CIT rate for branches of foreign companies and PEs is 375. Number of years at least 20 of issued share capital listed 272 3 Years- at least 30 of issued share capital listed 253 5 Years- at least 40 of issued share capital listed 204 5 Years-.

REDUCTION OF Withholding VAT rate. Though the taxpayers are appointed as withholding agents they still have their normal VAT obligations. Rates of tax Resident companies Corporation tax Standard rate 301 375 branch Newly listed companies.

Non-resident companies are subject to Kenya corporate income tax CIT only on the trading profits attributable to a Kenyan PE. The rate of CIT for resident companies including subsidiary companies of foreign parent companies is 30. The withheld VAT must be remitted to KRA within 14 days.

Reduction of the withholding VAT rate the withholding VAT rate has been reduced from 6 to 2 of an amount subject to VAT provided that withholding VAT shall not apply to the taxable value of zero-rated supplies. 8 if the beneficiary holds at least 25 of. Any amount withheld should be remitted to KRA on or before the 20th day of the following month.

The Account Number is the Payment Registration number quoted at the top right corner of the generated payment slip. Withholding VAT is not applicable on zero-rated supplies. The Minimum tax is also being referred to as the 1 tax.

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Tstv Nigeria 2017 2018 Job Recruitment Portal Requirements For Application Tstv Nigeria 2017 2018 Job Recruitment Portal Requi Recruitment How To Apply Job

Tstv Nigeria 2017 2018 Job Recruitment Portal Requirements For Application Tstv Nigeria 2017 2018 Job Recruitment Portal Requi Recruitment How To Apply Job

How To File And Pay Kra Taxes For Companies Nyongesa Sande Value Added Tax Income Tax Return Tax Payment

How To File And Pay Kra Taxes For Companies Nyongesa Sande Value Added Tax Income Tax Return Tax Payment

Kra Itax Portal Online Tax Returns Login Registration And App Nyongesa Sande Tax Return Tax Payment Filing Taxes

Kra Itax Portal Online Tax Returns Login Registration And App Nyongesa Sande Tax Return Tax Payment Filing Taxes

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

How To Create An Income Tax Calculator In Excel Youtube

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube

How To Calculate Income Tax Tax Calculations Explained With Example By Yadnya Youtube

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Opera Mini In Music Download Deal With Mdundo Companies Opera Mini In Music Download Deal With

Opera Mini In Music Download Deal With Mdundo Companies Opera Mini In Music Download Deal With

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How Compounding Can Grow Tiny Amounts Into Millions Money Market Fund Management Money Market Account

How Compounding Can Grow Tiny Amounts Into Millions Money Market Fund Management Money Market Account

Fakes Cost Taxpayers Sh8bn Annually Purchase Books Pirate Books Detective

Fakes Cost Taxpayers Sh8bn Annually Purchase Books Pirate Books Detective

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Global Corporate Tax And Withholding Tax Rates Deloitte Tax Services Article News

Understanding The Budget Revenues

Understanding The Budget Revenues

Vuvuzelas Come To Aid Of Farmers In War On Birds Farmer Birds War

Vuvuzelas Come To Aid Of Farmers In War On Birds Farmer Birds War

Post a Comment for "Withholding Tax Rates Kenya 2019"