Withholding Tax Rates On National Saving Certificate

Where profit on debt exceeds Rs5 million but does not exceed Rs25 million the tax rate shall be 175 percent. Where profit on debt does not exceed Rs5 million the tax rate shall be 15 percent.

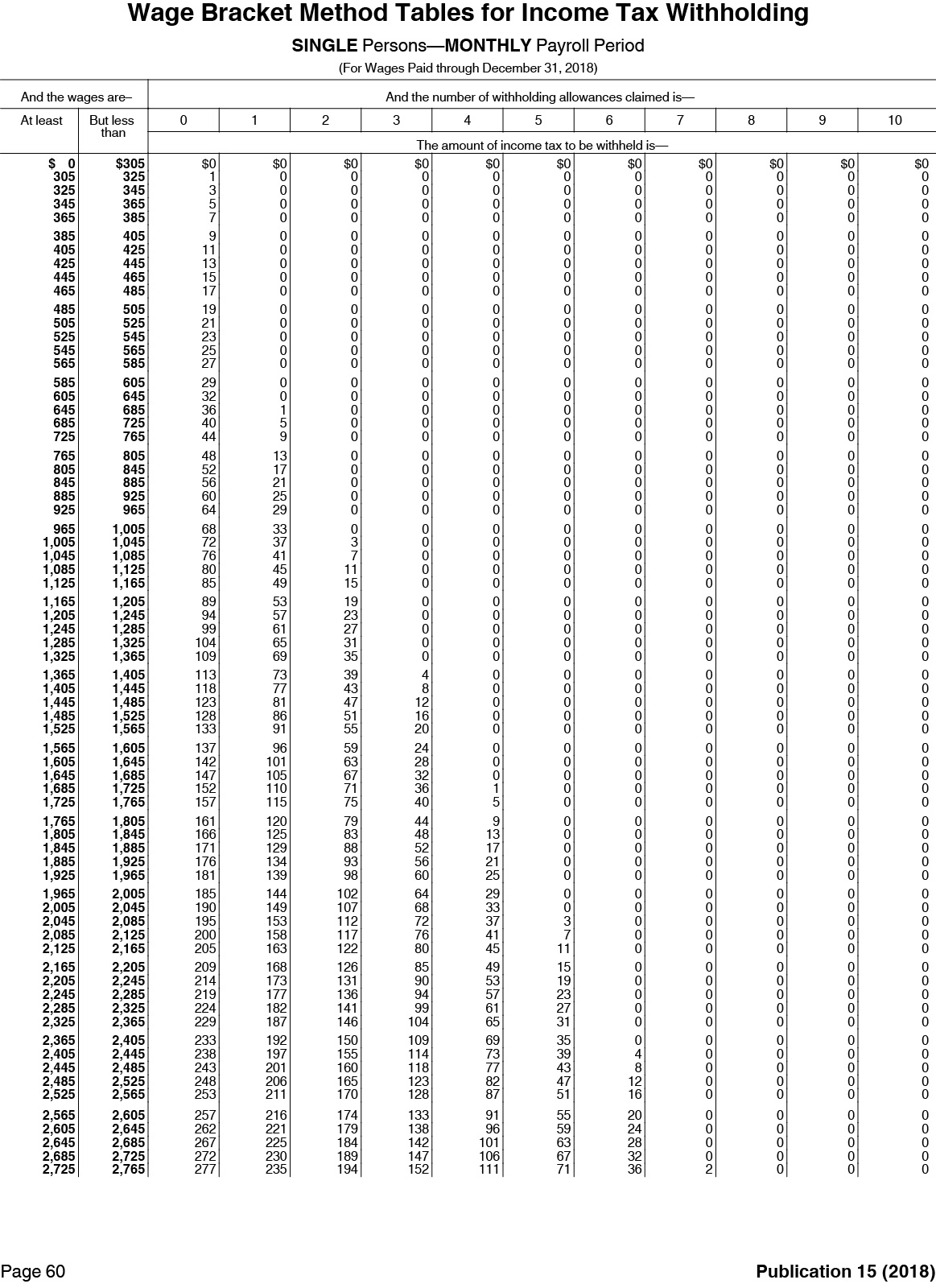

2020 Income Tax Withholding Tables Changes Examples Income Tax Tax Brackets Filing Taxes

2020 Income Tax Withholding Tables Changes Examples Income Tax Tax Brackets Filing Taxes

REDBOX Deals in Bahria Town Karachi DHA DHA CITY ASF CITY Gwadar Dubai Turkey Real Estate Projects.

Withholding tax rates on national saving certificate. In case the payable profit is Rs 500000- or above the rate shall be 15 on such profithowever in case profit is less than Rs 500000- the rate of WHT shall be 10 of the yieldprofit. Tightening noose on non-filers the withholding tax rate on the profit receive over Rs 500000 investment in National Savings schemes and Defence Saving Certificate has been increased up to 175 percent with effective from July 1 2015. In case the payable profit is Rs 500000- or above the rate shall be 30 on such profithowever in case profit is less than Rs.

2001 vide Finance Act 2019 new rates of Withholding Tax on Profit of National Savings Schemes under Section 151 shall be as under wef. In case the payable profit is Rs 500000- or above the rate shall be 15 on such profithowever in case profit is less than Rs 500000- the rate of WHT shall be 10 of the yieldprofit. A recently issued circular of the Federal Board of Revenue FBR has perturbed many senior citizens and widowed investors of the National Savings who have been slapped with 10 per cent tax.

The rate of return on regular income certificates has been maintained at 9 while the rate of return on welfare pensioners and martyrs welfare certificates will remain at 1128. In case the payable profit is Rs 500000- or above the rate shall be 30 on such profithowever in case profit is less than Rs 500000- the rate of WHT shall be 20 of the yieldprofit. 1 st July 2019.

If encashed after completion of 4 years there will be no service charges. Revised Rates of Withholding tax. There is no any Withholding Tax on BSC PBA profit but these profits consider as Income so Inc.

According to information for non-filers the government has raised the withholding tax rate for investments up to Rs. Non-filers investing above Rs500000 have to pay 30 percent withholding tax as opposed to 175 percent earlier. Ru ees five hundred thousand or less.

Special Saving Certificates New rates 2021 have been issued. The income tax withholding for the State of Rhode Island includes the following changes. Withholding Tax Rates Applicable Withholding Tax Rates.

In case the payable profit is Rs 500000- or above the rate shall be 15 on such profithowever in case profit is less than Rs 500000- the rate of WHT shall be 10 of the yieldprofit. The income tax wage table has changed. According to new withholding tax rate card for tax year 2019 issued by Federal Board of Revenue FBR the highest income withholding tax rate has been set at 175 percent in case a person deriving profit on national savings is non-filer of income tax return.

In case the payable profit is Rs 500000- or above the rate shall be 30 on such profithowever in case profit is less than Rs 500000- the rate of WHT shall be 20 of the yieldprofit. No action on the part of the employee or the personnel office is necessary. The Central Directorate of National Savings CDNS said withholding tax WHT rate on profits by non-filers of tax returns investing up to Rs500000 increased to 20 percent from 10 percent in the last fiscal year.

The Government has raised taxes on People investing in National Saving Schemes targeting both filers and Non-Filers. Rates on National Savings Products have been Revised. 880 Profit on Special Savings Certificate 2021.

Updated up to June 30 2020. Profit or Yield Where profit or yield paid is up to Rate of Withholding Tax under Section 151 read with Division IA of Finance Act 2019. Faizan July 15 2015 ISLAMABAD.

July 10 2019 MLN. Attachments Tax NotificationFile size. The Profit Rate on deposits in National Saving Bank has been revised from 25 March 2021.

Revised Rates of Withholding tax. The annualized wage threshold where the annual exemption amount is eliminated has changed from 231500 to 234750. 500000 from 10 percent to 20 percent while investment over the amount will be subject to 30 percent an increase from the.

Special Savings Certificates Rates 2021. Non-filers investing above Rs500000 have to pay. The Central Directorate of National Savings CDNS said withholding tax WHT rate on profits by non-filers of tax returns investing up to Rs500000 increased to 20 percent from 10 percent in the last fiscal year.

This video specially uploaded for BSC PBA account holders. The rate of tax to be deducted shall be as follows. If the certificates encashed before completion of 123 and 4 years from the date of purchase then 1 075050 and 025 service charges of the face value shall be deducted respectively.

Where profit on debt exceeds Rs25 million but does not exceed Rs36 million the tax rate shall be 20 percent.

General Information On The Brazilian Tax System Bpc Partners

General Information On The Brazilian Tax System Bpc Partners

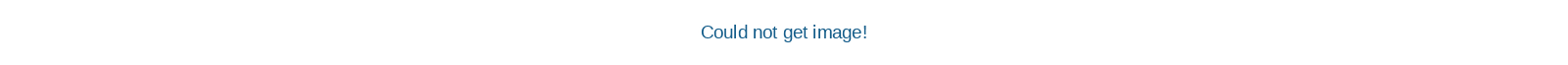

Withholding Tax In China China Briefing News

Withholding Tax In China China Briefing News

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Simple Tax Guide For Americans In Vietnam

Simple Tax Guide For Americans In Vietnam

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Income Taxation System In Indonesia

How To Compute Withholding Tax On Compensation Bir Philippines Business Tips Philippines

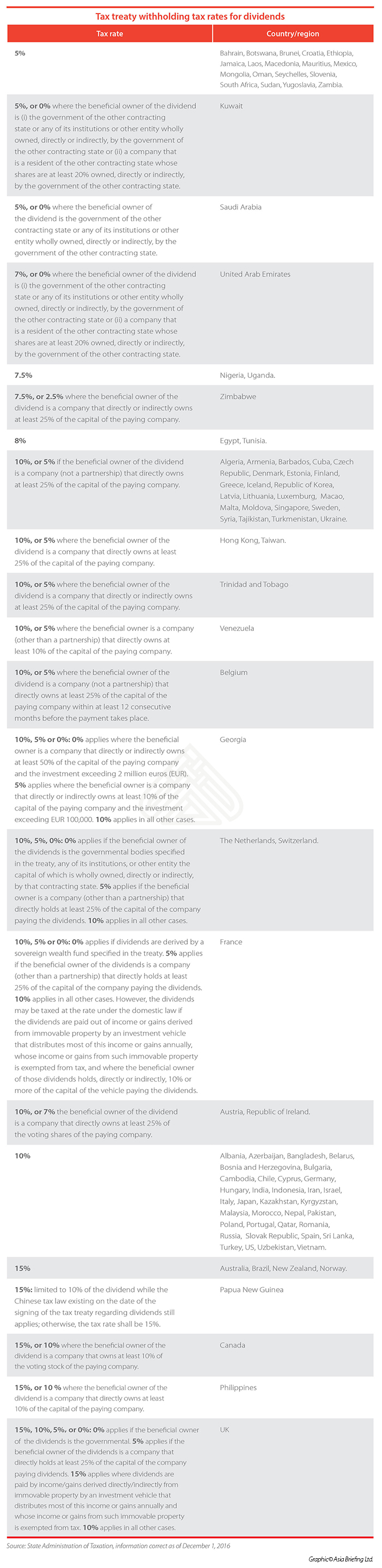

Income And Withholding Taxes Ppt Download

Income And Withholding Taxes Ppt Download

Withholding Tax On Prize Bonds Prize Money Rates Have Been Revised

Withholding Tax On Prize Bonds Prize Money Rates Have Been Revised

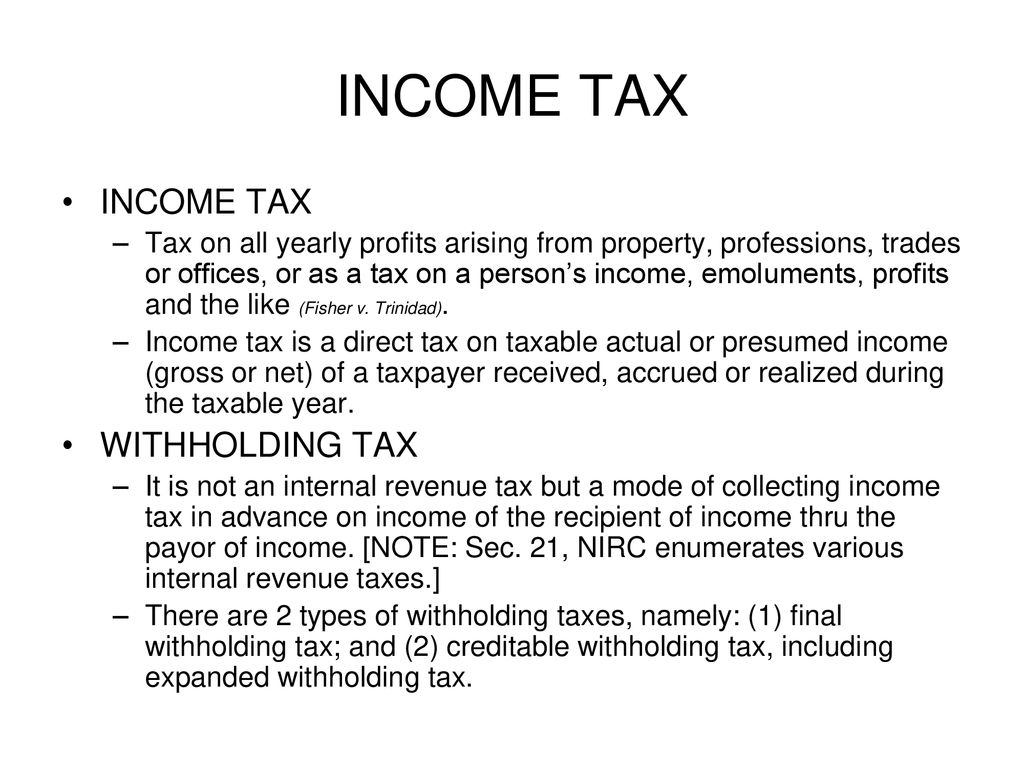

How To Save U S Taxes For Nonresident Aliens

How To Save U S Taxes For Nonresident Aliens

3 21 15 Foreign Partnership Withholding Internal Revenue Service

3 21 15 Foreign Partnership Withholding Internal Revenue Service

3 22 15 Foreign Partnership Withholding Internal Revenue Service

3 22 15 Foreign Partnership Withholding Internal Revenue Service

Income And Withholding Taxes Ppt Download

Income And Withholding Taxes Ppt Download

Doing Business In The United States Federal Tax Issues Pwc

Doing Business In The United States Federal Tax Issues Pwc

3 22 15 Foreign Partnership Withholding Internal Revenue Service

3 22 15 Foreign Partnership Withholding Internal Revenue Service

Withholding Tax On Profit And Prize Bond July 2019 Youtube

Withholding Tax On Profit And Prize Bond July 2019 Youtube

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Post a Comment for "Withholding Tax Rates On National Saving Certificate"