Employment Tax Rates Georgia

However taxes are due only on the first 9500 per employee per year. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest.

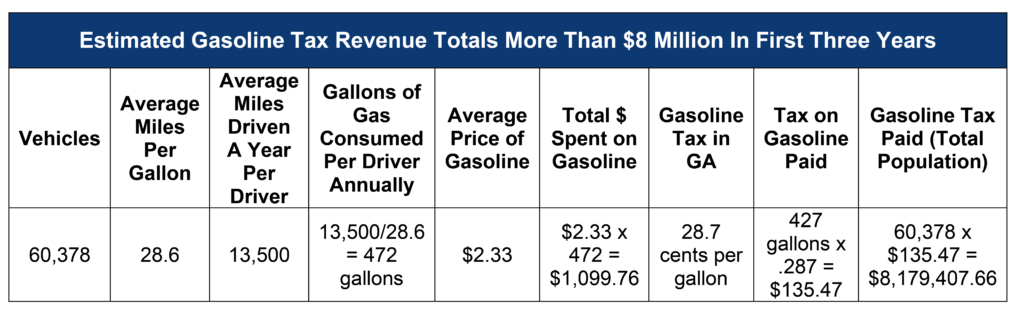

Green Light Georgia Driver S Licenses For All Immigrants Georgia Budget And Policy Institute

Green Light Georgia Driver S Licenses For All Immigrants Georgia Budget And Policy Institute

You are able to use our Georgia State Tax Calculator in to calculate your total tax costs in the tax year 202021.

Employment tax rates georgia. The 2020 Annual UI Tax Rate Notices are now available on the Georgia Department of Labor GDOL Employer PortalIf you are not registered on the Employer Portal please register immediately to avoid delays in receiving this important information. Emergency Rule 300-2-3-020 containing Rule 300-2-3-020-05 Charges to Experience Rating Account 1 An employer shall be charged for all benefits paid as a consequence of the employers failure. 160 rows Georgia utilizes a relatively simple progressive income tax system with rates ranging from.

Rates range from 1 to 55. Our calculator has been specially developed in order to provide the users of the calculator with. If you file in Georgia as a single person you will get taxed 1 of your taxable income under 750.

20 hours agoThe current rates and brackets are determined by the 2017 tax overhaul and they expire at the end of 2025. TAX RATES AND COVERED EMPLOYMENT. GEORGIA DEPARTMENT OF LABOR.

The release of Georgias 2021 Annual Unemployment Insurance Tax Rate Notices has been delayed and anticipated to be available on the Georgia Department of Labor Employer Portal in February 2021. 2 if annual gross is less than 8000 3 if annual gross is between 8000 and 10000 4 if annual gross is between 10001 and 12000 5 is annual gross is between 12001. As a reference for 2020 the new employer SUI state unemployment insurance rate was 270 percent on the first 9500 of wages for each employee.

The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest. Georgia new employer rate. The tax rate for the first.

A cash or surety bond is required for this election. The state of Georgia is automatically extending the 2020 individual income tax filing and payment deadline from April 15 2021 to May 17 2021 without penalties or interest. The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd LOST and the 1 TSPLOST do not apply.

For 2026 the top rate is set to return to 396 though Congress may adjust rates. Though this could definitely be checked off as complicated the rest of Georgia payroll taxes are a breeze. If you earn more than that then youll be taxed 2 on income between 750 and 2250.

Effective October 1 2018 the generally applicable tax rate in Ware County is 9 state sales tax at the statewide rate of 4 plus 5 local sales taxes at a rate of 1 each. EMPLOYMENT SECURITY LAW. Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax Rates.

With six different tax brackets payroll in Georgia is especially progressive meaning the more your employees make the more they have to pay. This form is for employers who voluntarily elect in lieu of contributions to reimburse the Georgia Department of Labor for benefit payments made based on wages paid by the employing unit as provided under Paragraph b of OCGA 34-8-158 of Georgia Employment Security Law. Rates include an administrative assessment of 006.

TABLE OF CONTENTS. Tax and wage reports may be filed using the preferred electronic filing methods available on the Employer Portal. Qualified employers may defer quarterly taxes of 500 or less until January 31st of the following year.

For information related to unemployment income please read FAQ 3.

Insurance Commissioner Complaint Ga Diminished Value Car Appraisal Insurance Complaints Georgia Page

Insurance Commissioner Complaint Ga Diminished Value Car Appraisal Insurance Complaints Georgia Page

Keller Williams Augusta Partners Augusta Ga Aiken Sc Real Estate Keller Williams Keller Williams Realty Keller

Keller Williams Augusta Partners Augusta Ga Aiken Sc Real Estate Keller Williams Keller Williams Realty Keller

Georgia Wine Performance Or Tax Liability Surety Bond Bond Doctors Note Birth Certificate Template

Georgia Wine Performance Or Tax Liability Surety Bond Bond Doctors Note Birth Certificate Template

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Llc Tax Calculator Video Llc Taxes Business Tax Small Business Tax

Llc Tax Calculator Video Llc Taxes Business Tax Small Business Tax

H And R Block Clarkesville Ga Georgia Corneliaga Shoplocal Localga Cornelia Georgia Income Tax Preparation Tax Preparation Tax Rules

H And R Block Clarkesville Ga Georgia Corneliaga Shoplocal Localga Cornelia Georgia Income Tax Preparation Tax Preparation Tax Rules

Georgia Income Tax Rates For 2021

Income Tax Consultant Services In Delhi Income Tax Income Tax Services

Income Tax Consultant Services In Delhi Income Tax Income Tax Services

Georgia Retirement Tax Friendliness Smartasset

Georgia Retirement Tax Friendliness Smartasset

Georgia Income Tax Calculator Smartasset

Georgia Income Tax Calculator Smartasset

Georgia Retirement Tax Friendliness Smartasset

Georgia Retirement Tax Friendliness Smartasset

Georgia Paycheck Calculator Smartasset

Georgia Paycheck Calculator Smartasset

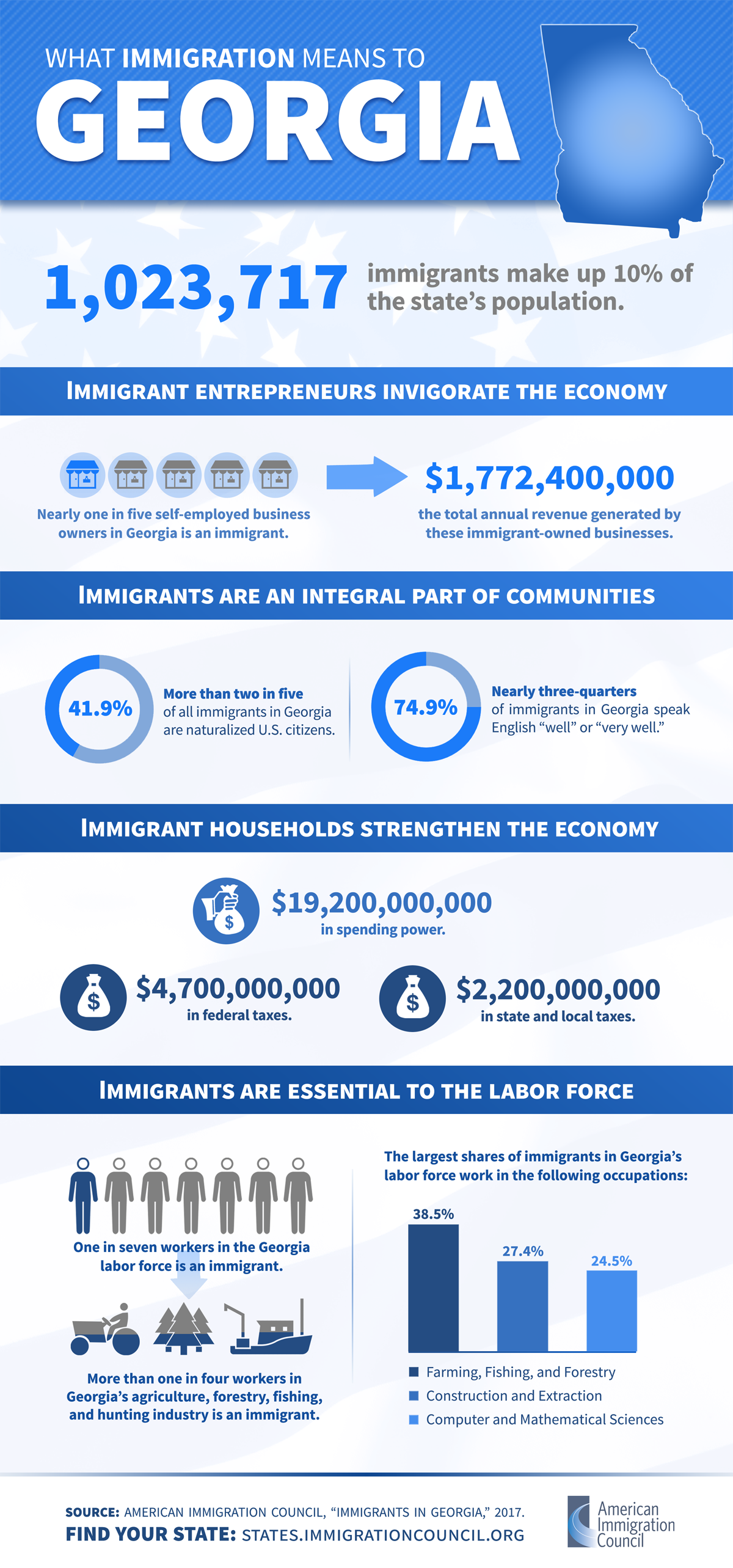

Immigrants In Georgia American Immigration Council

Immigrants In Georgia American Immigration Council

Seven Shocking Facts About Aflac Insurance Aflac Insurance Https Ift Tt 3h6uteb Aflac Insurance Shocking Facts Insurance

Seven Shocking Facts About Aflac Insurance Aflac Insurance Https Ift Tt 3h6uteb Aflac Insurance Shocking Facts Insurance

Georgia Income Tax Calculator Smartasset

Georgia Income Tax Calculator Smartasset

Tax Planning And Saving Schemes A Quick Comparison By Dhanayoga Www Dhanayo Ga Elss Html Indirect Tax Annuity Money Tips

Tax Planning And Saving Schemes A Quick Comparison By Dhanayoga Www Dhanayo Ga Elss Html Indirect Tax Annuity Money Tips

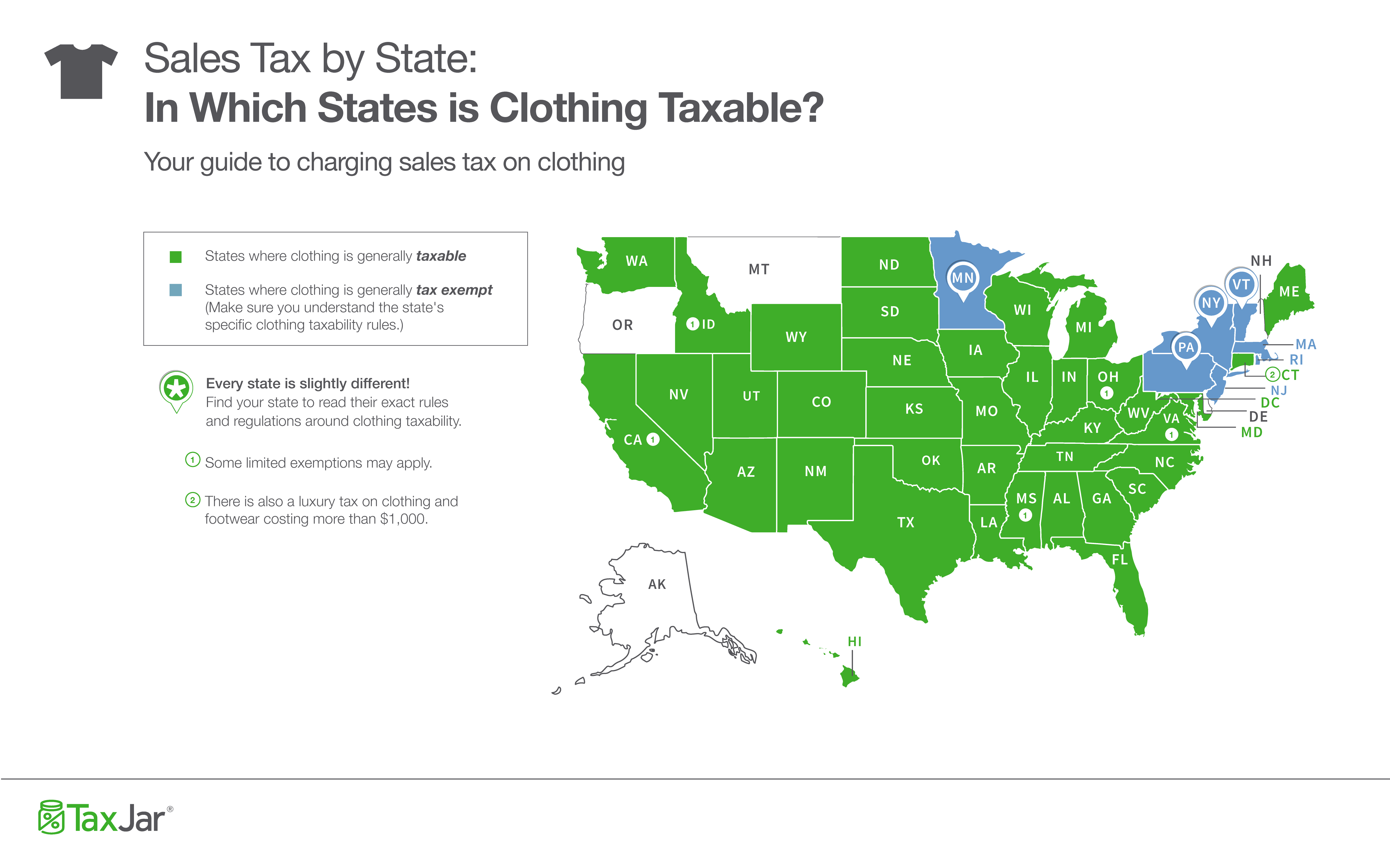

Which States Require Sales Tax On Clothing Taxjar Blog

Which States Require Sales Tax On Clothing Taxjar Blog

Https Dor Georgia Gov Document Form 2009 It 511 Individual Income Tax Booklet Download

Post a Comment for "Employment Tax Rates Georgia"