Employment Tax Rates Pennsylvania

The Office of UC Tax Services plans to issue the Contribution Rate Notice for calendar year 2021 Form UC-657 no later than December 31 2020. Monthly If total withholding is 300 to 999 per quarter the taxes are due the 15th day of the following month.

Small Businesses Do Just Fine With High Taxes On Wealthy Small Business Tax Business Tax Small Business

Small Businesses Do Just Fine With High Taxes On Wealthy Small Business Tax Business Tax Small Business

Wages subject to unemployment contributions for employees are unlimited.

Employment tax rates pennsylvania. With local taxes the total sales tax rate is between 6000 and 8000. Overview of Pennsylvania Taxes. Proudly founded in 1681 as a place of tolerance and freedom.

Multiply the annual wages by 307 percent to calculate the annual Pennsylvania tax withholding. Semi-Monthly - If total withholding is 1000 to 499999 per quarter the taxes are due within three banking days of the close of the semi-monthly period. Many cities in Pennsylvania collect a Local Earned Income Tax which is typically 1 but can be as high as almost 39.

Pennsylvania state income taxes are relatively simple with a 307 flat income tax rate. Due to the COVID-19 pandemic the Department of Revenue certification of 2018 Personal Income Tax by school district will be delayed until March 2021. Employer UC tax services important information Pennsylvania Department of Labor Industry website November 2019 As a result the calendar year 2020 employer state unemployment insurance SUI experience tax rates will range from 12905 to 99333 down from 23905 to 110333 for 2019.

Use the Address Search Application to lookup PSD Codes EIT Rates and LST Rates. Wages subject to unemployment contributions for employers remains at 10000. More Payroll Information for Pennsylvania Small Business.

Here is a list of the non-construction new employer tax rates for each state and Washington DC. However many cities in the Keystone State also collect local income taxes. You should have received yours for 2020 very recently.

Follow the four 4 steps outlined below in order to comply with local income tax requirements as an employer in PA. Pennsylvania has a flat state income tax rate of 307. As a small business owner you must fill out Form PA-100 to register for a federal employer identification number for state withholding.

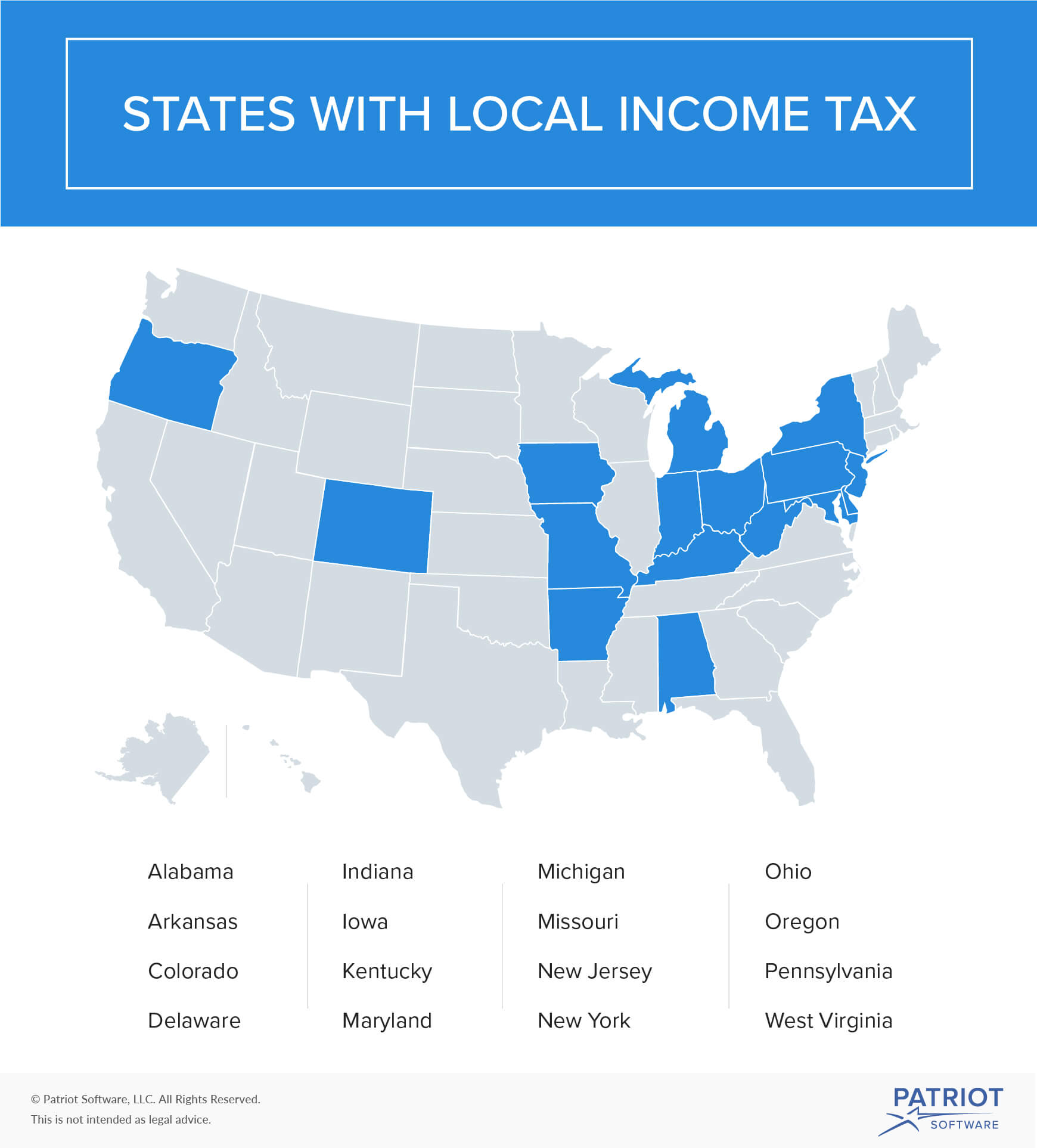

Like 14 other states Pennsylvania allows cities and other localities to collect a local income tax in addition to the Pennsylvania Income Tax. Divide the annual Pennsylvania tax withholding by 26 to obtain the biweekly Pennsylvania tax withholding. 0 percent on.

However in many larger cities including Pittsburgh and Philadelphia youll encounter higher rates. Lookup PSD Codes and Tax Rates. You will want to print or save the report generated by the Address Search Application for future reference.

The Pennsylvania Office of Unemployment Compensation Tax Services mails annual tax rate notices out to employers doing business in its state at the end of December each year. The state sales tax rate in Pennsylvania is 6000. This is the lowest rate among the handful states that utilize flat rates.

The Pennsylvania self employment tax provides 124 to Social Security and 29 to Medicare for a total of 153. 24 rows Tax Rate. The average income tax rate for counties and large municipalities weighted by total personal income within each jurisdiction is 125.

Some states are still finalizing their SUI tax information for 2021 as indicated with a blank. Select the Pennsylvania city from the list of popular cities below to see its current sales tax rate. With local taxes the total sales tax rate is between 6000 and 8000.

Multiply the adjusted gross biweekly wages times 26 to obtain the annual wages. Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee. If you have you may have noticed a significant decrease in your tax rate compared to the prior.

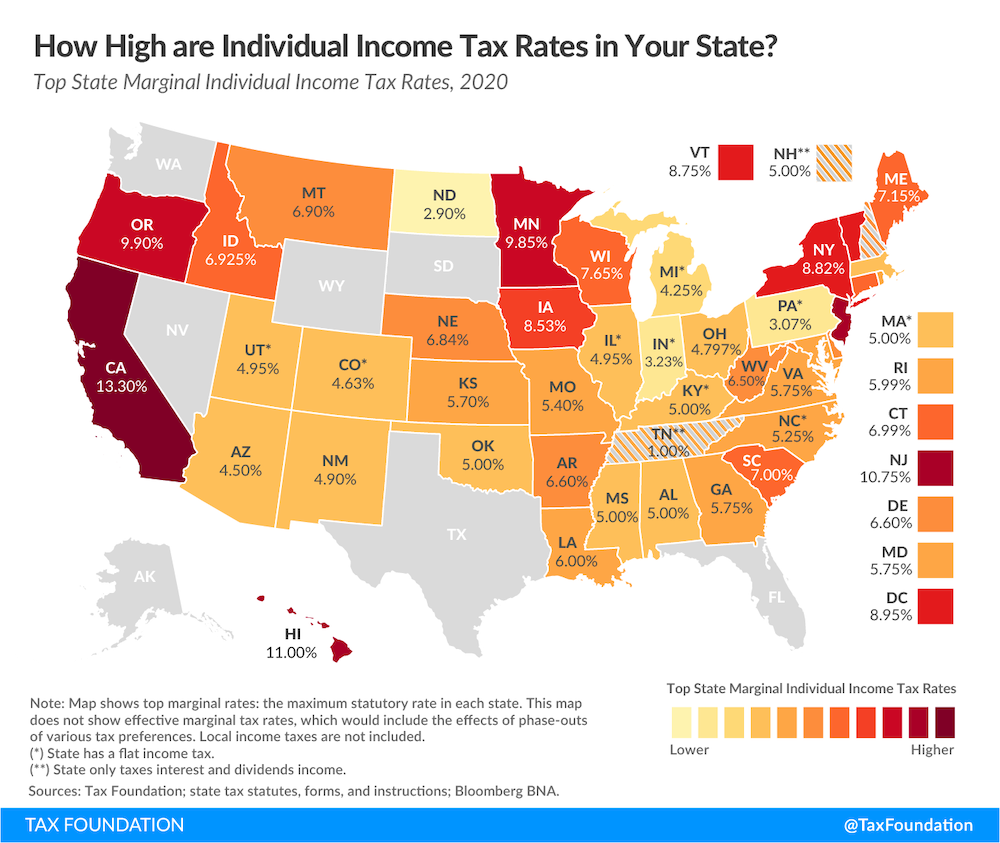

However it isnt the only tax you need to take into consideration. Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that varies by income level reaching rates as high as 133 in California. How much is the self employment tax for Pennsylvania.

Anyone who is a sole proprietor business owner or is self-employed has to pay Pennsylvania self employment tax which is actually a Social Security and Medicare tax. Pennsylvania Unemployment Tax The employee rate for 2020 remains at 006. If the Office of UC Tax Services issues a denial of a contribution rate appeal the employer has the right to file a second-level appeal with the UC Tax Review Office.

If you have any questions on the revised process please contact Nick Mackereth at nmackerethpagov or 4127701660. Inheritance and Estate Tax. Note that some states require employees to contribute state unemployment tax.

In smaller municipalities this tax is capped by state law at 2.

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Pennsylvania Property Tax Calculator Smartasset Com Tax Refund Calculator Income Tax Property Tax

Pennsylvania Property Tax Calculator Smartasset Com Tax Refund Calculator Income Tax Property Tax

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax What It Is How To Calculate It Bench Accounting

What Is Local Income Tax Types States With Local Income Tax More

What Is Local Income Tax Types States With Local Income Tax More

Self Employment Tax Everything You Need To Know Smartasset Self Employment Payroll Taxes Filing Taxes

Self Employment Tax Everything You Need To Know Smartasset Self Employment Payroll Taxes Filing Taxes

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

Key Issues Tax Expenditures Types Of Taxes Tax Infographic

Easy To Use Closing Cost And Mortgage Calculator For Pa Home Buyers And Real Estate Agents Nice Prin Mortgage Calculator Mortgage Amortization Online Mortgage

Easy To Use Closing Cost And Mortgage Calculator For Pa Home Buyers And Real Estate Agents Nice Prin Mortgage Calculator Mortgage Amortization Online Mortgage

Income Tax Filings In These U S Counties Were Audited At A Higher Rate Than The Nation As A Whole Infographic Map Map Irs Taxes

Income Tax Filings In These U S Counties Were Audited At A Higher Rate Than The Nation As A Whole Infographic Map Map Irs Taxes

How To Change A New Jersey Driver S License To Pennsylvania In 2020 Drivers License New Jersey Money Management

How To Change A New Jersey Driver S License To Pennsylvania In 2020 Drivers License New Jersey Money Management

2021 Federal Tax Brackets What Is My Tax Bracket

2021 Federal Tax Brackets What Is My Tax Bracket

Payroll Taxes 2021 Filing Deadlines Rates And Employer Responsibilities

Payroll Taxes 2021 Filing Deadlines Rates And Employer Responsibilities

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Ifta Tax Filing Filing Taxes Tax Tax Rate

Ifta Tax Filing Filing Taxes Tax Tax Rate

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax

Virtually Every State Tax System Is Fundamentally Unfair Taking A Much Greater Share Of Income From Low And Middle Income Familie Higher Income State Tax Tax

Pennsylvania Property Tax Calculator Smartasset Com Tax Refund Calculator Income Tax Property Tax

Pennsylvania Property Tax Calculator Smartasset Com Tax Refund Calculator Income Tax Property Tax

Pennsylvania Tax Rate H R Block

Pennsylvania Tax Rate H R Block

Unfiled Taxes Md Va Pa Strategic Tax Resolution Tax Return Tax Refund Tax Debt

Unfiled Taxes Md Va Pa Strategic Tax Resolution Tax Return Tax Refund Tax Debt

Post a Comment for "Employment Tax Rates Pennsylvania"