Self-employment Wages In Canada

Government or any of its instrumentalities. On January 1st 2021 the new CPP contribution rate will increase from 105 to 109.

Download Pay Stub Template Word Either Or Both Of The Pay Stub Templates Provided Here And Customize Use Payroll Template Printable Checks Templates

Download Pay Stub Template Word Either Or Both Of The Pay Stub Templates Provided Here And Customize Use Payroll Template Printable Checks Templates

25 000 - Taxes - Surtax - CPP - EI 20 80248 year net 2094464 52 weeks 40278 week net 40278 40 hours 1007 hour net You simply need to the the same division for the gross income base on the annual gross salary line 2 and 3.

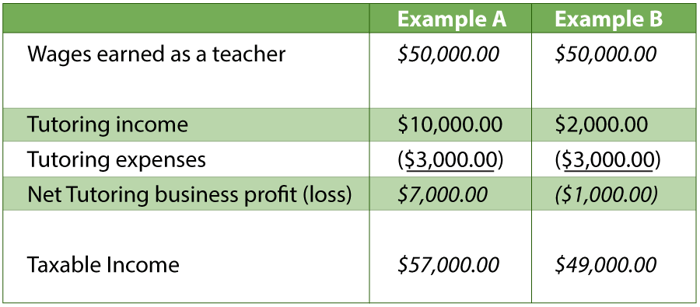

Self-employment wages in canada. Business income does not include employment income such as wages or salaries received from an employer. Employee or self-employed worker. You must take all your self-employment income into account in figuring your net earnings from self-employment even if all or a portion of gross receipts were excluded from income because of the foreign earned income exclusion.

The CRA self-employment income Guide T4002 Self-Employed Business Professional Commission Farming and Fishing Income provides the tax information you need for all types of self-employment. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. Canadians between the age of 18 to 70 who have net self-employment income and pensionable employment income greater than 3500 have to contribute to the Canada Pension Plan CPP.

However if youre self-employed you will have to pay the full CPP amount 102 percent yourself. For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self - employment tax Social Security tax or railroad. This royalty income is subject to self-employment tax in 2020.

The CPP contribution rate is set to increase over the next few years for self-employment so it is best to keep up to date with CRA on these figures. Schedule SE line 7 is the maximum amount of combined wages and self-employment earnings subject to social security tax or the 62 portion of the 765 railroad retirement tier 1 tax for 2020. As a self-employed sole proprietor you pay federal taxes by reporting your income or loss on a T1 income tax and benefit return with the CRA.

Up to this amount a Canadian-controlled private corporation CCPC pays income tax at a much lower rate than it would on income over this amountat a tax rate of about 16 depending on the province. Science and Economic. So you need to pay the full 99.

This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. CPP for Self-Employed Everyone between the ages of 18 and 70 whose income is greater than 3500 must contribute to the CPP. You are working for an American employer which includes.

An individual who is a resident of the United States. Its important to note that you will only need to pay CPP on income you earn from 3500 57400. Take for example a salaried worker who earns an annual gross salary of 25000 for 40 hours a week and has worked 52 weeks during the year.

Regular workers contribute a particular percentage of their wages above 3500 up to an annual maximum while their employer contributes an equal amount. In other words if you earn under 3500 you will not need to pay CPP contributions. There is no CPP contribution made on income above the maximum threshold.

If youre self-employed youre your own boss. Canadas tax law says a business is a profession calling trade manufacture undertaking of any kind whatever or an adventure or concern in the nature of trade Your business can either be a sole proprietorship if youre venturing out on your own a partnership if you have a partner or a corporation a business that makes larger. Regular workers contribute a particular percentage of their wages above 3500 up to an annual maximum while their employer contributes an equal amount.

The CRA changes this maximum threshold each year depending on the average wage and salaries in Canada. If you earned more than 10 outside Canada you wont be eligible to earn any tax free income up to a total amount of 12069 in 2019. It is important to decide whether a worker is an employee or a self-employed individualEmployment status directly affects a persons entitlement to employment insurance EI benefits under the Employment Insurance ActIt can also have an impact on how a worker is treated under other legislation such as the Canada Pension Plan and the Income Tax Act.

Basically you are allowed earn up to 12069 tax free in the tax year if 90 or more of your total income was sourced in Canada. Often a business salary and bonus are paid out to ensure a corporation doesnt earn over 500000 which is the small business limit in Canada. This 99 only applies to part of your incomea range of 3500 - 55300.

If you fail to report all your income you may have to pay a penalty of 10 of the amount you failed to report after your first omission. Effect of Foreign Earned Income Exclusion. Social security and Medicare taxes continue to apply to wages for services you perform as an employee outside of the United States if one of the following applies.

How to calculate self-employment income tax in 2019 Lets turn to the CRA Form T2125 Statement of Business or Professional Activities to see how to calculate your self-employment income tax. If you make under 3500 you cant contribute to. You must include all your income when you calculate it for tax purposes.

Check out marketing expert Michelle Mires tips on small business deductions for both the US and Canada.

Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Income Tax Business Tax Money Management

Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Income Tax Business Tax Money Management

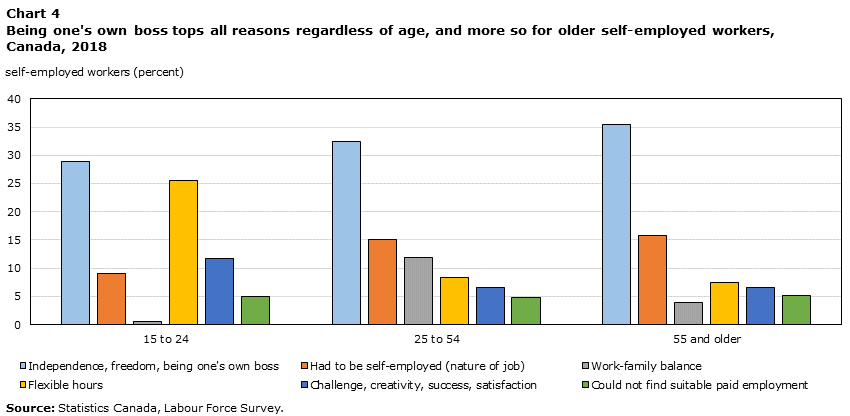

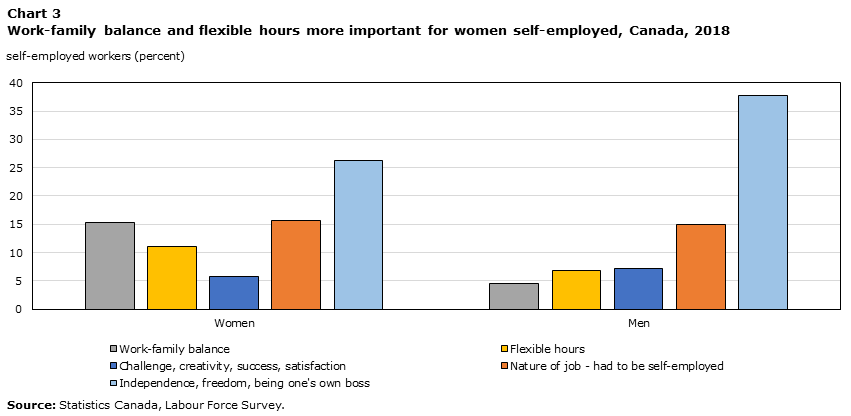

Self Employed Canadians Who And Why

Self Employed Canadians Who And Why

How To File Self Employed Taxes In Canada Quickbooks Canada

How To File Self Employed Taxes In Canada Quickbooks Canada

Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Youtube

Self Employed Taxes In Canada How Much To Set Aside For Cpp Ei Income Tax Youtube

Self Declaration Of Income Letter Unique Declaration Sample English Dlro Epfo Scholarship Thank You Letter Formal Business Letter Resignation Letters

Self Declaration Of Income Letter Unique Declaration Sample English Dlro Epfo Scholarship Thank You Letter Formal Business Letter Resignation Letters

2014 Tax Return Checklist For Canadians Business Tax Small Business Tax Business Tax Deductions

2014 Tax Return Checklist For Canadians Business Tax Small Business Tax Business Tax Deductions

Self Employment Income Statement Template Unique Self Employment Ledger 40 Free Templates Exampl Profit And Loss Statement Statement Template Self Employment

Self Employment Income Statement Template Unique Self Employment Ledger 40 Free Templates Exampl Profit And Loss Statement Statement Template Self Employment

16 Proof Of Income Letters Pdf Doc Employment Letter Sample Letter Sample Professional Reference Letter

16 Proof Of Income Letters Pdf Doc Employment Letter Sample Letter Sample Professional Reference Letter

Self Employed Canadians Who And Why

Self Employed Canadians Who And Why

Pin On Start Your Own Business Small Business Tax Business Tax Business Tax Deductions

Pin On Start Your Own Business Small Business Tax Business Tax Business Tax Deductions

Self Employed Canadians Who And Why

Self Employed Canadians Who And Why

Ei Special Benefits Benefit Taxact Special

Ei Special Benefits Benefit Taxact Special

What Are Some Self Employed Tax Deductions In Canada

What Are Some Self Employed Tax Deductions In Canada

Self Employed Canadians Who And Why

Self Employed Canadians Who And Why

Income Tax Rates For The Self Employed 2018 2019 Turbotax Canada Tips

Pay Stub Template 9 Free Pdf Doc Download Templates Printable Free Printable Checks Payroll Template

Pay Stub Template 9 Free Pdf Doc Download Templates Printable Free Printable Checks Payroll Template

Post a Comment for "Self-employment Wages In Canada"