Unemployment Benefits Taxable 2020

What is the Unemployment Insurance Benefits Income Tax Subtraction. Federal Pandemic Unemployment Compensation provided under the Coronavirus Aid Relief and Economic Security CARES Act of 2020.

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

The IRS will automatically refund money to eligible people who filed their tax return reporting unemployment compensation before the recent changes made by the American.

Unemployment benefits taxable 2020. Uncle Sam taxes unemployment benefits as if they were wages although up to 10200 of unemployment compensation received in 2020 is exempt from federal tax for people with an adjusted gross income. To determine if your. It provided an additional 600 per week in unemployment compensation per recipient through July 2020.

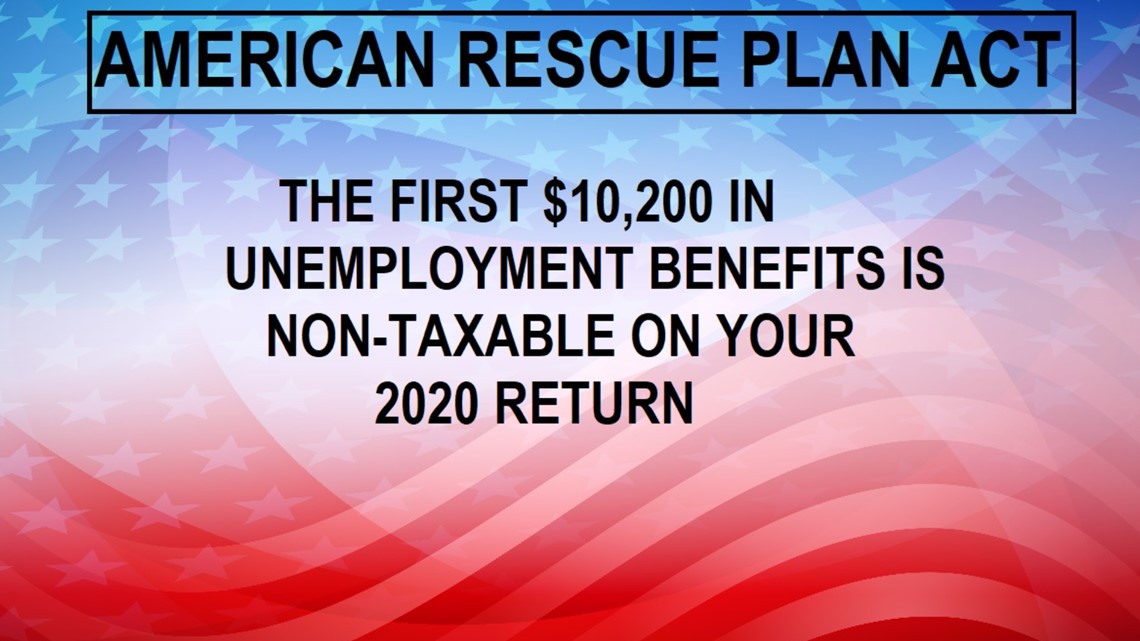

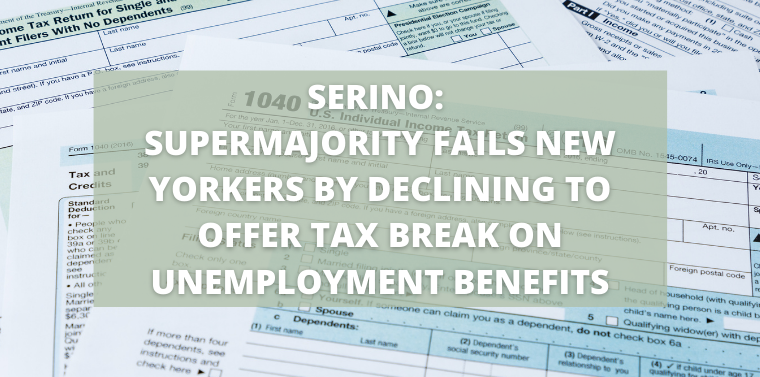

Beginning with Tax Year 2020 and including Tax Year 2021 the Act exempts from the state income tax. The federal 600 weekly unemployment benefit. The American Rescue Plan which was signed into law by President Joe Biden on March 11 made the first 10200 of unemployment income tax-free for.

Unemployment benefits are included along with your other income such as wages salaries and bank interest For tax year 2020 the first 10200 of unemployment income are tax free for taxpayers with an AGI of less than 150000. Unemployment benefits are generally treated as income for tax purposes. The American Rescue Plan waived federal tax on up to 10200 of jobless aid per person collected in 2020.

By law unemployment compensation is taxable and must be reported on a 2020 federal income tax return. Most beneficiaries will receive nearly 1000 in weekly combined federal and state benefits until July 31 2020. The RELIEF Act provides a State Income Tax Exemption for Unemployment Insurance UI Benefits for qualifying filers.

20 hours agoHow to Include Unemployment Benefits and Stimulus Payments in Your 2020 Tax Return By Scott Harrell Tampa PUBLISHED 1249 PM ET. New Exclusion of up to 10200 of Unemployment Compensation. 10 That extra 600 is also taxable after the first 10200.

Taxable benefits include any of the special unemployment compensation authorized under the Coronavirus Aid Relief and Economic Security CARES Act enacted this spring. If youve already filed your 2020 tax. Thats why the new COVID bill is a big deal for recipients of unemployment benefits.

COVID Tax Tip 2021-46 April 8 2021 Normally any unemployment compensation someone receives is taxable. Certain taxpayers who received unemployment benefits in 2020 can now exclude up to 10200 of compensation from. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable.

2 You might be alright if you arranged to have income tax withheld from your benefits but federal law caps withholding on benefits at 10. If you received unemployment compensation during the year you must include it in gross income. To the unemployment benefits tax.

Benefits from a private fund if you voluntarily gave money to the fund and you get more money than what you gave to the fund. A 10200 tax exemption was added into the details of the American Rescue Plan for those who received unemployment benefits in 2020. Unemployed workers can waive up to 10200 in unemployment benefits received in 2020 from their taxable income.

UI payments are currently subject to federal and state income taxation. The 19 trillion Covid relief measure limits. As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the pandemic will find that up to 10200 of those benefits will be exempt from taxes.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan enacted on March 11 2021 excludes from income up to 10200 of unemployment compensation paid in 2020 which means you dont have to pay tax on unemployment compensation of up to 10200. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com

Is Unemployment Taxed H R Block

Is Unemployment Taxed H R Block

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Are Unemployment Insurance Benefits Taxable A Guide On Ui Taxes

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

Unemployment Taxes Are Due Expect A Form To Arrive In The Mail Kvue Com

.jpg) How Will Unemployment Benefits Impact Your 2020 Taxes Legalzoom Com

How Will Unemployment Benefits Impact Your 2020 Taxes Legalzoom Com

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Senate Bill Indicates A Portion Of Unemployment Compensation May Not Be Taxable In 2020

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Here S Information On Why Unemployment Is Taxable In Colorado 9news Com

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Everything You Need To Know About The 10 200 Unemployment Tax Break Forbes Advisor

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Make Sure You Don T Pay Taxes On These Unemployment Benefits Newscentermaine Com

Top 3 Tax Tips For Unemployment Benefits

Top 3 Tax Tips For Unemployment Benefits

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

New Bill Aims To Eliminate Taxes On Up To 10 200 Of 2020 Unemployment Benefits

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due

2020 Unemployment Benefits Will Be A Factor When Your Taxes Are Due

Post a Comment for "Unemployment Benefits Taxable 2020"