What Does An Inquiry On Credit Report Mean

If you check your own credit file then you are able to see all soft and hard checks that have been made on your file. This type of inquiry is added to your report where it will stay for two years.

Sample Credit Report Dispute Letter Dispute Credit Report Credit Dispute Credit Repair Letters

Sample Credit Report Dispute Letter Dispute Credit Report Credit Dispute Credit Repair Letters

The credit bureaus note this information recording the date and the name of the company or entity accessing your information.

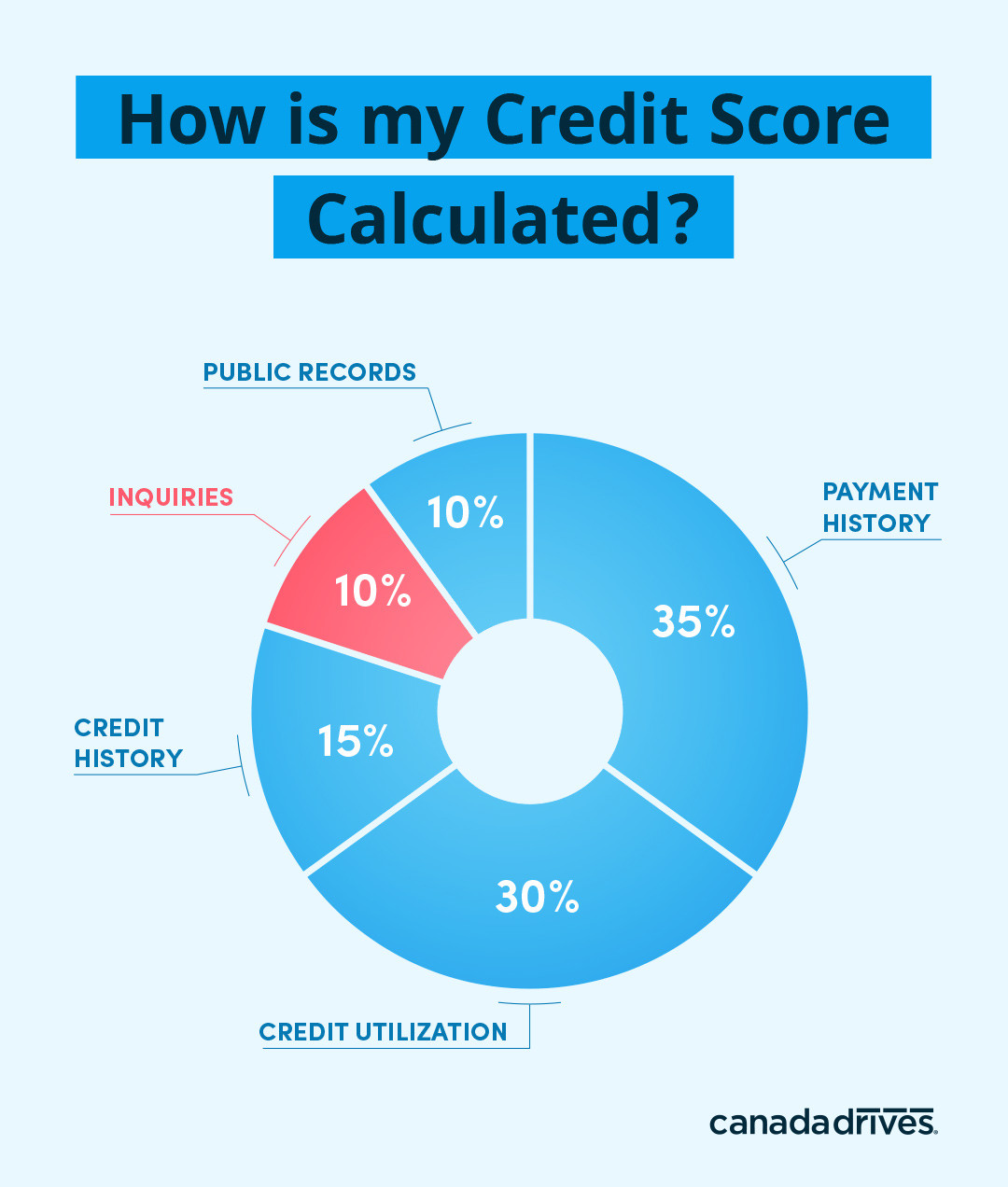

What does an inquiry on credit report mean. Along with new credit accounts hard inquiries count for 10 of your credit score. Employers soft credit inquiry only What does a credit check show. A hard inquiry requests your full credit history and credit score from a credit bureau.

The company pulls your credit report to help evaluate the risk of approving your request. There are a few other codes you may see in your Equifax credit report. As such they may obtain one or all of your credit reports in the screening process or a merged Factual Data credit report.

Several inquiries can lower your credit score. An inquiry is posted to a consumers credit report every time an individual or a business reviews or obtains a copy of the credit report. It means that a creditor has requested to look at your credit file to determine how much risk you pose as a borrower.

A soft inquiry is a review of your credit file that may occur when a lender preapproves you for a credit card or loan or when you request your credit reports. When you apply for credit a potential lender or creditor will generally access one or more of your credit reports to help inform its decision whether or not to extend you credit. Inquiries on your credit report are one of the ways credit scoring companies gauge the risk that youll default on new credit obligations.

Credit bureaus place hard inquiries on your credit report whenever a business checks your credit report to approve your application for a credit card loan or another credit-based service. Soft searches cannot be seen by any other people or companies other than you. Hard inquiries specifically refer to instances when a lender accesses your credit report for the purpose of evaluating you as a borrower.

All inquiries arent created equal. Lenders use your history with credit to determine how reliable of a borrower you are. These pertain specifically to soft inquiries made about you by a host of creditors lenders insurers employers and others.

Requests for a copy of your Equifax credit report. On your credit reports you could find two types of credit inquiries also known as pulls. Inquiries happen when there is a legally permitted request to see your credit report from a company or person.

This type of inquiry will affect your credit score. The initial credit check leading to a consumers name and address appearing on a prescreened offer list is never prompted by a consumers request for credit. The lender or creditor making the request has the option to choose the bureau and credit report style that.

A credit inquiry is when you or an organization requests access to the information included in your credit report. When you apply for creditbe it a credit card mortgage or car loanthe. Inquiry types of AR Account Review and PRM Promotional appear only on credit reports received directly by the consumer.

Credit-based insurance score inquiries credit information used to help determine if auto or homeowners insurance will be offered to a consumer and at what price. You contact your credit card issuer and request a credit line increase. Hard inquiries are ones made with your permission for specific transactions.

Your existing creditors sometimes initiate inquiries or reviews of your credit purely as a way to keep tabs on your credit health. A hard inquiry or a hard pull occurs when you apply for a new line of credit such as a credit card or loan. Too many inquiries especially in the past few months might mean that youre taking on too much debt or that youre in some kind of financial trouble and are looking for credit to help you out.

Simply put a credit inquiry is a credit check. When a lender or company requests to review your credit report as part of the loan application process that request is recorded on your credit report as a hard inquiry and it usually will impact your credit score. There are 2 different types.

An example of a hard inquiry. What is revealed by a credit check depends on the type of check that is being made. Credit inquiries occur whenever someone accesses your credit account.

Therefore the result is a soft inquiry that doesnt affect scores.

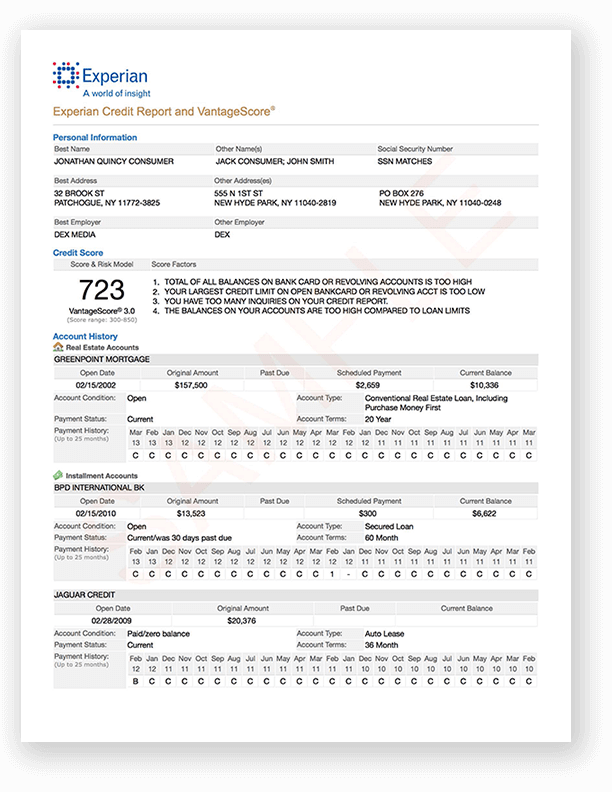

What S A Credit Report And How Do You Read One

What S A Credit Report And How Do You Read One

What S A Credit Report And How Do You Read One

What S A Credit Report And How Do You Read One

What Does Your Credit Score Mean Credit Score Credit Score Range Refinance Mortgage

What Does Your Credit Score Mean Credit Score Credit Score Range Refinance Mortgage

Too Many Hard Inquiries In A Short Amount Of Time Can Have A Devastating Effect On Your Credit Score Hard Inquiries Take Smart Money Bad Credit Credit Rating

Too Many Hard Inquiries In A Short Amount Of Time Can Have A Devastating Effect On Your Credit Score Hard Inquiries Take Smart Money Bad Credit Credit Rating

How To Remove Credit Inquiries From Credit Reports 2021

How To Remove Credit Inquiries From Credit Reports 2021

When Is My Credit Score Pulled Credit Score Bad Credit Repair Credit Repair Letters

When Is My Credit Score Pulled Credit Score Bad Credit Repair Credit Repair Letters

Understanding Credit Score Credit Repair Credit Score Paying Off Credit Cards

Understanding Credit Score Credit Repair Credit Score Paying Off Credit Cards

What S A Credit Report And How Do You Read One

What S A Credit Report And How Do You Read One

What S A Credit Report And How Do You Read One

What S A Credit Report And How Do You Read One

What S A Credit Report And How Do You Read One

What S A Credit Report And How Do You Read One

Hard Vs Soft Inquiries On Your Credit Report Experian

Hard Vs Soft Inquiries On Your Credit Report Experian

Do Credit Checks Hurt Your Credit Score

Do Credit Checks Hurt Your Credit Score

Hard Vs Soft Inquiry What You Should Know Before A Credit Pull Personal Finance Rebuilding Credit Credit Score

Hard Vs Soft Inquiry What You Should Know Before A Credit Pull Personal Finance Rebuilding Credit Credit Score

Credit Dispute Letters 2 638 Credit Dispute Credit Repair Letters Credit Repair Business

Credit Dispute Letters 2 638 Credit Dispute Credit Repair Letters Credit Repair Business

Bad Credit Score 300 599 Poor Credit Score 600 649 Fair Credit Score 650 699 Good Credit Score 700 Good Credit Good Credit Score Credit Score

Bad Credit Score 300 599 Poor Credit Score 600 649 Fair Credit Score 650 699 Good Credit Score 700 Good Credit Good Credit Score Credit Score

Credit Repair Deletion Letter For A 1355 Medical Collection Credit Repair Secrets Exposed Here Credit Repair Letters Online Mortgage Credit Repair

Credit Repair Deletion Letter For A 1355 Medical Collection Credit Repair Secrets Exposed Here Credit Repair Letters Online Mortgage Credit Repair

Creditrepair609letter Letters Secrets Exposed Sample Credit Repair Credit Repair Heresampl Credit Repair Letters Credit Repair Credit Repair Business

Creditrepair609letter Letters Secrets Exposed Sample Credit Repair Credit Repair Heresampl Credit Repair Letters Credit Repair Credit Repair Business

How To Run A Credit Check On Your Customer With Experian Connect

How To Run A Credit Check On Your Customer With Experian Connect

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Post a Comment for "What Does An Inquiry On Credit Report Mean"