Employee Retention Credit Qualified Wages Tips

The small business Employee Retention Credit lets employers take a 70 credit up to 10000 of an employees qualifying wages per quarter. Use the WOTC payroll next should you qualify and have use for a federal income tax credit in either year as the maximum percentage of wages for that credit is 40.

The federal Employee Retention Credit is a fully refundable tax credit for eligible employers equal to 50 of qualified wages including allowable qualified health plan expenses.

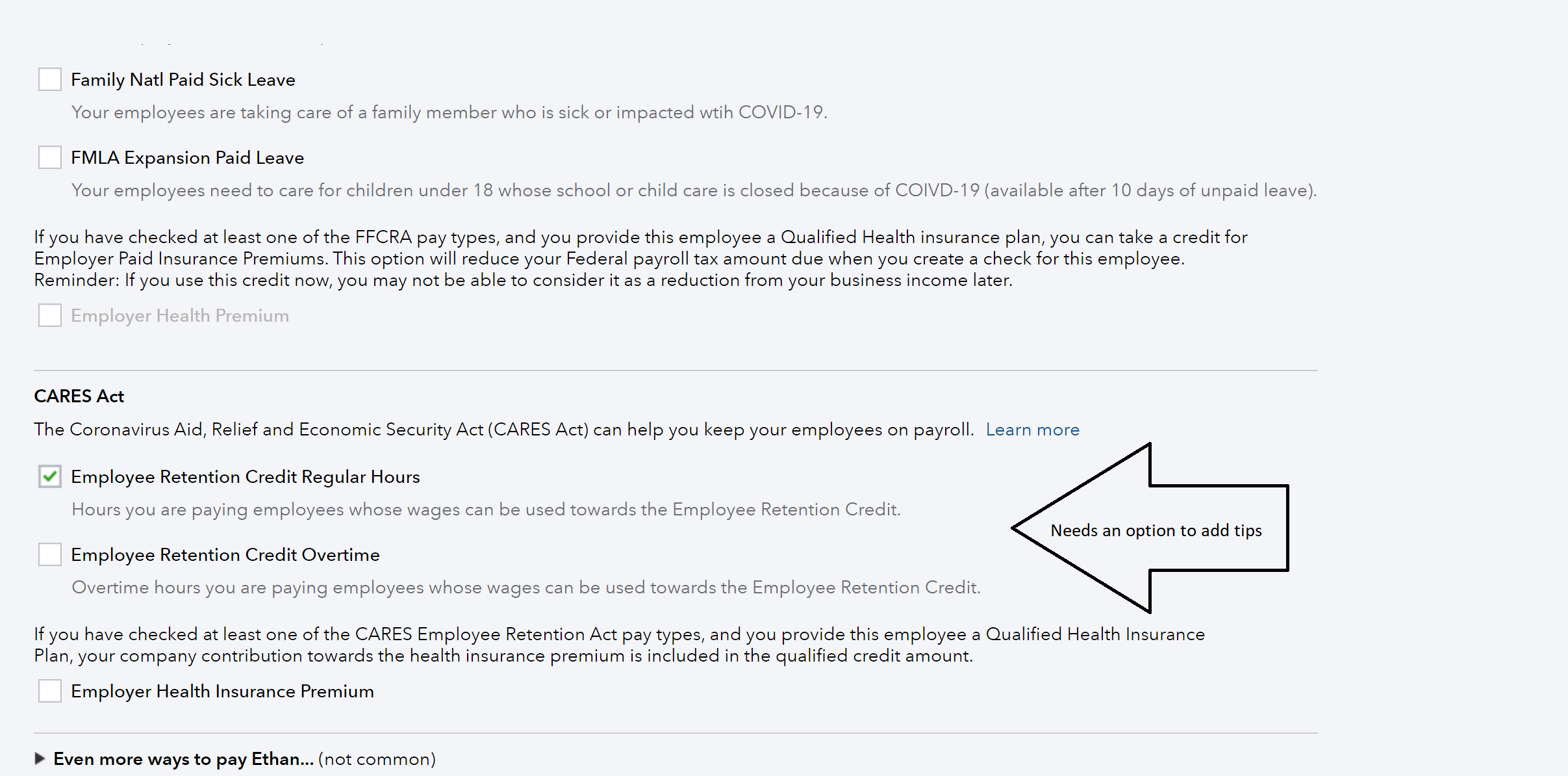

Employee retention credit qualified wages tips. Wagescompensation in general that are subject to FICA taxes as well as qualified health expenses qualify when calculating the employee retention credit. The Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter. Now when analyzing the ERC many restaurants have posed some of the same questions regarding eligibility and calculation.

For 2020 the credit is equal to 50 of up to 10000 in qualified wages including amounts paid towards health insurance per full-time employee for all eligible calendar quarters beginning March. If you qualify for this credit you can receive up to 7000 per employee per quarter. The credit applies to qualified wages paid after March 12 2020 and before January 1 2021.

Again the maximum credit amount per employee for 2021 is 14000 7000 per quarter. The credit is equal to 50 of qualified wages paid including qualified health plan expenses up to 10000 per employee in 2020 meaning the maximum credit available for each employee is 5000. A related individual is any employee who has of any of the following relationships to the employer.

70 of the first 10000 in qualified wages per employee in a quarter Eligibility. Max Credit 5000 per employee for year Qualified Wages - 2020. Eligible wages per employee max out at 10000 so the maximum credit for eligible wages paid to any employee during 2020 is 5000.

Qualified wages are limited to 10000 per employee per calendar quarter in 2021. 50 of the first 10000 in qualified wages per employee in a quarter. 100 employees or less.

The credit remains at 70 of qualified wages up to a 10000 limit per quarter so a maximum of 7000 per employee per quarter for all of 2021. Maximum Tax Credit per Employee. The IRS explained the changes to the employee retention credit ERC for the first two calendar quarters of 2021 in Notice 2021-23 which amplifies Notice 2021-20The credit was created by the Coronavirus Aid Relief and Economic Security CARES Act PL 116-136 and amended by the Consolidated Appropriations Act 2021 PL 116-260.

The tax credit is already available but the program ends on July 1st 2021. American Rescue Plan Act 2021. The recent revisions to the Employee Retention Credit ERC are proving to be very impactful to one particular industry the restaurant industry.

So an employee could claim 7000 per quarter per employee or up to 28000 for 2021. The calculations can be tricky. Therefore if a company can identify 10000 of qualified wages from each employee in the first and second quarter in 2021 they are looking at a maximum ERC of 14000 per.

The credit applies to wages paid after March 12 2020 and before January 1 2021. These must have been paid after March 12 2020 and qualify for the credit if paid through June 30 2021. As mentioned in our previous ERC article restaurants that received PPP loans are also eligible to claim the ERC.

9 Wages paid to related individuals are not taken into account for purposes of the Employee Retention Credit. The credit reduces your employer Social Security tax liability. 50 of the first 10000 in qualified wages per employee in a quarter.

Thus the maximum employee retention credit available is 7000 per employee per calendar quarter for a total of 14000 for the first two calendar quarters of 2021. The amount of the tax credit is equal to 70 of the first 10000 in qualified wages per employee in a quarter.

Is Your Business Eligible For The Employee Retention Credit Eder Casella Co Certified Public Accountants

Is Your Business Eligible For The Employee Retention Credit Eder Casella Co Certified Public Accountants

What You Need To Know About The Employee Retention Tax Credit In 2021 Mod Ventures Llc

What You Need To Know About The Employee Retention Tax Credit In 2021 Mod Ventures Llc

Q A Employee Retention Credit Yptc

Q A Employee Retention Credit Yptc

The Cares Act Employee Retention Tax Credit Challenges And Opportunities

The Cares Act Employee Retention Tax Credit Challenges And Opportunities

Us Employee Retention Credit Erc Help Center

Us Employee Retention Credit Erc Help Center

Planning To Maximize Your Employee Retention Credit

Planning To Maximize Your Employee Retention Credit

Everything You Need To Know About The Employee Retention Credit

Everything You Need To Know About The Employee Retention Credit

Irs Employee Retention Credit Update On Eligiblity Qualified Wages

Irs Employee Retention Credit Update On Eligiblity Qualified Wages

Irs Provides Employee Retention Credit Guidance For 2020

Irs Provides Employee Retention Credit Guidance For 2020

A Guide To The Employee Retention Tax Credit Cerini Associates Llp Blogs

A Guide To The Employee Retention Tax Credit Cerini Associates Llp Blogs

What To Know About The Cares Act Employee Retention Tax Credit

What To Know About The Cares Act Employee Retention Tax Credit

Unsure How To Take Advantage Of The Employee Retention Credit Find Out How It Works And If Your Business Qualifies Assembly

Unsure How To Take Advantage Of The Employee Retention Credit Find Out How It Works And If Your Business Qualifies Assembly

Does Your Food Beverage Business Quality For Employee Retention Credit For 2020 And Or 2021 One Step Closer

Does Your Food Beverage Business Quality For Employee Retention Credit For 2020 And Or 2021 One Step Closer

Employee Retention Credit Could Help Your Business Abip

Employee Retention Credit Could Help Your Business Abip

Cares Act Faq Employee Retention Credit White Nelson Diehl Evans Cpas

Cares Act Faq Employee Retention Credit White Nelson Diehl Evans Cpas

Don T Leave Money On The Table Employee Retention Credit Modified And Extended Cpa Practice Advisor

Don T Leave Money On The Table Employee Retention Credit Modified And Extended Cpa Practice Advisor

Employee Retention Credit Lawson Rescinio Schibell Associates P C

Employee Retention Credit Lawson Rescinio Schibell Associates P C

Post a Comment for "Employee Retention Credit Qualified Wages Tips"